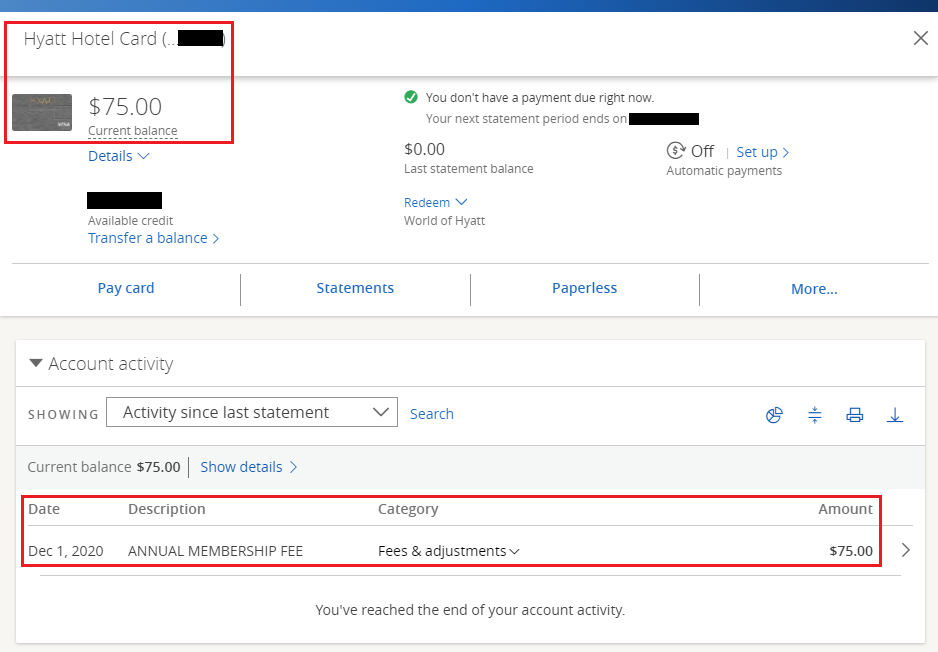

Good evening everyone, I hope your week is going well. I was just checking my Chase credit card accounts and saw that the $75 annual fee posted on my old Chase Hyatt Credit Card. Effective January 11, 2021, Chase will convert all cardmembers who have the old Chase Hyatt Credit Card to the new $95 annual fee Chase World of Hyatt Credit Card. Since I have never had the new card, I am planning on closing the old card and then applying for the new card to get the sign up bonus. I decided to call Chase to see if they could waive the $75 annual fee anyway, but the rep said no. I told the rep that I would think about it and call back later if I decide to close the card. I plan on calling back in a few days to close the card and transfer my credit limit over to one of my other Chase cards.

Frequent Miler recently wrote about receiving multiple Chase retention offers, so while I was still on the call, I asked the rep to see if they could waive the $49 annual fee on my Chase IHG Rewards Select Credit Card that recently posted. The rep said he could waive half the annual fee and provide a $25 statement credit. I gladly accepted the $25 statement credit and thanked the rep for their help.

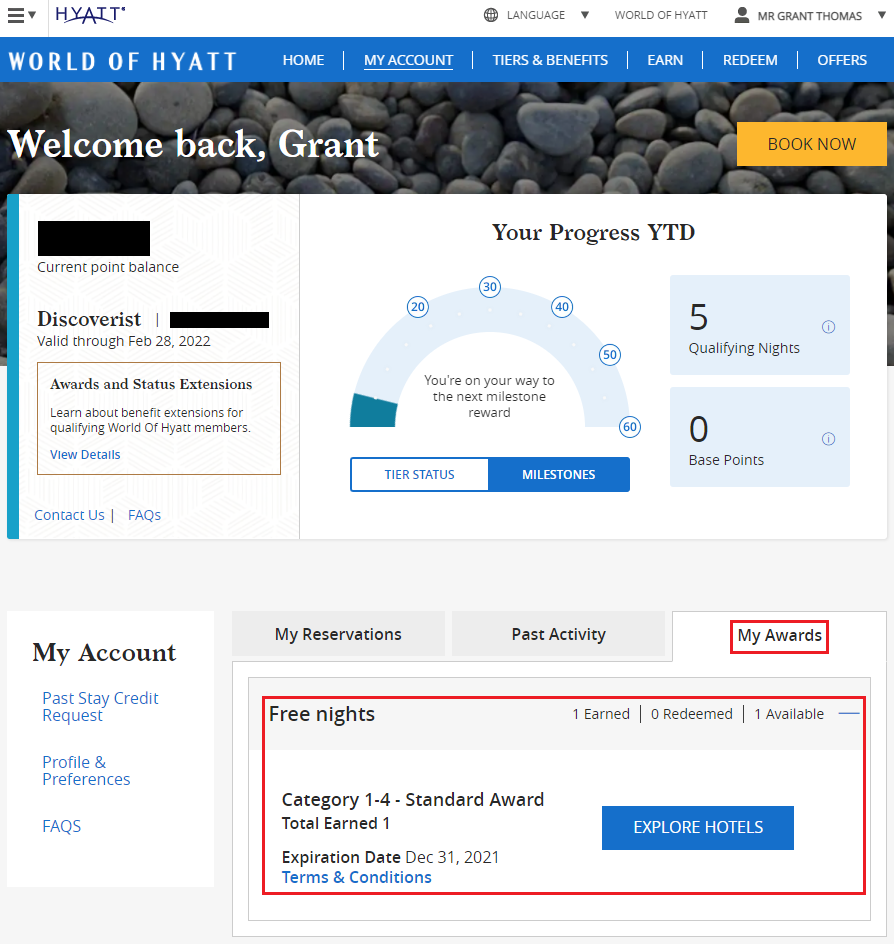

For those wondering about the Hyatt category 1-4 free night certificate, that actually posted to my Hyatt account around November 16 and is valid for stays through December 31, 2021. Since the Hyatt free night certificate has already posted to my Hyatt account, I can close my old Chase Hyatt Credit Card without worry – the free night certificate is mine to keep regardless if I have / keep the credit card.

Since my wife currently has the new Chase World of Hyatt Credit Card (and that is the credit card we normally use for Hyatt stays), I will not be losing anything by closing my old Chase Hyatt Credit Card. I am still over 5/24, but I should be under 5/24 in April 2021. At that point, I will consider applying for the new Chase World of Hyatt Credit Card. I do not have any plans to go for Hyatt Globalist Elite Status or spend $4,000 to earn a Hyatt free night certificate (I am still working on meeting minimum spend for 2 other credit cards this month).

If you have any questions about the old Chase Hyatt Credit Card, please leave a comment below. Have a great day everyone!

Just got the WOH card myself, with the promo, Explorist till 2023 with just 3 nights or Globalist with 10 make it a easy play

That’s great, are you going for Globalist status?

I have a very similar question if I cancel my old card and assuming I keep my explorer status and free nights, how long do I have to wait to apply for the new one

Hi Isaac, your Hyatt Explorist elite status should be valid until February 28, 2022 (check with your Hyatt account for the expiration date).

You can also see the expiration date of your free night certificate in your Hyatt account.

As far as closing the old card and apply for the new card, here are the offer terms: “The product is not available to either (i) current Cardmembers of any Hyatt Credit Card, or (ii) previous Cardmembers of any Hyatt Credit Card who received a new Cardmember bonus within the last 24 months.” Since you probably received the sign up bonus more than 24 months ago, you don’t need to worry about that part. I would close the old card, wait at least 1 month, and then apply for the new card. That’s my plan.

What are the rules for applying for the new card? I have the old card and the annual fee will be in Feb or March. I’m not staying in hotels at all and have tons of free nights to use next year so if canceling before January means I can collect the bonus on the WoH card next year it will be worth it. Ideally I would renew the card for $75, get the free night, then cancel and sign up again in a year, but that would make me ineligible for a bonus, correct?

Hi Jeff, I think the important thing to do is to close the old card before the product change on January 11. Here are the new card offer terms: “The product is not available to either (i) current Cardmembers of any Hyatt Credit Card, or (ii) previous Cardmembers of any Hyatt Credit Card who received a new Cardmember bonus within the last 24 months.” I would close the old card by January 11 and then wait at least 1 month before applying for the new card.

Any data points of certificate claw-back by Chase?

I’ve never heard of anything like that happening, especially on the anniversary free night certificates.

Well, Chase is pulling a fast one with their new World of Hyatt visa. Two weeks ago I was approved, in anticipation of my ten qualifying nights for 2020 and 2021 I’ve booked a week’s stay from Christmas to New Year’s, then another in early January for 10 nights. Then was all set to get explorist for 2020 and globalist for 2021. Now Chase is saying the offer is only five qualifying nights for each year (that’s after talking to countless Chase representatives who said they’d never heard of the offer or couldn’t find it). I told them I’m looking at the offer right now: https://creditcards.chase.com/lp/worldofhyattcc/dualoffer?CELL=61R2&icamp=hy_cc_footer —finally after 30 minutes on hold (two hours in total) a supervisor tells me that’s bonus isn’t applicable to my new card because I wasn’t routed FROM Hyatt to the chase application directly. What a load of shite that is. Now I’ve already got my nights booked with Hyatt and Chase is playing the ‘bait n switch’ game with me. And I’ve been with Chase for twenty years now.

Hi PM, that is really frustrating. It sounds like you did everything right but Chase is just giving you a hard time because you applied for the CC after starting at the Hyatt site. I wish I had some advice for you, but I’ve never had anything like this happen to me. I’m really sorry.