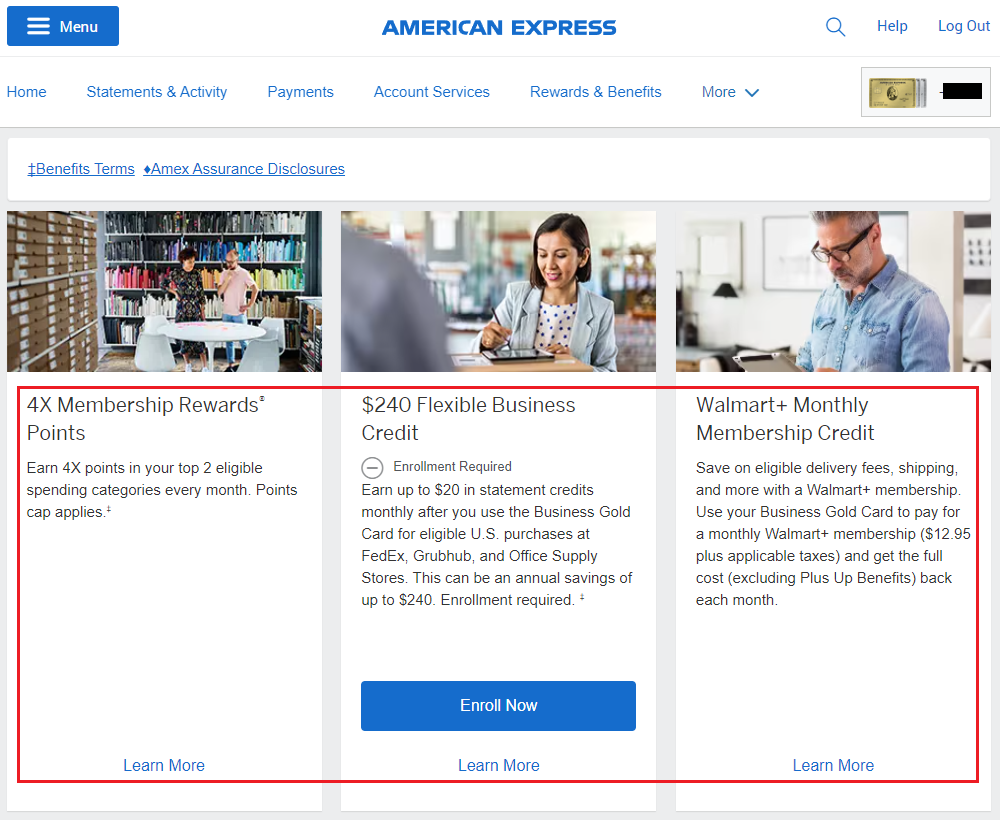

Good afternoon everyone, I hope your week is going well. I just noticed that the American Express Business Gold Card made some changes to their 4x AMEX Membership Rewards Points earning categories, added a $240 Flexible Business Credit ($20 / month at either FedEx, Grubhub, or at office supply stores), and is offering a $12.95 / month credit to offset the $12.95 / month Walmart+ Subscription. Let’s go through these changes so you can see if these new benefits are useful. You can see these benefits on the Benefits tab in your AMEX online account. Let’s look at the 4x categories first.

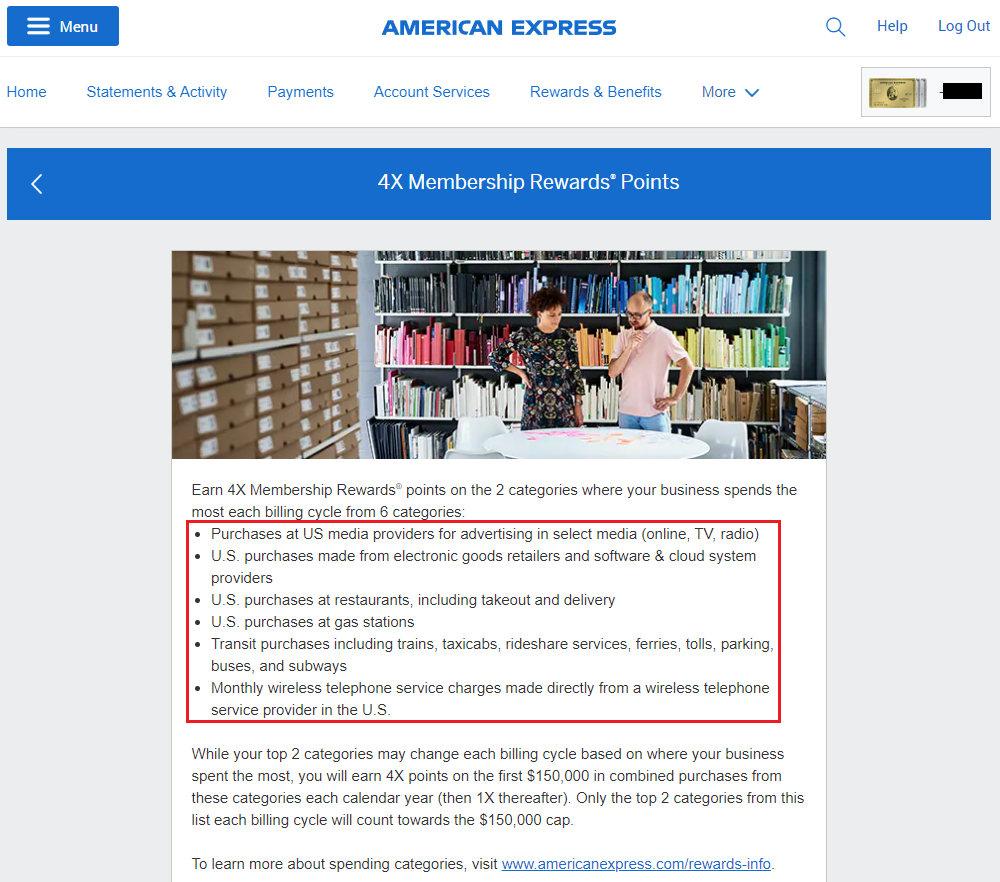

Effective today (October 3, 2023), there are new 4x categories. You earn 4x points on your top 2 categories each month, up to a max of $150,000 yearly spend.

At the bottom of the page, there are terms that are broken into 3 date ranges. It may be hard to tell the differences, so I have them broken down even further below.

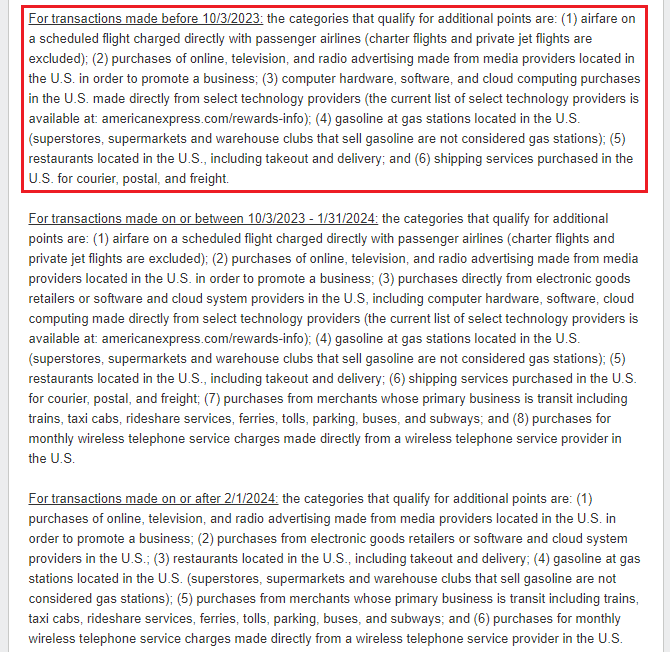

Here are the 3 sets of terms, broken into date ranges, and then broken down into the various bonus categories. Red text indicates new categories, effective today (October 3, 2023):

For transactions made before 10/3/2023: the categories that qualify for additional points are:

(1) airfare on a scheduled flight charged directly with passenger airlines (charter flights and private jet flights are excluded);

(2) purchases of online, television, and radio advertising made from media providers located in the U.S. in order to promote a business;

(3) computer hardware, software, and cloud computing purchases in the U.S. made directly from select technology providers (the current list of select technology providers is available at: americanexpress.com/rewards-info);

(4) gasoline at gas stations located in the U.S. (superstores, supermarkets and warehouse clubs that sell gasoline are not considered gas stations);

(5) restaurants located in the U.S., including takeout and delivery; and

(6) shipping services purchased in the U.S. for courier, postal, and freight.

For transactions made on or between 10/3/2023 – 1/31/2024: the categories that qualify for additional points are:

(1) airfare on a scheduled flight charged directly with passenger airlines (charter flights and private jet flights are excluded);

(2) purchases of online, television, and radio advertising made from media providers located in the U.S. in order to promote a business;

(3) purchases directly from electronic goods retailers or software and cloud system providers in the U.S, including computer hardware, software, cloud computing made directly from select technology providers (the current list of select technology providers is available at: americanexpress.com/rewards-info);

(4) gasoline at gas stations located in the U.S. (superstores, supermarkets and warehouse clubs that sell gasoline are not considered gas stations);

(5) restaurants located in the U.S., including takeout and delivery;

(6) shipping services purchased in the U.S. for courier, postal, and freight;

(7) purchases from merchants whose primary business is transit including trains, taxi cabs, rideshare services, ferries, tolls, parking, buses, and subways; and

(8) purchases for monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

For transactions made on or after 2/1/2024: the categories that qualify for additional points are:

(1) purchases of online, television, and radio advertising made from media providers located in the U.S. in order to promote a business;

(2) purchases from electronic goods retailers or software and cloud system providers in the U.S.;

(3) restaurants located in the U.S., including takeout and delivery;

(4) gasoline at gas stations located in the U.S. (superstores, supermarkets and warehouse clubs that sell gasoline are not considered gas stations);

(5) purchases from merchants whose primary business is transit including trains, taxi cabs, rideshare services, ferries, tolls, parking, buses, and subways; and

(6) purchases for monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

If you compare the second group of bonus categories and the third group of bonus categories, you will notice that “(1) airfare on a scheduled flight charged directly with passenger airlines (charter flights and private jet flights are excluded)” and “(6) shipping services purchased in the U.S. for courier, postal, and freight” are excluded after February 1, 2024.

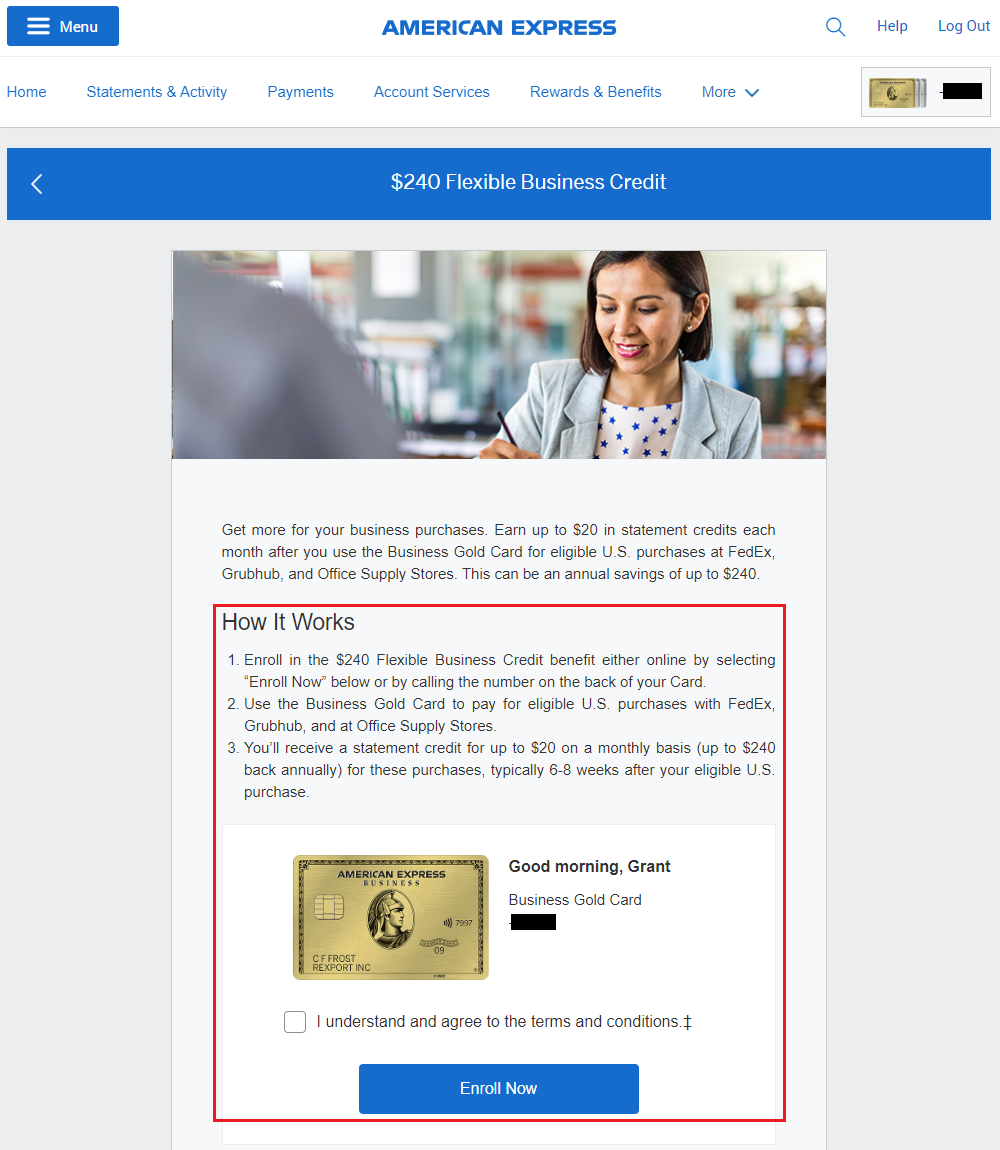

Moving on, the $240 Flexible Business Credit is $20 / month for purchases made at FedEx, Grubhub, and at office supply stores. I don’t use FedEx (I normally use USPS 90% of the time and UPS 10% of the time for my shipments since there is no FedEx drop-off location close by). Grubhub is a decent option for a take out or delivery meal once a month. Lastly, the office supply store purchase could be useful for Staples and Office Depot gift card sales that come around every week.

Here are the complete terms of the $240 Flexible Business Credit:

Enrollment is required to receive the benefit. Only the Basic Card Member or Account Manager(s) on a U.S. Business Gold Card Account can enroll the Card Account in the benefit. U.S. Business Gold Rewards and Classic Business Gold Card Members are not eligible to enroll. Please note, enrollment may take up to 24 hours to process. Basic Card Members can receive up to a total of $20 in statement credits each month on eligible U.S. purchases made across all Cards on the Card Account directly with FedEx, Grubhub, and at U.S. Office Supply Stores (“Select Business Merchants”). See additional details and restrictions below. Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. Purchases by both the Basic Card Member and any Additional/Employee Card Members on the enrolled Card Account are eligible for statement credits. However, each Card Account is only eligible for up to $20 in statement credits per calendar month, for a total of $240 per calendar year in statement credits across the Card Account. Purchases of prepaid or gift cards from third-party retailers for use at these participating partners are not eligible for this benefit. Other restrictions may apply to each partner, see each partner’s terms & conditions for more information.

FedEx: Eligible purchases include qualifying services paid for on-site at U.S. FedEx locations, via the U.S. FedEx website, or billed to a U.S. FedEx account that is linked to a Card on your Business Gold Card Account. Eligible purchases include in-store and online purchases with FedEx Express and FedEx Ground shipping services. Qualifying Services include: FedEx Priority Overnight®, FedEx Standard Overnight®, FedEx 2Day®, FedEx 2Day® A.M., FedEx Express Saver®, FedEx 1Day® Freight, FedEx 2Day® Freight, FedEx 3Day® Freight, FedEx International Priority®, FedEx International Economy®, FedEx International Priority® Freight, FedEx International Economy® Freight, FedEx Ground®, FedEx International Ground®, FedEx Home Delivery®, shipping transactions made via FedEx Ship Manager® and FedEx Ship Manager® Lite, and shipping through FedEx® Compatible solutions. Excludes invoiced payments, such as FedEx® Billing Online (FBO), Electronic Data Interchange (EDI), and paper invoices, international duties and taxes, other brands (FedEx Custom Critical®, FedEx Freight, FedEx TechConnect®, FedEx Office, FedEx Trade Networks, FedEx Cross Border, FedEx Authorized ShipCenter®), FedEx SameDay®, FedEx Delivery Manager®, FedEx® Cold Shipping Solution, and non-shipping product purchases or services. Use of FedEx service is subject to the terms and conditions of the FedEx Service Guide in effect at time of shipment and available at www.fedex.com/serviceguide. FedEx reserves the right to modify the FedEx Service Guide at any time without notice.

Grubhub: Eligible purchases include U.S. purchases made at Grubhub.com, on the Grubhub app, Seamless.com and on the Seamless app. Excludes Grubhub Corporate.

U.S. Office Supply Stores: Eligible purchases include purchases at U.S. Office Supply Stores. U.S. Office Supply Stores are in the business of selling a range of office supplies including items like paper, notebooks, office equipment (e.g., fax machines and printers) and office furniture (e.g., desks, desk chairs and filing cabinets). For additional information please visit https://www.americanexpress.com/us/rewards-info/business.html.

Please allow 6-8 weeks after an eligible purchase is charged to your Card Account for statement credit(s) to be posted to the Account. Please call the number on the back of the Business Gold Card if statement credits have not posted after 8 weeks from the date of purchase. American Express relies on the merchant to process transactions within the same calendar month that you made the purchase in order to apply the $20 monthly statement credit in the month that it was intended. For example, if you make an eligible purchase on the last day of the month, but the merchant doesn’t process that transaction until the next day, then the statement credit would be applied in the following month. To determine eligibility for certain bonus categories, Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for rewards. A purchase with a merchant will not earn rewards if the merchant’s code is not included in a reward category. Basic Card Members may not receive a statement credit if we receive inaccurate information or are otherwise unable to identify a purchase as eligible for a reward category. For example, Basic Card Members may not receive the statement credit when: a merchant uses a third-party to sell their products or services; or a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet. To receive statement credits, Card Account(s) must not be canceled and not past due at the time of statement credit fulfillment. Statement credits may be reversed if an eligible purchase is returned/canceled. Statement credits for eligible purchases, or any reversal of a statement credit, may be applied to either the Pay in Full balance or the Pay Over Time balance regardless of where the eligible purchases originally posted. For additional information, call the number on the back of your Card.

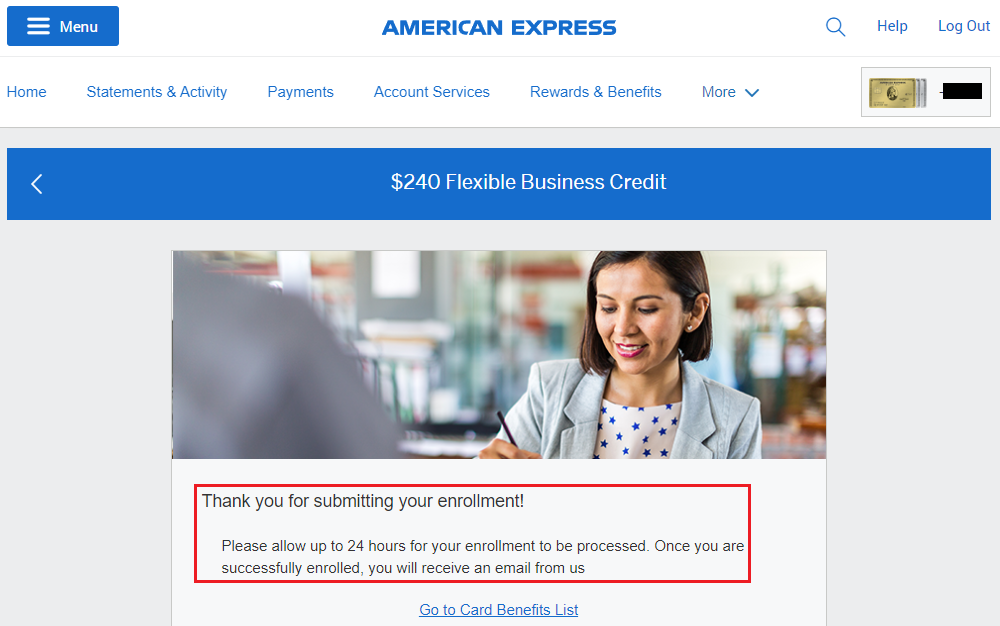

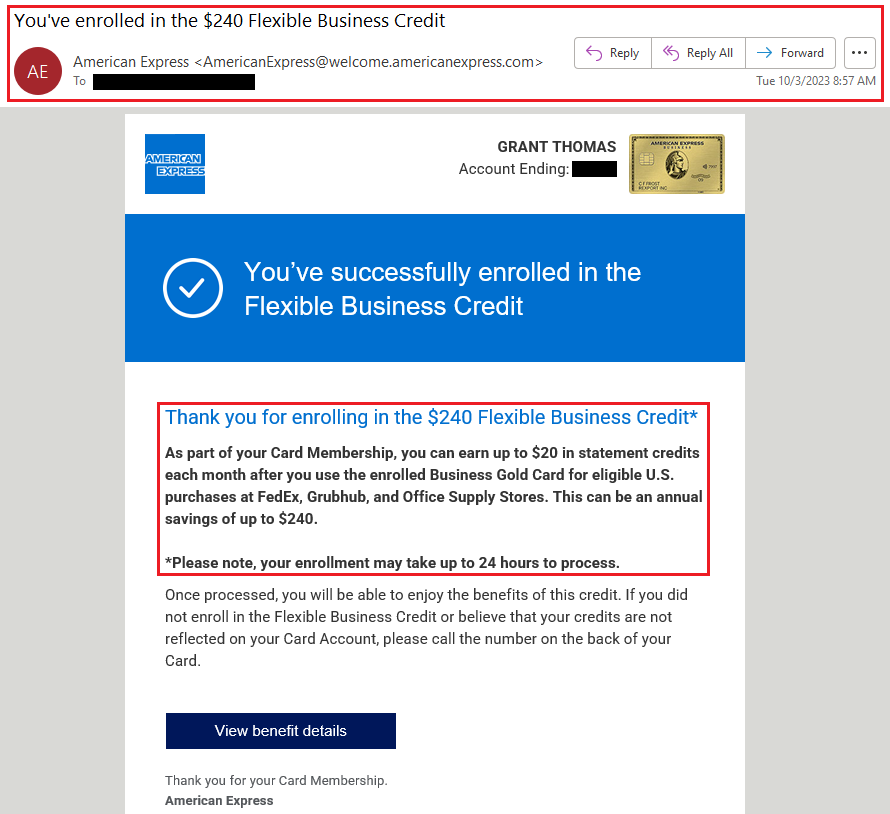

Enrollment was easy, but you need to wait 24 hours before you make your first eligible purchase.

I also received a confirmation email with my enrollment.

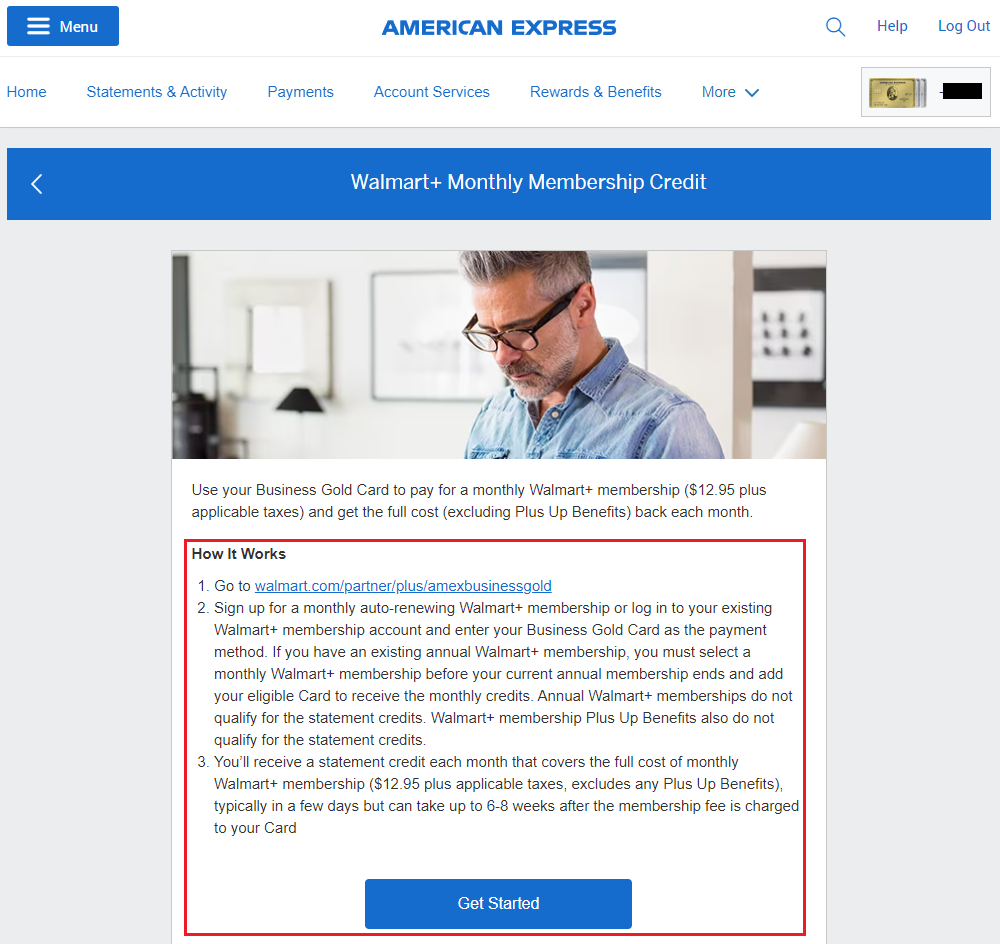

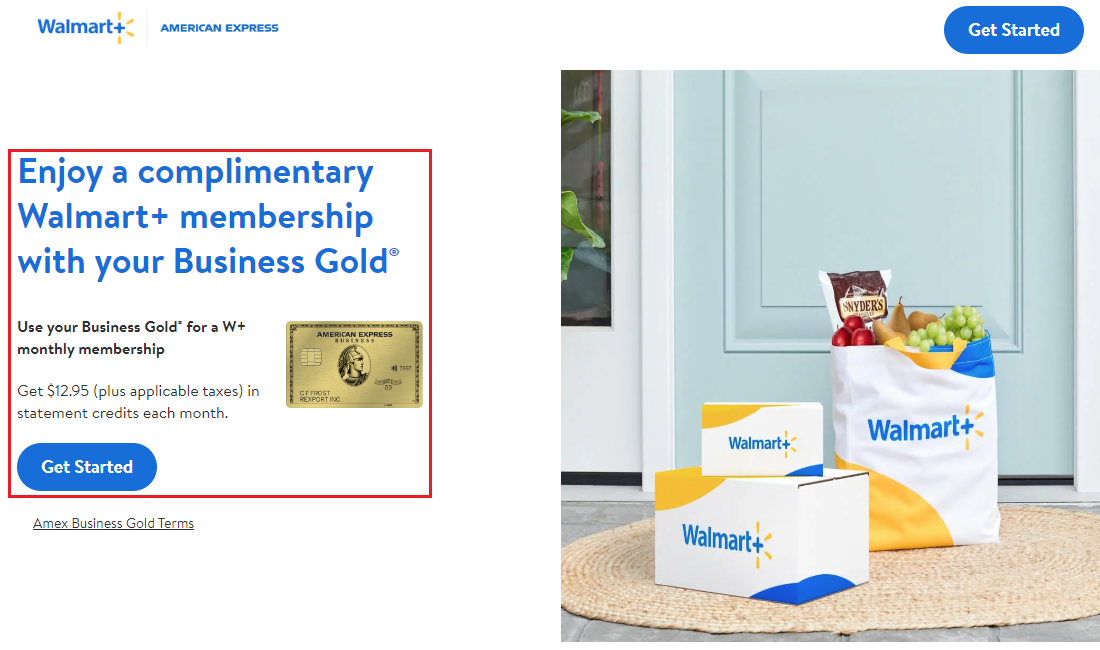

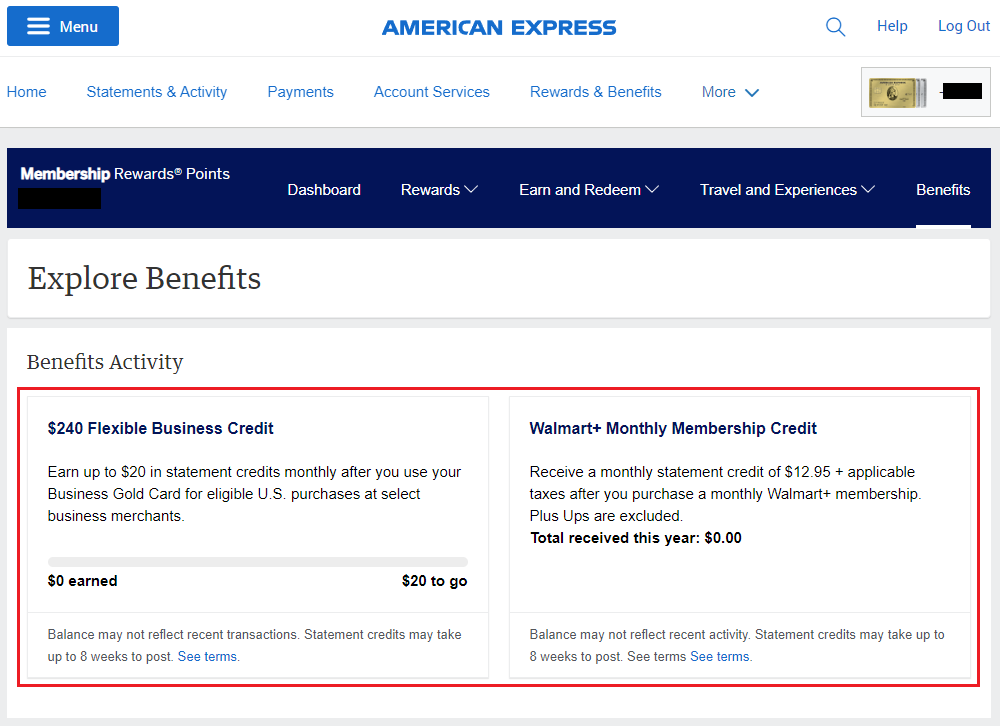

Lastly, you can now get a $12.95 / month credit to offset the $12.95 / month Walmart+ Subscription. Click the Get Started button to sign up for Walmart+.

Here are the complete terms for the Walmart+ Monthly Membership Credit:

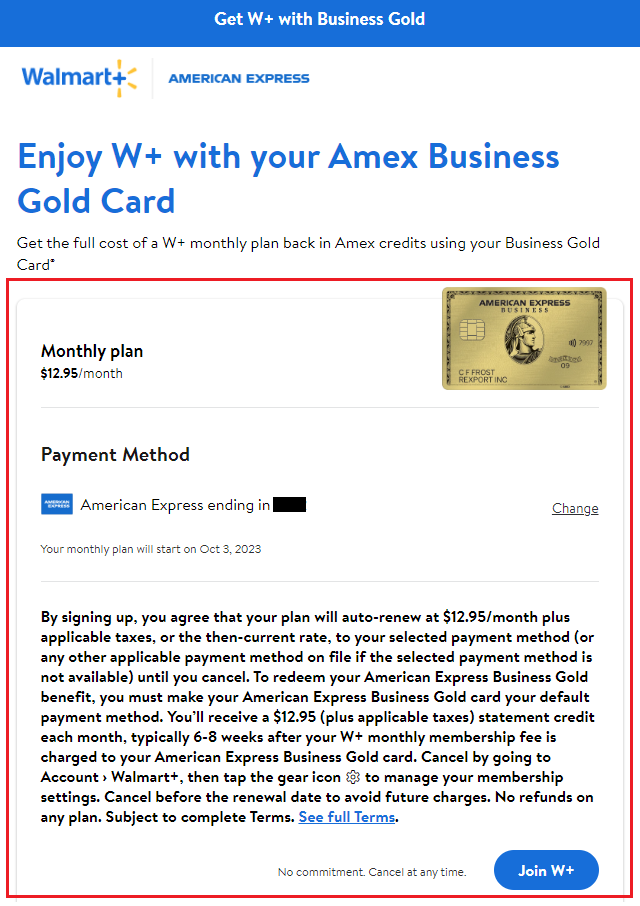

Basic Business Gold Card Members can receive a statement credit for a monthly Walmart+ membership fee ($12.95 plus applicable taxes each month) when a Basic or Additional/Employee Card on the Account is used to pay for a monthly Walmart+ membership. Enrollment in monthly Walmart+ membership is required. Purchases of any membership Plus Up Benefits (for example, Walmart InHome) and purchases of Walmart Business+ memberships are not eligible for this benefit. Purchases by both the enrolled Basic Card Member and Additional/Employee Card Members on the Card Account are eligible for statement credits. However, a statement credit will be provided for only one monthly Walmart+ membership fee per Card Account per month, whether the fee is charged to the Basic Card or an Additional/Employee Card. If you are already enrolled in a monthly Walmart+ membership, the Basic Card Member will begin receiving a monthly statement credit after your monthly Walmart+ membership fee is charged to the Card. If you are enrolled in an annual Walmart+ membership, the Account will not receive monthly statement credits for that annual membership. For the Card Account to receive the credit, you must switch your annual Walmart+ membership, at least one day before your annual renewal date, to a monthly Walmart+ membership. If you do not switch before your renewal date, your annual Walmart+ membership will automatically renew, and the Account will not receive the monthly statement credit for the annual membership fee. To switch your annual Walmart+ membership to a monthly membership, please update your membership type by visiting www.walmart.com/partner/plus/amexbusinessgold or by calling 1 (800) 925-6278.Once enrolled in a monthly Walmart+ membership, your membership will automatically renew each month unless canceled and Walmart will charge the applicable membership fee to the Card Walmart has on file. American Express has no control over the approval process for Walmart+ and does not have access to any information provided to Walmart by the Card Member or by Walmart to the Card Member. Enrollment in the Walmart+ membership program is subject to the full Walmart+ Terms of Use (including the Walmart.com Terms of Use), found here: www.walmart.com/partner/plus/amexbusinessgold/terms. Walmart+ membership is available to all U.S. residents, however, certain benefits of Walmart+ membership (such as free shipping and fuel discounts) are not available in the U.S. territories other than Puerto Rico. For additional information on Walmart+ memberships, including a summary of their benefits and benefit availability, please go to www.walmart.com/plus or call 1 (800) 925-6278. American Express has no control over, or responsibility for, the Walmart+ membership program which is subject to change according to the Walmart+ terms.

Please allow up to 6-8 weeks after a qualifying monthly Walmart+ membership fee is charged to the Card Account for the statement credit to be posted to the Account. American Express relies on accurate transaction data to identify eligible Walmart+ membership purchases. If you do not see a credit for a qualifying purchase on the Card Account after 8 weeks, please call the number on the back of your Card. To be eligible for this benefit, the Card Account must not be cancelled or past due at the time of statement credit fulfillment. Statement credits may be reversed if an eligible purchase is returned/cancelled. If you are assigned a new Card number or have a Card number on file with Walmart+ that is outdated (for example, if you replace your Card or if your Card has expired), you must update your Card information on file with Walmart+ to help ensure that you receive statement credits for eligible Walmart+ membership fees charged to your eligible Card. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide and may reverse any statement credits provided to you. For additional information, call the number on the back of your Card.

Then click the Get Started button.

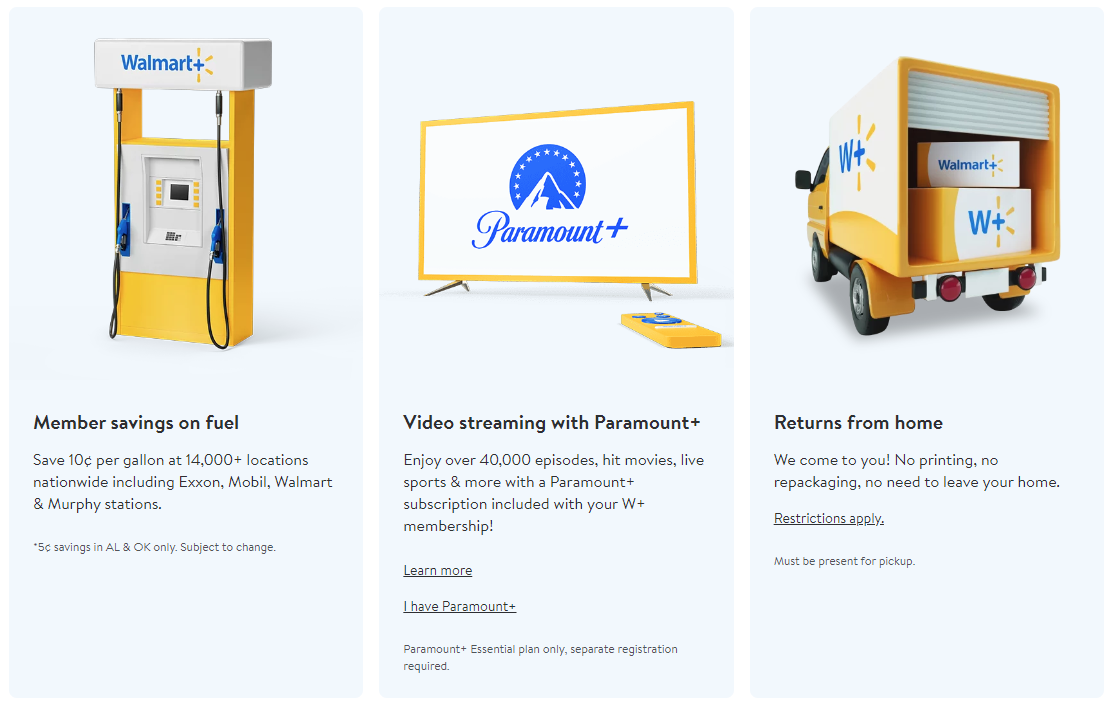

Here are all the Walmart+ benefits. I do not order a lot of items from Walmart, but I am excited for the free Paramount+ subscription (so I can stop doing consecutive 1 free month trials).

Your American Express Business Gold Card details will automatically be transferred to Walmart+, so you do not need to enter your card details. Click the Join W+ button to continue.

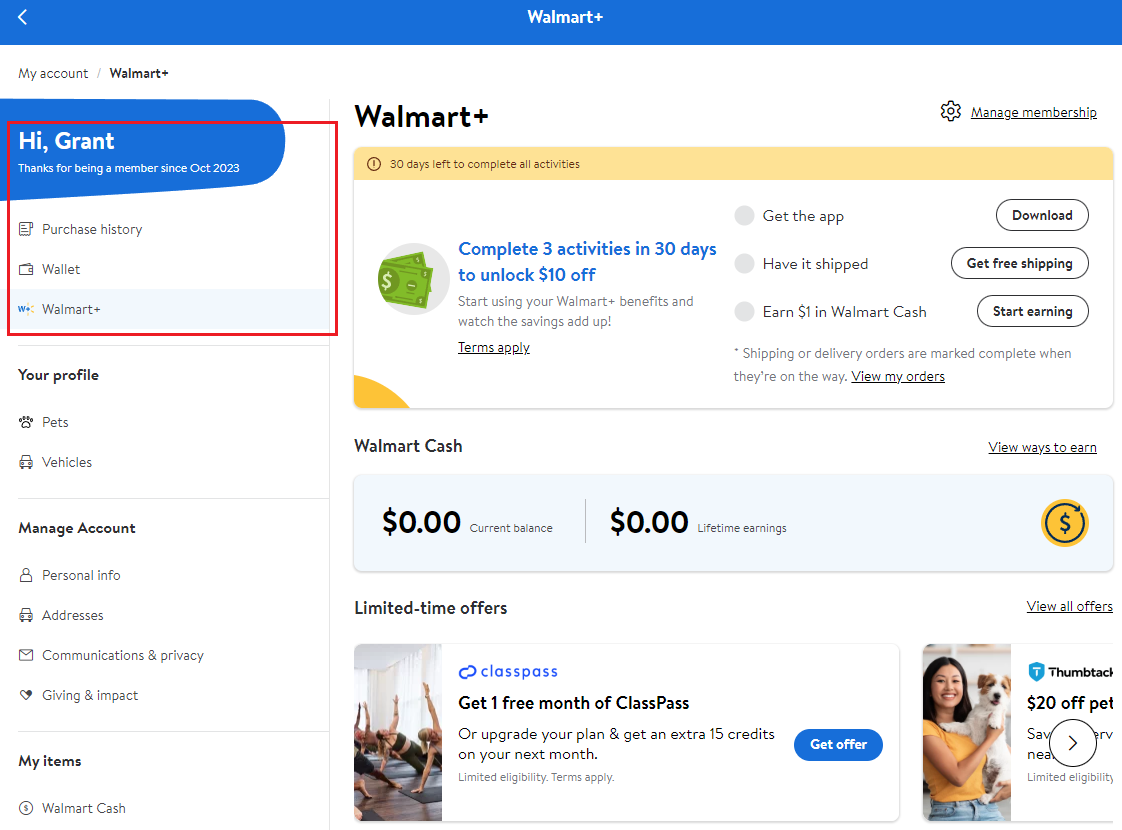

Congrats, you are now a member of Walmart+.

You can view all your Walmart+ benefits on this page. I scrolled down and signed up for my Paramount+ subscription.

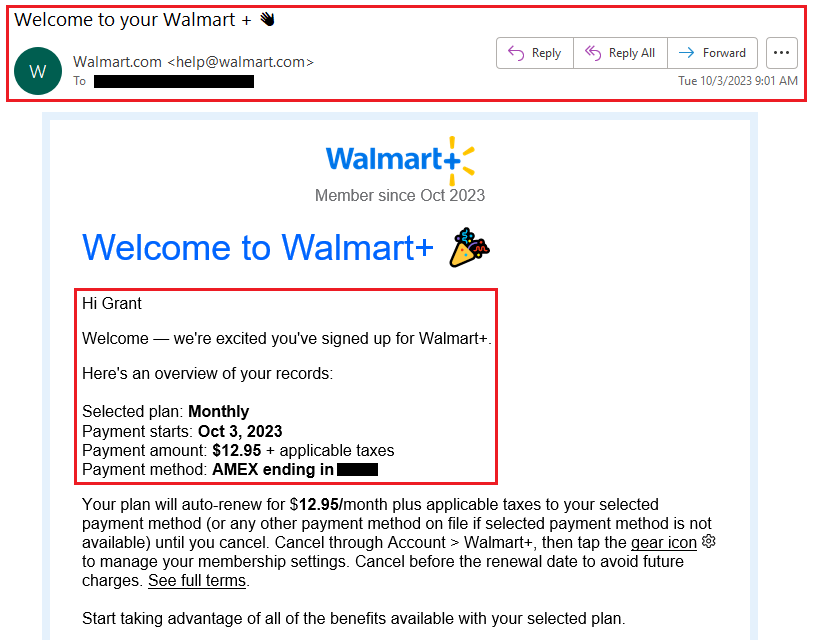

I also received a confirmation email about my enrollment in Walmart+.

Lastly, you can track your savings for both the $240 Flexible Business Credit and Walmart+ subscription on your Benefits tab.

If you have any questions about these changes, please leave a comment below. Have a great day everyone!