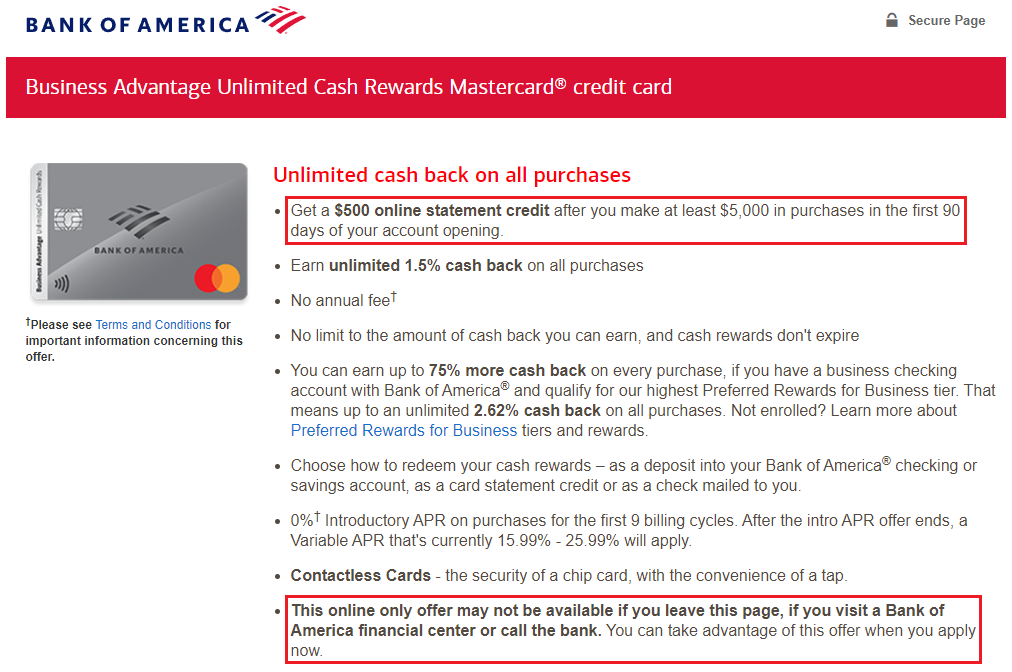

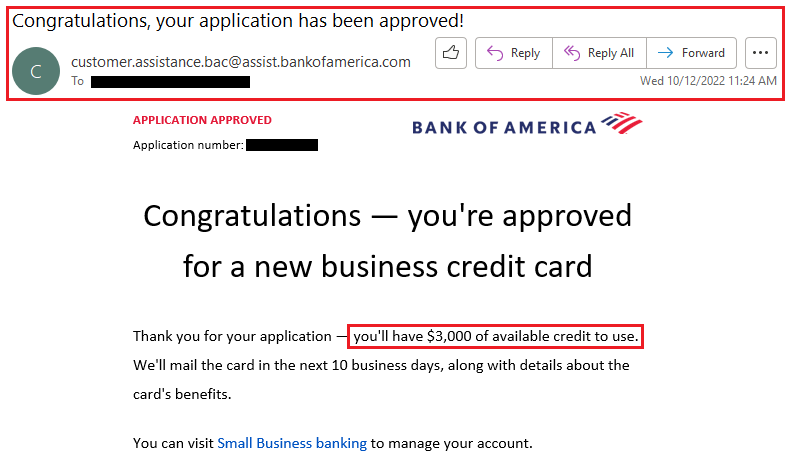

Good morning everyone. A few weeks ago, I did a mini App-O-Rama and applied for 3 business credit cards. One of those cards was the Bank of America Business Advantage Unlimited Cash Rewards Credit Card. The standard offer is $300 cash back after spending $3,000 in 3 months, but there is an alternative offer (link) that has a $500 cash back bonus after spending $5,000 in 3 months. I applied for the alternative offer and was instantly approved. The only problem… my credit limit was only $3,000 and I had a $5,000+ charge I needed to make.

Luckily I was instantly approved, but unluckily, only approved with a small credit limit of $3,000.

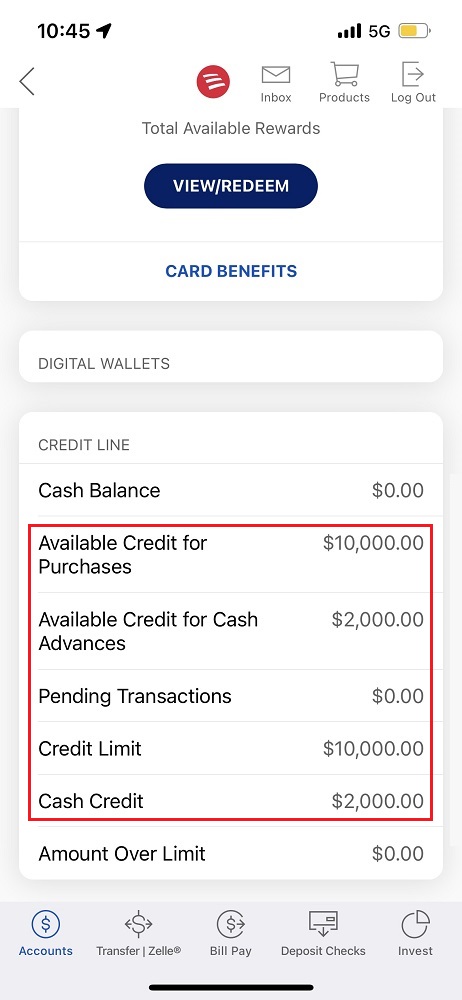

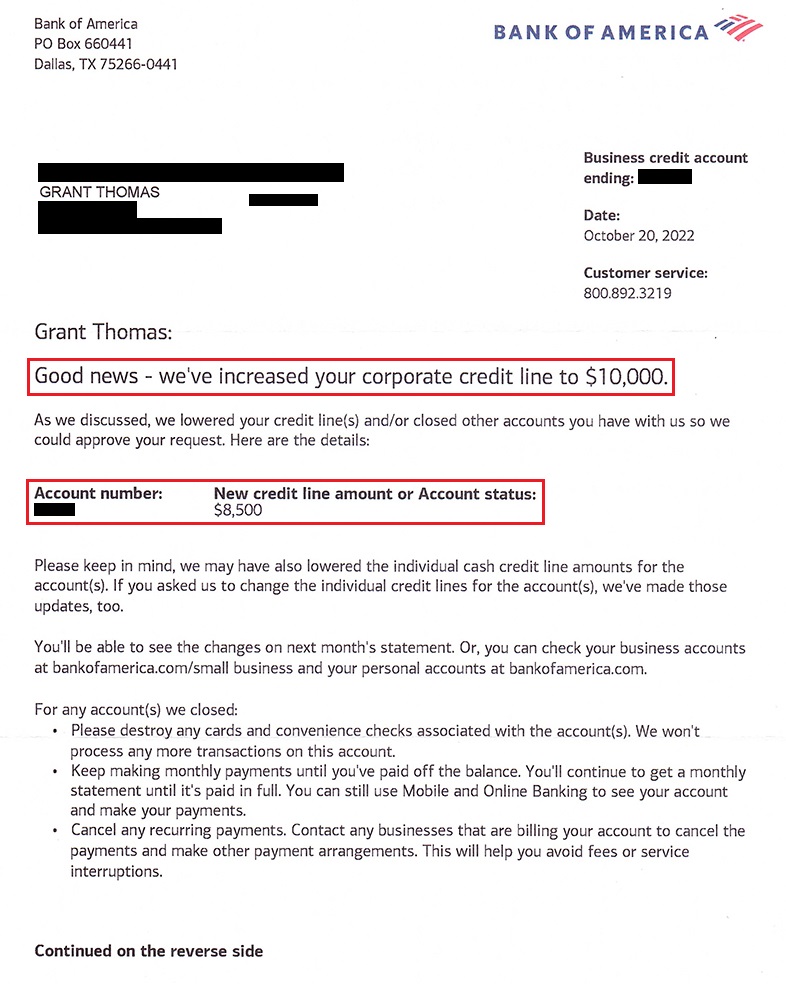

I have a few other business credit cards with Bank of America, so I called the number on the back of one my other Bank of America business credit cards and asked if I could move / reallocate credit to the new business credit card to get a higher credit limit. The rep understood my request and asked me how much I would like to move from each business credit card. I had a large credit limit on an old business credit card that I wasn’t using any more, so I asked to move $7,000 from the old business credit card to my new business credit card. The rep submitted my request and said I would receive a letter in 7-10 business days with the results. Luckily, I logged into my Bank of America app a few days later and saw the new $10,000 credit limit.

A few days later, I received a confirmation letter confirming the $7,000 credit limit move / reallocation. My old business credit card now had a new credit limit of $8,500 and my new business credit card had a new credit limit of $10,000.

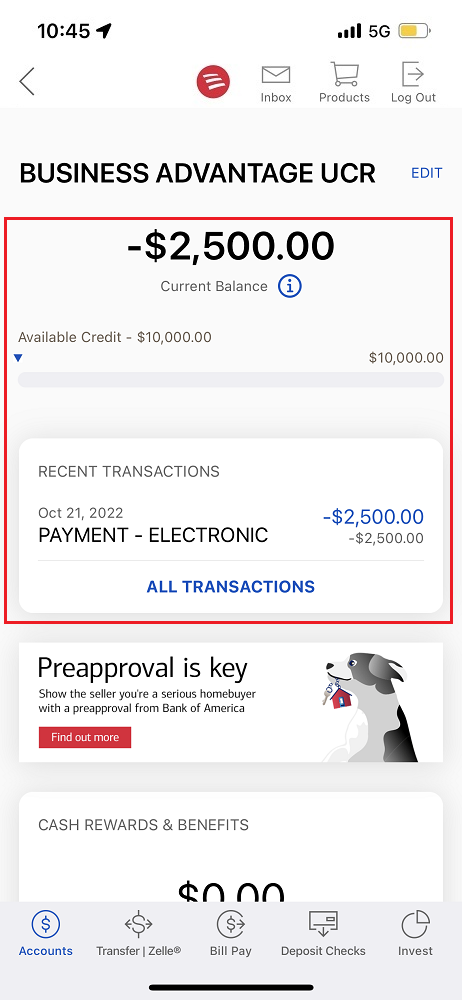

I also wanted to see if my credit limit would increase if I prepaid my credit card before making the purchase. I made a $2,500 payment (bill payment from my Wells Fargo checking account, not through the Bank of America bill pay service). Unfortunately, prepaying $2,500 did not increase my credit limit above the previous $10,000 credit limit.

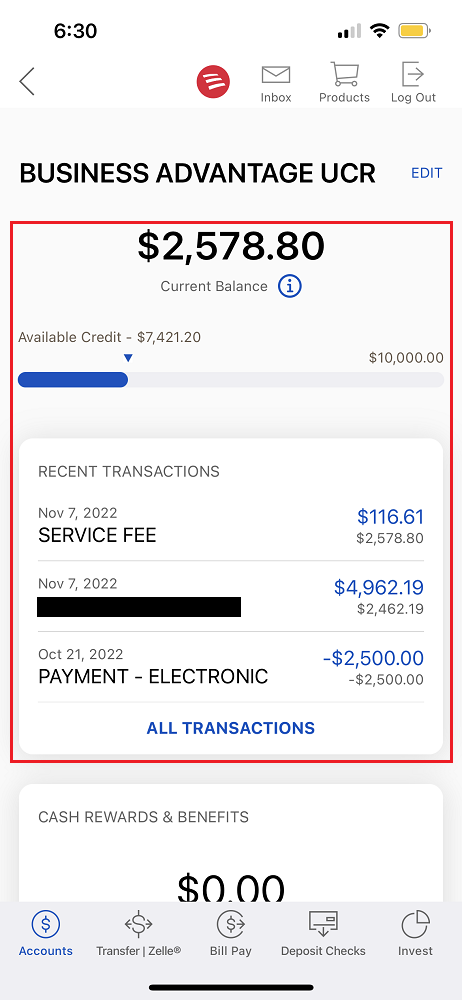

This next part isn’t related to moving / reallocating credit limits, but talks about meeting the minimum spending requirement and receiving the $500 cash back sign up bonus. I made a property tax payment and paid the service fee to complete the $5,000 minimum spending requirement during Bank of America’s More Rewards Day on November 5. The purchases posted to my account on November 7.

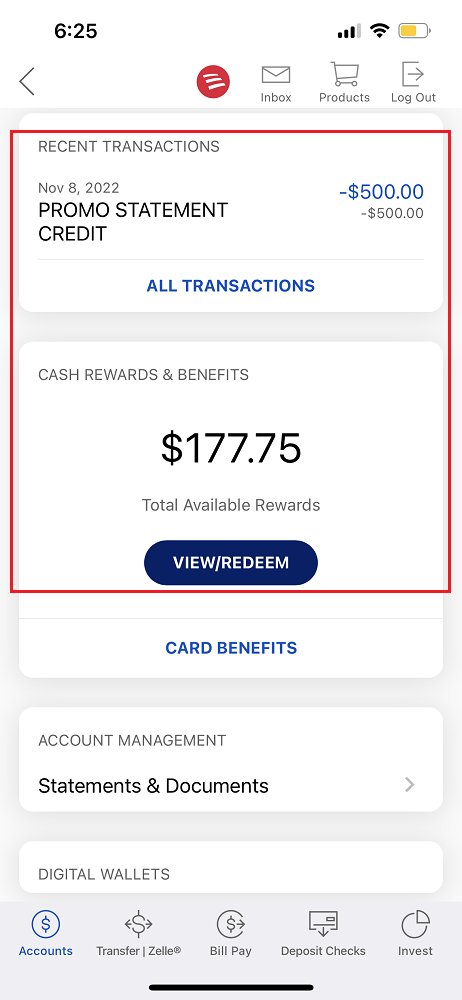

I’m not sure if my timing was excellent or if Bank of America processes the $500 cash back sign up bonus the next business day after completing the minimum spending requirement, but the $500 “PROMO STATEMENT CREDIT” posted on November 8. I also redeemed the $177.75 in cash back that I earned from the purchase and bonus 2% from More Rewards Day as a statement credit toward my credit card statement and then paid off the remaining balance.

All in all, the process to move / reallocate credit limits with Bank of America business credit cards was very simple and straightforward. This is in contrast to my failed attempts with my new Capital One Spark Cash Select Credit Card. Read about that process here: My Negative Experience Moving / Reallocating Credit Limits / Prepaying Bill with Capital One Spark Business Credit Card.

If you have any questions about moving / reallocation credit limits with Bank of America, please leave a comment below. Have a great day everyone!

Pingback: My Negative Experience Moving / Reallocating Credit Limits / Prepaying Bill with Capital One Spark Business Credit Card