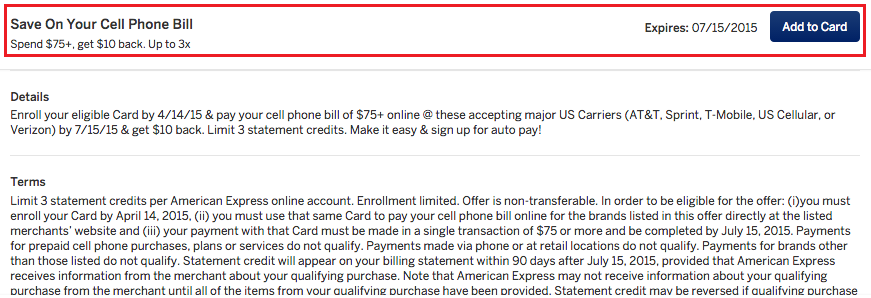

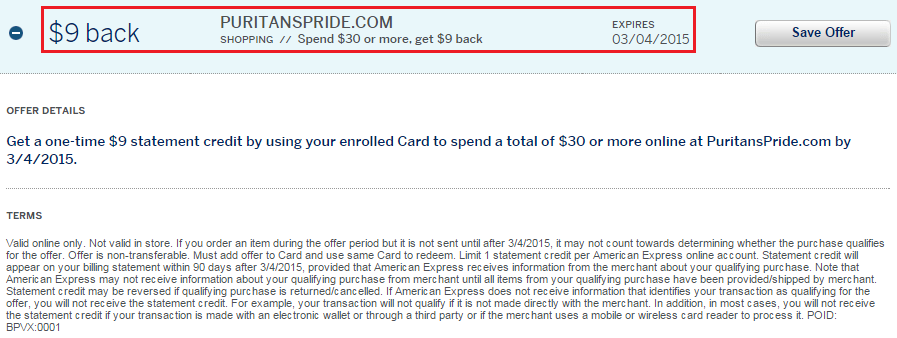

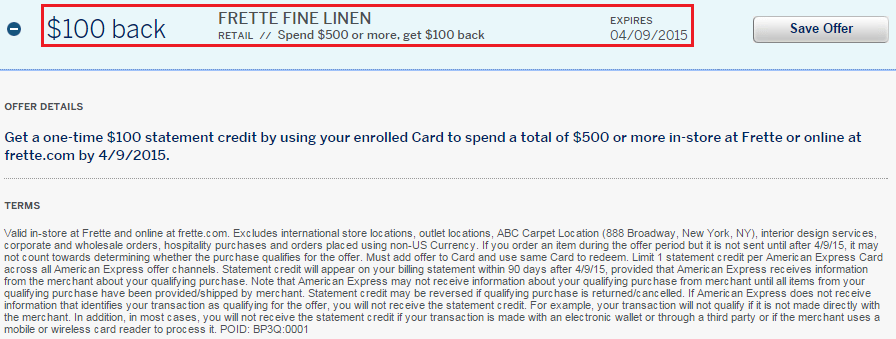

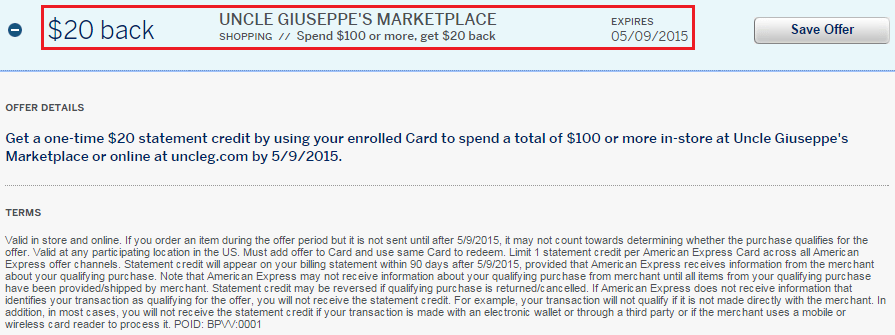

Good afternoon everyone, I have 4 new AMEX Offers to share, a quick update regarding the Discover It Q1 cash back category (transportation) and my results using the United MileagePlusX app. First off, there is an awesome AMEX Offer to pay your AT&T, Sprint, T-Mobile, US Cellular, or Verizon cell phone bill. You can get 3 $10 statement credits when you make a payment of $75 or more toward your cell phone bill. There are also 3 AMEX Offers for Puritan’s Pride, Frette Fine Linen, and Uncle Giuseppe’s Marketplace (I have never heard of any of these merchants before).

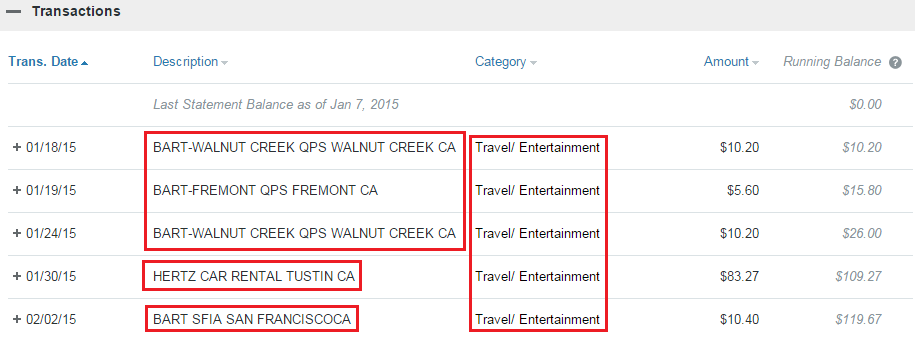

This quarter (January 1 through March 31), all Discover It charges that are coded as transportation earn 5% cash back. Over the last month, I rode BART (Bay Area public transportation) several times and needed a Hertz rental car for a few days. As you can see below, all the purchases posted as “Travel / Entertainment” which Discover counts as “transportation.” If you have every ridden BART before, you could say that the BART experience provides travel and a bit of entertainment.

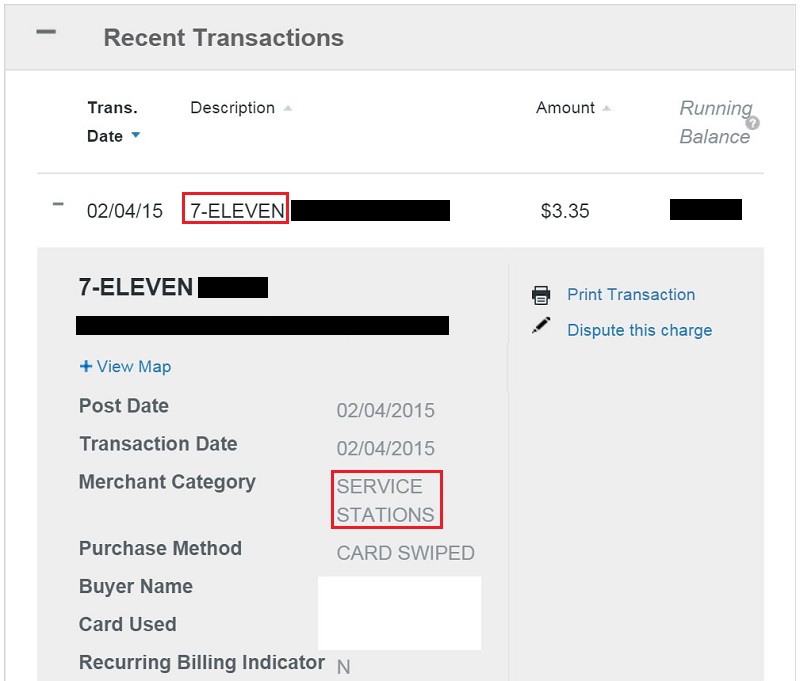

A friend of mine used his Discover It Credit Card at 7-Eleven and the charge posted as a service station (aka gas station), thus earning 5% cash back. I have seen several gift cards and PayPal My Cash Cards at 7-Eleven, but it is up to the store manager / cashier whether or not they will let you pay with a credit card. YMMV

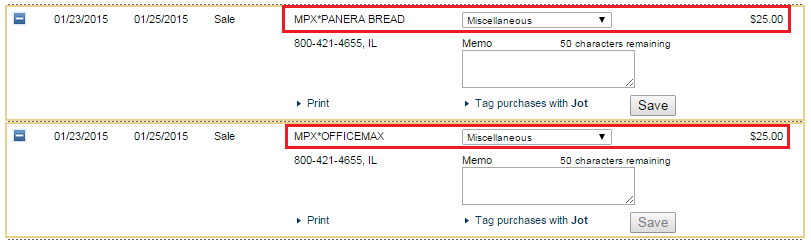

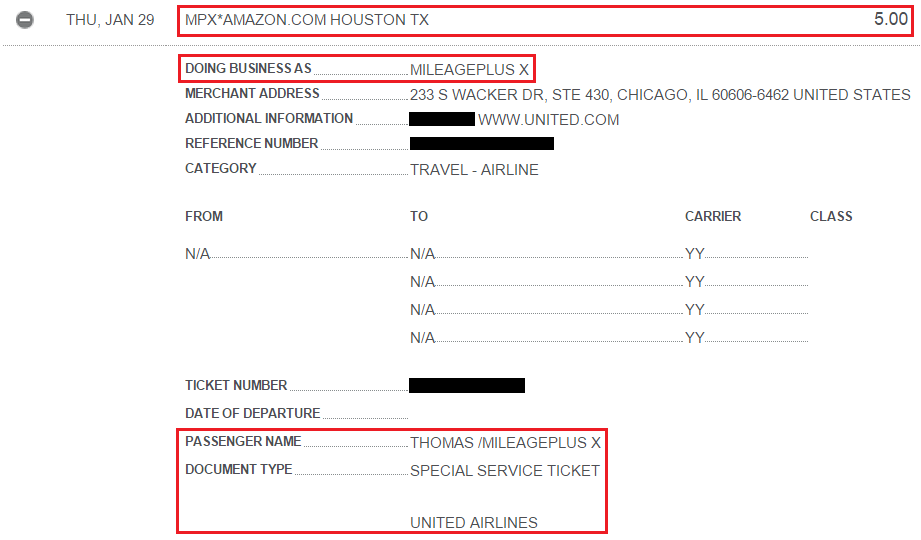

A few weeks ago, I talked about the New United MileagePlusX App puts an Online Shopping Portal in your Pocket. I tested out the app with my Chase Ink Bold Charge Card by purchasing a $25 Office Max egift card. Unfortunately, the charge did not post as an office supply store, thus not earning the 5x Chase Ultimate Rewards Points. Instead, the charge only earned 1x.

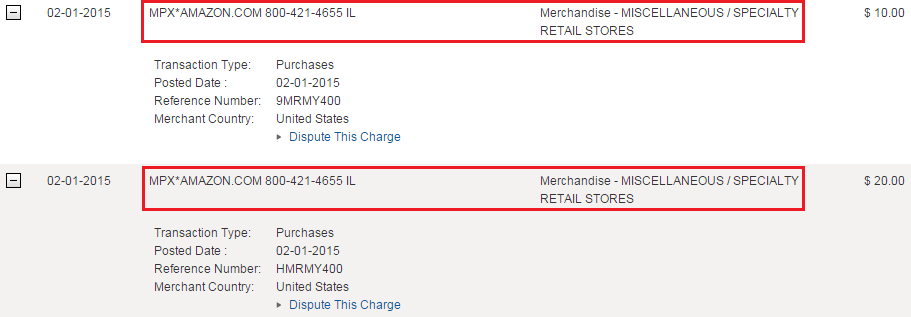

My second test was using my Citi Forward Credit Card to purchase 2 Amazon egift cards. If I use my Citi Forward Credit Card directly on Amazon.com, I receive 5x for the purchase. But using the United MileagePlusX app only resulted in 1x.

Lesson learned: you will not earn any category bonuses by using your linked credit card at participating merchants through the United MileagePlusX app. With that information in mind, I would only using the United MileagePlusX app in 2 situations:

- For merchants/retailers that only offer 1x, I would check the app and see if the app offers a higher payout rate (like 2x or 3x United miles vs. 1x Chase Ultimate Rewards Point).

- If the merchant/retailer offers a higher earning rate through the app than what you can get if you used your credit card directly (3x United miles vs. 2x Chase Ultimate Rewards Points for restaurant purchases).

If you have any questions, please leave a comment below. Have a great day everyone!

Thanks for posting this. How to maximize the Amex offer to pay phone bills 3 times? How do you plan to max it out?

Depending on your phone bill amount, you might be able to make multiple $75 payments ($75.00, $75.01, and $75.02) at the same time.

We have to make a payment online in order to be elihible for this offer or it can be over the phone or in store?

I dont see the AMEX offer in my card. Can i get this offer anyhow if someone has idea to get this :) Thanks!

The offer is extremely targeted, I only see it on one of my AMEX credit cards. Unfortunately, there is no way to add the offer to your account.

I also only see it on one of my 4 Amex cards, and it’s not on my Bluebird or Serve either.

1 card is better than no cards :)

I’m not sure, whatever the terms and conditions say should be followed.

@Jay It must be online only. The phone or in store won’t give you a credit per the T&Cs

Thanks for the clarification, always good to read the small print.

Thank you for helping!

Did any one use mileage plus app with travel category card? I mean i wanna see if that racks you up 4x at office max plus 3x with travel category like sams mastercard? Just wanna know if someone had this before? I see my american express put purchase as travel when i use it through mileage plus app to toyrus merchant. This is posted as travel. I will check if i earn travel bonus too!

As far as I know, AMEX counts all United MileagePlusX app purchases as a United Airlines purchase. I tested this with my AMEX PRG and need to wait for the points to post.

Waiting eagerly for an update on that. 3x MR in addition to 2-4 UA miles would be sweet!

This is what my AMEX PRG statement says:

My first restaurant GC on MPX using my Chase Sapphire Pref card gave me 2x points + I got 3.75 x on MPX (3x and 25% bonus for holding MileagePlus cc). That’s 5.75x on restaurant spend I would have gotten 2x without the MPX.

Interesting, maybe MPX works for some retailers, but not all retailers. Have you had success at all restaurants when you used MPX?

Just a few more data points. I have been using MPX app for about 3 months now. I have received category bonus every time when using any chase card. Citi is a hit an miss and never received any bonus for Amex card.

Thanks for sharing, maybe I just have been unlucky. When I eat at restaurants, I always use my Citi Forward Card. I’ll keep using the MPX app and hopefully things get better for me.