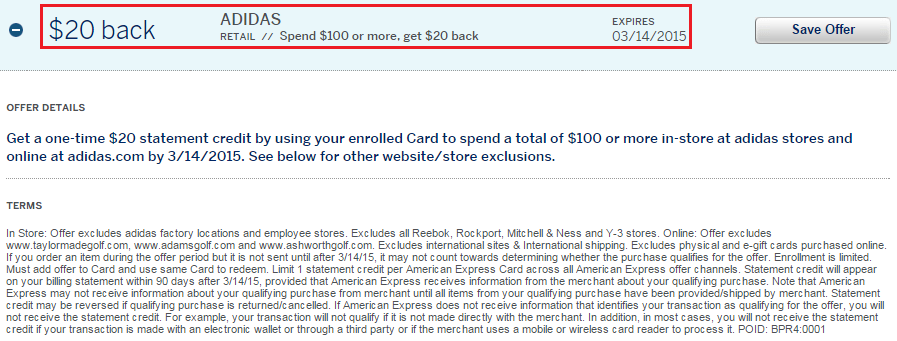

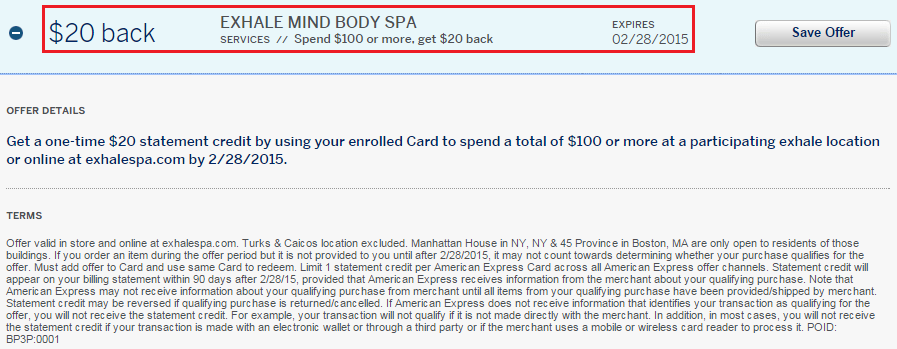

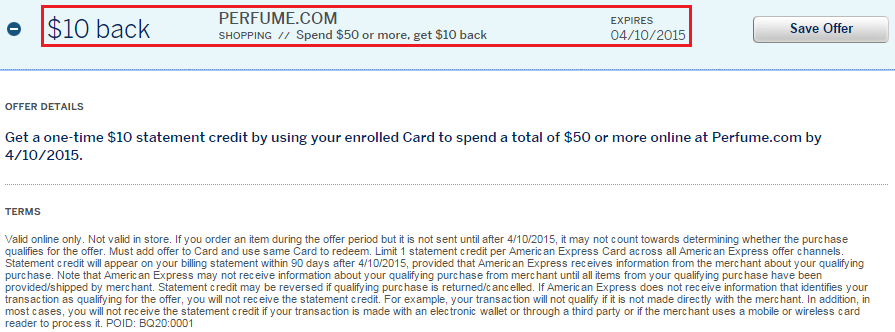

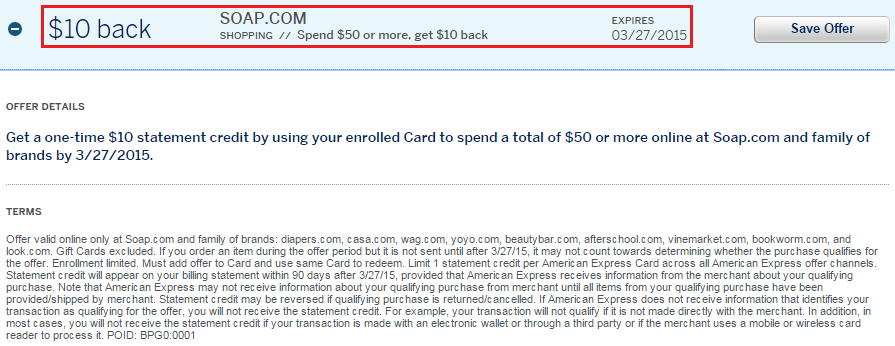

Good afternoon everyone, I have 4 new AMEX Offers for Adidas, Exhale Mind Body Spa, Perfume.com, and Soap.com. I also have an update on the recent US Bank FlexPerks promo for spending $5,500 on “holiday shopping.” Here are the details of the AMEX Offers:

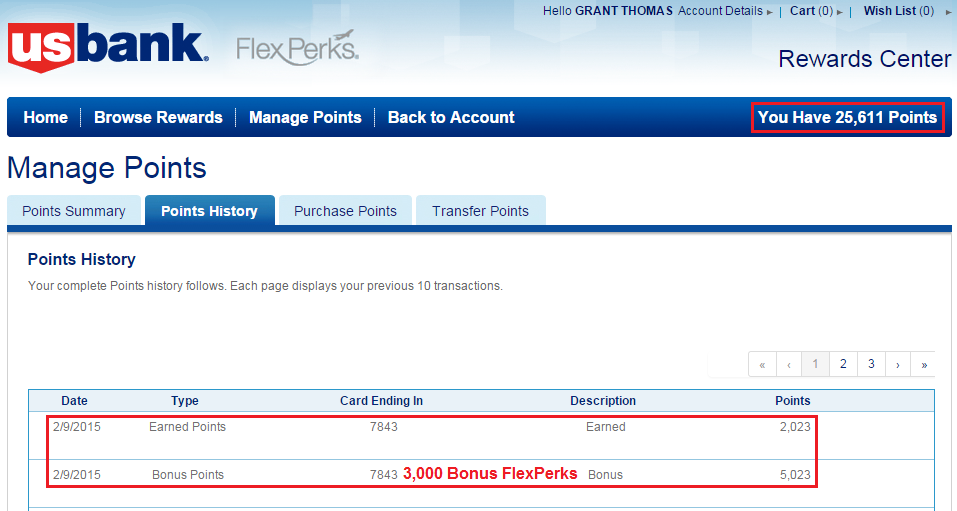

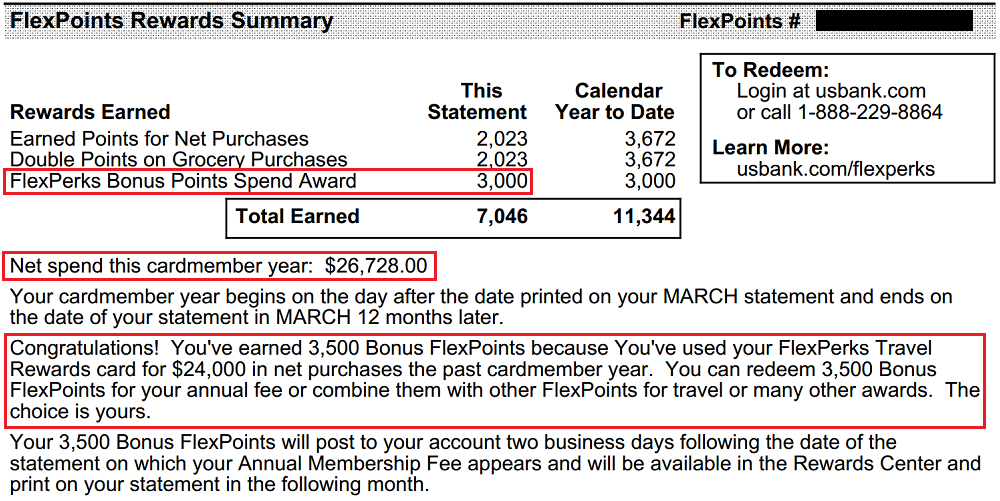

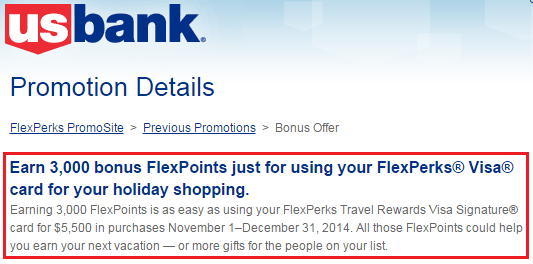

My US Bank FlexPerks Credit Card statement just closed and I received 3,000 bonus FlexPoints. At first glance, I thought this was related to spending more than $24,000 on my credit card, but that bonus would be 3,500 FlexPoints, which will post after my annual fee posts.

After doing some digging, I found the original promotion details, which I first wrote about here (US Bank FlexPerks: No Foreign Transaction Fees, 1,000 FlexPoints for Joining Visa Checkout, 3,000 FlexPoints for Spending $5,500, and other Offers (Targeted?)). I easily spent $5,500 with a combination of Redbird Card reloads and gift card purchases.

The bonus FlexPoints posted to my US Bank FlexPerks Reward Center, so now I have enough to redeem for a $400 airline ticket. I am still trying to decide if I want to keep the card another year, I hope the US Bank retention department has a good offer for me, I would hate to have to redeem 3,500 FlexPoints to offset the annual fee.

For more information regarding the US Bank FlexPerks Credit Card and how to redeem FlexPoints for travel, please read How to Book Airfare with US Bank FlexPerks. If anyone is interested in applying for the US Bank FlexPerks Credit Card, I have a referral link available. Just leave a comment below asking for the link and I will send you the link directly.

If you have any questions, please leave a comment below. Have a great day everyone!

I was looking at the FlexPerks cards from US Bank. Quick question (and if you have answered these before, I am sorry for repeating).

Are the prices that U.S. Bank comparable to prices if you were to pay it on the airlines direct site? (do they charge a fee or anything like Amex Travel does?)

Also, are the points you redeem directly tied to the price of a ticket? Or is it a tiered system? I have read it both ways and don’t know who to believe.

Thank you very much!

Good afternoon Jason, all your questions should be answered in this post: http://travelwithgrant.boardingarea.com/how-to-guides-airlines-miles-points/book-airfare-with-us-bank-flexperks/

As for the airfare, it is usually identical as what you could get on the airline’s website or through an OTA (online travel agency like Expedia/Orbitz).

FlexPerks is a tiered redemption point currency. 20,000 FlexPoints = 1 ticket up to $400 in value. A $399 ticket and a $99 ticket would both cost 20,000 FlexPoints.

I apologize for not linking to the above post. I will update the blog post to add that information.

Awesome, thank you very much!

You’re welcome Jason, I probably sent you more info than you could ever want. Enjoy :)

Pingback: Miles & Points Strategies, New Diamond Benefits, AmEx Offers, Fuel Surcharges & Credit Cards After A Bankruptcy - Doctor Of Credit

Grant, thanks for the post. I was considering signing up for this card last week. Just looked at the fares of some of the flights I want to take and now I’m convinced. Can you send me your link?

Will do Jeff, check your email in 2 minutes.

I got my 2,500 bonus points today. When US Bank says points will be issued 45 days after end of promotion they usually use every day of it.

I recently also got the US Bank Amex Select+. With no annual fee ever I won’t have the dilemma of renew or lose points. I’d just need to transfer the points from the AF card. For some reason they won’t let the two cards feed to one FlexPerks account, but you can transfer easily.

That is a good point. I might get the US Bank AMEX FlexPerks credit card. I’ll just move the points from one account to another.

is it possible to product change from annual-fee Visa to a no-annual fee Amex Flexperks and keep your existing Flexperks points?

I don’t know, I’ve never done a product change with US Bank. If you call US Bank, they should be able to tell you if it is possible. Please report back if you find out. Thanks Jeff!

I think I’d just apply and get the 10K points after $1K spend on the Amex Select. Then transfer existing points and cancel Visa This assumes you don’t think there would be approval problems and don’t mind the hard pull.

I think I could easily get another US Bank credit card. I currently have 3 (Club Carlson Personal + Biz, along with FlexPerks Visa). I think the spending categories are better on the Visa than the AMEX. Check out this comparison: http://travelwithgrant.boardingarea.com/2014/10/31/random-news-us-bank-flexperks-visa-signature-vs-american-express-vs-business-cards-and-4-new-amex-offers/

How are the spending categories better on the Visa vs. the AMEX? They look exactly the same except for the AMEX includes 2X points on restaurant spend, whereas the Visa does not. Or have I overlooked something?

Technically the categories are the same, with the addition to restaurants on the AMEX, but I use my Visa FlexPerks at Target to load my Redbird Card. Visa categories Target as a grocery store, therefore earning 2x. AMEX, on the other hand, does not consider Target a grocery store, therefore only earns 1x.

Good point. However, I’ve found not all Targets are coded as grocery by Visa. For those interested in this card and trying to decide Visa or AMEX, it is strongly advisable to refer to the Visa Merchant coding tool to check what how your local Target is classified. If it is indeed grocery, then I would agree with you, the Visa is probably the better option for most folks.

Targets, Super Targets, and City Targets are coded differently. I think all the Targets around me are coded as a grocery store.