Is the new Chase World of Hyatt Credit Card the fantastic, Hyatt hit-it-out-of-the-ballpark card it’s being touted as? Is it worth the hype? For being able to reach elite status through spend, perhaps. Is it worth both having and using? Well, the signup bonus is indeed generous. As a Hyatt Globalist who has already qualified for Globalist again next year, and as a holder of the Chase Hyatt credit card for many years, I’ve been thinking about the pros and cons of the newest version of this card. Yes, there are cons, too.

With all the exuberance surrounding the card these past few weeks, I’ve stepped back and thought about who this card is good for, when it doesn’t make sense to apply for it or even upgrade your current card, what the lost opportunity costs might be, and I’ve decided what I’ll do with my current Chase Hyatt card. Spoiler alert……the new World of Hyatt card is not for me, though maybe for you. Here’s what you’ll need to know to decide for yourself.

First, let’s go over the new World of Hyatt card offer.

The Chase World of Hyatt Credit Card now offers the following welcome bonus:

- 40,000 World of Hyatt bonus points after spending $3,000 within three months

- 20,000 additional World of Hyatt bonus points after spending $6,000 total within six months

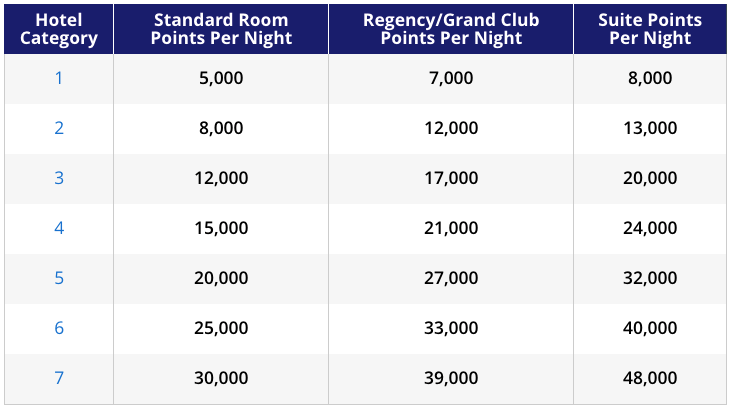

World of Hyatt currently has 600+ properties divided into 7 categories of hotels.

60,000 World of Hyatt points is enough to redeem points for 2 free nights at any Hyatt in the world, even those in the highest Category 7 properties that require 30,000 points per night. This is better than with previous Hyatt bonus offers because this is POINTS and not a free night certificate, so you’ll have more flexibility in using them.

Annual Free Nights

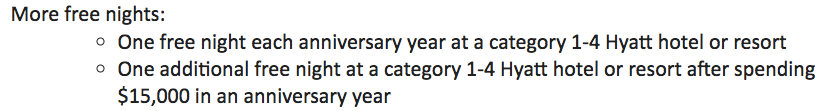

The annual fee for the card goes up from $75 to $95 with the new Chase World of Hyatt Credit Card. You do, however, get the opportunity to earn an additional free night. Here are the annual free night benefits via the press release:

As with the previous Hyatt card, each year after your card member anniversary you’ll receive a free night award redeemable at any Category 1–4 hotel. The potential value of this free night award can make up for the annual fee. When a cardmember reaches the $15,000 spend threshold each year, the additional free night award will show up in the “Awards” section of the cardmember’s World of Hyatt account. Also, please note that you will NOT get 5,000 Hyatt points for adding an authorized user on this card.

Elite Status

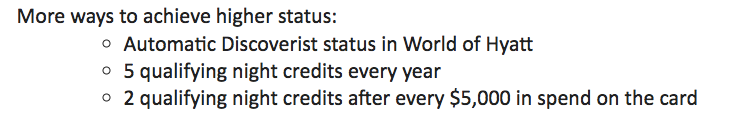

Perhaps the most attractive feature of the new Chase World of Hyatt Credit Card, and the one making many people take a good long look at this new card, is that it allows for cardmembers to earn top elite status from spend. This is something that the initial version of the Hyatt credit card offered, but when Hyatt Gold Passport became World of Hyatt, this opportunity was taken away.

Card members automatically get Discoverist status, which is the second tier in World of Hyatt membership. As a cardholder you’ll get five qualifying night credits, which count towards elite status. Additionally, for every $5,000 you spend on the card, you’ll also receive two qualifying night credits toward elite status.

For many people, because of Hyatt’s fairly small footprint when compared with other hotel chains, maintaining Globalist status can be a huge challenge. So if you’re close to achieving status, 5 qualifying nights definitely helps. And then, if you’re still shy of status, you can supplement your hotel stays with spend.

New Benefits

1. World of Hyatt cardholders will earn 4 points per $1 spent at Hyatt hotels and resorts, rather than the current 3 points per $1 spent on the current Hyatt card.

Those familiar with the current Hyatt credit card will notice that the 2 points per $1 spent earning option with car rental agencies goes away with the new World of Hyatt card.

2. Wellness has become a focus for Hyatt, so on the World of Hyatt card you’ll earn 2x for $1 of spend on fitness clubs and gym memberships. For those of you that have the US Bank cash+card, that card offers 5x cashback on gyms, so that could be a better option for gym spend.

3. Local transit plus rideshare services are now a 2x bonus category on the World of Hyatt card.

Chase World of Hyatt Credit Card Free Nights

With this card you’ll also have the opportunity to earn more free nights. You get one free night at a Category 1-4 property on your account anniversary every year, and you can earn an additional free night at a Category 1-4 property after spending $15,000 on the card in an account anniversary year.

Key Card Details

- $95 annual fee

- Get one free night at any Hyatt Category 1-4 property each year after account anniversary

- Get one additional free night at any Category 1-4 Hyatt if you spend $15,000 during your cardmember anniversary year

- Earn 4x at Hyatt hotels (including participating restaurants and spas)

- Earn 2x on local transit and commuting, including taxis, mass transit, tolls and ride-share services

- Earn 2x at restaurants, cafes, and coffee shops

- Earn 2x on airline tickets purchased directly from an airline

- Earn 2x on fitness clubs and gym memberships

- Earn 1x everywhere else

- Get automatic Discoverist status with the card

- Get 5 elite qualifying night credits toward elite status each year

- Earn 2 additional elite qualifying night credits for each $5,000 you spend on the card

Should you keep the old Hyatt credit card?

Good question. For many the answer is YES! If you’re not interested in chasing elite status, and don’t put spend on your Hyatt card, you might prefer to keep the old card for a cheaper Category 1-4 free night each year. That card (which will no longer be available for new applicants) will retain its $75 annual fee, so you’ll save $20 per year by holding onto that card. Also, many people have a long credit history attached to the card that they do not want to give up. The old card is not one you can downgrade nor can it be converted to any other card.

However, if you’re going to do much spending on your old Hyatt Credit Card, consider an upgrade. With $15K spend per year, you’ll earn that additional Category 1-4 certificate. Earning at least 15K Hyatt points gets you another Category 4 night. Existing Hyatt Credit Card members can upgrade to the new Chase World of Hyatt Credit Card at any time, and for a limited time can earn 2,000 Bonus Points if approved for the new card. Remember that the 2,000 bonus points only comes your way once, but the increase in the annual fee is every year. If you already have the Hyatt Credit Card and switch over to the new card, note that your current year to date spend would not count towards elite night credit with the new card.

Opportunity Cost

Opportunity cost is different for each of us and certainly needs to be considered when shifting $15k spend to this World of Hyatt card. And for those of us who keep the card without putting much spend on it at all, we have to ask ourselves if we want to now put ANY spend on the new card.

I am not sure the new Chase World of Hyatt card is an outstanding value compared with the original card. The main attractive aspect is the 5 qualifying nights, but it is still only a small part of what is required for Globalist status. The anniversary free night award is the same, and I don’t think 4x Hyatt points is necessarily better than 3x Ultimate Rewards.

For those who see the 15k spend as spend they wouldn’t be putting on 2% cash back cards, that means $300 in cash back. Of course you’d also get 15k Hyatt points at least, which depending on your Hyatt hotel choices could get you more than $300 in value (plus a free night for that spend).

To many of us the opportunity cost seems too high or is a wash since you’d be giving up on 3 Ultimate Reward points per dollar on dining and travel. Spend on the card gets Hyatt points which, though I’m stating the obvious, are not flexible because they can only be used at Hyatt hotels. Even with the additional status qualifying nights after each 5K in spend, it is still too expensive to make status by just spending on this card. Perhaps those who already stay at Hyatt properties 30-40 nights a year can use a blended approach and reach Globalist with some spending. The new card is appealing, and the welcome bonus is good, that’s for sure, but certainly this card is not a slam dunk for everyone.

One other opportunity cost that I haven’t heard anyone else mentioning is the use of Citi Prestige Credit Card 4th night free. Can I be the lone wolf using this card to pay for Hyatt hotel stays? Of course it depends on your travel patterns. When I stay at Hyatt hotels I’m either using points, cash and points, or paying cash. Given the length of some of my stays, I always maximize my cash savings by using the Citi Prestige credit card. Hotel stays must be paid for with that card to get the 4th night free. Usually I’m at Hyatt hotels between 80-100 nights a year and last year alone this strategy saved me over $1,000. It looks to be even more this year. And I put those Thank You points to good use. I also, given how Hyatt elites are bonused on stays, have more than enough Hyatt points in my account, so upgrading my card for the 2000 bonus points isn’t significant for me. If I canceled my card and applied for the new one, the 60k Hyatt points welcome bonus would be nice, but I wouldn’t shift spend to this card. And since I haven’t upgraded my card yet, I think I’ll stay put for now.

Bottom line

The new Chase World of Hyatt Credit Card can look pretty good, depending on your lens. You can definitely earn more points in most of the bonus categories using other credit cards, but the World of Hyatt Credit Card does come with benefits if you’ll put spend on it, and if that spend gets you a higher elite status. Because it’s a co-branded credit card, this card is not subject to Chase’s 5/24 policy, so Chase does not limit approvals for this card to those with fewer than 5 new card accounts in the last 24 months. As with the old Chase Hyatt card there are no foreign transaction fees and points don’t expire as long as the credit card account remains open.

Bottom Line

If you like the Hyatt brand and have the spend, it’s a clear yes. But even if you like Hyatt, the card is not necessarily great for you. It’s not an all purpose travel rewards card. If you want Hyatt status, and have a solid plan to earn it on credit card spend alone, or can cobble together a blended plan for status, then the card does become a slam dunk. Hyatt status is wonderful!

It’s been a great exercise and lesson in thinking these decisions through. It’s the way to approach each new credit card offer when they come our way. I hope you’ve taken the time to think it through for yourself!

What’s your thinking on the new card? Upgrade, apply for the new Chase World Of Hyatt Credit Card, stay put with your old card, or Hyatt cards don’t matter to me—I’m curious what TWG readers are thinking about Hyatt these days.

Pingback: World of Hyatt: Improved Elite Benefits and Summer Promo News!

Pingback: Hyatt Acquires Two Roads Hospitality

Pingback: What Does It Mean to Have a Hyatt Concierge

Pingback: Keep or Close? Old Chase IHG Rewards Select & Hyatt Credit Cards