Good morning everyone. Earlier this month, my annual fees posted on my Chase IHG Rewards Select Credit Card ($49 annual fee) and Chase Hyatt Credit Card ($75 annual fee). The main reason I hold onto these credit cards is for the annual free night certificate. As a reminder, the free night certificates are not really free, since you pay the annual fee before getting the free night certificate – they are more like prepaid free night certificates with a strict expiration date. Unfortunately, both of these credit cards are no longer available to new applicants, so if you do not have these credit cards right now, there is no way for you to get them now. Both cards have been replaced by the new Chase IHG Rewards Premier Credit Card and the new Chase World of Hyatt Credit Card. Anytime one of my credit cards charges me an annual fee, I take a moment to evaluate the credit card and decide if it is still worth keeping. Here are my thoughts on both of these credit cards.

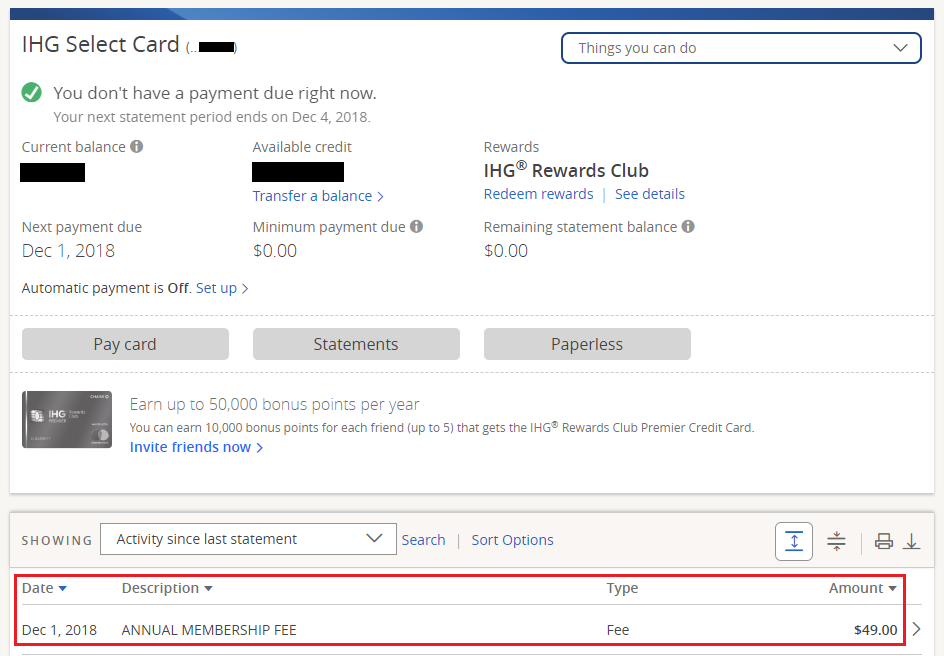

The $49 annual fee posted on December 1 for my Chase IHG Rewards Select Credit Card. I also have the Chase IHG Rewards Premier Credit Card which I got a few months ago that came with a 100,000 IHG Points sign up bonus (matched via Chase Secure Message) and a $50 statement credit card. I tried my luck calling Chase and asked them to waive the $49 annual fee on the Chase IHG Rewards Select Credit Card because I also have the Chase IHG Rewards Premier Credit Card (which has an $89 annual fee). I claimed that the benefits overlapped a lot and I use the Chase IHG Rewards Premier Credit Card more often for my IHG hotel stays. I thought it was a compelling argument, but the rep said that she could not waive the annual fee. Bummer. I have always planned on keeping this credit card, but I was hoping Chase would throw in some bonus points or waive the annual fee to make the deal even better.

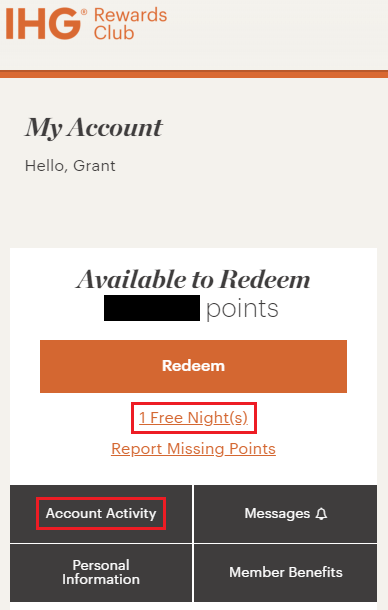

A few days ago, I logged into my IHG account to see if the IHG free night certificate had posted yet. After logging into my IHG account, I noticed the “1 Free Night” link under the Redeem button. But I first clicked on the Account Activity button to see when the IHG free night certificate posted to my account.

Surprisingly, the IHG free night certificate posted to my IHG account on November 20, roughly 11 days before the annual fee was billed. The 2 charges from December 5 are points I earned on my December 1 statement.

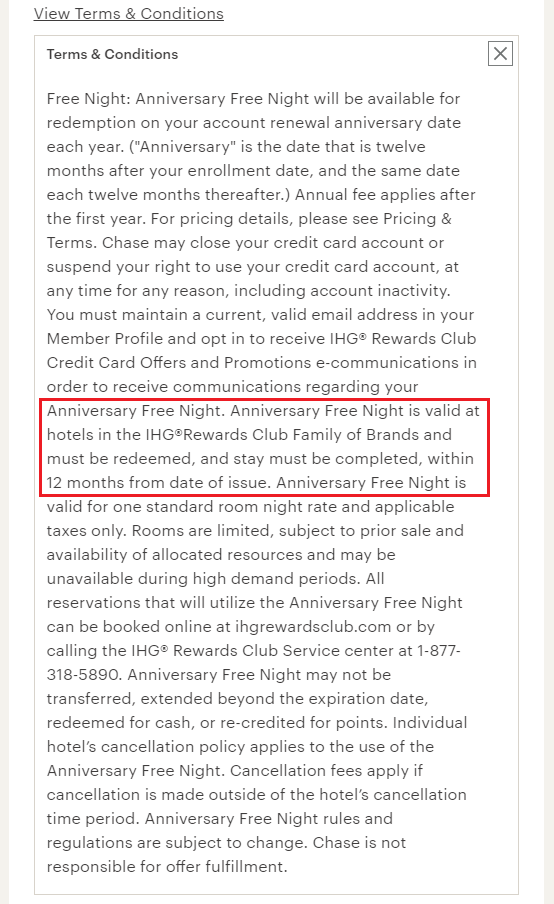

I then went back to my IHG account and clicked the “1 Free Night” link. Here are the details of my IHG free night certificate. I have to redeem and stay at an IHG property before November 20, 2019. Based on the terms and conditions, I do not see any language regarding caps or restrictions on which properties are available. That is great since I have my eyes on the InterContinental Moorea Resort & Spa in French Polynesia.

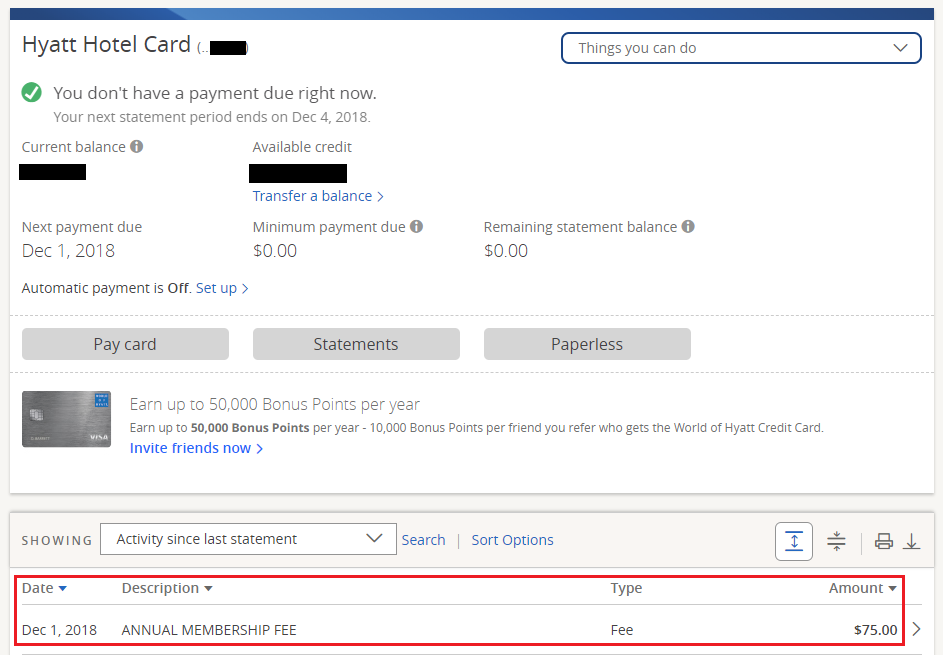

As luck would have it, the $75 annual fee on my Chase Hyatt Credit Card also posted on December 1. Even though I do not stay at Hyatt properties often or charge large amounts to my Chase Hyatt Credit Card, I decided to call Chase and see if they would waive my annual fee. It was a long shot and I wasn’t expecting any retention offers. Just as I predicted, Chase would not waive my annual fee, so I decided to keep the credit card. I have been able to get good value out of my Hyatt free night certificates over the years. A great place to use a free night certificate would be at the Andaz Papagayo Resort in Liberia, Costa Rica (category 4 hotel, charging 15,000 Hyatt points per night). If you need help redeeming your Hyatt free night certificate, click here.

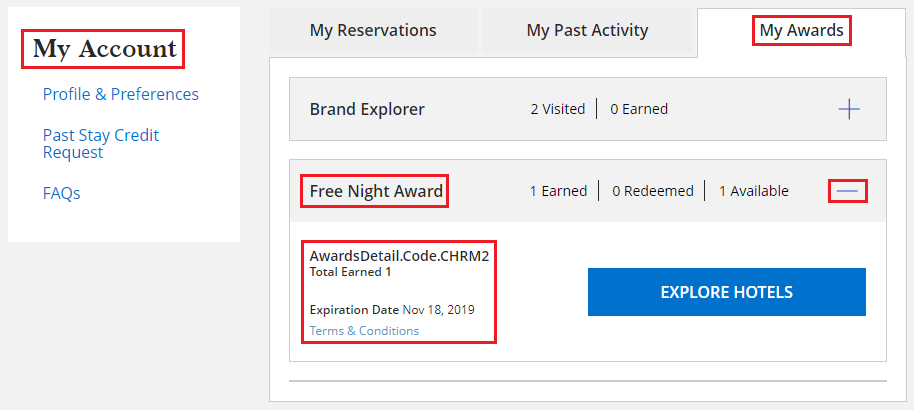

A few days ago, I logged into my Hyatt account to see if the Hyatt free night certificate had posted yet. After logging into my Hyatt account, I clicked the My Awards tab, scrolled down to the Free Night Award section, clicked the ‘+’ icon and saw that the free night certificate posted to my account on November 18. This was roughly 13 days before my annual fee posted to my credit card.

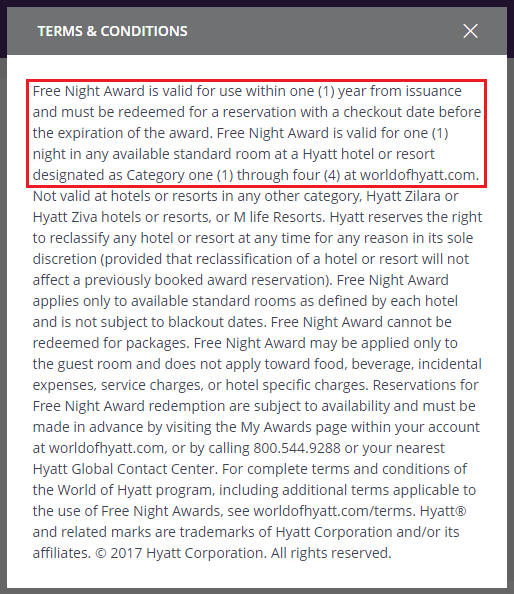

Here are the complete terms and conditions for the Hyatt free night certificate. You must redeem and stay at a qualifying category 1-4 Hyatt property by the expiration date of the free night certificate.

If you have any questions about either of these credit cards, please leave a comment below. Have a great day everyone.

P.S. I am working on a few more “Keep, Cancel or Convert?” blog posts, so stay tuned for those blog posts.

P.P.S. Check out other “Keep, Cancel or Convert?” blog posts here.

What are your thoughts about the world of hyatt credit card? Would you be able to get both at the same time like you have with the IHG and IHG Select?

Unfortunately, you cannot have both the old Chase Hyatt CC and the new Chase World of Hyatt CC. If I didn’t already have the old Chase Hyatt CC, I would be very interested in the new Chase World of Hyatt CC. I do not care about spending my way to Globalist status or spendin $15,000 to get another free night certificate. I will gladly keep paying $75 for 1 free night certificate.

So in both cases the cards are worth it for the free night, but not to put spending on. I wonder how you are going to view the SPG AmEx card. It now offers an annual free night, and it appears AmEx is going to deliberately not award the free night until after it is too late to avoid the AF by cancelling the card. AmEx has learned its lessons about churning.

I don’t have the AMEX SPG CC anymore, but I do have 2 Chase Marriott CCs which both come with a free night certificate. I think as long as you get more value out of the free night certificate than the cost of the CC annual fee, you come out ahead. The other CC benefits are just icing on the cake.

Pingback: Keep, Cancel or Convert? Chase IHG Rewards Premier Credit Card ($89 Annual Fee)