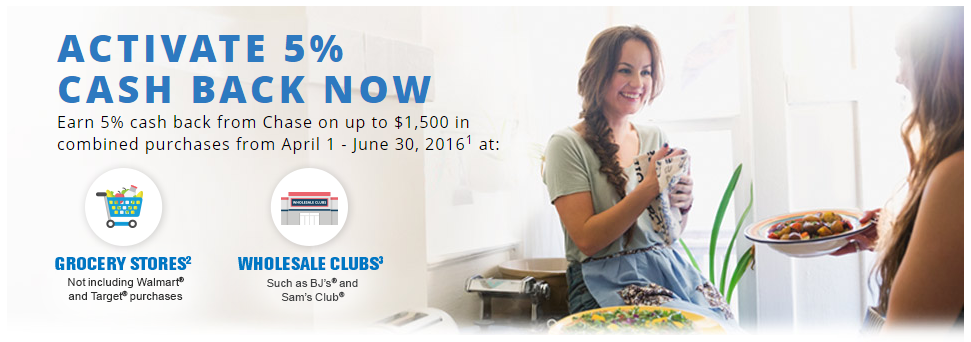

Good morning everyone, I hope you all had a great weekend. My Chase Freedom and Discover It credit card statements just closed and I wanted to take a quick look and see how I was doing on the quarterly cash back categories. As a reminder, the Chase Freedom Credit Card earns 5% cash back on the first $1,500 spent at grocery stores and wholesale clubs from April 1 through June 30.

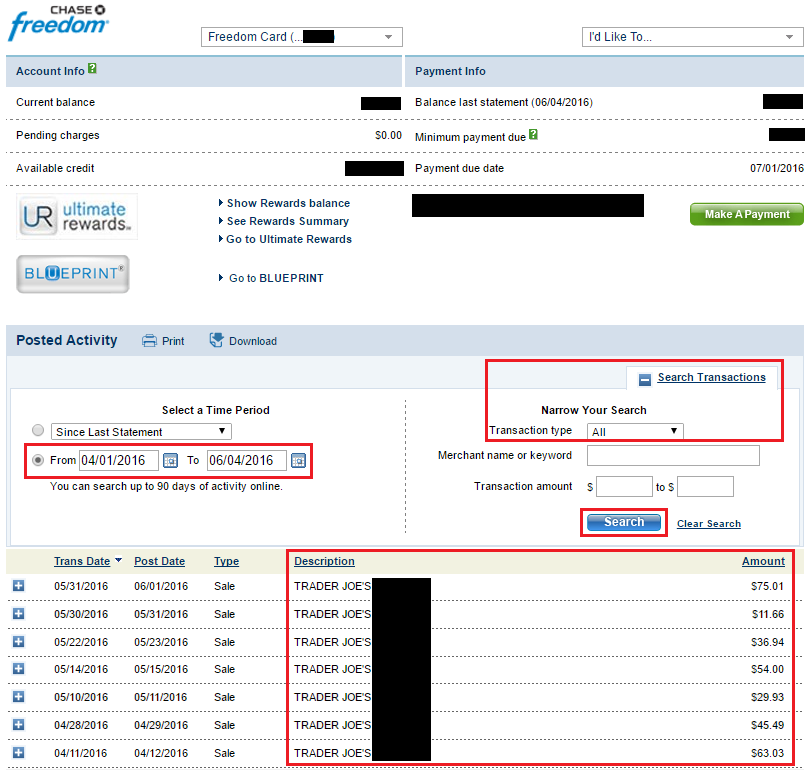

To see how much I spent at grocery stores on my Chase Freedom Credit Card, I logged into my Chase account, went to my Chase Freedom card, clicked the Search Transactions link, enter April 1 and June 4, and clicked the Search button. I then downloaded the report and calculated that I spent $316.06 at grocery stores so far in Q2. That means I have $1,183.94 left to spend to max out the 5% cash back category.

To see how much I spent at grocery stores on my Chase Freedom Credit Card, I logged into my Chase account, went to my Chase Freedom card, clicked the Search Transactions link, enter April 1 and June 4, and clicked the Search button. I then downloaded the report and calculated that I spent $316.06 at grocery stores so far in Q2. That means I have $1,183.94 left to spend to max out the 5% cash back category.

Since I live in San Francisco, there are a lot of small, independent grocery stores and my local Trader Joe’s. I plan to stock up on a few hundred dollars in Trader Joe’s gift cards at the end of the month since it is almost impossible to find Trader Joe’s gift cards sold at a discount. I could go to a Ralph’s or Safeway and purchase a few hundred dollars in eBay or Amazon gift cards, but I could always just go to my local Staples and buy those gift cards with my Chase Ink Plus Business Credit Card, so there is really no motivation to max out the Chase Freedom Credit Card with those gift card purchases.

Since I live in San Francisco, there are a lot of small, independent grocery stores and my local Trader Joe’s. I plan to stock up on a few hundred dollars in Trader Joe’s gift cards at the end of the month since it is almost impossible to find Trader Joe’s gift cards sold at a discount. I could go to a Ralph’s or Safeway and purchase a few hundred dollars in eBay or Amazon gift cards, but I could always just go to my local Staples and buy those gift cards with my Chase Ink Plus Business Credit Card, so there is really no motivation to max out the Chase Freedom Credit Card with those gift card purchases.

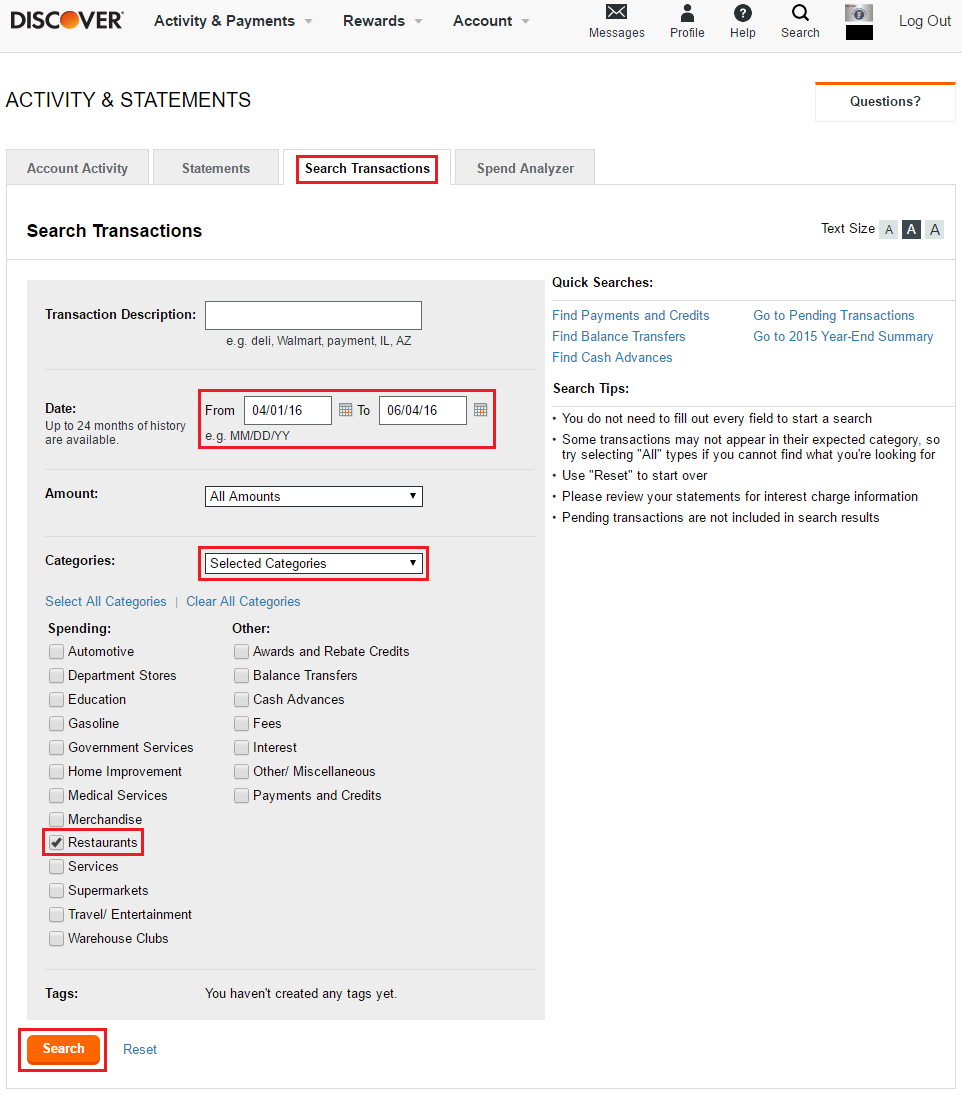

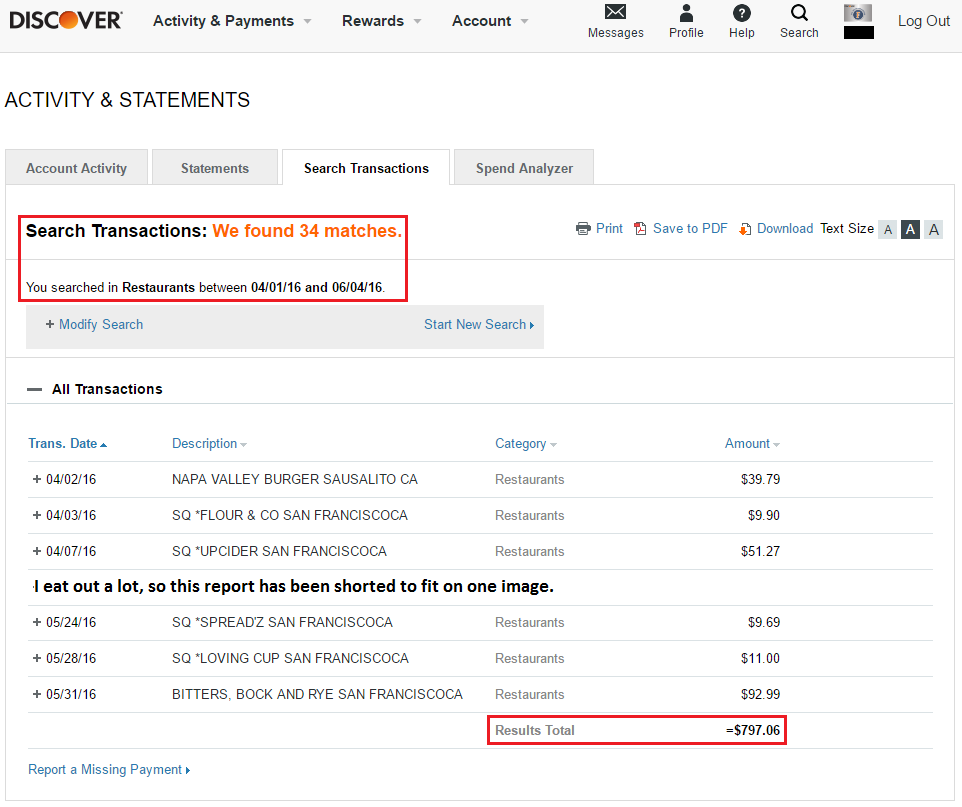

As a reminder, the Discover It Credit Card earns 5% cash back on the first $1,500 spent at restaurants and movie theaters from April 1 through June 30. Since I do not spend much money at movie theaters, most of my spending on this credit card goes to restaurants. Unfortunately again, most of the smaller restaurants in San Francisco do not accept Discover. Drats!

To see how much I spent at restaurants on my Discover It Credit Card, I logged into my Discover account, went to Activity & Statements, clicked the Search Transactions tab, entered April 1 and June 4, clicked Selected Categories, checked Restaurants, and clicked the Search button.

Discover makes it really easy for me and calculated that I spent $797.06 at restaurants so far in Q2. That means I have $702.94 left to spend to max out the 5% cash back category. I probably won’t max out the quarterly limit, but that is ok because…

Discover makes it really easy for me and calculated that I spent $797.06 at restaurants so far in Q2. That means I have $702.94 left to spend to max out the 5% cash back category. I probably won’t max out the quarterly limit, but that is ok because…

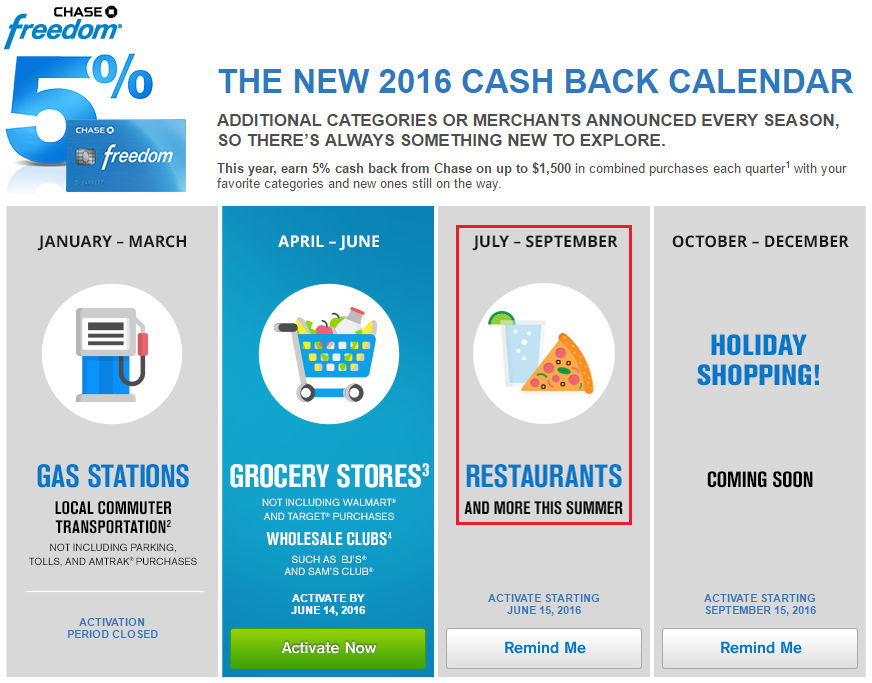

…the Chase Freedom Credit Card is offering 5% cash back at restaurants in Q3 (July 1 through September 30). Since “Visa is accepted everywhere” (except Sam’s Club), it should be very easy to max out the $1,500 restaurant cash back category in Q3. Registration for the Chase Freedom Q3 is not open yet, but I expect to see registration open around June 15.

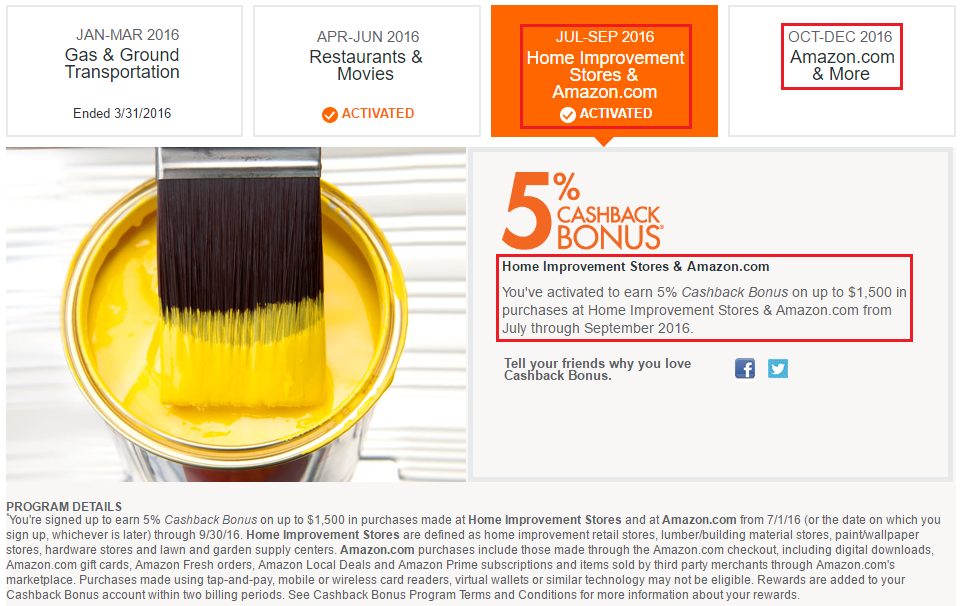

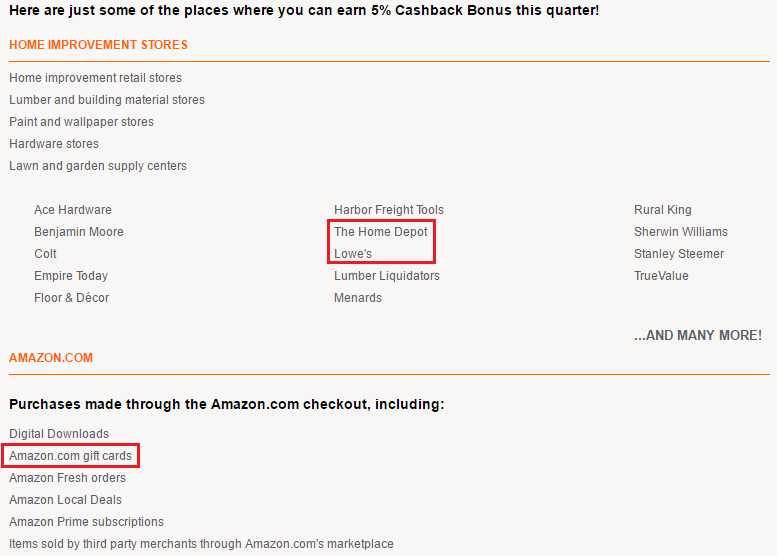

If you are a big fan of home improvement and Amazon, then the Discover It Credit Card will be your best friend in Q3. If you have a local Home Depot or Lowe’s, you should be able to purchase $1,500 in retailer gift cards for several different merchants (including airlines, cruises, and hotels). If Amazon is more your style, you can purchase $1,500 in Amazon gift cards. If you can’t get enough Amazon in Q3, you are in luck. Amazon will return as a Discover It Q4 merchant. Discover It Q3 registration is now open.

If you have any questions, please leave a comment below. Have a great day everyone!

P.S. If you are interested in applying for either the Chase Freedom or Discover It, please click this credit card link. Thank you for your support :)

Sams Club now accepts Visa http://help.samsclub.com/app/answers/detail/a_id/1551/~/accepted-payment-methods

Good catch, let me fix that sentence. Thanks Seth!

Good info. There are a few more days left at Chipotle to purchase a gift card for as little as $25 and you can get a free burrito on your receipt you must use by June 30. I used Discover at 5% back for a few of these.. If a burrito is worth $8 the card cost is about $17 or another way to look at it is 4 burritos for the cost of 3… Plus the 5% back!

That’s a pretty smart idea, especially if you can split the burrito with another person or eat it for 2 meals.

For Chase, I use Blueprint to see the category spend.

Does Blueprint work for both personal and business Chase cards?

+1 for Blueprint! Without it keeping track of the rotating categories would require some real effort on my part. With Blueprint you just click, view by category, click on the category(ies) and add up the months.

As to the business card question, I’m not sure. About to pull the trigger on a Chase Ink next month.

Cool, thanks for another recommendation for Blueprint. Good luck on your upcoming Chase Ink Plus application :)