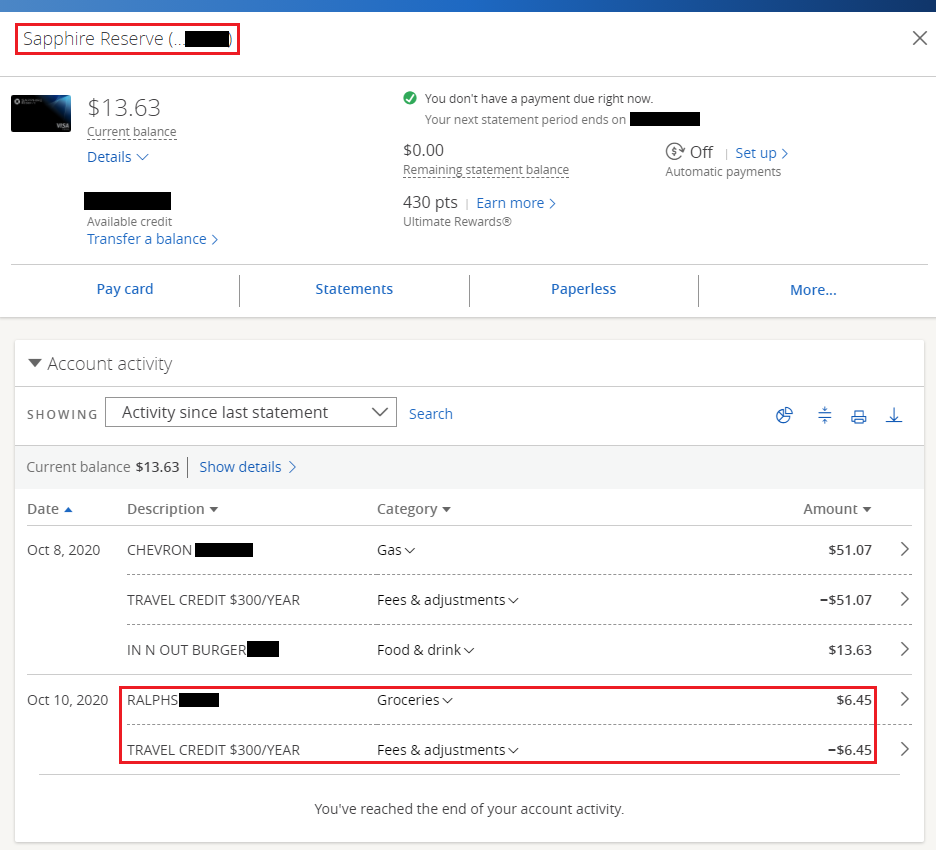

Good morning everyone, happy Friday! I routinely check my credit card transactions a few times a week and noticed that the $300 annual travel credit began to post on my Chase Sapphire Reserve Credit Card. In this post, I will show you how to double dip the same transactions that qualified for the $300 annual travel credit and are also eligible for Chase’s Pay Yourself Back feature. As you can see below, a $6.45 Ralph’s grocery store purchase was eligible for the $300 annual travel credit.

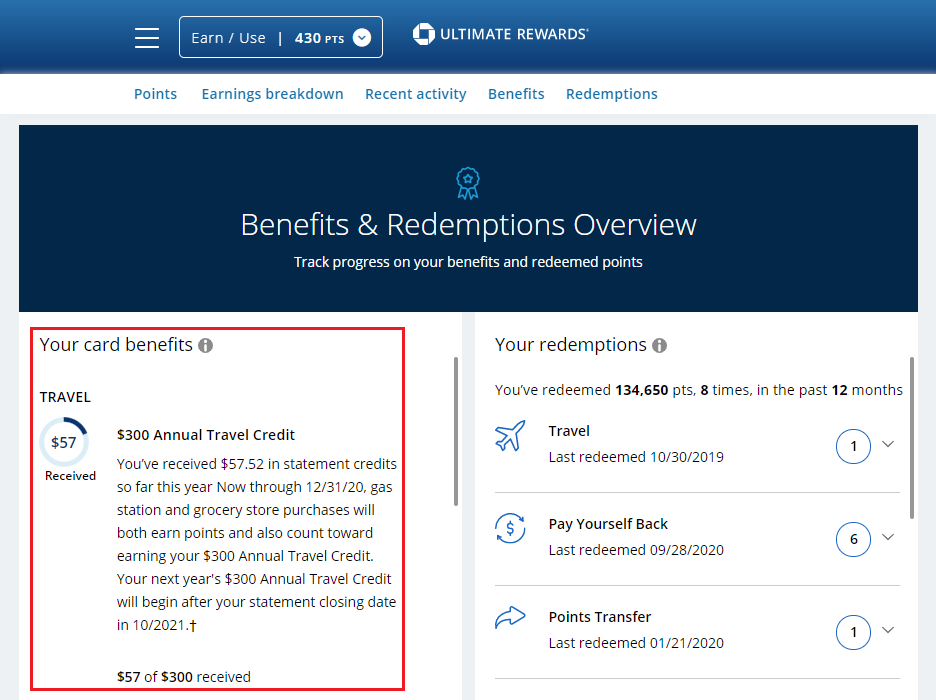

When I looked at the Benefits & Redemptions Overview for my Chase Sapphire Reserve, it showed that I have received $57.52 in statement credits toward the $300 annual travel credit. Now through December 31, 2020, the $300 annual travel credit will also reimburse eligible purchases at gas stations and grocery stores.

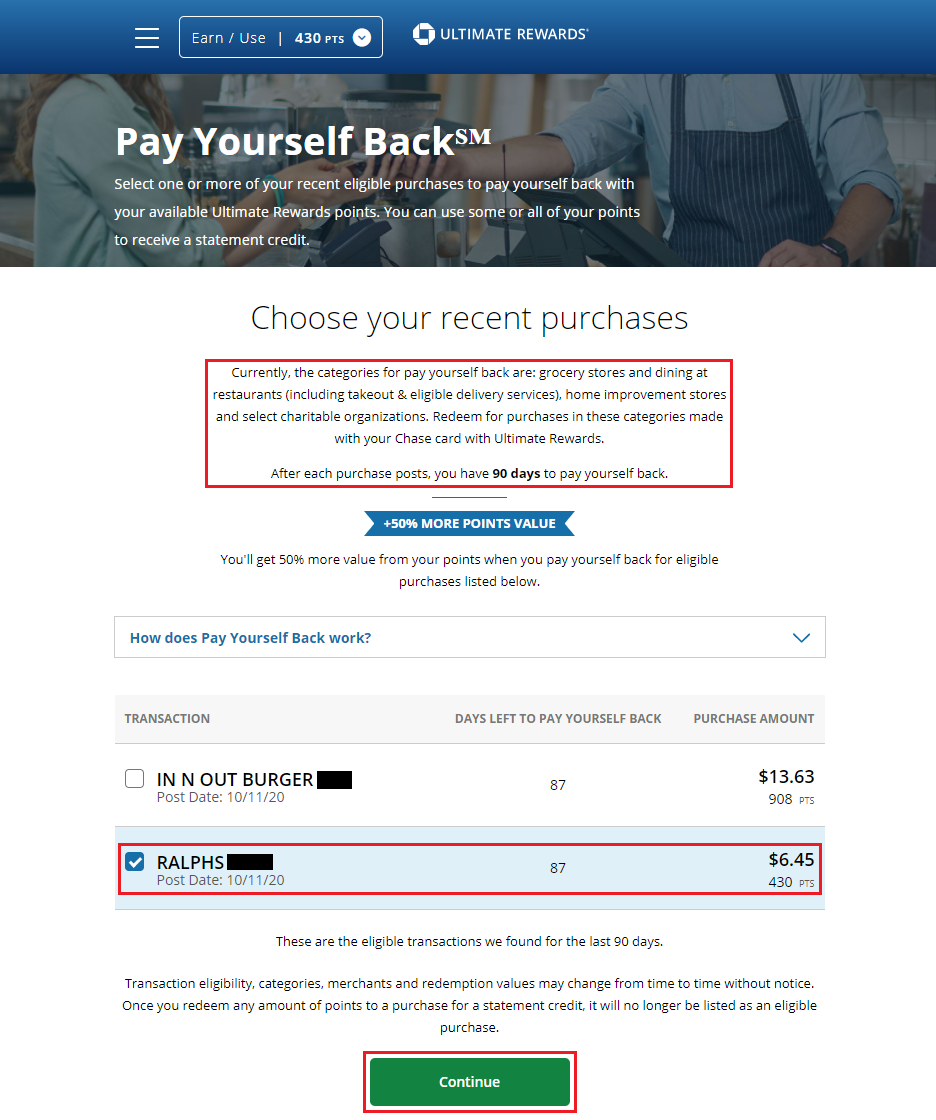

When I go to the Pay Yourself Back page, it shows 2 eligible transactions (an In-N-Out Burger restaurant purchase for $13.63 and a Ralph’s grocery store purchase for $6.45). I selected the Ralph’s transaction and clicked the Continue button.

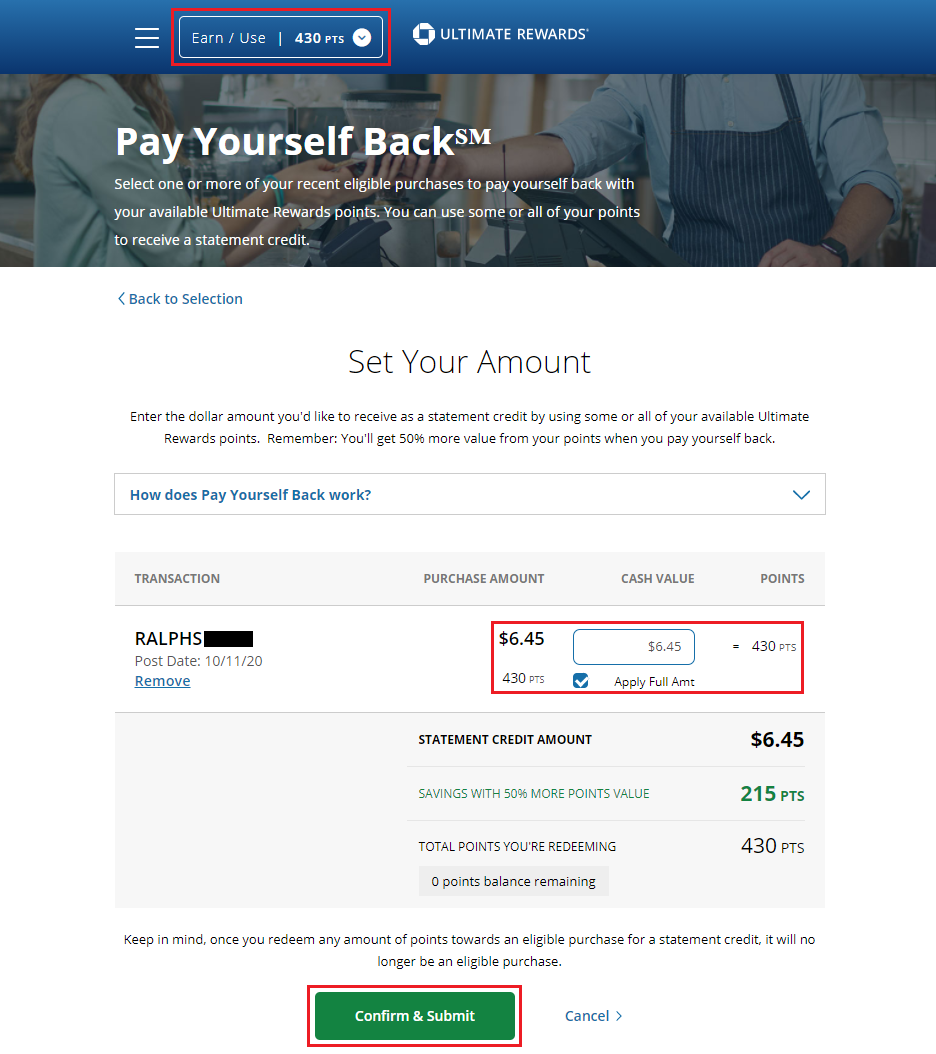

I then selected the Apply Full Amt checkbox to offset the $6.45 charge by redeeming 430 Chase Ultimate Rewards Points. Then I clicked the Confirm & Submit button.

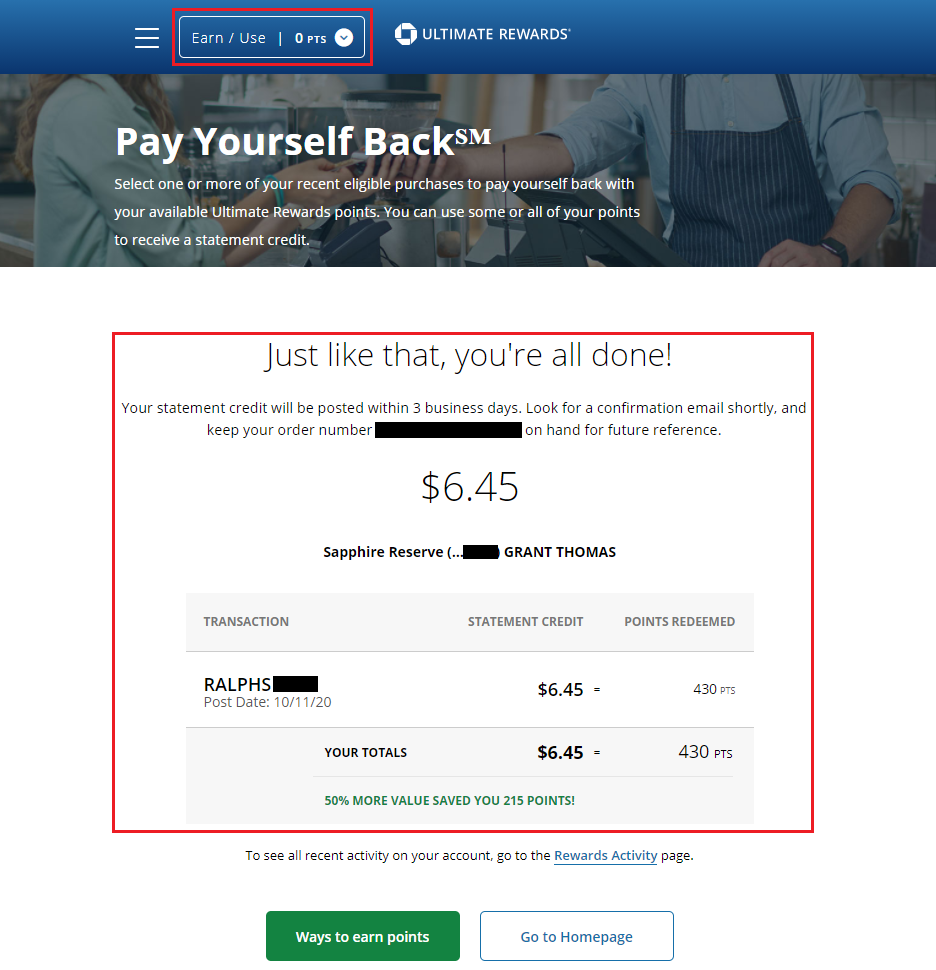

Congratulations, I just redeemed 430 Chase Ultimate Rewards Points. A $6.45 statement credit should post to my Chase Sapphire Reserve within 3 business days.

I also received a confirmation email with the details of the Pay Yourself Back transaction.

The following day, the $6.45 statement credit posted from my Pay Yourself Back transaction. As you can see, I was able to double dip the same $6.45 Ralph’s purchase with the $300 annual travel credit and with the Pay Yourself Back feature.

If you have any questions about the Chase Sapphire Reserve Credit Card $300 annual travel credit or Chase’s Pay Yourself Back feature, please leave a comment below. Have a great weekend everyone!

You sure this won’t claw back?

Hi Marty, I’m not 100% sure. If Chase wants to claw back the Pay Yourself Back statement credit and give me back my Chase Ultimate Rewards Points, that’s fine with me. Only time will tell.

Question. I recently rented an RV from Cruise America and stayed at several private campgrounds and paid with my reserve card. Any idea at to whether this counts towards “travel” in my $300 credit?

Hi Rob, that is a great question. When you log into your Chase online account, click on the transaction details and see if it says Travel. You can also check the pie chart that shows the breakdown of which categories your purchases fell into. If it shows your RV campground purchases coded as Travel, you should be good.

FYI, your first $300 in travel expenses would still earn 0x as usual, so keep that in mind.

Yes, you are correct Trung. If you made exactly $300 in travel purchases to use up the $300 annual travel credit, you would miss out on the 900 Chase Ultimate Rewards Points ($300 x 3x = 900).

This is not a double dip. You are not getting anything extra. You buy something and get points and use the points. You’d get the $300 travel credit orthogonally to using the points for anything.

Hi Paul, you’re right, I would receive the $300 annual travel credit eventually with other qualifying purchases.

I still fail to see why you would want to use the “pay yourself back” feature. I would rather keep the points for future travel.

If you can get more than 1.5 CPP out of your Chase UR Points, you are better off holding onto the points to transfer to travel partners. In my case, I don’t foresee travelling anywhere over the next several months or booking award travel in the near future, so I would rather cash out my points for statement credits. I also have decent balances of Citi TYPs and AMEX MRs, so I plan on holding on to those points for future award travel.