Good morning everyone, happy New Year’s Eve! Doctor of Credit has a Best Bank Account Bonuses page that he keeps up to date with the best offers each month. In that master post, he links to individual bank account bonuses with helpful information regarding the bonus details, how to avoid monthly fees, when to close the account, how often you can open a new account, and much more. For the last 6 years, I have been opening new checking accounts for the new member bonuses. And at the end of each year, I share my results on the blog. Over the last 6 years, I have made $12,250 in bank account bonuses. You will receive 1099-INT tax forms every year, so you have to pay taxes on the bank account bonuses, but sometimes you can fund the opening deposit with a credit card and earn miles, points, or cash back. If you are lucky, you can meet a minimum spending requirement by funding a new checking account or reach a high spending target to earn more rewards. Here are my results from the last 6 years with links to corresponding blog post summaries:

- 2015: $1,175 (no post)

- 2016: $2,850 (summary)

- 2017: $3,700 (summary)

- 2018: $2,725 (summary)

- 2019: $1,000 (summary)

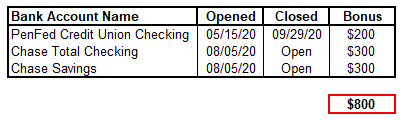

- 2020: $800 (this post)

Drum roll please… Here are the 3 new checking accounts I opened in 2020:

There are 5 main reason why my 2020 total is so much lower than previous years. For starters, there are only so many nationwide bank account bonuses (much fewer than previous years) and only so many local banks and credit unions in Northern California. Smaller banks and credit unions only want customers near their branches and in their region. Secondly, most banks implement rules where you cannot open, then close, then reopen a new checking account within a certain amount of time (usually 1-2 years). Thirdly, most banks are more ChexSystems inquiries sensitive and won’t approve new customers if they see many recent ChexSystems inquiries. Fourthly, I don’t get very excited about earning $50 or $100 in Swagbucks or MyPoints for opening new accounts from small online banks. And lastly (and probably most importantly), my wife did not want me to open so many new checking accounts (happy wife = happy life). I don’t mind jumping through hoops to open new checking accounts (funding accounts, moving money around, changing direct deposits, keeping track of bonuses, and then closing accounts). That might not sound fun to you (or my wife), but I enjoyed the process. In 2021, I will focus more on savings account bonuses that require large deposits since our current Discover savings accounts pay around 0.5% as of December 31.

If you are interested in bank account bonuses, I recommend checking out Doctor of Credit’s Best Bank Account Bonuses page and by reading Frequent Miler’s 2020 bank account bonus tally: $4480 earned, $1725 more on the way.

If you did any bank account bonuses in 2020, let me know how much you made this year and whether your total is higher or lower than previous years. Thanks for reading and have a great New Years everyone!

You should include your referral credit earned

I earned a few hundred dollars from Service Credit Union referrals but that account is a few years old so I didn’t include that account or bonuses in my calculations for 2020.

How much did you make from bank account bonuses in 2020?

$7,568 in bonuses and $625 in referrals since April

Dang, that is impressive. Do you think you will be able to do more/less in 2021?

Less. I won’t have as much interest when I can actually do things.

Got it, that makes sense. Hopefully in 2021 you can spend some of that money on fun stuff :)

2020 $5,450 (with $500 on the way)

2019 $8,675

2018 $2,100

I started doing bank bonuses in August 2018.

The accounts are two player mode as well as business bank account bonuses.

Hi Charles, that is a great haul. I have only done a few business checking accounts (I stick to the major US banks since the smaller / regional banks are more difficult). I am working to get my wife interested in bank account bonuses, so I am hopeful I will make more in 2021 than this year. Have a great New Years!

Thanks! For the online banks, I do all the work and sign up my wife and then meet all the requirements for her. She is not even aware of all the bonuses she has received! Have a great New Years as well!

I like your strategy but I would feel bad opening accounts for my wife without telling her.

My wife is good with me opening bank accounts for her. She is just glad she does not have to do the work!

Pingback: Get 0.7% APY + $100 Bonus by Stacking 2 Marcus Savings Account Deals (Expires February 12)