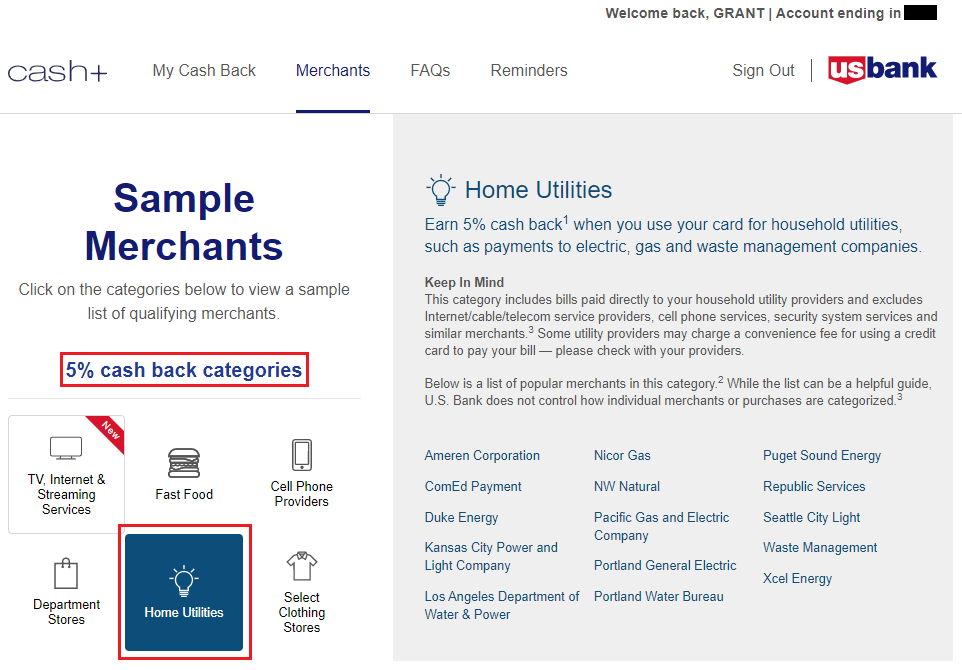

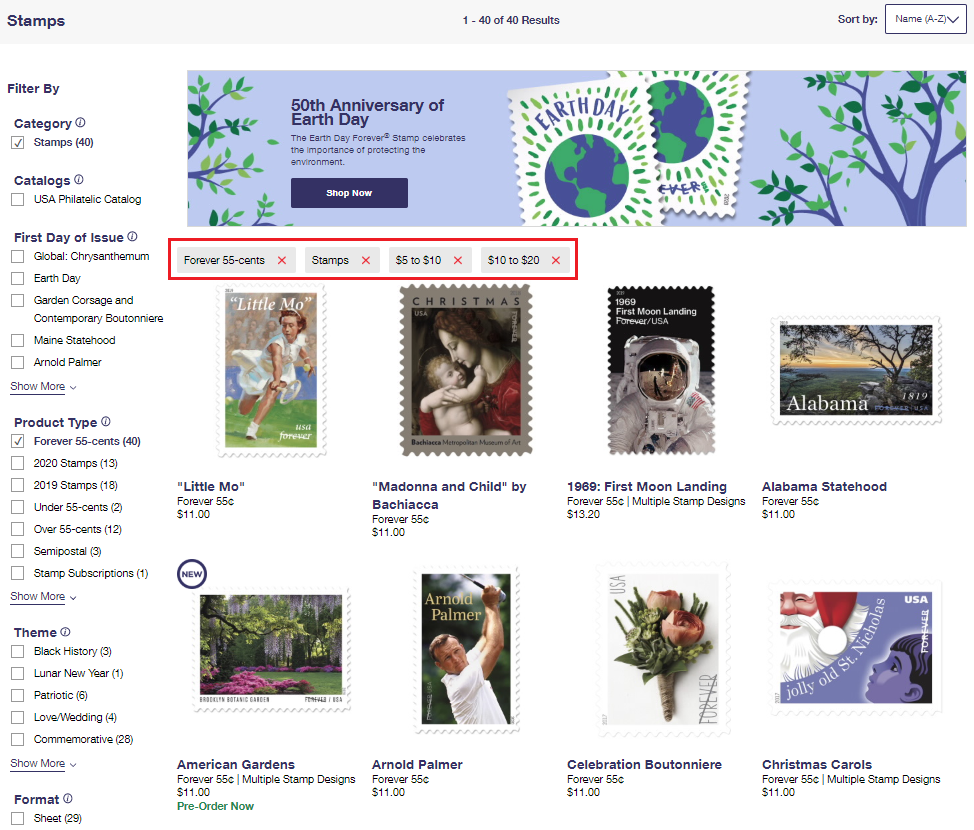

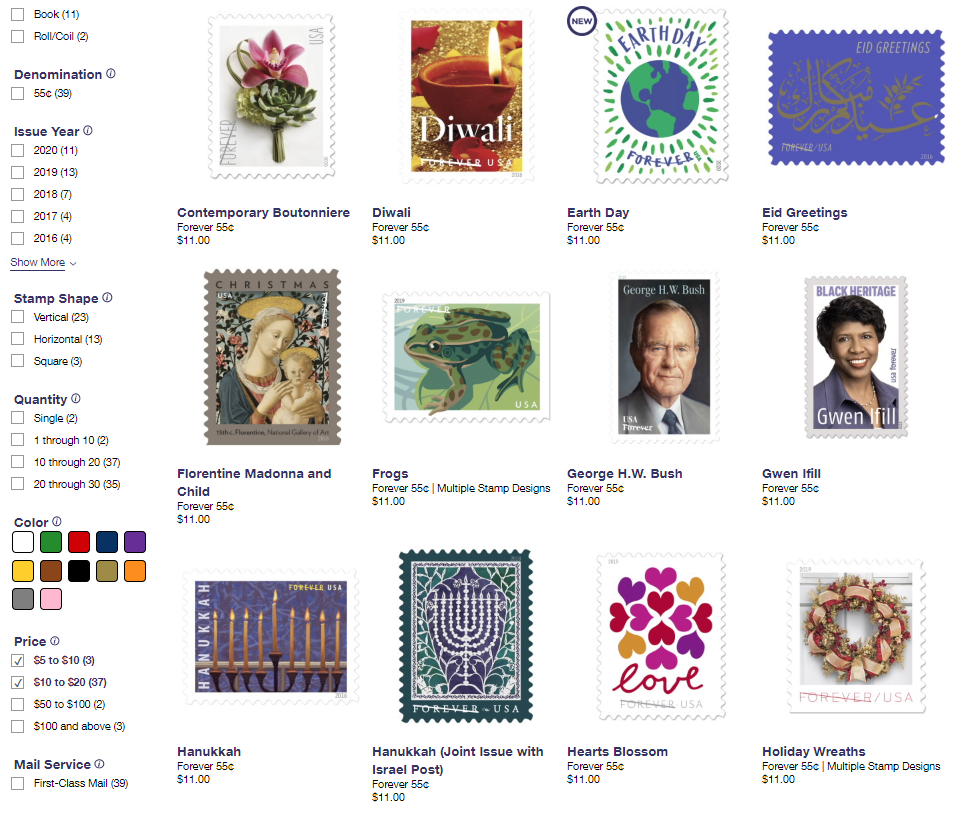

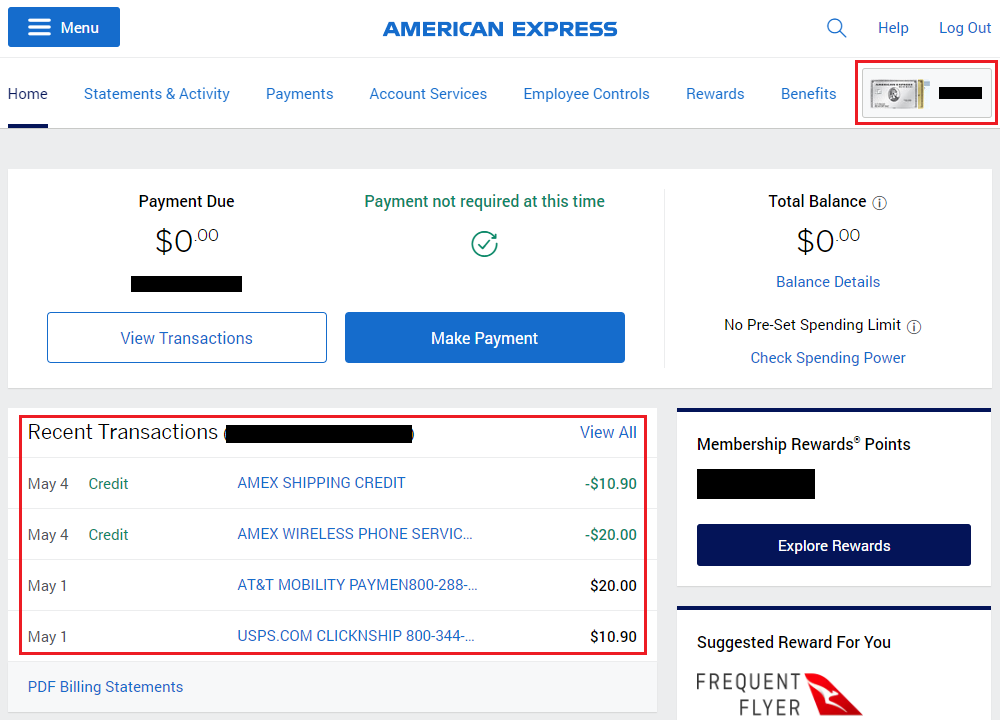

Good afternoon everyone, I hope your week is going well. During the current Coronavirus Pandemic, it is important to save money on everyday purchases. I recently wrote how to Use Trim to Save Money on Cable / TV / Internet / Phone Utility Bills. In today’s post, I am going to show you how to save money on your electricity bill with Arcadia and earn 5% cash back paying your bill. Most electricity utility companies charge you a fee to pay your bill with a credit card, but with Arcadia, you can use a credit card without paying any fees. Plus, if you have a US Bank Cash+ Credit Card, you can earn 5% cash back (just select the Home Utilities cash back category). Keep reading to find out how to earn a $25 utility bill credit.