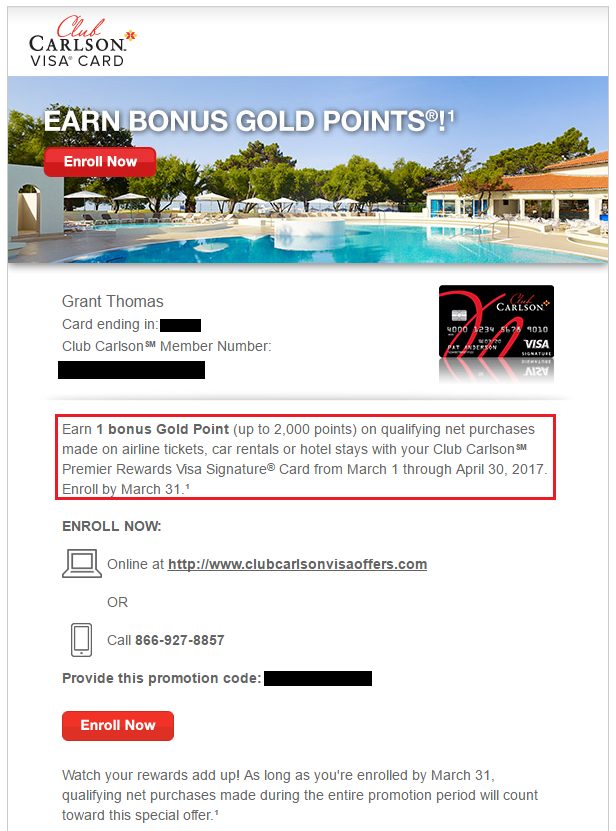

Update: I just received an email offer on March 1 for my US Bank Club Carlson Personal Visa Signature Credit Card. Scroll to the bottom to see the details of that offer.

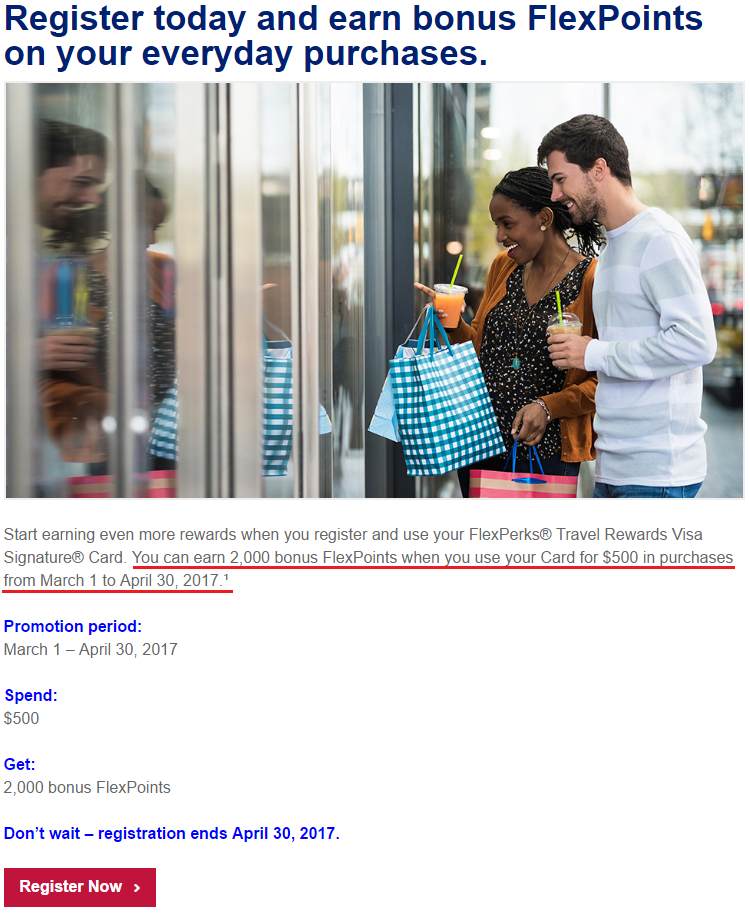

Good morning everyone, I just received 2 targeted credit card offers from US Bank. The first is on my US Bank FlexPerks Visa Signature Credit Card and offers 2,000 bonus FlexPoints after spending $500 between March 1 and April 30. You can log into your FlexPerks PromoSite portal and see if you have the same (or better) offer. If you do not see the offer after logging in, you can try clicking this link to go directly to the offer, but YMMV. This offer is really generous from US Bank and is a no brainer in my book since 2,000 FlexPoints is worth ~$40 to me.

Disclaimer / Terms and Conditions:

Promotion period is from March 1, 2017, through April 30, 2017. Registration deadline is April 30, 2017 at 11:59 p.m. CDT. Bonus based on net card purchases (purchases minus credits and returns) March 1 to April 30, 2017, at 11:59 p.m. CDT. Bonus FlexPoints will be awarded 8-10 weeks after the promotion ends on April 30, 2017, up to a total of 2,000 bonus FlexPoints. We will not award FlexPoints for Advances, Convenience Checks, Balance Transfers, Interest Charges and Fees, credit insurance charges, or transactions to fund certain prepaid card products. We reserve the right to adjust the number of FlexPoints for Purchases or to stop issuing FlexPoints for Purchases on the Account, upon notice to you. Your Account must remain open, have available credit and be current (no minimum payment past due) to qualify. This offer may not apply if your credit card has changed to a different type of card within the last 12 weeks or changes before additional points are applied.

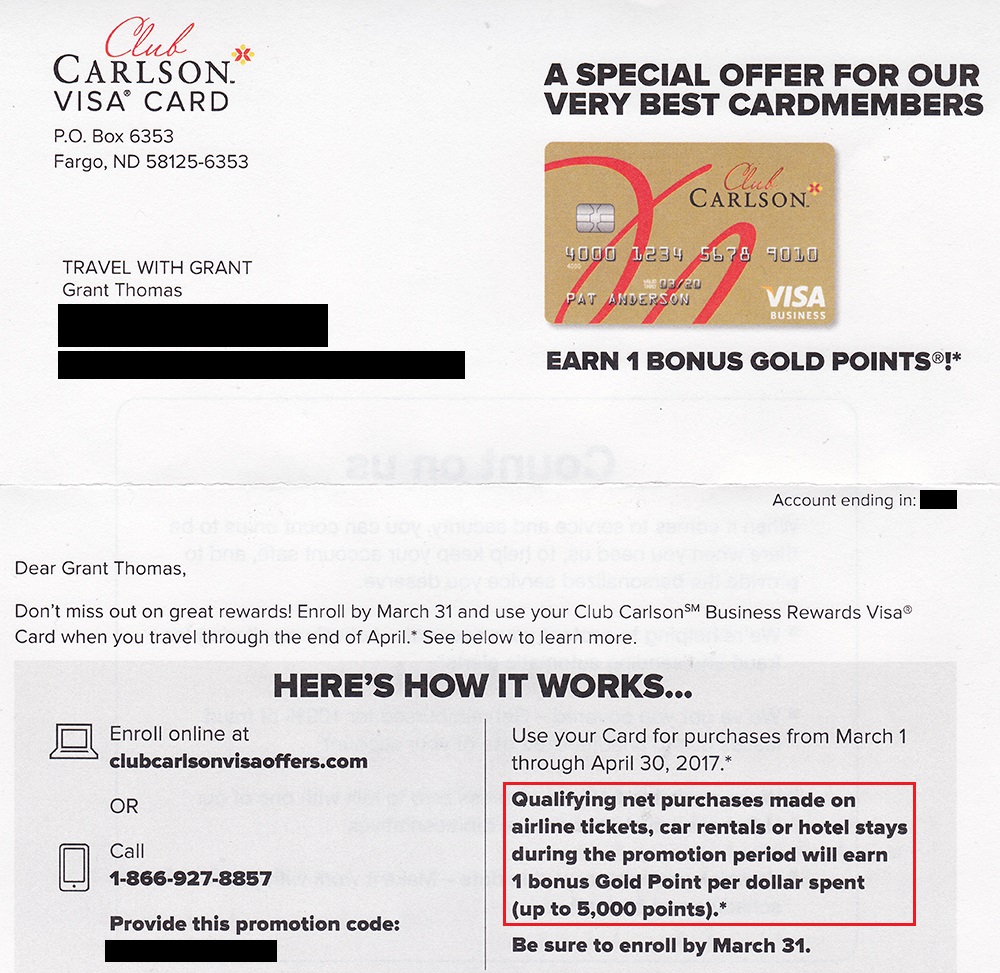

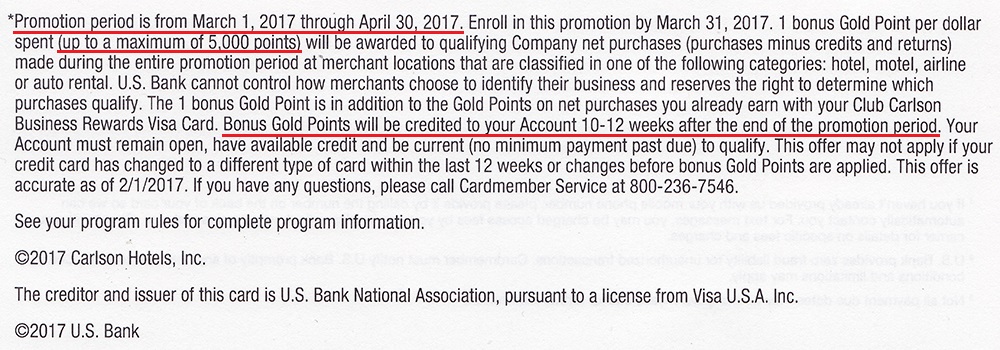

The next offer came in the mail for my US Bank Club Carlson Business Credit Card and offers 1x bonus Club Carlson points on the first $5,000 spent on airline tickets, car rentals, and hotel stays between March 1 and April 30. Since this card earns 5x on everything (10x on Club Carlson stays), an extra 1x on certain travel categories is not enticing enough, especially considering that I can get 3x on my Citi Thank You Premier Credit Card. I am going to pass on this offer.

Disclaimer / Terms and Conditions:

The last offer I received is for my US Bank Club Carlson Personal Visa Signature Credit Card and offers 1x bonus Club Carlson points on the first $2,000 spent on airline tickets, car rentals, and hotel stays between March 1 and April 30. Since this card earns 5x on everything (10x on Club Carlson stays), an extra 1x on certain travel categories is not enticing enough, especially considering that I can get 3x on my Citi Thank You Premier Credit Card. I am going to pass on this offer.

Disclaimer / Terms and Conditions:

Promotion period is from March 1, 2017, through April 30, 2017. Enroll in this promotion by March 31, 2017. The one bonus Gold Point per dollar spent (up to a maximum of 2,000 points) will be awarded to qualifying net purchases made during the entire promotion period at merchant locations that are classified in the following categories: hotel, motel, airline or auto rental. Net purchases are purchases minus credits and returns. U.S. Bank cannot control how merchants choose to identify their business and reserves the right to determine which purchases qualify. The one bonus Gold Point is in addition to the Gold Points on net purchases you are already earning with your Club Carlson Visa Card. Bonus Gold Points will be credited to your Account 10–12 weeks after the end of the promotion period. Your Account must remain open, have available credit and be current (no minimum payment past due) to qualify. This offer may not apply if your credit card has changed to a different type of card within the last 12 weeks or changes before the bonus Gold Points are applied. This offer is accurate as of 2/1/2017. If you have any questions, please call Cardmember Service at 800-236-4012.

Have you received any targeted US Bank credit card offers for March-April? If not, you may receive a letter, email, or targeted offer online, so make sure you check all three places over the next few days. Please share any offers you receive and if you are going to participate in any of the offers. If you have any questions, please leave a comment below. Have a great day everyone!

Hi Grant,

I’ve been considering the Amex FlexPerks card for the past few weeks. I’m looking for a card to compliment my AMEX EDP card, and the fact that this variation has restaurants, and airfare categories is very appealing to me. Do you think that this is a good card to pair with the EDP even though the points do not transfer to partners?

Thanks,

MG

As long as you know the FlexPerks earning structure and when to redeem FlexPoints, it could be a good partner to pair with your existing Amex Everyday Preferred. You can also use the new card for Amex Offers. I’ve had my eye on the US Bank FlexPerks Gold Rewards Amex for a long time but I think I have too many credit cards with US Bank already.

The tier redemptions are a little quirky, but I think I can get some good value flying out of IAH. At the very least, I’d get free Global Entry / Boingo, and can pay off the annual fee just from restaurant spend. I only have two cards, and the other is my first one from Wells Fargo.

You should be fine. Let me know if you apply for the card and get instantly approved. Good luck!

even in it’s heyday (long gone!), these promo-mailers for the Club Carlson card were generally laughable. i’ve gotten “1 extra point” bonus offers more than any other kind. how enticing!

I know, US Bank loves to send out lackluster spending offers.

Thanks for the tip! I didn’t receive an email, so I’m glad I checked. My FP Amex (discontinued card) has an offer for 1k points after $4.5k spend. My FP Visa Signature and FP Gold Amex both have nothing. I try to spend ~2k monthly anyway so I’ll get that 3500 bonus points, so I guess I’ll just strice to do a little more than that and accept the 1k.

Thanks for the data points. I think you spend too much on the cards to get good offers ;)

I’m now putting no spend on the Gold Amex since I’ve had too many instances of not getting the restaurant bonus because they claim many establishments are categorized differently. So maybe I’ll get a targeted offer on that one later this year before I cancel it. :)