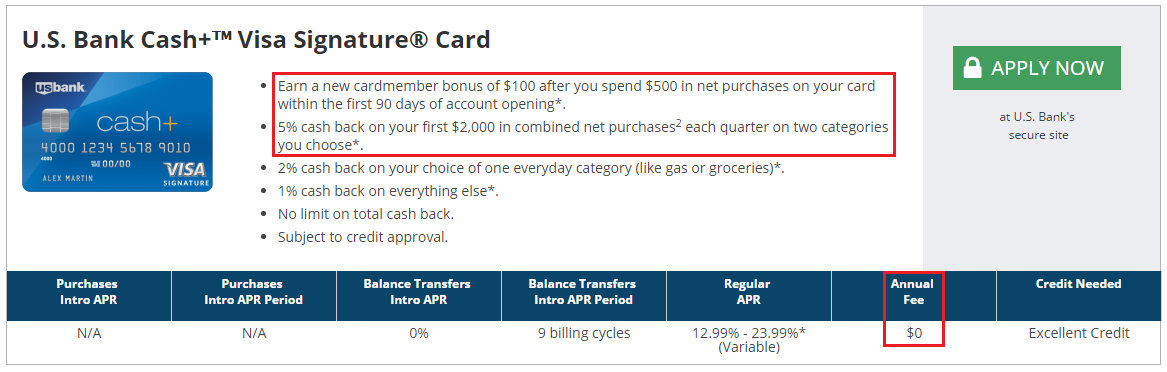

Good morning everyone. Last month, I wrote July 2015: My 8 Credit Card App-O-Rama Game Plan where I shared my thought process on my upcoming App-O-Rama. On the list, was the US Bank Cash Plus Credit Card. The sign up bonus is small ($100 bonus after spending $500 in 3 months), but the 5% rotating cash back categories was intriguing. This credit card has the potential to generate $400 in cash back every year (5% of $2,000 = $100 x 4 quarters = $400 yearly). Since I already have the US Bank FlexPerks Visa and AMEX, Club Carlson personal and business, this was the only other US Bank credit card I was interested in.

If you have never applied for a US Bank credit card or have a hard time getting approved for US Bank credit cards, I recommend Freezing your ARS and IDA Credit Reports before applying. I have had great success after freezing both of these smaller credit bureaus.

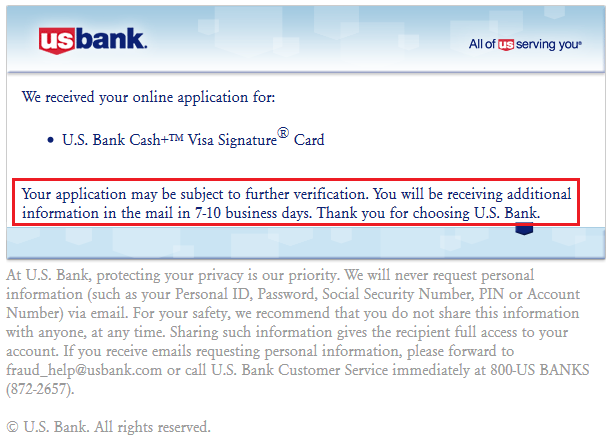

When my App-O-Rama date arrived (July 14), I applied for the credit card…

… and I was promptly met with a pending decision. I found US Bank’s reconsideration department phone number (compliments to Doctor of Credit) and gave them a call. The rep told me that US Bank did receive the application and that it was sent to the credit department for review. There was no way to expedite the process, so I just had to wait it out.

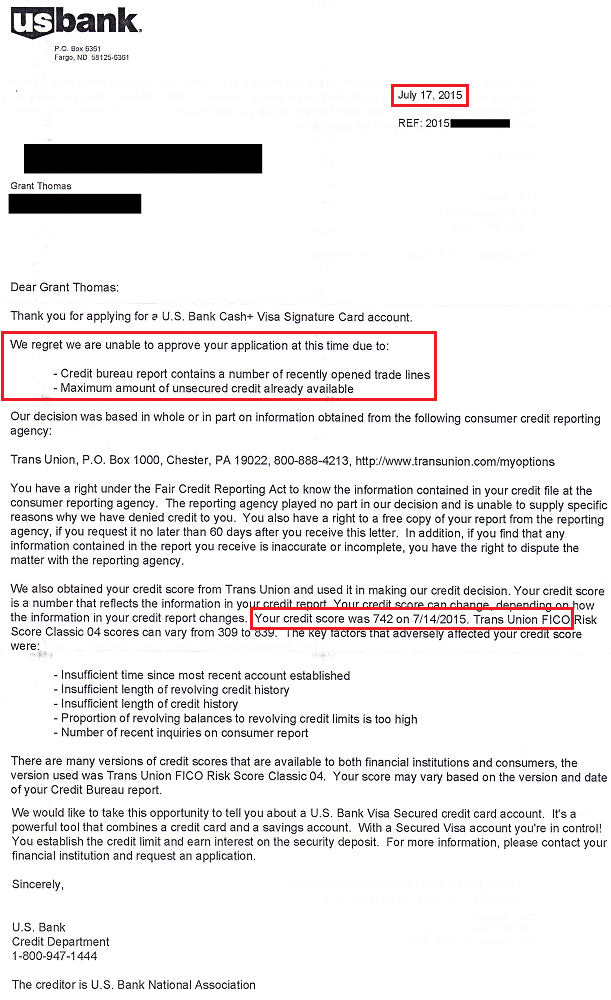

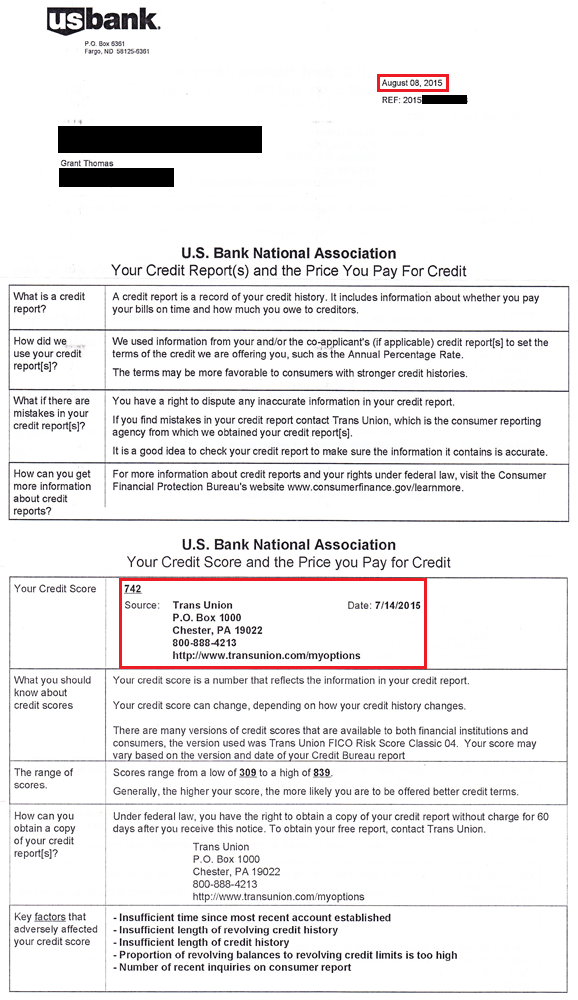

A few days later, I received the *first* denial letter from US Bank (dated July 17), which was 3 days after my application. The denial letter said I had too many recent credit inquiries and newly opened accounts (both are true). I called the US Bank reconsideration department again and pleaded my case. I explained that I *did not want* more credit from US Bank, I just wanted to move credit lines from one of my existing US Bank credit cards. The rep put me on hold for a few minutes to review the application. When she came back on the line, she said that she would reopen the application and send it to a credit analyst for a second look. I was told that I would hear back in 1-2 days regarding their decision.

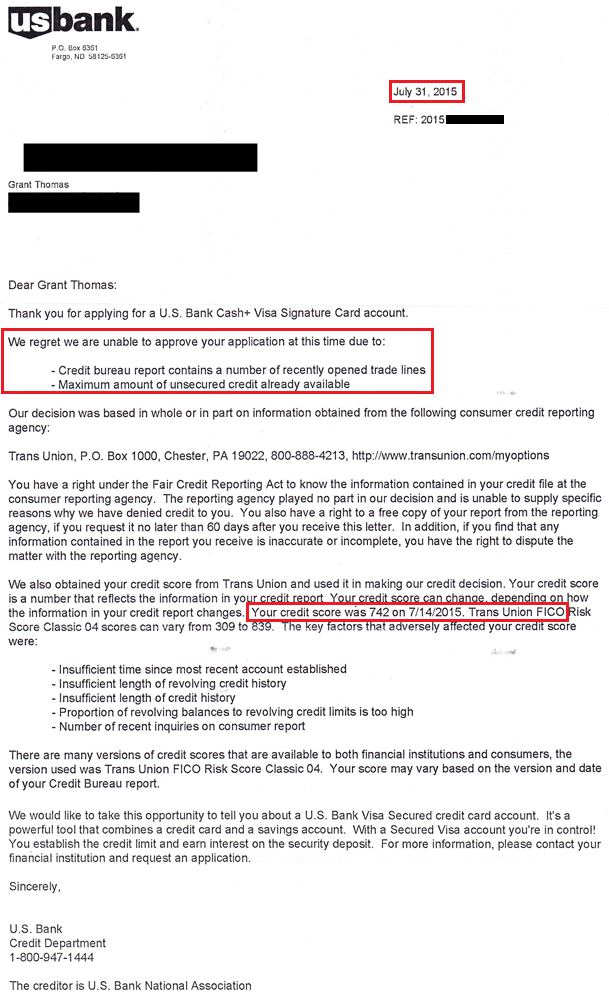

Fast forward another week and I receives the *second* denial letter from US Bank (dated July 31), which is 2 weeks after applying for the credit card. The letters are identical with the exception of the dates. I called US Bank’s reconsideration department one more time and explained the situation. This time, I specifically asked if I could move $5,000 from my US Bank FlexPerks AMEX Credit Card ($12,500 credit line, opened in March 2015). The rep said that should be possible and put me on hold for a few minutes. He came back on the line and told me he would send another request to a credit analyst. I was told I would hear back in 1-2 days of their decision. Later that day, I got a call back from US Bank telling me that my request to move credit around was approved and that my US Bank Cash Plus Credit Card would have a $5,000 credit line. Success! Finally!

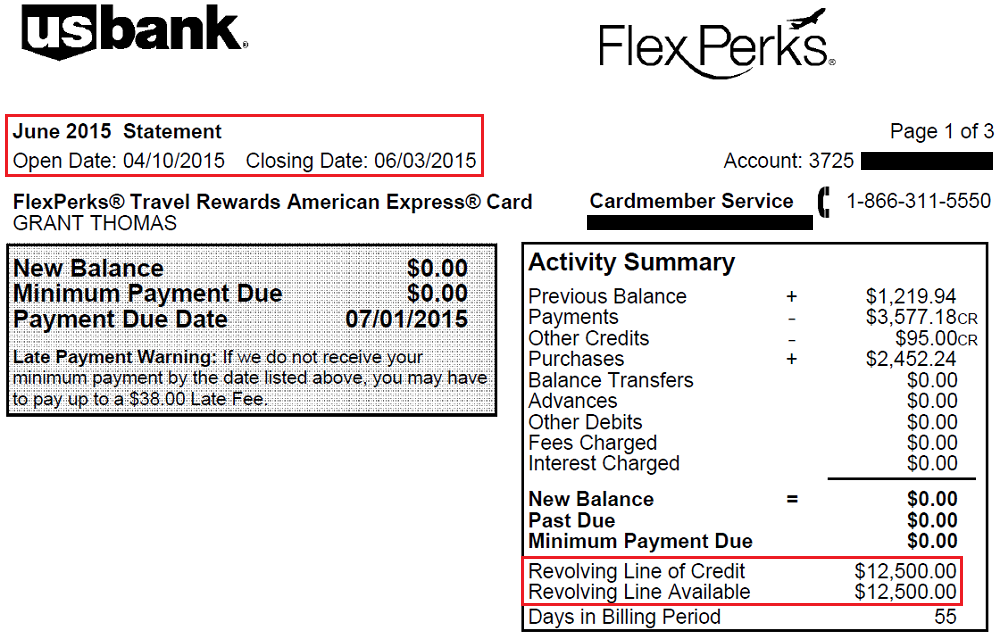

Here is what my US Bank FlexPerks AMEX Credit Card statement looked like as of June 3 (showing the $12,500 credit line). I didn’t make any purchases in July, so there is no July statement for this credit card.

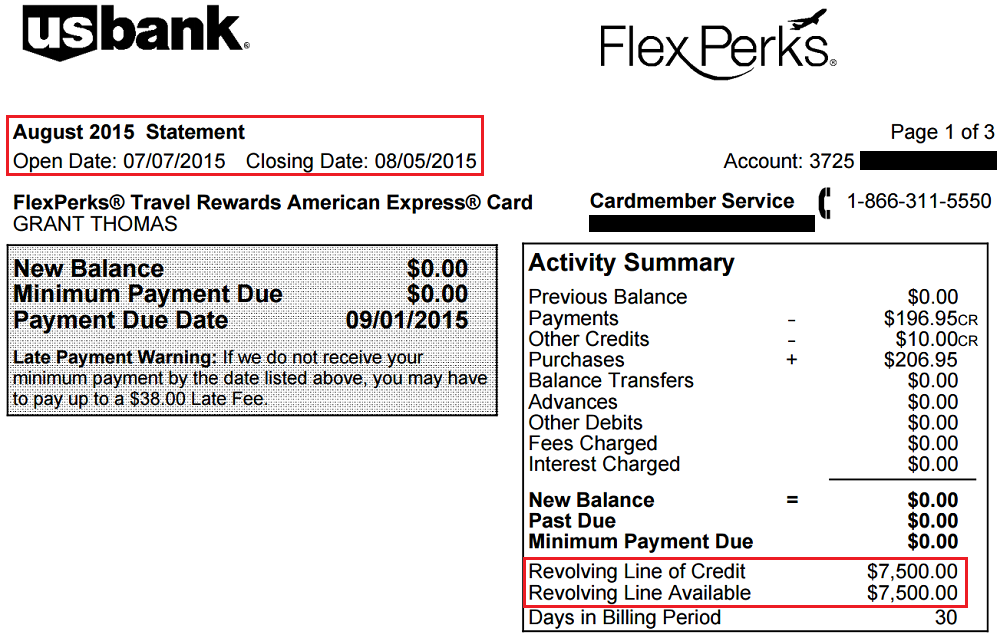

Here is what my US Bank FlexPerks AMEX Credit Card statement looked like as of August 5 (showing the $7,500 credit line). It appears that US Bank did move $5,000 from my US Bank FlexPerks AMEX Credit Card to approve my new US Bank Cash Plus Credit Card.

A few days later (on August 14), I received the US Bank Cash Plus Credit Card and the below approval letter. After exactly 1 month after applying for the credit card, I finally had the card in my possession. Persistence pays off. Never give up!

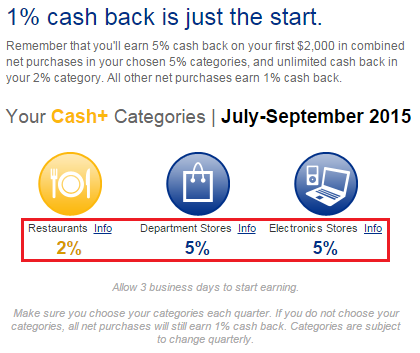

A few days ago, I wrote US Bank Cash Plus Q3 Categories: Any MS Opportunities? where I shared my thought process on picking the Q3 cash back categories. After listening to some of your feedback, I decided to go with Restaurants (2%), Department Stores (5%), and Electronics Stores (5%). Let the fun begin!

If you want to read about all my App-O-Rama successes and failures, please read July App-O-Rama Update: Several Reconsideration Calls Required to be Approved for 6 New Credit Cards. I apologize that all these posts are out of chronological order. If I was instantly approved for all of these credit cards, there would be no blog posts to write.

If you have any questions, please leave a comment below. Have a great weekend everyone!

P.S. I will work on a post about the $100 Bank of America Alaska Airlines statement credit taking longer than usual to post. Stay tuned.

Well, I understand electronics stores where you might try to MS, but restaurant and department stores? What can you possibly do there to MS?

No MS at restaurants, I just had to pick a 2% cash back category.

Hey Grant,

I applied for the Flex Perks visa last week and not only was I denied, but USB closed my existing Cash + and Club Carlson accounts. After I called in, they reluctantly opened them but reduced the credit line on one saying that they close accounts when they see too many new account openings and inquiries by their card holders (I think I opened 8-10 cards in the past year). This closure was done by their card member investigations dept who also placed a note on my application to have the CSR refer any calls to them (I found out about this after calling recon). Just wanted to share this for everyone to be careful with USB. Also do you think I should call recon again asking to reallocate credit from existing cards now that i spoke to the fraud dept. or is the app off limits now?

Wow, that is intense. I have never had that problem, but I have heard similar stories from other other people. That is pretty scary, I would lay off US Bank apps for a while and use the credit cards safely.

US Bank is not worth doing business with–they recently reported me to the credit agencies for being delinquent on paying fraudulent charges they have taken two months to get resolved. Their customer service is a complete nightmare . . .

US Bank’s customer service is definitely not on par with the other credit card companies. I’m sorry you are having such a nightmare getting the fraud charges resolved.

A truly mammoth opportunity cost. It’s odd this piece begins by telling readers you have had “great success after freezing both of these smaller credit bureaus”. Actually, your recent reporting shows plenty of rough sledding on you latest app-o-rama, and not only with US Bank. You’ve reported on several rejections and reconsideration calls based on too many recent inquiries. Seasonal bonus cards are B-list stuff, and just because something can be hard to get doesn’t mean it’s worth having. In your situation, I would have saved the pull; I wouldn’t want to disqualify myself from the next great offer before it even arrives.

It’s great to hear your perspective, eusticetilley. Credit card app-o-ramas are one my favorite ways to earn miles and points. Instant approvals are few and far between for me, so I am used to doing a little extra work to get approved for credit cards. I’d rather apply now than wait to see what the next great offer will be. I haven’t missed out on too many of those, but if I did, it wouldn’t bother me. I don’t lose sleep over missed opportunities. All the best to you and have a great weekend.

Persistence!!! I am thinking of getting it in my next churn.

Good luck JC!

Pingback: My Week in Points: US Bank, More Cards and more

My credit score is 715 but still my app for a bofa c c was rejected. I hope I will get a carlson card but it Is taking so long about 10 days with no result yet.

Did you get denied by Bank of America or US Bank?