Good afternoon everyone. At the end of every year, I write a post like I Paid $4,043 in Credit Card Annual Fees in 2022 – Was it Worth it? In that post, I shared how much I paid in credit card annual fees and how much value I received from credit card benefits, targeted spending offers, and retention offers. 99% of the time, I get more value out of a credit card than the cost of the annual fee (otherwise I would have closed or downgraded to a cheaper or no annual fee credit card). One of the key parts of my credit card strategy is to call every time a credit card annual fee posts to my account. 90% of the time, I do not get any retention offer or a retention offer that does not excite me (like 0% APR for 12 months or 0% balance transfers). But about 10% of the time, I do get a decent retention offer that I happily accept. Like the old saying goes, you miss 100% of the shots you do not take.

Most of the time, the retention offer will post within a few weeks or by the time the next credit card statement closes. But sometimes it doesn’t, so you may need to follow up to see what is going on. This is exactly what happened to me regarding 2 retention offers I recently received from Chase. I called in early July about the $450 annual fee on my JPMorgan Chase Ritz Carlton Credit Card and explained that I was considering closing the credit card because the annual fee posted and I wasn’t getting enough value out of the credit card. The rep looked at the retention offers and said they could offer me a $150 statement credit if I kept the credit card open and paid the annual fee. I happily accepted the offer and patiently waited for the $150 statement credit to post. Unfortunately, nothing happened for 2 full months.

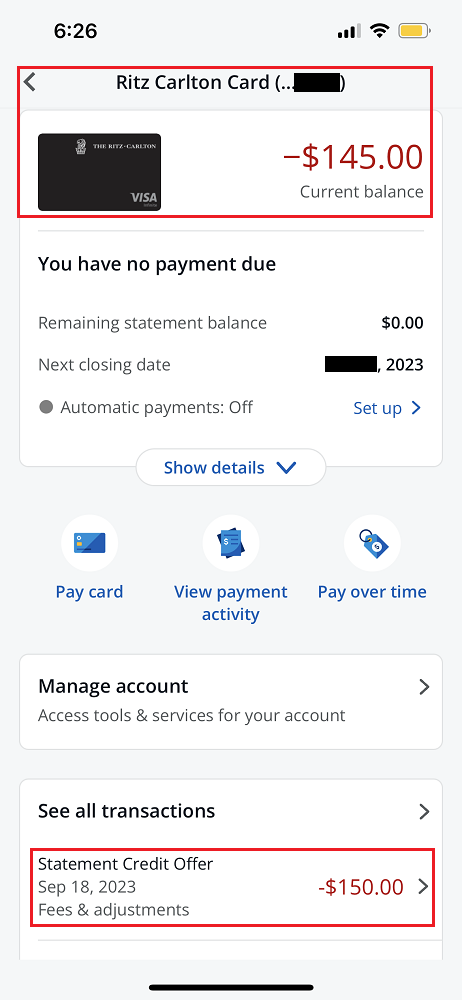

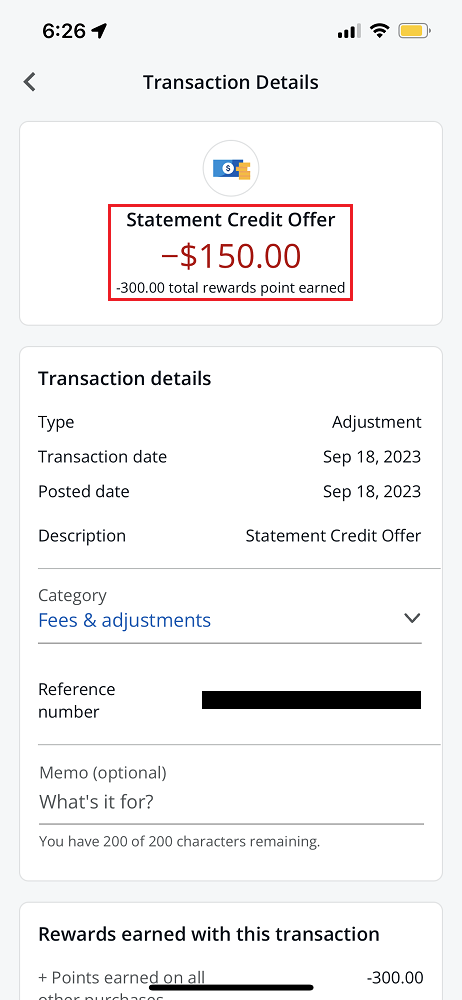

I called Chase in mid September and asked about the $150 retention offer and the agent said that they see the $150 retention offer statement credit as an option, but that the button to accept the offer was not pressed / selected. The rep was able to click / accept the offer and said that the $150 statement credit would appear in the next few weeks. A few days after the call, the $150 statement credit posted on September 18.

Mini Rant: I hate that a $150 statement credit on my Ritz Carlton credit card causes me to lose 300 Marriott Bonvoy points. I didn’t earn any points when I paid the $450 annual fee, so why am I paying 300 points when I receive a $150 statement credit?

Similarly, the $89 annual fee on my Chase IHG One Rewards Premier Credit Card posted in early August and I called Chase the next day to ask about retention offers. The rep said they could offer me a $50 retention offer statement credit if I kept the credit card open and paid the annual fee. I happily accepted the offer and patiently waited for the $50 statement credit to post. Unfortunately, nothing happened for the next 1.5 months.

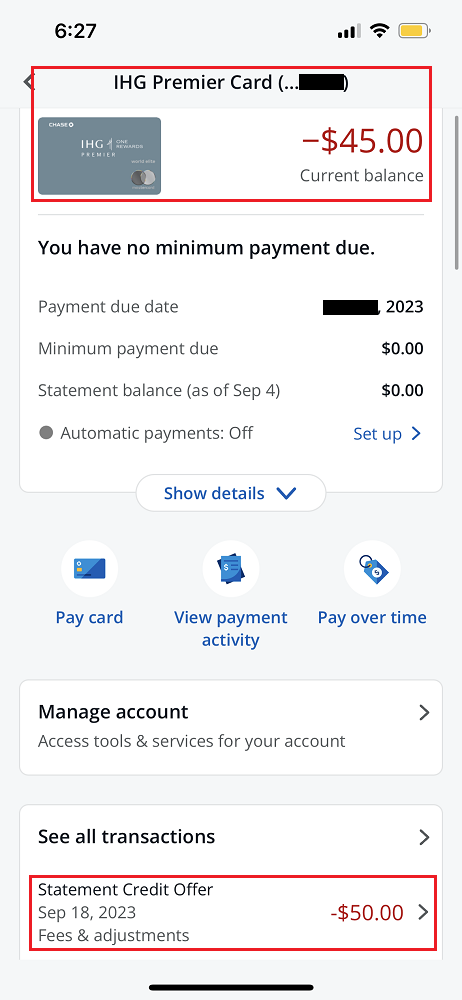

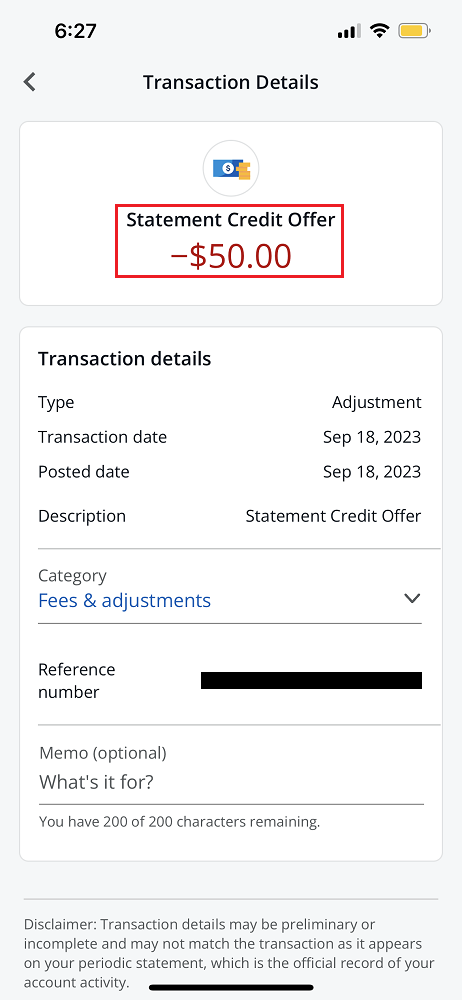

As part of the same call from above, I called Chase in mid September and asked about the $50 retention offer and the agent said that they see the $50 retention offer statement credit as an option, but that the button to accept the offer was not pressed / selected. The rep was able to click / accept the offer and said that the $50 statement credit would appear in the next few weeks. A few days after the call, the $50 statement credit posted on September 18.

Mini rant: In this case, I am not penalized for receiving a $50 statement credit on my Chase IHG credit card, since there is no loss of IHG points.

I’m not sure if the first reps I spoke with about retention offers did not accept the offer correctly, but that would seem strange since the 2 calls were about a month apart and I spoke to 2 different reps. I’m going to guess that there was some IT glitch in the Chase retention offer system from early July to mid September that caused the retention offers to not be processed correctly. If you have accepted a retention offer recently and not received the retention offer in a timely manner, you may want to follow up and see what is going on. If you have any data points about retention offers with Chase from July – September, I would love to read them, so please share the details in the comments section. If you have any questions about retention offers, please leave a comment below. Have a great day everyone!

Been waiting over 2 months to get retention offer on my Ritz Carlton as well. Seems to be some kind of pattern either with this card or Chase retention offers lately. You were more fortunate than me. In my case they keep telling me to wait and it will come on the next statement, and it never does. 2 statements so far, still trying to get it.

Definitely call back and ask if the retention offer was properly applied to your account, it should take that long. Are you calling the special JPMorgan customer service number on the back of the Ritz Carlton credit card?

Called, emailed, Chase customer service lately sucks. Only 1 supervisor I spoke to about a month ago nailed it right on the head and even said what exactly what you and I have been telling Chase for a while now, that it is an IT issue. He even said that if it happened to me, it is probably happening to others as well. Your blog proves he was right. Other than him though, all the other reps and supervisors I’ve spoken with for 2 months have no clue. I’ve gotten retention offers in the past and they always posted within a week. I have another escalation in the works. We’ll see what happens with that one.

Dang, that’s frustrating. I would keep calling until you get a rep who can properly accept the statement credit or manually provide a $150 statement credit. You’ve waited long enough for the system to work correctly.

I got the same offer on the Ritz card and it posted in about 10 days. No problem

Hi Paul, that’s good to hear. Do you remember when you called and when the retention offer statement credit posted?

Is there a reason points are deducted from the Ritz card and not the IHG? That makes no sense to me.

I agree with your logic, why should points ever be deducted for a retention fee?

I have no idea. I think the engineers who programmed that card might have assumed that statement credits should be processed like returns, with points being deducted. It’s been happening like this for years, so it doesn’t seem like this will ever be fixed.