Good morning everyone, I just wanted to share my experience and findings using the new Citi Double Cash Credit Card. I recently converted my Citi Dividend Credit Card to the Citi Double Cash Credit Card since the upcoming categories did not interest me. My first statement just closed and I learned some interesting things about my Citi Double Cash Credit Card.

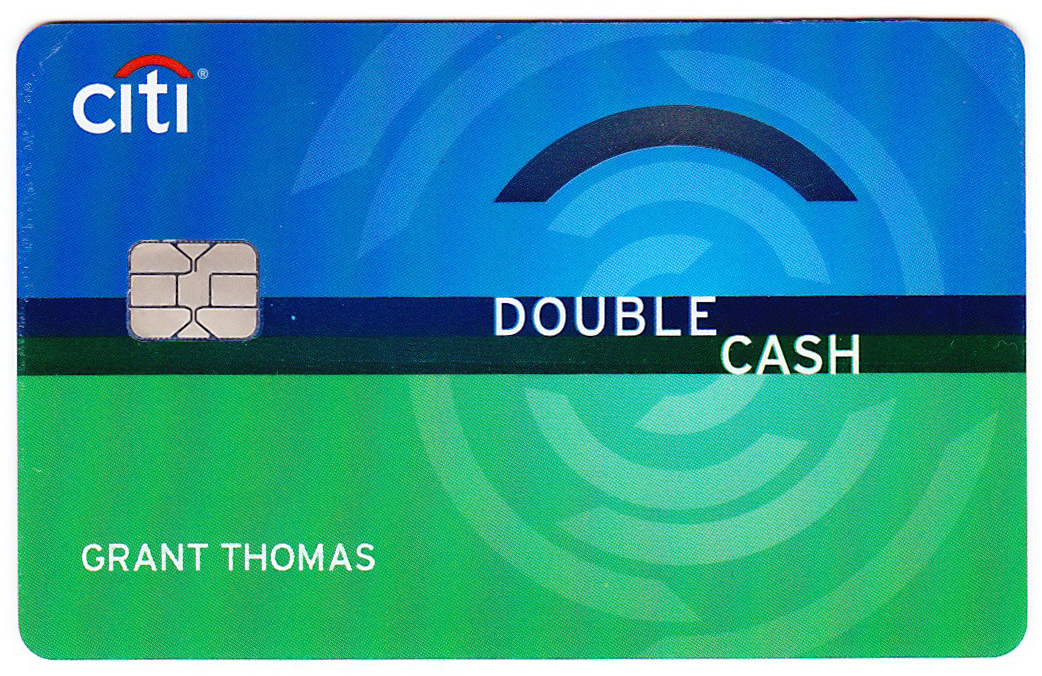

First of all, this is what the front and back of the credit card looks like. The card has no raised/embossed numbers or letters. The card has EMV Chip and Signature but it does charge a 3% foreign transaction fee for all international purchases. If you pay a 3% fee but only get 2% cash back, you are losing. Never take this credit card out of the country.

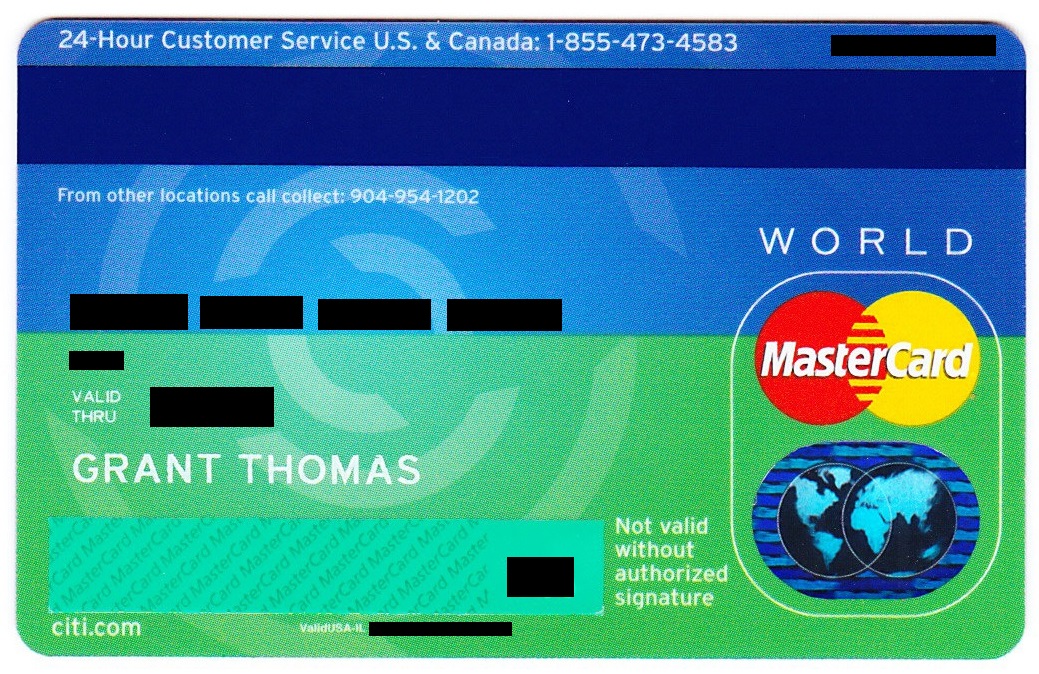

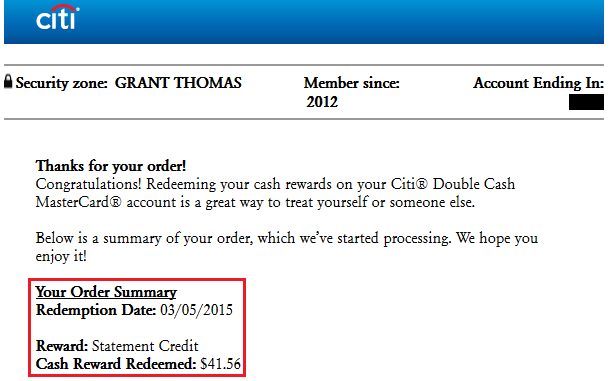

With that said, I will show you how I ended up earning $41.56 cash back in my first month.

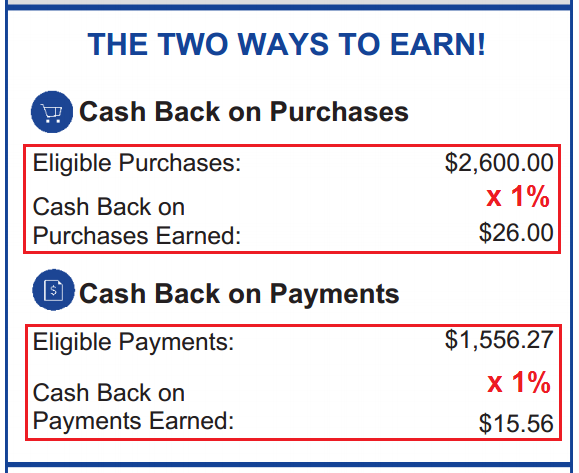

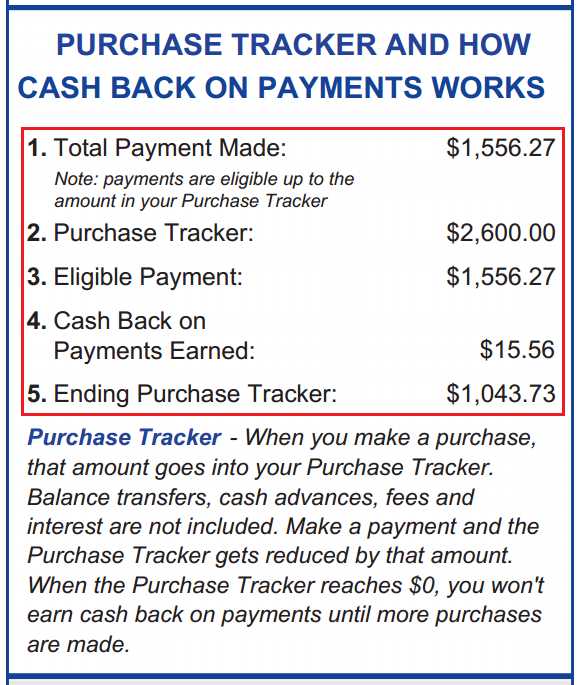

Here is a breakdown of all the calculations from the credit card statement. I charged $2,600 onto the credit card (Redbird reloads) which earned me 1% cash back = $26.00. During the month, I made a payment of $1,556.27, which also earned 1% cash back = $15.56. If you add those numbers up, I earned $41.56. I was under the impression that paying off my credit card early would not generate any cash back, but it looks like it does. If you have this credit card, you are better off paying the balance early so you get your full 2% cash back sooner.

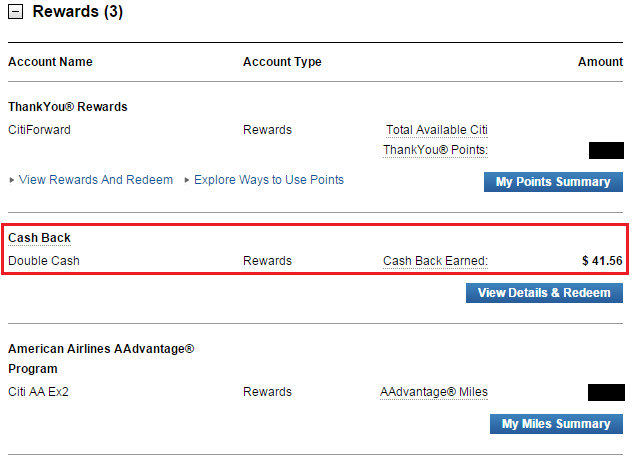

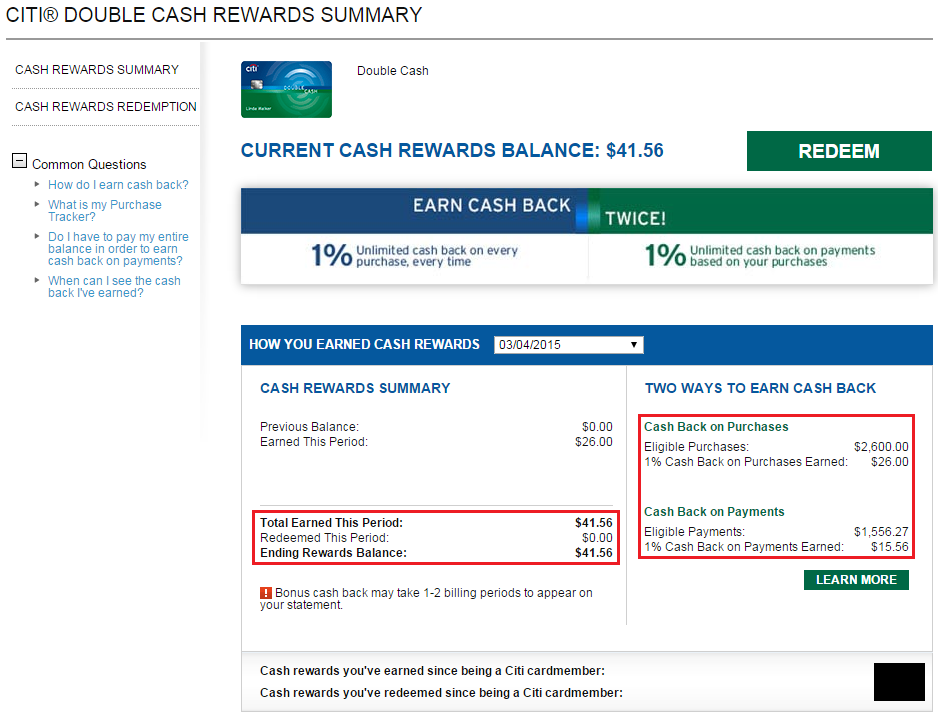

Here is my Citi Double Cash rewards summary after the first statement closed. It shows the exact same calculations from above. I then clicked the green Redeem button.

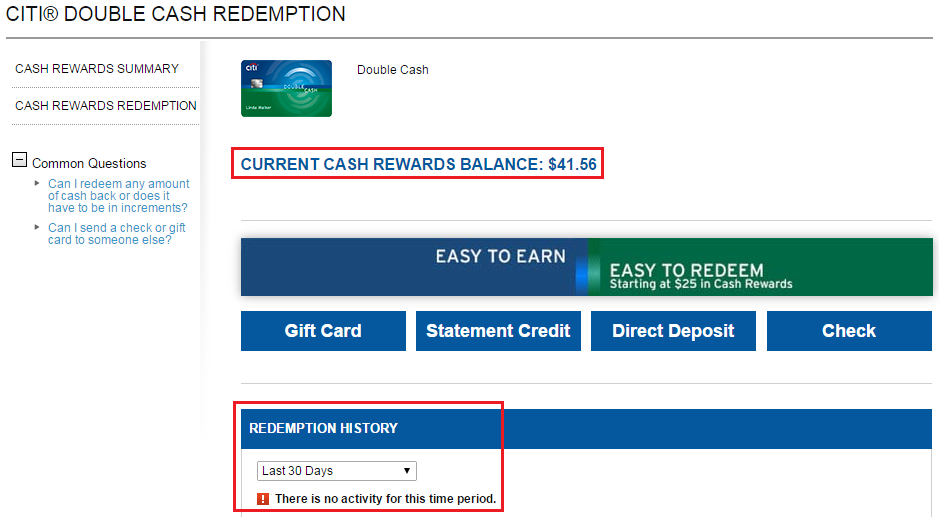

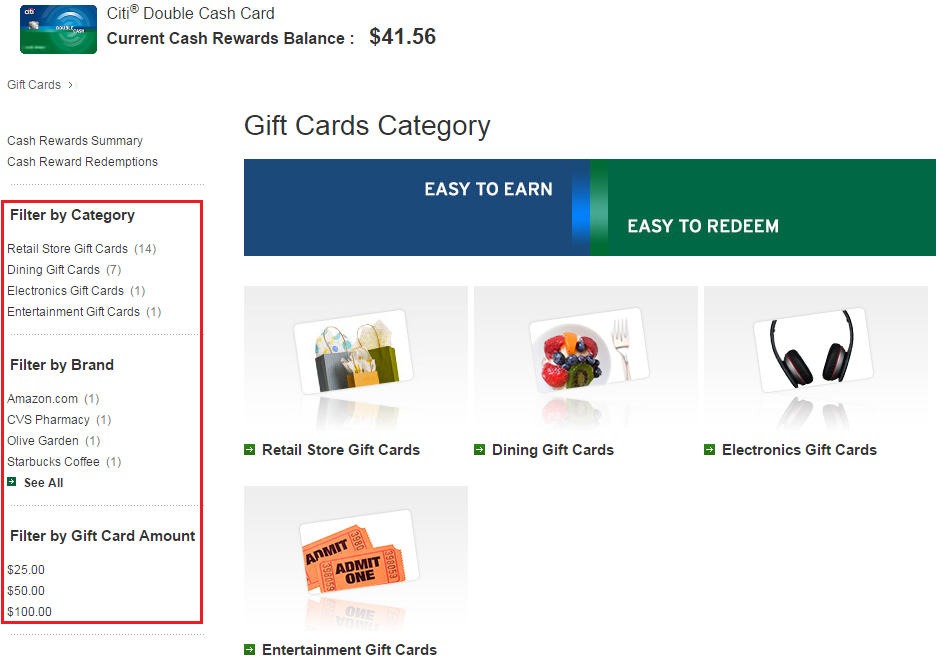

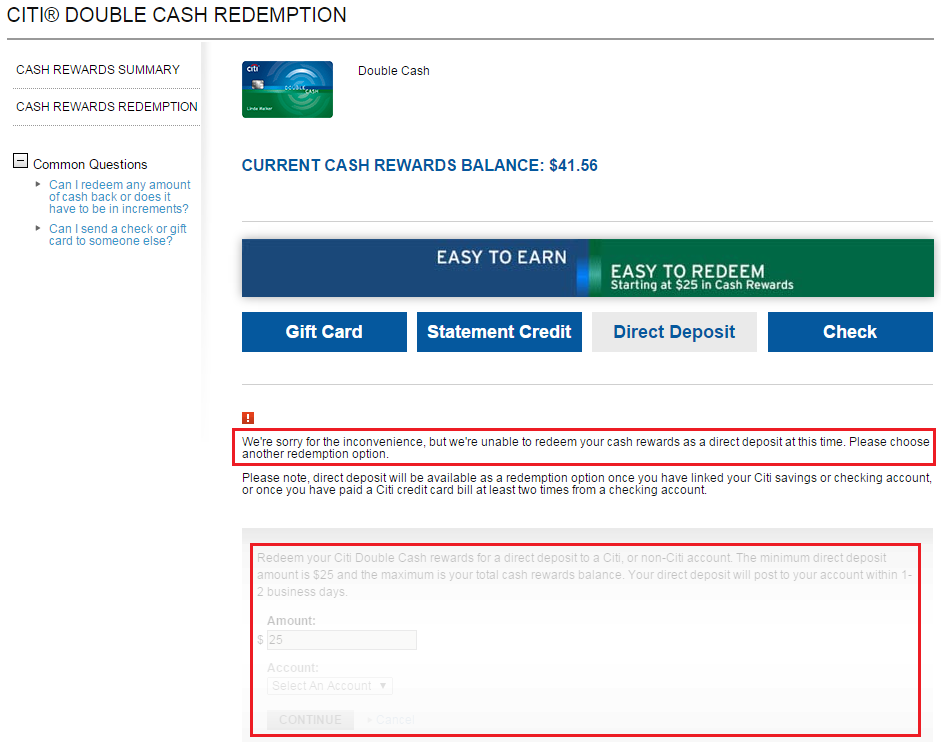

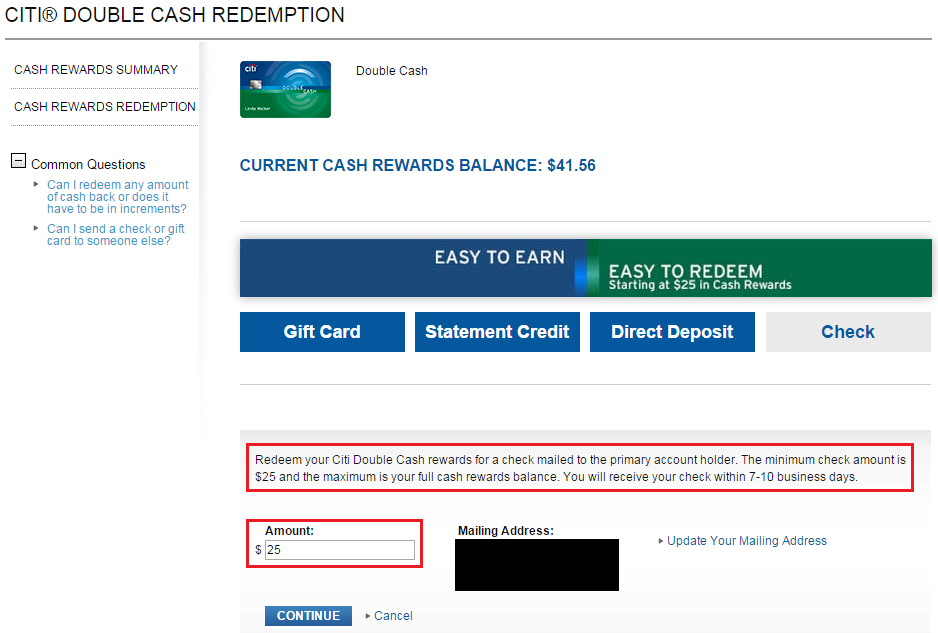

With the Citi Double Cash Credit Card, you can redeem your cash back for gift cards, statement credit, direct deposit, and a check. I will walk you through all the options and end with statement credit since that is the option I chose.

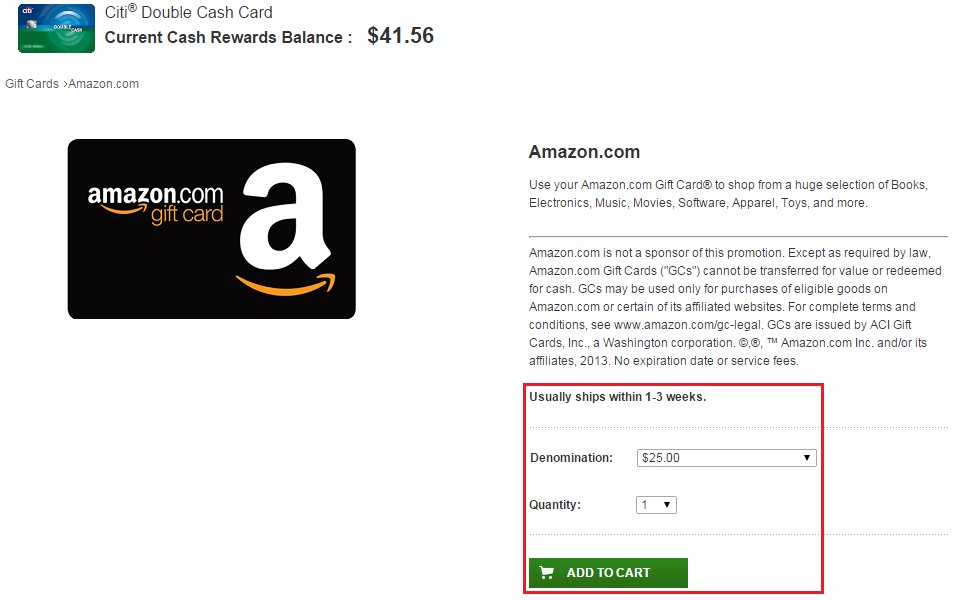

The gift card selection is pretty small at the moment. I clicked on $25 gift cards and there were only 23 options available. The gift cards are at face value and you can redeem $25 in Citi Double Cash cash back for a $25 gift card. There is a 1-3 week delivery time for gift cards.

Moving over to direct deposit, it looks like this option is not available. It could be my account or Citi’s IT that is causing the problem. My guess is Citi’s IT department is having issues.

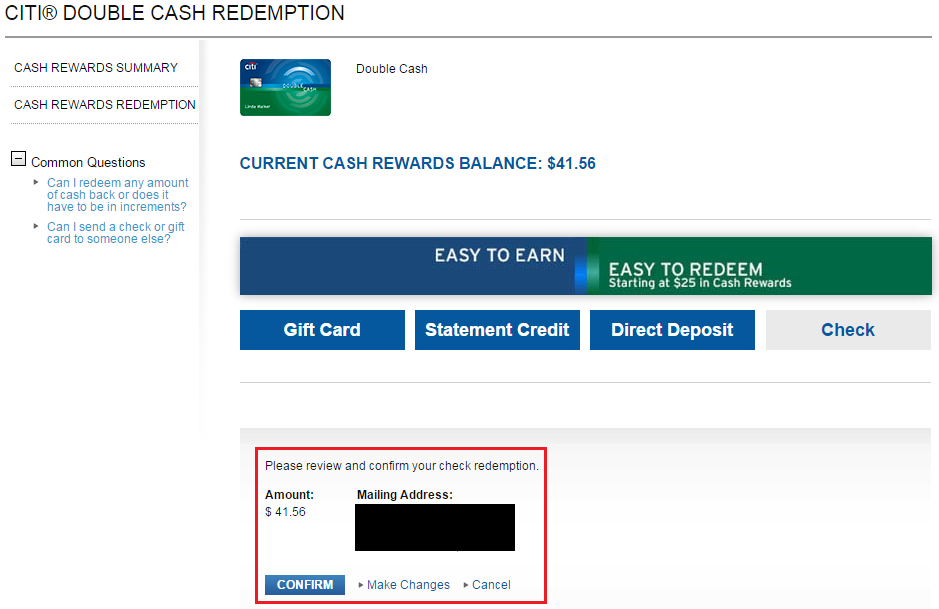

Moving over to the check option, you can request a check for $25 or more. Citi will mail a check to your billing address in a few days.

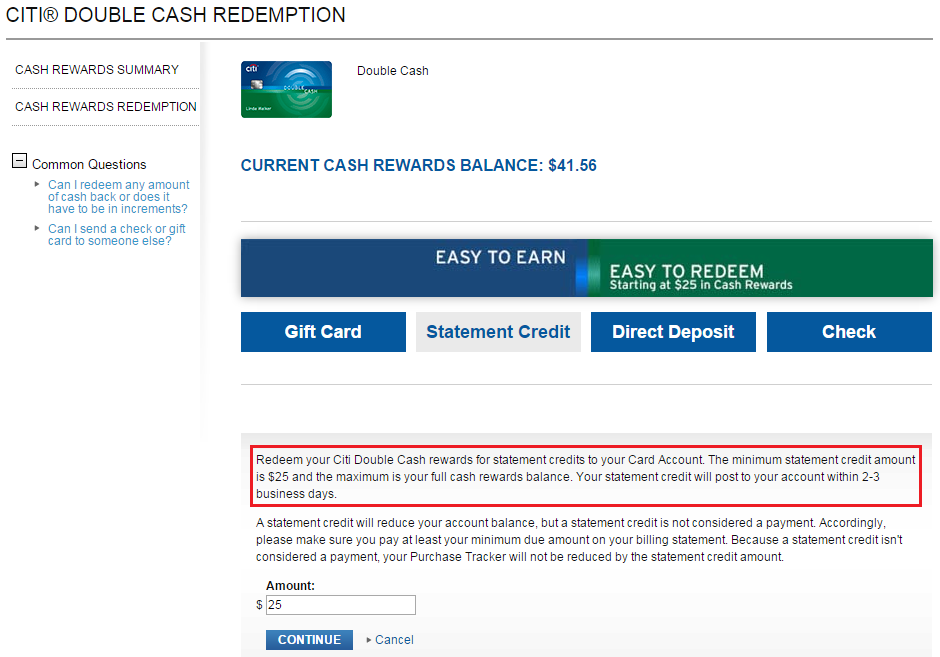

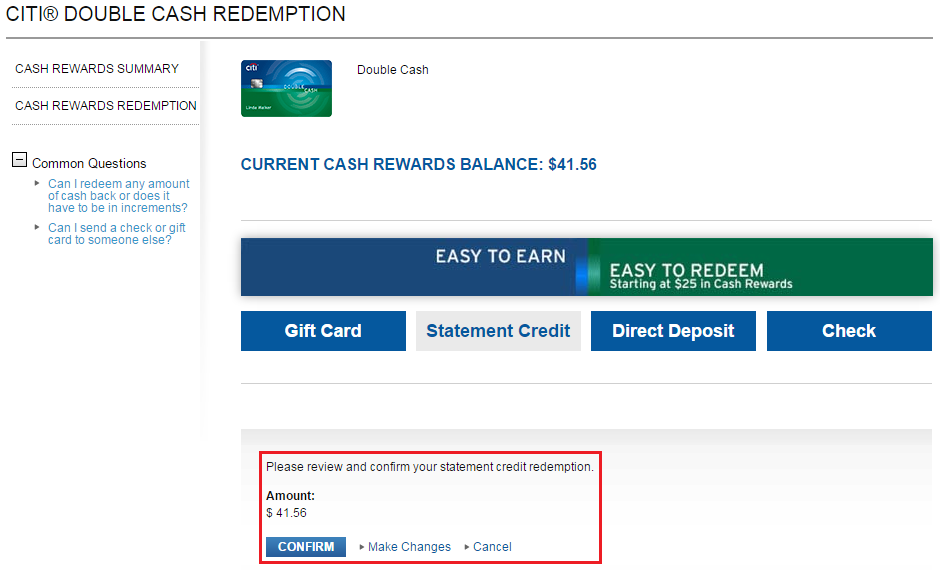

Last but not least, you can request a statement credit anytime you have at least $25 in cash back. The statement credit should post to your account in 2-3 business days. I decided to cash in my full $41.56 with one statement credit.

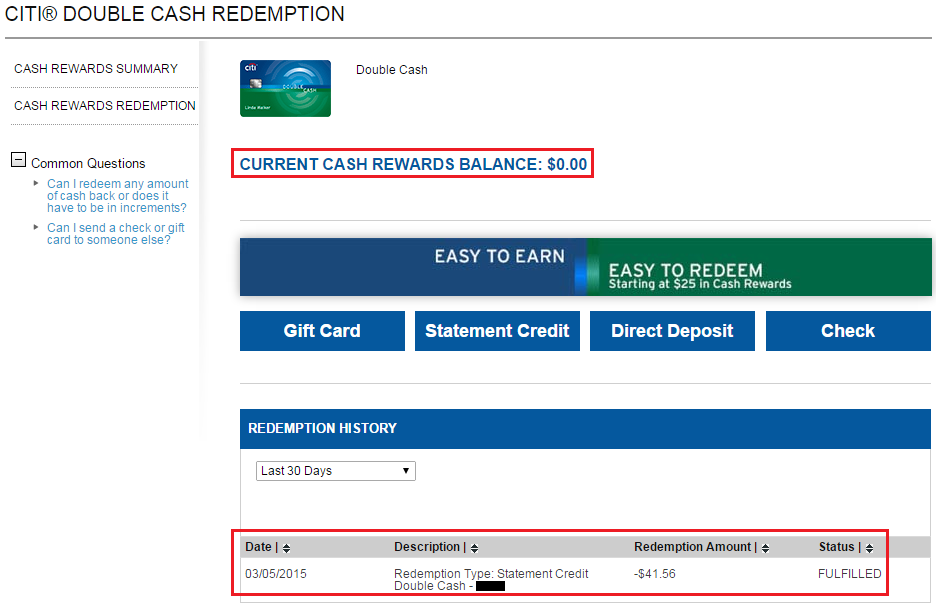

After a few minutes, my Citi Double Cash redemption page updated to show my new $0 balance and now displays my recent statement credit request.

I also received an email from Citi with details of my statement credit request.

If you have any questions, please leave a comment below. Have a great day everyone!

Great review of the Citi “Double Stuff” card Grant! I looked at the other cards you review for REDbird MS and for someone who doesn’t live in CA this one looks fantastic!! I had been looking hard at this one for a while and now I am going to pull the trigger!! I have two REDbird cards “under management” and this should give me a quick and easy $200 per month in and out!! I still have to pinch myself when think about it. Who is paying the merchants fee on these transactions? Just kidding, I don’t care!!

If you have an existing Citi credit card, I suggest calling to convert that card to a Citi Double Cash Credit Card. Since there is no sign up bonus (only targeted offers), it makes sense to convert an existing Citi credit card.

I know it’s only 42 cents, but when you redeem for a statement credit, you’re losing out on that 1% you could have earned by making that a payment. You’re always better off taking it as a DD. Basically you’ve turned it into a 1.99% cash back card. Insignificant in small amounts, but if you’re similar to the first commenter and cash out $200 a month, then that’s an extra $24 annually you are giving up.

I don’t understand completely. Are you talking about leaving 99 cents or less on a Citi credit card so that the fee is automatically paid by Citi when your statement closes?

Mind explaining with more detail? Not sure what you mean?

You only earn the second 1% cash back when you pay your credit card. When you request a statement credit, you are losing the opportunity to pay your credit card and earn the second 1% cash back. Does that make sense?

Right. That’s the point I was making. So requesting statement credits will turn this into a 1.99% cb card.

Ari, you are correct. I always request a check by mail and then make the payment online so I get my full cash back on payments

If you have a Citi checking account, you can request a deposit into that account and then do a bill payment to your Citi Double Cash credit card.

Nice review. When you say “you’re better off when you pay your balance early,” does that mean it is OK to do billpay before the close date? I wasn’t sure if the 1% on payment gets paid if the bill is paid before the statement closes, or even if before charges are incurred, ie. a negative balance. Any data on that? Thanks.

What I mean is if you get the second 1% cash back when you pay your bill, you might as well pay your bill early so you get the second 1% cash back early.

Good info Ari!! Thanks. I’ll take $24 bucks anytime!

When you redeem your cash back for statement credit, you lose that opportunity to make a payment of the same amount and earn that 1% cash back, 42 cents in your case.

Ahh I see what you mean. Thank you for clarifying for me.

If you overpay your citi double cash and then request a check for the overpayment, wll you still earn the full 1% on the total payment?

Good question, I can try and let you know.

PD, you can only earn cash back on payments up to your purchase tracker balance. This is how they prevent you from earning back back on a balance transfer

Thanks for the heads up, Kevin.

ok converting cards, how is that done?? I have a Citi Simplicity and a Diamond preferred, would it be in my best interest to covert one of those? if so, can you enlighten me. Thanks!

Just call the number on the back of the credit card that you don’t use that has the highest credit limit. When you speak to the rep, tell them you want to convert your current credit card to the Citi Double Cash Credit Card.

Thanks Grant. I had an old Citi AA Bronze card sitting around that I kept since it’s a long-term account. Totally sock drawered for years. Just read your post, called ’em up and changed the product to a Double Cash. They also let me raise my CL without a hard pull. Appreciate the info!

Quick question – did any remaining balance in your Dividend Rewards carry over to the Double Cash Rewards? I have ~$35 (not enough to reach the minimum $50 redemption threshold) that I don’t want to lose if I convert.

It should carry over since both are cb, but verify with the CSR.

I earned and cashed in the full $300 last year, so there were no funds to carry over. When I view my Citi Double Cash cash back summary, I see the $300 from my Citi Dividend so there might be some connection. I would definitely call Citi before you do anything and see what they say. Good luck!

Did you convert your AA exec to this card? I am thinking whether to PC to double cash or 5% Citi dividend.

Take a look at the Citi Dividend quarterly categories and see which card has the better offers for you. You might be able to do a product change if the phone rep is willing to help you.

Hi Grant,

When you requested a change, did they ask you to pull your credit score? Do you know if you’re supposed to get your credit score pulled if you want to close a card and allocate the money on a different credit card?

Product changes don’t require a pull but they also preclude you from a sign up bonus.

Since you are not asking for more credit, there should be no hard credit pull/inquiring.

Good to know that paying off your card in advance will still generate cashback…I did so a few days ago payment has not posted yet)…hopefully, the cashback will post!

Your second 1% cash back should post, no worries.

Thanks, Grant. I am assuming I have to wait for the statement to close in order to see how much I have earned for purchases and payments? Thanks in advance.

Maybe, but you can check the Citi Double Cash Rewards Summary to see if it is updated mid-statement.

can you move credit lines? is that a possibility or even take some from one and add it to another?

Most likely yes, just call Citi and have them reallocate your credit lines.

statement credits don’t count as eligible payment for 1% back. The reason you couldn’t get direct deposit is your account is too new. I think you should be able to do a dd to an account you used on citi site to pay double cash next month.

Thank you Sam, I will try again next month and see what my options are. I appreciate all the help.

well that was easy, and I got a CL increase…the only thing is, you lose the bennies of a new account opening. Oh well, that’s ok… I don’t carry balances so the only thing that appeals to me would have been the 15 mo no interest…..Thanks Grant for the help!

You’re welcome Marc, have a great weekend!

Is direct deposit only into a Citi account or can you send it to any bank account of your choice ?

The direct deposit feature should work for any checking account from any bank.

Grant, I only see one of my three pay from bank accounts listed as a direct deposit redemption option (the one I have set up for auto pay). Any idea how to change the account to send Direct Deposits to? Citi has been clueless.

Hmm, I have no idea. Have you fiddled with changing your autopay settings?

Not yet, was hoping to avoid doing that if there was another option available. I have autopay linked to my main account that has money to cover payments but want the rewards to go to another account where I’m stashing money for a goal. Was just looking for an easy way to do this. Thanks for responding!

I wish there was a way. You can always Tweet @AskCiti and let them know that they should implement that option. Who knows, they might just make it happen.

also how is this card and Citi in general when using to buy Visa/MC gift cards from stores, thought there was talk somewhere that Citi was one of the few banks that would/could dive into the transactional records to see what was purchased at say a grocery store etc ?

Not that I know of. The transactions go through as usual. Nothing to worry about.

Great review, thanks..

Quick question, my statement balance is $800 and my current balance is $1500. In my double cash rewards summary, I was already awarded the $8 for purchases. If I happen to pay in full(current balance) will Citi pay me the $15 for paying and $7 for the difference. Or will I just get the $15 as a payment. Thanks for any input.

You will earn 1% on every change and another 1% on every payment you make. So if you charge $1500, you will earn $15, then when you pay the $1500, you will earn another $1500.

I use Citi DoubleCash for most living expenses, and because CL is so small ($6,000) I sometimes pay the balance before due date so that I have more available credit. Last week I saw something that said Citi won’t pay the second 1% if you pay before statement is generated. Is that true? Thanks.

That’s not true at all. You get 1% cash back when you pay your Citi Double Cash bill, before or after the statement closes. The only way you don’t get cash back is when you redeem cash back for statement credit to pay off your Citi Double Cash credit card.

Good info, I got my card more than six months ago, but never have use it. Now I start using it, but I don’t get any statement. I check my Citi Web and is not link to my account. So my question is. Am I go to get a paper statement every month? Or this card is all Web account?

Call the number on the back of your card and they can help add the card to your Citi online account and enroll you in estatenents.

using Citi Double Cash redemption to pay off balance will generate the extra 1% cashback or not?

No, if you use your cash back as a statement credit, you won’t earn the second 1% cash back.

Pingback: Goodbye Citi Double Cash Gift Card Redemption; Hello American Express Plan It (Pay-Over-Time Payment Option)