Good morning everyone, I hope your weekend is off to a great start. My wife and I have a few large expenses coming up in the next few months, so we decided to get a new credit card. Since Laura is under 5/24, we decided that she should apply for a new Chase credit card. She currently has a Chase World of Hyatt Credit Card, a Chase Southwest Airlines Priority Credit Card, and a Chase Freedom Credit Card (converted from a Chase Sapphire Preferred Credit Card last year).

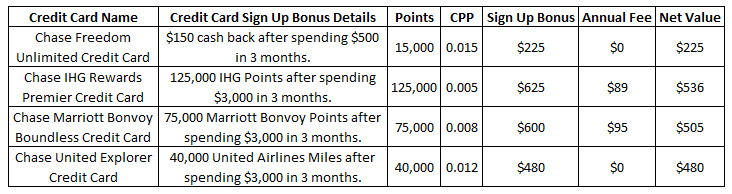

Laura doesn’t have a business, so we didn’t look at any business credit cards. It’s too soon to apply for a Chase Sapphire Reserve, she didn’t want any more Southwest Airlines credit cards, she didn’t want an international airline credit card (Aer Lingus, British Airways, or Iberia), and she wanted a decent sign up bonus. After whittling down the list of possible Chase credit cards, we were left with 4 options.

After calculating the value of the sign up bonus and subtracting the first year annual fee, the Chase IHG Premier Credit Card had the highest net value. Coincidentally, I wanted Laura to get this credit card because I also have a Chase IHG Premier Credit Card. My annual fee will post next month, so I wanted to have 2 credit cards that would renew around the same time so that the free night certificates would be valid for the same date range.

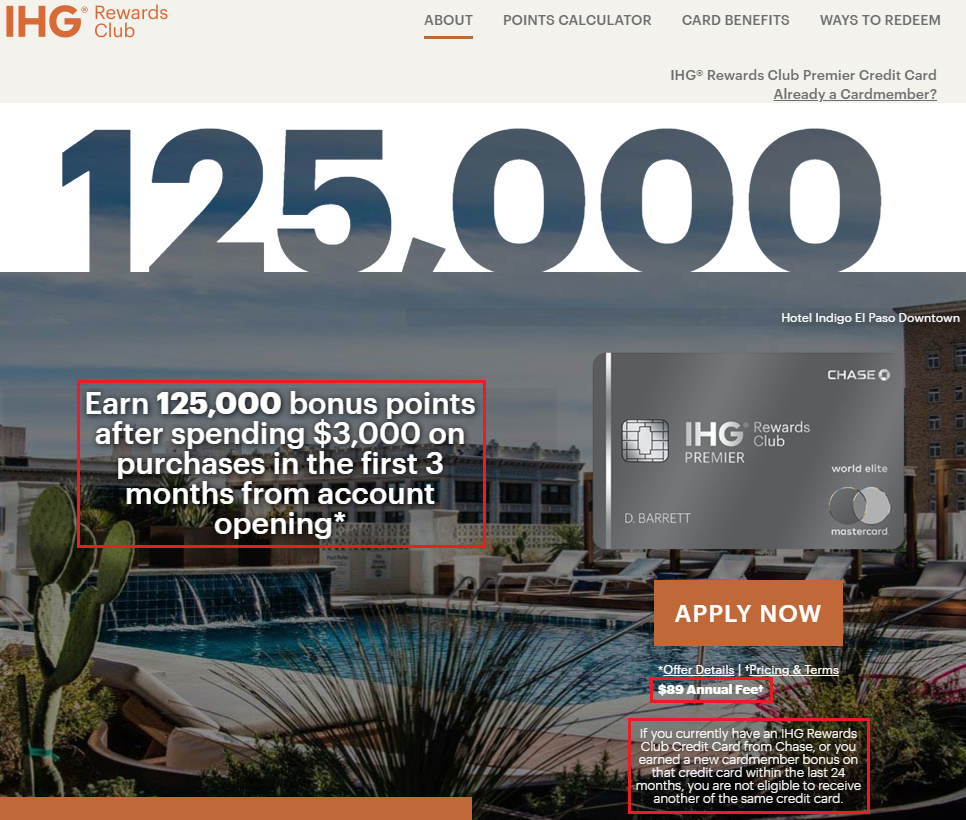

After agreeing on the Chase IHG Premier Credit Card, Laura created an IHG Rewards Club account and entered that account number in AwardWallet and on her credit card application. The application process was pretty easy and we were hoping for an instant approval…

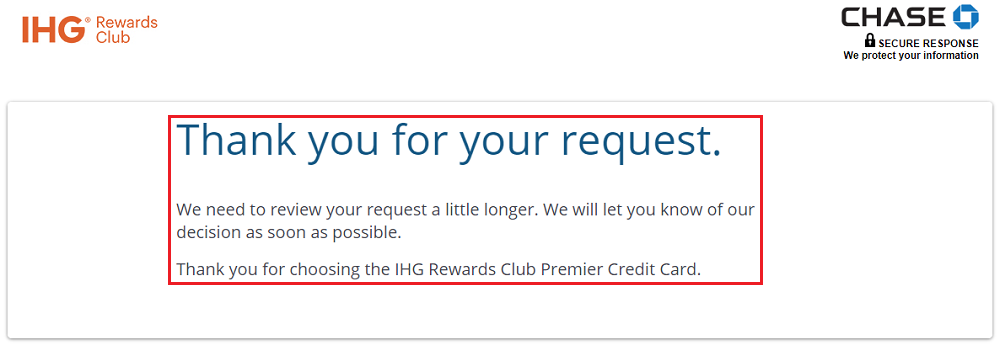

But unfortunately, Laura received a pending decision on her credit card application. I told her we should wait for Chase to make a decision before contacting Chase for reconsideration.

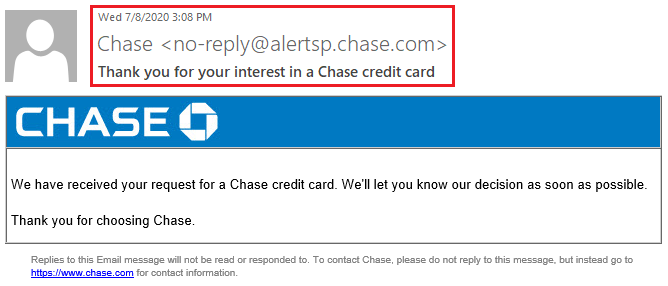

Laura also received the pending decision via email.

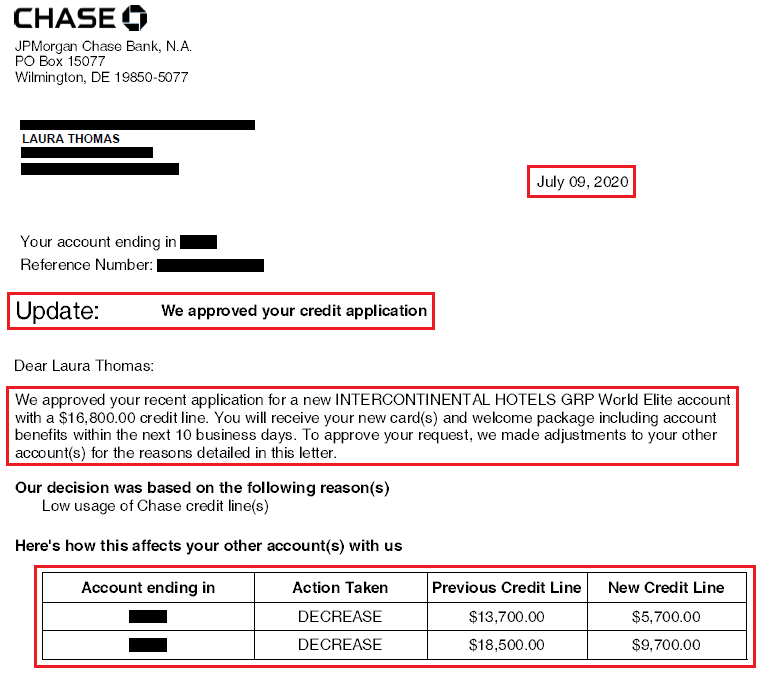

2 days later, Laura received this email from Chase. The subject line said “You received a new letter” but the body of the email said “We approved your credit application”. She logged into her Chase mobile app and went to the Statements and Documents area to view the letter.

Even though the above email arrived on July 10, the Chase letter was dated July 9. She was approved for the new credit card with a credit limit of $16,800. That’s great news! The strange thing about the letter is that Chase lowered Laura’s credit limits on her Chase Freedom and Chase World of Hyatt in order to get her a credit limit of $16,800 on her Chase IHG Premier. This is not a big deal since Chase let’s you reallocate credit limits between personal credit cards very easily, but we will do that after she completes the minimum spending requirement and receives the sign up bonus.

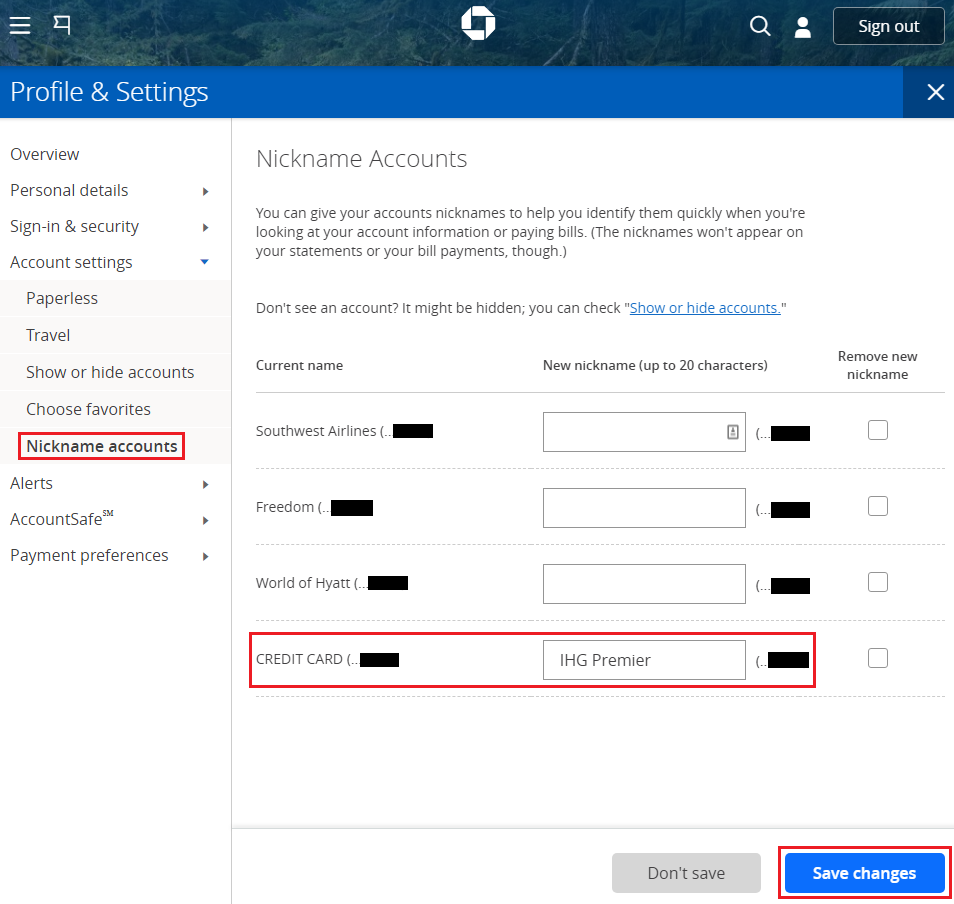

Laura then logged into her Chase online account and saw her new credit card listed at the bottom.

She then changed the name of the card in her account to IHG Premier.

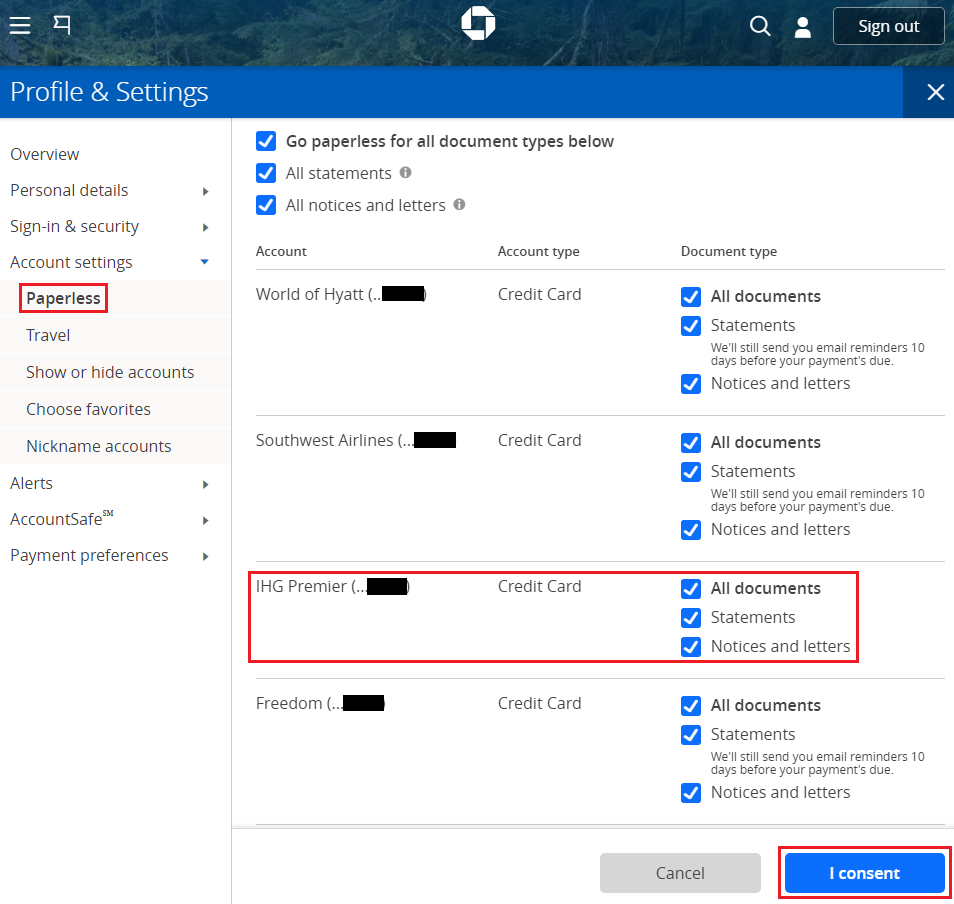

She then signed up for paperless statements.

Lastly, she tried to change the due date for the payment, but was unable to online because her account was too new.

The application process was pretty easy and waiting 2 days for a decision was faster than we expected. We are looking forward to the credit card arriving and meeting the minimum spending requirement. If you have any questions about the application process, please leave a comment below. Have a great weekend everyone!

“r we should wait for Chase to make a decision before contacting Chase for reconsideration.”

is this a general guideline or more specific to your scenario?

I used to contact Chase and all other credit card companies immediately after getting a pending decision on a credit card application. Over the last few years, I think people have had better luck waiting for the bank to make a decision or to contact the applicant with any questions or concerns to make a decision.

I can’t say for 100% certainty that calling the reconsideration department right away will be better or worse than waiting. In my recent cases, I’ve heard back from the banks within a few days, so I don’t mind the short wait.

Do you have any recent data points on this topic?

have 9 chase cards (personal), last 4 were all pending, most recently this year. always called immediately, so far so good. so were last 2 bus cards (ink, swa), which they dont instantly approve.

I see, I’m glad calling the reconsideration department instantly is still working. That is great to hear. Glad you were able to get approved for all your Chase CCs.

Pingback: 125K Chase IHG Premier Credit Card Sign Up Bonus Posts 2 Days After Other Points