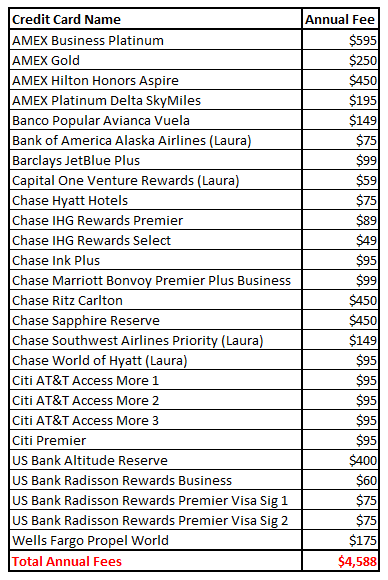

Good morning everyone. As we approach the end of the year, I decided to take a look at my credit card spreadsheet and see how much my wife and I paid in annual fees this year. I removed all the no annual fee credit cards and here are the 26 credit cards that have annual fees (sorted alphabetically). I will break down this list into cards that I am 99% sure that I will cancel, 99% sure that I will keep, and the 50/50 cards that I might keep or cancel. Read through this post and let me know if you agree or disagree with my thinking.

After reviewing the 26 credit cards from above, I identified 3 credit cards that I am 99% sure that I will cancel (mainly because the value of the benefits do not exceed the annual fee, in my opinion). Greg @ Frequent Miler recently wrote a post about how to value credit card benefits and annual fees, that I recommend reading. I would keep these credit cards if I get a sweet retention offer that waives the annual fee or provides a generous portion of miles/points, but I think that is very unlikely since I applied for these credit cards solely for the sign up bonus and haven’t spent any money on these credit cards after completing the minimum spending requirement. After the annual fee posts on my Wells Fargo Propel World Credit Card, I plan to get another $100 in airline gift cards reimbursed.

| 99% Cancelling | Annual Fee | Annual Value | Net Cost | Reasons to Keep |

| AMEX Platinum Delta SkyMiles | $195 | $50 | $145 | Free checked bags, priority boarding, domestic companion certificate |

| Banco Popular Avianca Vuela | $149 | $0 | $149 | None |

| Wells Fargo Propel World | $175 | $100 | $75 | $100 airline reimbursement |

| Total | $519 | $150 | $369 |

I also identified 2 credit cards that I might keep or cancel (the annual fees exceed the value of the benefits but only by a small amount). Last year, I was able to get half of my Barclays JetBlue Plus Credit Card annual fee ($49.50) refunded, so I decided to keep the credit card open. I also just redeemed 47,000 JetBlue TrueBlue Points for a summer trip from SFO to BOS, so I should get 4,700 JetBlue TrueBlue Points rebated to my JetBlue account after my flight (but I need to have this credit card open). As for the US Bank Altitude Reserve Credit Card, I don’t have enough 3x ApplePay purchases to make up for the remaining $75 in annual fees, so I am leaning toward closing this credit card. $75 difference in the annual fee / 1.5 CPP (value of the FlexPoints when redeemed for travel) = 5,000 FlexPoints / 3x ApplePay = $1,666.67 / 12 months = $138.89 in ApplePay purchase per month to justify the annual fee.

| 50% Keeping / 50% Cancelling | Annual Fee | Annual Value | Net Cost | Reasons to Keep |

| Barclays JetBlue Plus | $99 | $60 | $39 | 5,000 anniversary points, 10% points rebate, free checked bags |

| US Bank Altitude Reserve | $400 | $350 | $50 | $325 travel credit, 3x ApplePay |

| Total | $499 | $410 | $89 |

I decided that the other 21 credit cards are worth paying the annual fees. Since there are so many credit cards to cover, I broke this section up into 3 groups. I hope that the reasons I listed for keeping a credit card make sense and are self explanatory. I did want to point out that I had a disappointing experience with the 35% AMEX Membership Rewards Points rebate for first class flights that comes with the American Express Business Platinum Charge Card. I think the American Express Hilton Honors Aspire Credit Card provides tremendous value every year. Lastly, my wife loves her Capital One Venture Rewards Credit Card and was her primary credit card when she met me (and she still loves using this credit card). I told her that credit card is not worth the $59 annual fee since she could use my Citi Double Cash Credit Card or American Express Blue Business Plus Credit Card to earn 2% cash back everywhere.

| 99% Keeping | Annual Fee | Annual Value | Net Cost | Reasons to Keep |

| AMEX Business Platinum | $595 | $600 | -$5 | Centurion Lounge access, $200 airline credit, $200 Dell credit, 35% MR airline rebate |

| AMEX Gold | $250 | $320 | -$70 | 4x restaurant, 4x grocery store, $120 dining credit, $100 airline credit |

| AMEX Hilton Honors Aspire | $450 | $600 | -$150 | Free weekend night certificate, Diamond status, $250 resort credit, $250 airline credit |

| AMEX Hilton Honors Aspire | $75 | $125 | -$50 | $99 companion fare, free checked bags |

| Capital One Venture Rewards (Laura) | $59 | $0 | $59 | 2x Capital One miles everywhere, convert miles into airline miles |

All of our Chase credit cards are no brainers to keep and we have kept these credit cards for many years. If you want more information on these credit cards, click any of these links: Hyatt, IHG Rewards Premier, IHG Rewards Select, Ink Plus Business, Marriott Bonvoy Premier Plus Business, Ritz Carlton, Sapphire Reserve, and Southwest Airlines Priority.

| 99% Keeping | Annual Fee | Annual Value | Net Cost | Reasons to Keep |

| Chase Hyatt Hotels | $75 | $150 | -$75 | Free night certificate (categories 1-4, up to 15,000 Hyatt Points) |

| Chase IHG Rewards Premier | $89 | $200 | -$111 | Free night certificate (up to 40,000 IHG Points), 25% points rebate on 4 nights |

| Chase IHG Rewards Select | $49 | $250 | -$201 | Free night certificate (up to 40,000 IHG Points), 10% points rebate |

| Chase Ink Plus | $95 | $150 | -$55 | 5x Ultimate Rewards Points at office supply stores & utilities ($50,000 annual limit) |

| Chase Marriott Bonvoy Premier Plus Business | $99 | $175 | -$76 | Free night certificate (up to 35,000 Marriott Bonvoy Points) |

| Chase Ritz Carlton | $450 | $650 | -$200 | Free night certificate (up to 50,000 Marriott Bonvoy Points), $300 airline reimbursement, Visa Infinite Discount Air Benefit |

| Chase Sapphire Reserve | $450 | $500 | -$50 | $300 travel credit, 3x travel and dining, redeem Ultimate Rewards Points at 1.5 CPP, primary rental car insurance |

| Chase Southwest Airlines Priority (Laura) | $149 | $170 | -$21 | 7,500 anniversary SWA points, $75 SWA travel credit, 4 upgraded boarding passes |

| Chase World of Hyatt (Laura) | $95 | $150 | -$55 | Free night certificate (categories 1-4, up to 15,000 Hyatt Points) |

All of my Citi and US Bank credit cards are keepers too. I have 3 Citi AT&T Access More Credit Cards and make sure to spend $10,000 on each credit card to earn 10,000 bonus Citi Thank You Points every year. I actually do not use my Citi Premier Credit Card very often, but I have to keep it so that I can redeem my Citi Thank You Points at 1.25 CPP for travel and for the ability to transfer Citi Thank You Points to travel partners. Lastly, I do not put any spend on my 3 Radisson Rewards credit cards, but I do earn 40,000 Radisson Rewards Points every year when I pay the credit card annual fee.

| 99% Keeping | Annual Fee | Annual Value | Net Cost | Reasons to Keep |

| Citi AT&T Access More 1 | $95 | $125 | -$30 | 10,000 Citi Thank You Points after spending $10,000 per year, 3x online transactions |

| Citi AT&T Access More 2 | $95 | $125 | -$30 | 10,000 Citi Thank You Points after spending $10,000 per year, 3x online transactions |

| Citi AT&T Access More 3 | $95 | $125 | -$30 | 10,000 Citi Thank You Points after spending $10,000 per year, 3x online transactions |

| Citi Premier | $95 | $150 | -$55 | 3x travel, redeeming TYPs at 1.25 CPP for travel, transfer TYPs to travel partners |

| US Bank Radisson Rewards Business | $60 | $100 | -$40 | 40,000 Radisson Rewards Points every anniversary |

| US Bank Radisson Rewards Premier Visa Sig 1 | $75 | $100 | -$25 | 40,000 Radisson Rewards Points every anniversary |

| US Bank Radisson Rewards Premier Visa Sig 2 | $75 | $100 | -$25 | 40,000 Radisson Rewards Points every anniversary |

| Total | $3,570 | $4,865 | -$1,295 |

After crunching the numbers for the 21 credit cards that I plan on keeping, I pay $3,570 in annual fees, but I get $4,865 in value. Feel free to agree or disagree with my thinking, but please let me know what you think in the comments section. Thank you for reading and have a great day.

Dear Grant,

Surely a lot of credit cards. May I offer a different perspective? If you were to take $4500 and invested it in a growth stock mutual fund plus added 3500 per year you would be left with around $55,000 after ten years. (It would be well over $400,000 over 30%) using a modest 8% return. This is not even counting all the overspending to meet the minimum requirements. I fell on this trap for over a decade and even went as far as paying all my taxes with credit cards just to meet minimum requirements and paying so many fees to do this. Currently I still have 1 cash back credit card but now I invest the cash back. Points just seems to loose value over time. I have so many skymiles that just keep loosing value every year. Just another perspective.

That is indeed another perspective. I do have a Roth IRA that I max out every year and a traditional 401k that I fund through work. I get a lot of value (tactically and intrinsically) from my credit cards, so I don’t think I will change much in the near term, but it is something to look into next year.

Interesting perspective. I am sure others will have a good counter argument. So you keep only one card only?

For me its been an interesting transition and at the moment I only have the cash back from Amex (the one with the annual fee, the one with 6% on groceries). I previously had 2 Delta reserve cards (for the mqm boosts) and a slew of other cards. I caught myself over spending (ie paying for certain things with credit cards that carried a processing fee) to meet the spending thresholds and minimum spend on other cards -. If you analyze the cost in 10 years its so interesting how much its costing – I didn’t realize just how much I was spending in annual fees and extras.

For sure there’s the argument that you can get out sized value from miles and I don’t disagree with that. If somebody has a particular goal to go on a specific vacation, by all means the sign up bonuses are a great deal there. I’ve taken several points vacations to Europe in business back when Delta had decent redemption levels and actually published their award fares. Just don’t forget to analyze the cost and opportunity cost every once in a while.

It depends on how much one values travel experiences. 55K after 10 years sounds nice but if I spend 20K on 1 big international vacation a year for a family of 3, I’m not saving anything. What it really comes down to is if the benefits and extra points earned by paying for annual fee cards provides for what one would legitimately spend in cash if not for the cards. If I would be paying $4588 or more for these benefits the annual fees are at worst a wash.

Also depends how much you travel, destination and your travel size. Due to new jobs don’t think we will be traveling as much next year.

Yes that is very true. I try to do 3 week long trips a year and several weekend getaways throughout the year. So I travel quite a bit. I work in SF so it’s easy to get anywhere in the US from SFO and OAK.

Lolz. Millenial ‘thinking’ markets only go up. Too much ‘loosing’ thinking. Smh

Great analysis. I have a tough time justifying more than one premium card, and I’m surprised you keep so many.

I’m also curious why the net benefit of the $49 IHG card is higher than the $89 IHG card. Do you not stay anywhere 4 nights, and this don’t enjoy the 25% off? That card combo is fantastic, as you essentially get 32% off of all 4-night award stays.

Hi Ian, which premium CC do you keep?

Yes, I stay at IHG hotels usually 1-2 nights at a time (weekend getaways), so I put very little value on the 25% rebate on 4+ nights for the IHG Premier CC.

I’m confused regarding how you value the AMEX airline fee credits. My understanding is that buying airline gift cards no longer works? How do you use the credit? Thanks.

My plan for 2020 is to choose SWA and look for international award flights that have high taxes ($50-$100 range). The taxes on award tickets will get reimbursed by AMEX, then I will cancel the SWA award, get the points back, then have SWA travel credit to use for a future trip.

I use the AmEx Plat ($200) and Am Ex Hilton ($250) airline credit to pay for my AA Admiral’s Club membership. That way it costs me $50 out of pocket.

That is a great idea. I didn’t know that you could split the payment of your Admirals Club membership onto multiple CCs.

Pingback: Hyatt Adds More SLH Hotels, Transferring Points, New China Scare, Chase Closing Accounts - TravelBloggerBuzz

Pingback: Over $4k in CC Annual Fees, Chuck Schumer Going to Bat for Families on Flights, Goodbye Super Shuttle and More - Miles For Family

Pingback: What I Spend on my Credit Card Annual Fees - Miles For Family

Pingback: Ask Me Anything (AMA): Credit Card Edition

Pingback: My Chase Sapphire Reserve Credit Card Plan for 2020

Pingback: The World's Most Uncomfortable Airline Seats, Why First-Class Seats Fly Empty, Justifying $4,500 in Credit Card Fees, and More! - Points with a Crew

Pingback: If I Could Only Keep 5 Credit Cards with Annual Fees...

Pingback: Reconsideration Strategy for Credit Card Annual Fees During Coronavirus Pandemic

Pingback: How Much Did I Pay in Credit Card Annual Fees in 2020?

Pingback: I Paid $4,043 in Credit Card Annual Fees in 2022 – Was it Worth it?