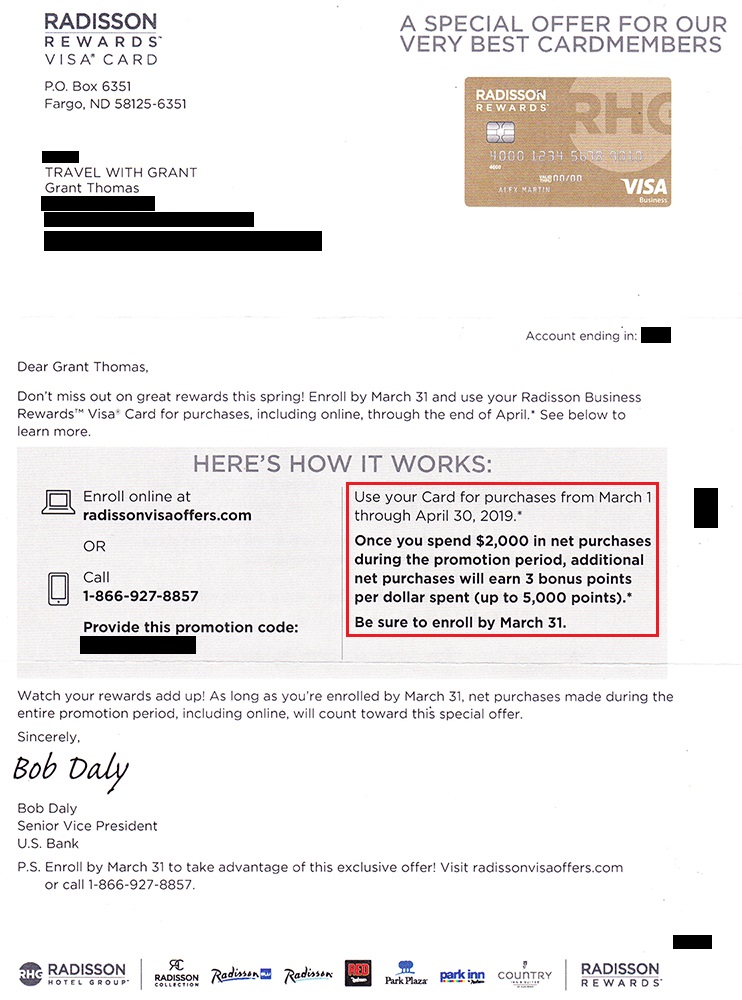

Good morning everyone, happy Friday! I’m heading to Las Vegas this weekend to do some hiking and watch the Golden Knights NHL game. I hope you have a fun filled weekend ahead too! Yesterday, I received 2 targeted spending offers from US Bank regarding my US Bank Radisson Rewards Business Credit Card and US Bank Radisson Rewards Visa Signature Credit Card. I will go through both offers and tell you what I think of each offer. If you received different targeted offers, please let me know in the comments. Without further ado, let’s go over the targeted spending offer on my US Bank Radisson Rewards Business Credit Card.

After spending $2,000 on the credit card, I will earn 3 bonus points per dollars, up to 5,000 bonus points. I would need to spend an extra $1,666.67 to max out the 5,000 bonus points. In total, I would need to spend $2,000 + $1,666.67 = $3,666.67 and earn 23,333 points ( [5 x 2,000 = 10,000] + [8 x 1,666.67 = 13,333], 10,000 + 13,333 = 23,333). If I spent $3,666.67 on my Citi Double Cash Credit Card, I would earn $73.33. So $73.33 cash back vs. 23,333 Radisson Rewards Points. According to Frequent Miler’s Reasonable Redemption Value table, Radisson Rewards Points are worth 0.38 cents per point, so 23,333 points is worth $88.67, or only $15.34 more than the cash back. I’m currently sitting on a stash of 146k Radisson Rewards Points, so I do not want/need any more points. If you value Radisson Rewards points at more than 0.38 cents per point, you might be interested in this offer.

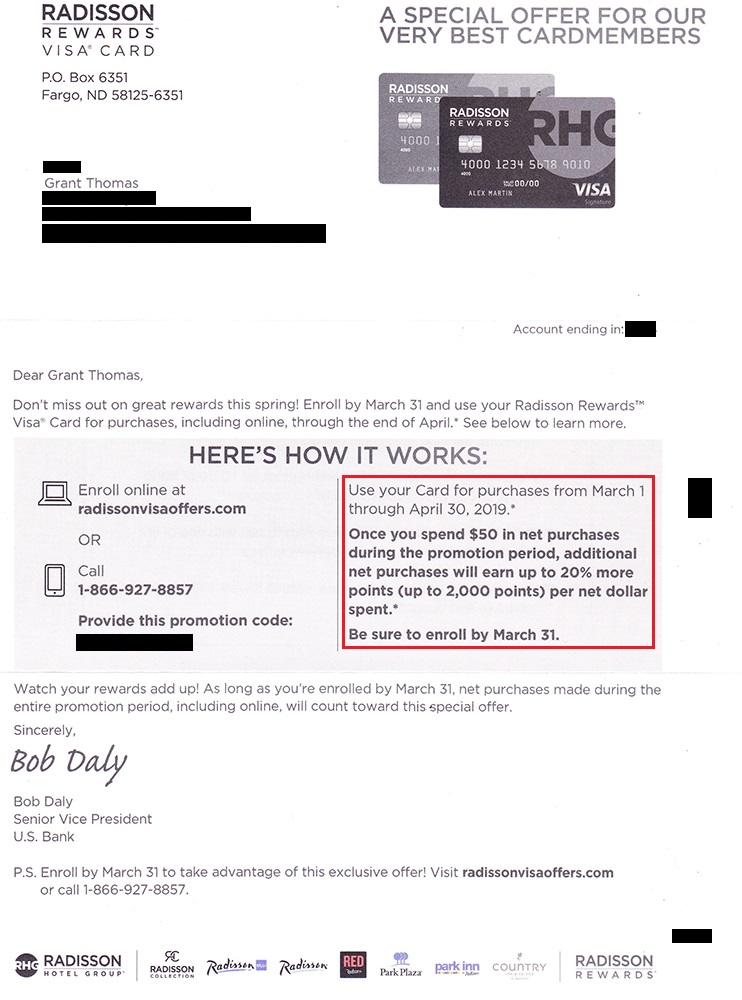

Up next, let’s look at the targeted spending offer for my US Bank Radisson Rewards Visa Signature Credit Card. After spending $50, I will earn 20% more points, up to 2,000 bonus points. Since this credit card currently earns 5x Radisson Rewards Points on all purchases, an extra 20% means 1 extra point per dollar. Very clever US Bank and Radisson Rewards! So I would need to spend an extra $2,000 to earn 2,000 bonus points. In total, I would need to spend $50 + $2,000 = $2,050 and earn 12,250 points ( [5 x 50 = 250] + [6 x 2,000 = 12,000], 250 + 12,000 = 12,250). If I spent $2,050 on my Citi Double Cash Credit Card, I would earn $41.00. So $41.00 cash back vs. 12,250 Radisson Rewards Points. 0.38 cents per point x 12,250 points = $46.55, or only $5.55 more than cash back. I’m going to pass on this offer as well.

If you received a different targeted spending offer, please share the offer details below in the comments. If you have any questions about these targeted spending offers, please leave a comment below. Have a great weekend everyone!

Thank you for the great analysis – we need to see more of this. Based on this, I’m also passing on this Carlson offer either as I already sit on 300K+ points and another 60K coming my way for the AF soon.

On a side OT, which CC to use for the annual auto and home insurance?

Thank you.

I have a hard time finding decent Radisson Rewards properties to redeem my points at :(

For insurance payments, I tend to use Blue Biz Plus or whatever card I need to use for minimum spend or a targeted spend bonus.

I value Radisson points at around a half cent each. Until the impending devaluation happens, the Radisson Blu Beke in Budapest is a good deal at 15,000 point per night. Rooms there normally run around $90-$100 a night. Also, I’m looking at Copenhagen, so that’s a possible good use on the top tier end.

The Radisson Blu properties in Europe can be pretty good deals. Are you going to take advantage of this targeted spending offer?

I haven’t seen it yet, but maybe. It’s pretty easy to gather their points at 5 per dollar for anything but like you, I’m not sure I want to bank too many.

Yes, I want to start redeeming my Radisson Rewards points before I start earning more.

Where do you go hiking in Las Vegas? Red rock canyon?

We drove to Valley of Fire State Park. Good hikes there yesterday :)