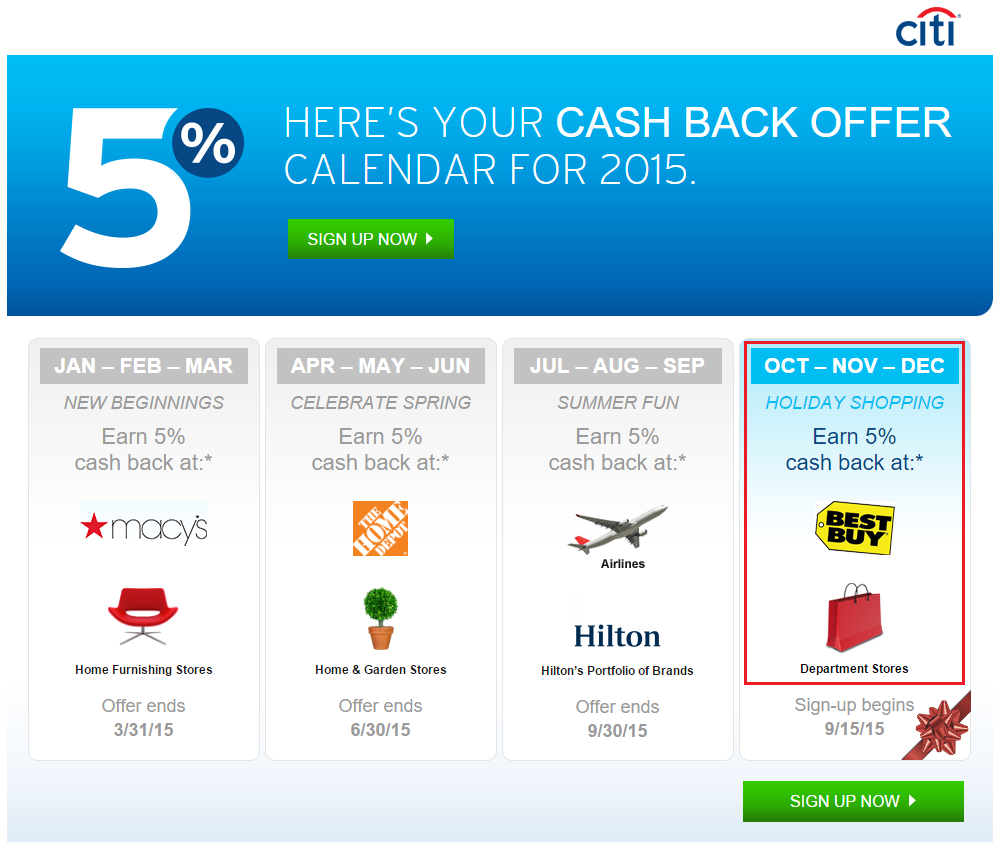

Good afternoon everyone, Q4 is among us. With that, comes new cash back categories for Chase Freedom, Citi Dividend, and Discover It credit card holders. Let’s go through the list of categories really quickly, starting with the Citi Dividend Credit Card: 5% cash back at Best Buy and department stores. Most people will probably buy Visa Gift Cards at Best Buy. I would also like to mention that you can often buy department store gift cards for much more than a 5% discount by shopping on Gift Card Granny. Macy’s gift cards are 10%+ discounted, Sears gift cards are 6%+ discounted, and Kmart gift cards are 7%+ discounted.

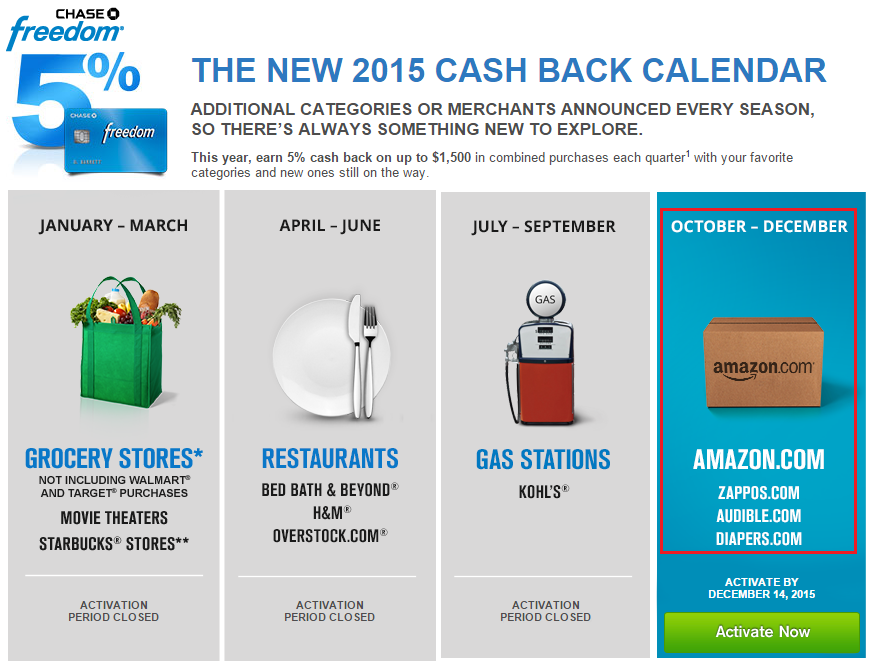

Up next, we have the Chase Freedom Credit Card: 5% cash back at Amazon, Zappos, Audible, and Diapers.com. Most people will probably buy Amazon gift cards or shop on Amazon.

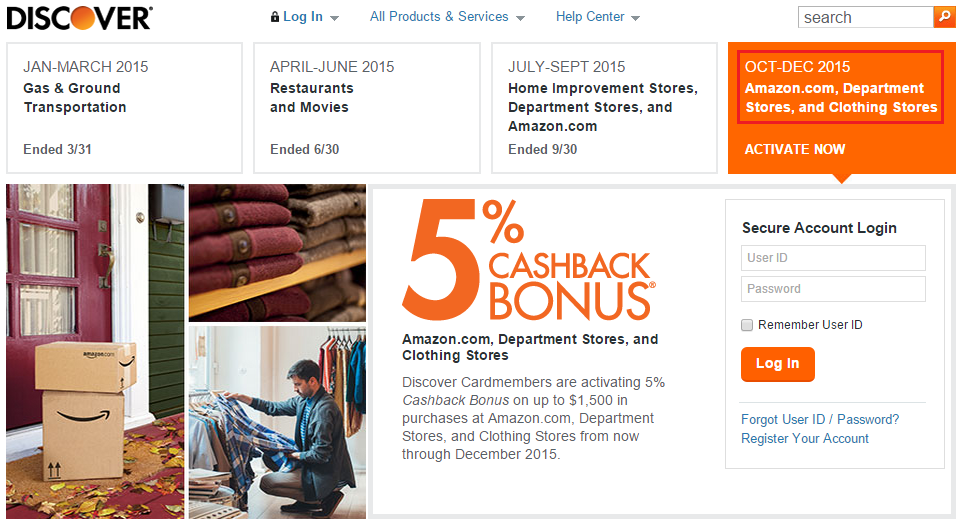

Last but certainly not least, we have the Discover It Credit Card: 5% cash back at Amazon, Department Stores, and Clothing Stores. Like I mentioned above, you can probably do better buying gift cards from Gift Card Granny than using your Discover It Credit Card at department stores and clothing stores. However, the Cash Back Doubling feature could sway your decision. It would then look like Amazon is the clear winner, so after doubling, you would get 10% cash back. But wait just a minute. With the current Apple Pay promotion, you can actually buy Amazon gift cards at a store that accepts Apple Pay. My local Walgreens sells variable load Amazon gift cards (loadable from $20-$500). With the Cash Back Doubling feature, you can earn 22% cash back (1% purchase + 10% Apple Pay bonus = 11% x 2 = 22% cash back).

Alternatively, most Walgreens also sell Southwest Airlines gift cards, so you could get 22% cash back on Southwest Airlines flights. I keep a detailed spreadsheet of all the paid and award flights I booked since last December. Assuming I paid cash for all my Southwest Airlines flights from December 2014 to December 2015, I would have spent more than $3,300. If I earned a 22% cash back bonus on those purchases, I would have earned $726 in cash back. With that said, I will probably purchase around $2,000 in Southwest Airlines gift cards during the Apple Pay promotion.

If you have any questions, please leave a comment below. Have a great day everyone!

Great idea grant. Though any word yet if discover is accepting gift cards for their Apple Pay promotion?

Not sure yet, but we should know in the next few days. My statement closes on 10/5 I think.

Yea, I heard gift cards are excluded from the promotion. That probably means all gift cards, not just vanilla visa gift cards. Please let us know if you get the double points for purchasing gift cards.

I’m skeptical the no gift card policy will be enforced. If they could enforce it, I think every credit card company would enforce that policy. I’m planning to continue buying gift cards until proven wrong.

Unfortunately, Discover takes 2 statements to post the cash back. We won’t likely have any hard data on gift card purchases until sometime in November.

I think Discover posts cash back when your statement closes. Amex usually posts cash back the following month.

I haven’t seen anybody whose statement closed in late September confirm that any cash back has posted yet. Discover is notoriously slow. Even if we don’t know for sure until November, we will still have time to spend $10k to max the bonus… Even if it has to be one $500 GC per day at Walgreens.

My Discover statement closes in a few days and it should show the cash back earned. If there is anything to report, I will write a blog post.

Sounds good! I will keep an eye out. Mine closes tomorrow. Will also report on that.

Sounds good Jesse, good luck!

Grant,

Good article as always.

However, in calculating the Apple pay savings of buying SWA GCs you did not take into account the value of the opportunity to use up SWA miles or AE points on your SWA flights.

Jim

My SWA account usually has less than 1000 miles, since I usually transfer Chase UR points to top up my account for an award ticket. Plus, when you use SWA GCs, you earn 6 SWA miles for Wanna Get Away tickets, which could skew the “cash back” value.

Yah, if you’ve found a way to do better on retail cashback than 5% I’ll eat my hat.

I have been content with buying Amazon gift cards online with my Freedom for the 5% off, and the SW GC at office supply for Ink 5x points. Since I valued Chase points at 2 cents, this works out to 10% of “value” back to me, but it’s no the same as cash!

I just wanted to remind people to think outside the box and don’t settle for 5% cash back.

Yep, I learned that the hard way. I thought Home Depots were NFC enabled for Apple Pay. I remember they were at one point, but when I went to buy SWA GCs on 9/30 (for the 5% category bonus), their terminals were only EMV Chip read and not NFC enabled as they used to be.

I settled not thinking about going to WAGs. In any case, the 5% don’t have that “excludes GCs” T&C like the Apple Pay promo and I’ve got the 2X promo, so I’m OK with 10%, but 22% would be better :-)!

BTW, I also reread the T&Cs on the SWA cards and noticed I could use only 4 forms of payment for a ticket which includes GCs. So I read that to mean you could only pay with 3 GC’s and 1 credit card for example. I assume that’s correct?

I read that there are or were $200 SWA GC’s? Is that true?

The 4 payment method is true and enforced. You can use all SWA GCs if the full ticket cost will be less than the 4 GC limit. You can also book one ways and use 4 SWA GCs or book individuals separately. I think SWA GCs are variable load from $20-$500, but I’m not sure.

Brilliant! I forgot that on WN that I can break it into OWs. I was resigned to 3 GCs and a CC since the fare will exceed $450/RT. The WN cards I’ve seen are fixed at $100.

I will take a look the next time at Walgreens to see what denomination of SWA GCs are available.

Looks like they are $20 to $500 variable at Walgreens.

Home Depot is $100 fixed.

Thank you for the update.

Yah, Tell me how the hat tastes. :)

I have several thousand dollars Amazon GC all at 20-50% off from Amex offers promos (20 off 100 staples, 25 off 50 smart and final). If this works through grants described method I’m gonna Keep buying more .

Amazon gift cards are pretty easy to accumulate from various AMEX Offers and cash back deals. I will keep you posted with my gift card purchases.

There have been many reports of people being able to buy Sears gift cards through Discover Deals (currently 10% cash back – 20% when doubled) and then taking them to Sears or Kmart and flipping them for either $200 VGC (which some locations carry) or any other 3rd party gift cards. So by buying them this way you would end up getting 30% cash back (5% Q bonus and 10% Discover Deals and then doubling). Again it depends on the cashier if they will allow it. Or if you need to buy something from Sears you could end up going through Discover Deals and using your gift cards to make the purchase. You would get another 10% cash back (20% when doubled) for a total of 50% cash back. So basically netting $750 in cash back on the $1500. When buying something at Sears I always do a small amount on my Discover Card just so part of it is actually charged to my Discover card. This has worked for me recently on some large appliance purchases.

It’s important to test this out on a small purchase. I would not try to buy $1500 of Sears GCs and expect to convert those to VGCs or other retail GCs. There are lots of things that could go wrong with that plan. Good to have plan B and C :)

Definitely agree! I started with a small $25 test run.

Good idea. I think small GCs will be easier to convert to other GCs. Cashiers might not be suspicious. Larger GC values might draw too much attention. So keep that in mind too.

What’s the real point of using the Dividend card to buy $200 VGCs at Best Buy? You make $10 with the 5% and lose something like $5-6 in fees on the card… there’s not much value in that, is there?

You’re right, it’s just like buying $200 VGCs at Staples/OD, but some people choose to do that.

Except those doing that are typically getting 1000 URs for $6, as opposed to getting $4 outright. Actually, I never do that unless there’s an OM sale on the cards. But anyway, they seem like fairly different deals. I suppose you could also argue that enough BB points also yields some extra dollars in BB certs.

Pingback: My Short Term MS Plans with 4 Dead Redbirds (Target Memo) | Travel with Grant