Good afternoon everyone. The holiday season is upon us and we are now in the home stretch. If you still have a few more gifts to give this year, there is still time to send your friends, family members, neighbors and teammates a gift card. Of course you can run out to your local grocery store, restaurant, pharmacy, or office supply store to pick up a physical gift card, but if you don’t want to leave your house, you can buy a virtual gift card from the convenience of your phone (and earn rewards). Whenever I need to buy a gift card for myself or for someone else, there are 3 apps that I use: Slide, Fluz, and MileagePlusX.

I will go into more detail on how to use each app, but there are 3 important things to know about these apps: your virtual gift card is ready to use right away; you can usually purchase the virtual gift card in an exact dollar amount; and you earn rewards in the form of cash back or United Airlines Miles. Without further ado, let’s go through these 3 apps.

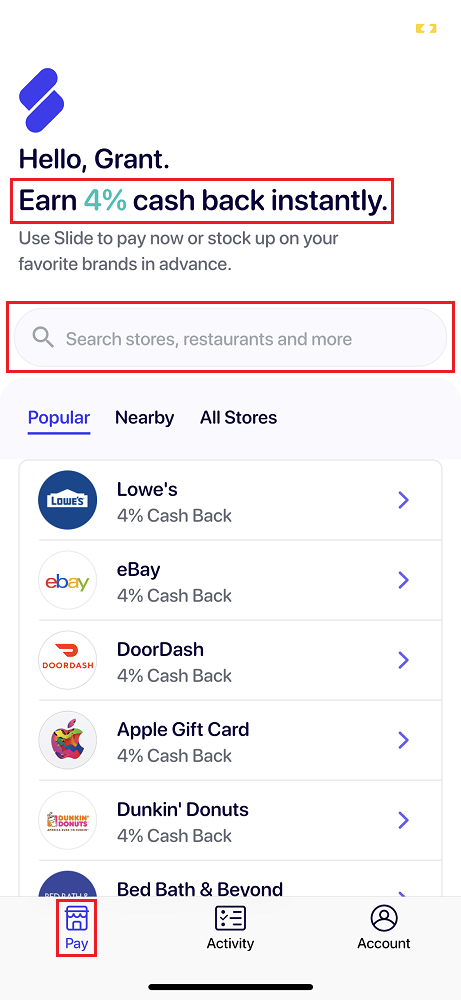

Slide (Apple App Store / Google Play Store)

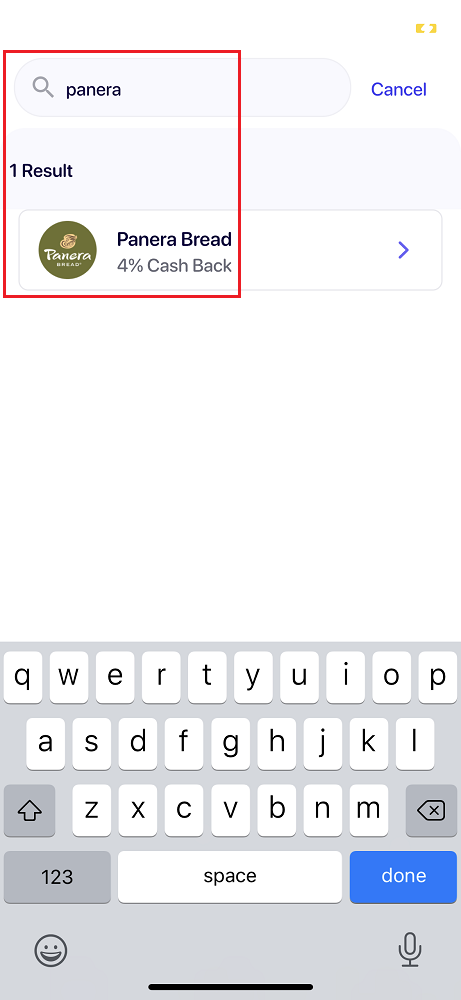

Slide offers 4% cash back on all virtual gift card purchases (which may be higher or lower than the other 2 apps, depending on the store). If you are a new member, please use my Slide referral link and you will get a $5 credit towards your first 4 purchases ($20 off total). For comparison purposes, I bought Panera Bread virtual gift cards from all 3 apps to compare the process and show the various rewards. After you create your Slide account, type the store name into the search box. If the store is offered on Slide, you will see it in the search results. Click on the store name to purchase a virtual gift card.