Buenos días everyone! I know it’s been a long time since you’ve heard from me – I’ve got a couple of things in the works, but for now, I thought I’d hop on to Grant’s Keep, Cancel, or Convert? Series with my thoughts on the Chase Sapphire Reserve Credit Card.

The CSR has had a spot in my wallet since it was first released, but over time, it’s been losing its luster for me as other cards have caught up with it. When Chase announced that the annual fee would be rising to $550, I knew its days in my wallet were numbered. Here’s why:

- I opened the JPMorgan Chase Ritz Carlton Credit Card right before Chase stopped offering the card to new applicants, which offers the same travel protections as the CSR and a better Priority Pass membership.

- Late last year, I opened a Chase Ink Business Preferred Credit Card, which earns 3x on travel and allows me to transfer my Chase Ultimate Rewards Points to airline and hotel partners.

- Earlier this year, I opened a Citi Premier Credit Card, which earns 3x Citi ThankYou Points on restaurants and most travel purchases.

- My Chase Freedom Credit Card and Chase Freedom Unlimited Credit Card now earn 3x Chase Ultimate Rewards Points at restaurants (though both cards have foreign transaction fees, so I won’t be using them in Mexico).

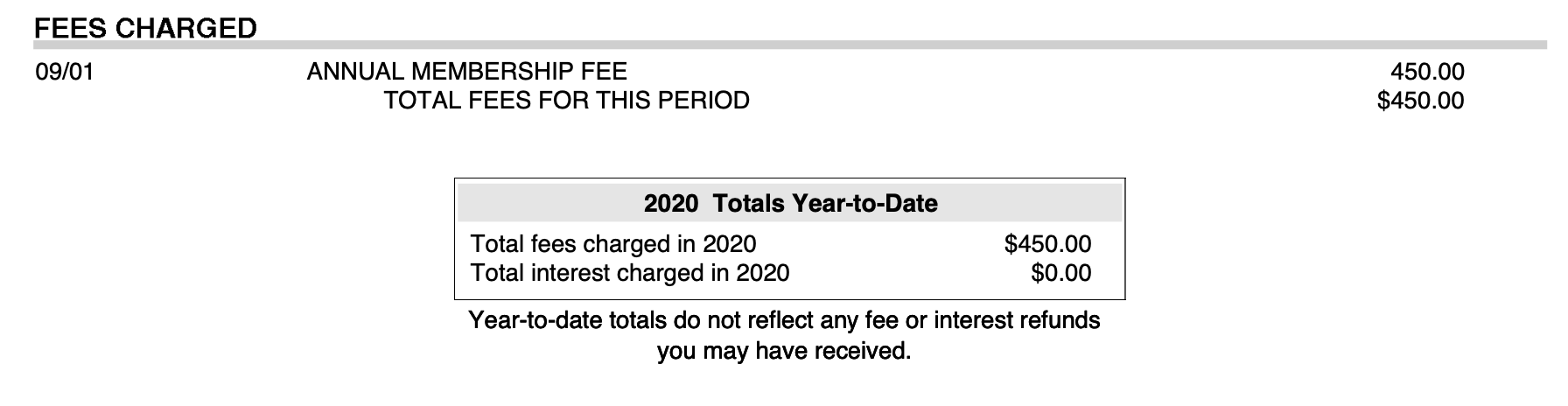

Although Chase added two new (temporary) perks to the CSR to help offset the $100 annual fee increase, they don’t do me much good. Neither DoorDash nor Lyft operate here in Mexico, and while I was fortunately able to use most of my DoorDash credit on a trip to the US at the beginning of the year, it doesn’t make enough of a difference. And even though the annual fee was temporarily reduced back to $450 due to COVID-19, I’d already set myself up so well to live without the CSR that I decided I still didn’t need to keep it. The temporarily-reduced $450 annual fee posted to my card on September 1.

My statement close date was September 23. Since Chase gives you 30 days after the annual fee posts to get a refund for closing your card, I decided to wait until the statement closing date so I could keep the handful of Chase Ultimate Rewards Points I’d earned that month. In the meantime, I used the Chase Pay Yourself Back feature to erase a few hundred dollars worth of Home Depot purchases, and used the $100 Trusted Traveler Credit to pay for a friend’s Global Entry enrollment. I also sent a secure message to Chase asking to move part of my credit limit to my Ritz Carlton Credit Card, which was done within a few hours. Since my CSR is so old, my $300 travel credits still run on a calendar year rather than alongside my account membership year, so I didn’t have a new travel credit to spend – if you decide to close your CSR, make sure you’ve used up your $300 credit for the year first!

Once my statement closed, I moved all of my Chase Ultimate Rewards Points from the CSR to my Ink Business Preferred, and called the number on the back of my CSR. As usual, I was immediately connected to a Chase representative. After verifying my identity, I told the rep that I wanted to close my account. The rep asked why, and I told them that I haven’t traveled since February and haven’t been able to use the benefits of the card enough to justify the high annual fee. After reminding me that I can use the $300 travel credit towards grocery stores and gas stations, the rep went ahead and closed the account without any type of retention offer. I was on the phone for less than two minutes.

My wallet won’t be Sapphire-less for long, though. In a few weeks, I plan to apply for the Chase Sapphire Preferred Credit Card to get the 80,000 point welcome bonus after spending $4,000 in the first three months. I’m well under 5/24, and since it’s been more than 48 months since I received the signup bonus on my CSR, there should be no issue now that I don’t currently have a Sapphire card open.

If you have any questions about why I closed my CSR, how to transfer Chase Ultimate Rewards Points to another card, or anything else, please leave a comment below. Have a great day everyone!

Does anyone get a retention offer to keep the Reserve?

Hi Patrick, I don’t think so. I haven’t heard / read about any retention offers on the CSR.

You didn’t discuss the “convert” option. Isn’t Freedom (both varieties) a strong option considering they’ve upped the benies?

Great question. As I mentioned in the post, I already have a Freedom Unlimited and a Freedom (two actually). But this is definitely a great option for folks who don’t have both of those cards (and aren’t interested in/able to apply for them outright).

Could you later share your experience when you apply for the Chase Sapphire Preferred? I too am thinking of doing something similar

pretty sure you can’t reapply for CSR immediately after you cancel – there’s a 2 year wait before you can reapply!

Nope! You’re probably thinking of Citi ThankYou cards – opening or closing a card resets their bonus clock. For Sapphire cards, the rules are just that you have to have gone 48 months since receiving a signup bonus and you can’t currently have any of the cards open. I opened a CSP at the beginning of November and am working on the signup bonus now :)

I’m in a weird situation. I need to cancel my CSR in 2 days (30 days after $450 charge), but one of the travel credit eligible purchases worth $200+ has not yet posted to my account. If I cancel the card before the transaction posts to the account (basically before I see the travel credit applied against the charge), will I still be eligible for the credit? OR will I have to pay for it as if it were a regular purchase?

Thanks for the help in advance!

Hmm, that is a good question. I’m not exactly sure what to do. When did your travel purchase post? The credits usually post in 1-2 days after that, so you should see the credit pretty soon.

Currently, the travel purchase is showing up as a ‘pending’ charge, so I’m hoping that it gets posted with the credits by tomorrow or day after.

Another clarification – does chase give you 30 days from the date the annual fee was billed, or 30 days from the statement date during which annual fee appears. I’m reading both from different web sources, so wanted to be sure. If it’s the latter, that will give me more time.

Thanks again for your help!

I looked at my CSR statement when the AF posted (April 2020) and it said: “The annual membership fee is non-refundable unless you notify us that you wish to close your account within 30 days or one billing cycle (whichever is less) after we provide the statement on which the annual membership fee is billed.”

I think you need to look at the “Opening/Closing Date” listed on your statement to see when your billing cycle ends. If you receive your statement by mail, you may have a few extra days since you didn’t receive the statement on the same day that the statement was created.

I hope that helps.

Perfect! I just looked at mine and it says the same, so I might have a few more days than what I initially thought. So overall, I should be good here.

Thanks for the quick responses and for digging into the details. +1

Thanks!!

You’re welcome. If you haven’t tried calling for a retention offer, you might get a good offer to keep the CSR open.