Good evening everyone, happy New Year’s Eve! Doctor of Credit has a Best Bank Account Bonuses page that he keeps up to date with the best offers each month. In that master post, he links to individual bank account bonuses with helpful information regarding the bonus details, how to avoid monthly fees, when to close the account, how often you can open a new account, and much more. For the last 8 years, I have been opening new checking accounts, savings accounts, brokerage accounts, and cash management accounts for the new member bonuses. At the end of each year, I share my results on the blog. Over the last 8 years, I have made over $20,000 in bank account bonuses. You will receive 1099-INT tax forms every year, so you have to pay taxes on the bank account bonuses, but sometimes you can fund the opening deposit with a credit card and earn miles, points, or cash back. If you are lucky, you can meet a minimum spending requirement by funding a new checking account or reach a high spending target to earn more rewards. Here are my results from the last 8 years with links to corresponding yearly summaries:

- 2015: $1,175 (no post)

- 2016: $2,850 (summary)

- 2017: $3,700 (summary)

- 2018: $2,725 (summary)

- 2019: $1,000 (summary)

- 2020: $800 (summary)

- 2021: $3,600 (summary)

- 2022: $4,485 (this post)

Drum roll please… Here are the 18 new accounts I opened in 2022 that paid out $4,485 in bonuses:

The list above includes traditional checking accounts, savings account, and brokerage accounts. I include everything above since the process is basically the same. The Charles Schwab Brokerage bonus was in the form of $101 in stock slices across 5 different stocks. The American Express Business Checking bonus was in the form of 20,000 American Express Membership Rewards Points, which I value at $300 (1.5 CPP per AMEX MR Point) – wish I knew the bonus would increase to 60K AMEX MR Points later in the year. The Fidelity Bloom Save and Fidelity Bloom Spend were easy online savings accounts from Fidelity. The Oxygen Business Checking bonus was paid out as a $100 cash bonus + iPad ($329 value).

The requirements vary quite a bit between the accounts: several debit card purchases, recurring direct deposits, and large initial funding deposits. I don’t mind jumping through hoops to open new accounts, like funding accounts, moving money around, changing direct deposits, keeping track of bonuses, and then closing accounts. I try to focus on bonuses that pay more than $100 unless the bonus is very easy and quick.

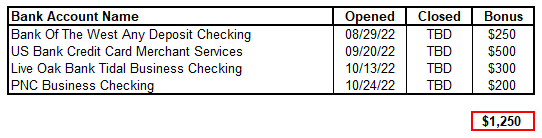

There are 4 other accounts that I opened in 2022 but the bonus has not posted yet, so those will count toward my 2023 numbers. The US Bank Credit Card Merchant Services required a single credit card to be processed for $50. The 3 other accounts required deposits and some debit card transactions. Here are the 4 accounts with $1,250 in bonuses pending:

If you are interested in bank account bonuses, I recommend checking out Doctor of Credit’s Best Bank Account Bonuses page. If you did any bank account bonuses in 2022, please let me know how much you made this year and whether your total is higher or lower than previous years. Thanks for reading and have a great New Year’s Eve everyone!

How much tax you will be paying for these bonuses?

Hi Ram, probably 15-30% tax, but I won’t know for sure until I do my taxes in March or April.

The argument about paying taxes doesn’t make sense to me. If you received a raise at work, would you complain that you would need to pay more in taxes?

Have a great New Years Eve!

2018 $2,100

2019 $8,675

2020 $5,450

2021 $10,250

Huntington (P1 & P2) $600

Huntington Bus. $750

Wintrust (P1 & P2) $600

US Bank $500

Fifth Third (P1 & P2) $750

Wells Fargo (P1 & P2) $400

Wells Fargo Bus. $1,500

Bank of America $100

First Tech FCU (P1 & P2) $600

PNC (P1 & P2) $800

PNC Bus. $200

Relay Financial $150

Alliant $200

Ally Invest (P1 & P2) $300

BMO Harris Bus. $400

Amex Bus. $300

Tradestation (P1 & P2) $300

US Bank Bus. $300

Capital One $250

Laurel Road (P1 & P2) $600

Mercury Bus. $500

2022 $10,100

I was not expecting such a great 2022 after a fantastic 2021!

I did travel OOS for 8 of the bonuses (7 in Chicago and 1 in Kansas City).

Dang, you killed it in 2021 and again in 2022! Do you think you will be able to match those numbers again in 2023? Any pending bonuses that you expect to post in early 2023?

Thank you for sharing your bank account bonuses!

I really do not see a possibility of matching those numbers again but I would really like to!

For 2023 (the following I have completed the requirements or I am working on):

Citibank Bus. $500

Live Oak Bus. $300

Hawthorn (P1 & P2) $600

HSBC (P1 & P2) $1,000

Regions (P1 & P2) $400

First Bank (P1 & P2) $600

Associated $400

AllTru Savings (P1 & P2) $300

A potential of $4,100.

$4,100 is a great start for 2023. My Live Oak Bank business checking is taking a while to post, so that should be any day now. Wishing you all the best in 2023!

Thanks, Grant!

Nice!! About $6,500 for wife and I this year! Almost half of it being the insane $1,500 Wells Fargo business checking account bonuses!

Hey David, that Wells Fargo bonus is the one that got away for me. Glad you were able to get in on the deal. Good work to you and your wife. Here’s to a great 2023 for you both!

It is a little depressing to start adding the 1099-INTs, and see the “refund” dropping each time.

It’s worthwhile to track these, particularly any business checking bonus, in the event that a 1099-INT doesn’t arrive. (e.g. an account with e-statements activated, but the account is closed, or accidentally closed before checking for an existing tax statement)

Yes, agreed. Hate seeing the numbers recalculate every time in TurboTax :/

I always report all my bonuses even if I don’t get a 1099, since I assume my copy got lost in the mail but the other copy made it to the IRS safely.

Not as good as last year. Some of my crypto deals have gone negative.

10432 8294 2137

Bank Bonus Referral

1st United 250 0

Abra -2 11

Air Academy 5 0

Ally 100 0

Alt 0 25

AltoIRA 50 51

America First 100 0

American Express 300 0

Aspiration 25 0

Axos 150 0

Bakkt 22 0

Bitflyer 1 5

Bumped 2 0

Cash App 0 10

Celsius 66 0

Cheese 9 51

CIT 40 0

Citi 700 0

Coinbase 68 0

Coinlist 1 10

Collectable 19 5

Commonwealth 100 0

Concreit 0 30

Crypto.com 4 0

Current 10 0

DCU 0 200

DimeFi 20 25

Enzo 50 0

Fidelity 36 0

Financial Partners 100 0

Fintron 20 20

First Tech 300 0

Firstrade 3 2

Front 5 3

GO2Bank 166 50

GoHenry 30 40

Groundfloor 10 0

Hodlnaut 0 30

Idaho Central 102 0

Investors 25 0

Juno 10 200

Kabbage 250 0

KeyPoint 305 0

Landa 10 0

Ledn -29 0

Lex 20 5

Loved 5 6

M1 Finance 100 0

Mainvest 20 5

Makara 0 4

Marcus 100 0

MoneyLion 0 454

MPH 100 0

Navy Federal 90 0

NBKC 44 0

Nearside 0 50

OKCoin 91 0

Oxygen 0 5

Pennsylvania State Employees 0 300

Point 91 150

Public 0 3

Redstone 0 100

Sable 140 95

Schwab 101 0

Service 100 0

SoFi 151 0

Southland 53 0

Spiral 200 0

Starship 30 0

StreetBeat 17 30

Tastyworks 0 20

TBK 600 0

Tornado 5 0

Upgrade 400 100

Uphold 2 43

US Bank 700 0

Wells Fargo 1700 0

Good job, lots of accounts to keep track of and I’m sure your tax accountant will be busy with your 1099s.

You have 8 out of 18 accounts still open. I’d imagine that some will be closed after an appropriate amount of time but that’s still a surprising amount. Would you care to share why? I’m not doing bank account bonuses currently but I’m intrigued and would welcome any more information.

Hi Christian, that is a great question. If an account has cumbersome ways to waive the annual fee and doesn’t have an early account termination fee, I would close it about a month after getting the bonus. The accounts I kept open are more fintech than traditional banks, so I was hoping that there would be other promos. That might be unlikely, so I’ll probably close those accounts in the next few months.

Does opening and closing so many bank accounts effect your credit score?

Hi Wendy, most bank accounts do a soft pull on your credit report, but not a hard pull that would affect your credit score. There is a similar system call Chex System that keeps track of your banking history, but that doesn’t affect your credit score.

Chex only applies if you’re opening a checking account.

Some of us like these checking account bonuses.

I had one bank pull Chex because they refused to convert a previous account to a different type. Ironically, it was Norton LifeLock that reported the inquiry and new account, when my intent was to just convert the old account.

No sign-up bonus, but 1% on debit purchases… with our current rate environment, the old account earning only 1% APR is pretty much useless. (lots of 3% rates, and a few reaching 4.45%)

I will make a comment about JPMC.

JPMC “chased” me out in ’21 as part of their crackdown to prevent money laundering on small business checking account. I verified my identity with driver’s license, but when I got the new conditions a few weeks later, after satisfying the first set of conditions, I closed my business account voluntarily. When I closed the account, the banker was asking me why, and I quite bluntly told them that in 90 days they would make me an offer to return, so why let my funds get frozen… fine, their effort to satisfy regulators resulted in closed accounts, so JPMC got to include my account in the “closed” number, and 90 days later, I could return as a “new” customer. Close my account, I’ll wait for an offer to return.

Yes, I collected on that offer to return in 2022.