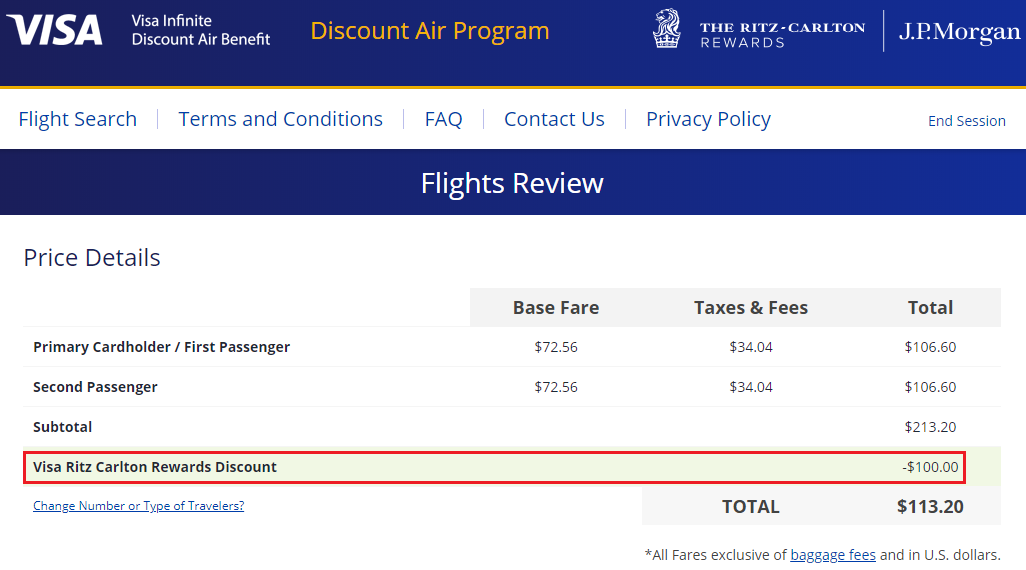

Good morning everyone. With last week’s news about the demise of the City National Bank CNB Crystal Visa Infinite Credit Card, I needed to find a replacement credit card that offered the $100 Visa Infinite Discount Air Benefit. With this benefit, you get $100 off roundtrip, domestic flights for 2 or more passengers on select airlines (excludes low cost airlines). This benefit can be used an unlimited amount of times. I used to have this benefit when I had the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card, but I downgraded to the Chase Marriott Bonvoy Boundless Visa Signature Credit Card a few years ago. The good news is that the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card is still available, but only as an upgrade option from the Chase Marriott Bonvoy Boundless Visa Signature Credit Card.

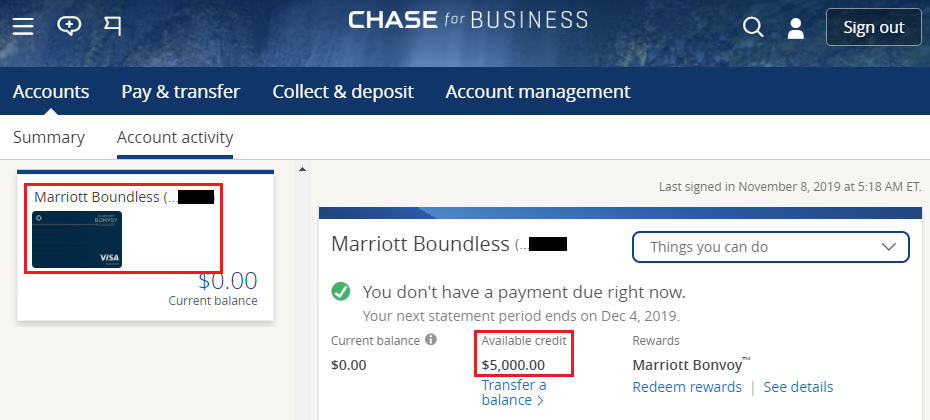

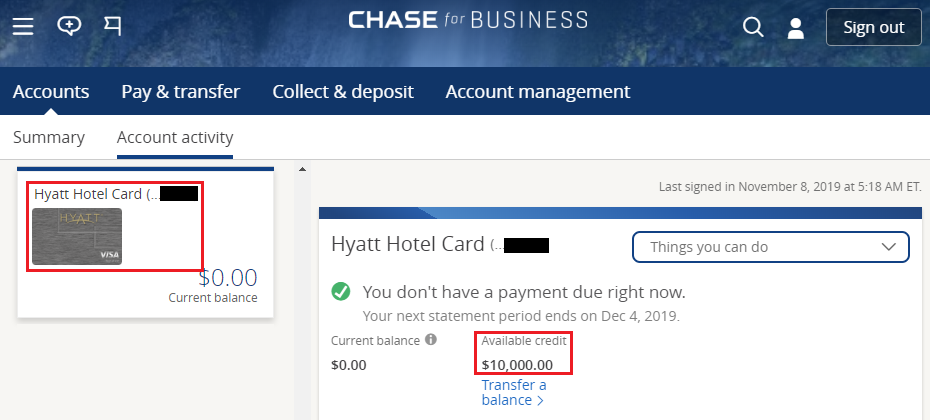

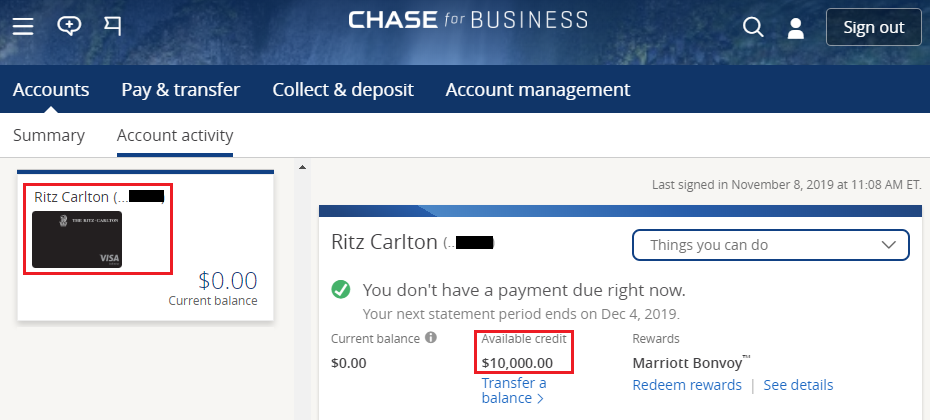

I called Chase and asked to upgrade my Chase Marriott Bonvoy Boundless Visa Signature Credit Card to the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card. The rep said that I needed to have a $10,000 credit limit to upgrade to a Visa Infinite credit card. She asked if I would like to request a credit limit increase. No thank you, but I did ask if I could move some of my credit limit from my old Chase Hyatt Credit Card. She said that was possible, so I moved $5,000 from my old Chase Hyatt Credit Card to my Chase Marriott Bonvoy Boundless Visa Signature Credit Card.

Side note: I only keep my old Chase Hyatt Credit Card for the free night certificate – my credit card has a $75 annual fee. We use my wife’s Chase World of Hyatt Credit Card for our Hyatt expenses – her credit card has a $95 annual fee.

The rep was able to process the $5,000 credit limit transfer from my old Chase Hyatt Credit Card to my Chase Marriott Bonvoy Boundless Visa Signature Credit Card. She then processed my upgrade to the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card and read off a lengthy disclosure about the new credit card. She said my account number would not change and I would receive my new credit card in the next 3-5 business days. For the record, I had to manually change the nickname from Marriott Boundless to Ritz Carlton in my Chase online account.

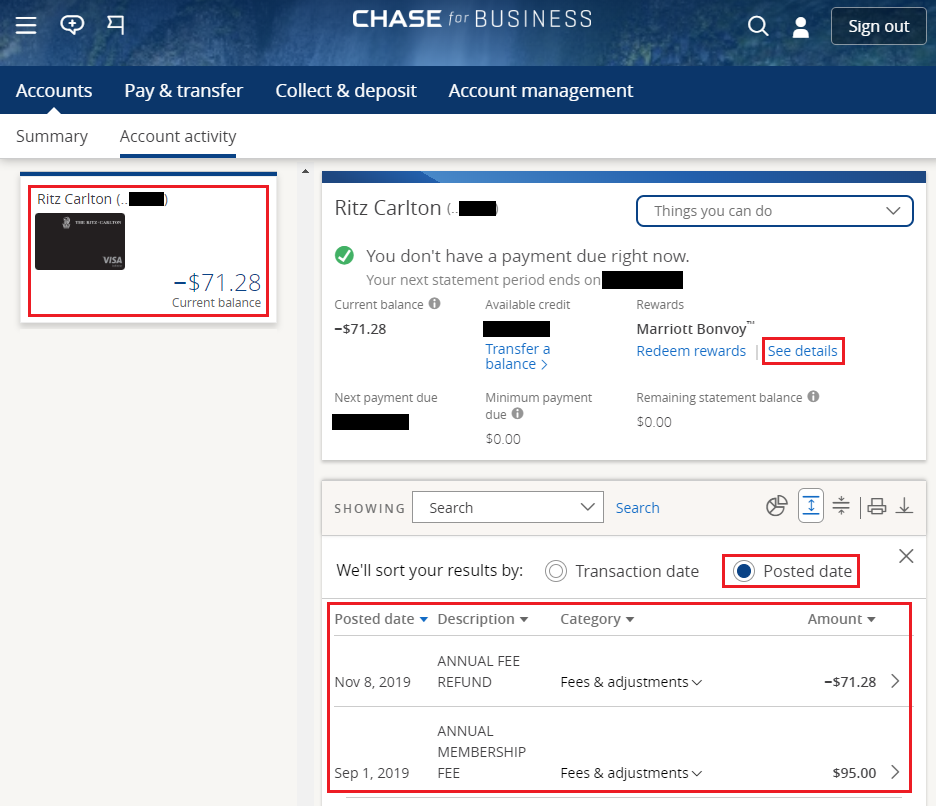

A few days after the upgrade, I logged into my Chase online account and noticed a $71.28 credit on my new JPMorgan Chase Ritz Carlton Visa Infinite Credit Card. The credit represents a prorated annual fee refund (similar to the prorated annual fee refund I recently received on my downgraded Citi Rewards+ Credit Card). $71.28 / $95.00 = 75%, so I received a 75% refund on my $95 annual fee. I assume the $450 annual fee for the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card is going to post soon. Let’s see what I get for the $450 annual fee by clicking on the See Details link.

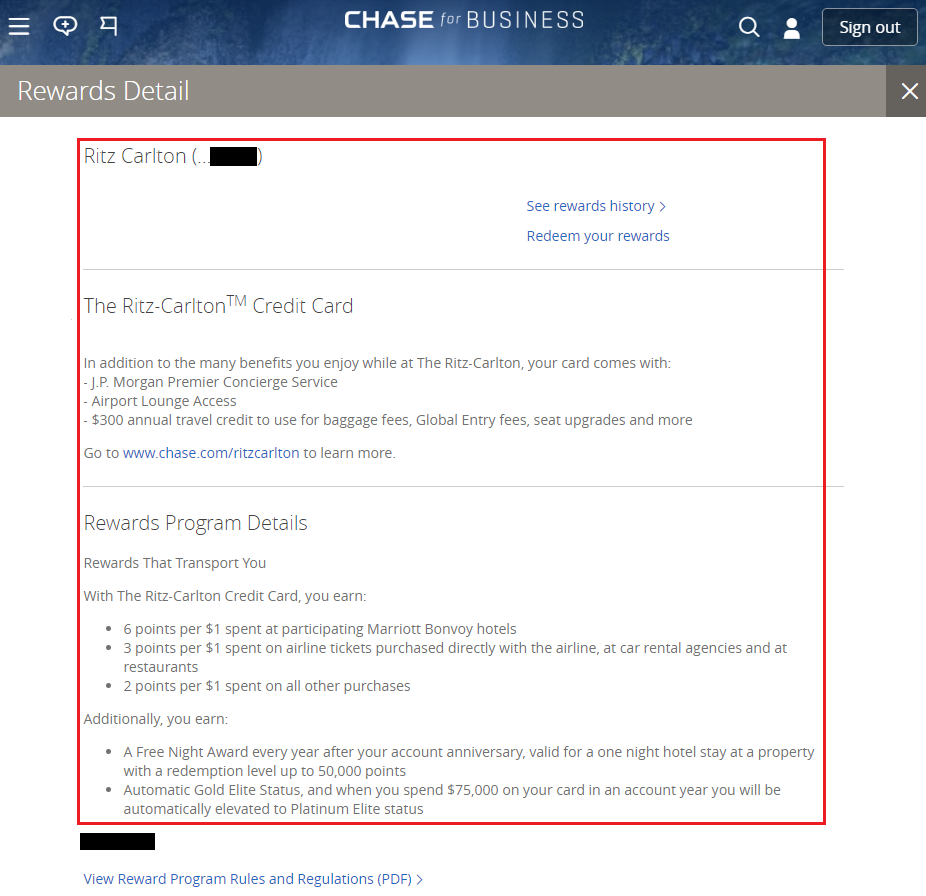

The Rewards Detail page doesn’t have much info, so I also looked at chase.com/ritzcarlton. Here are the highlights for the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card:

Hotel Benefits

- 6x at Marriott; 3x on airline tickets, rental cars, and restaurants; 2x everywhere else (more details)

- Free night certificate at Marriott properties that cost up to 50,000 points (more details)

- $100 hotel credit at Ritz Carlton or St. Regis when staying 2 nights or longer (more details)

- 3 upgrades to the Ritz-Carlton Club Level (more details)

- Free Gold Elite Status; earn Diamond Elite Status with $75,000 in yearly spend (more details)

Travel Benefits

- $300 annual travel credit that can be used for airline lounge day pass, or towards a yearly lounge membership of your choice; airline seat upgrades; airline baggage fees; in-flight internet / entertainment; in-flight meals (more details)

- $100 Global Entry reimbursement (more details)

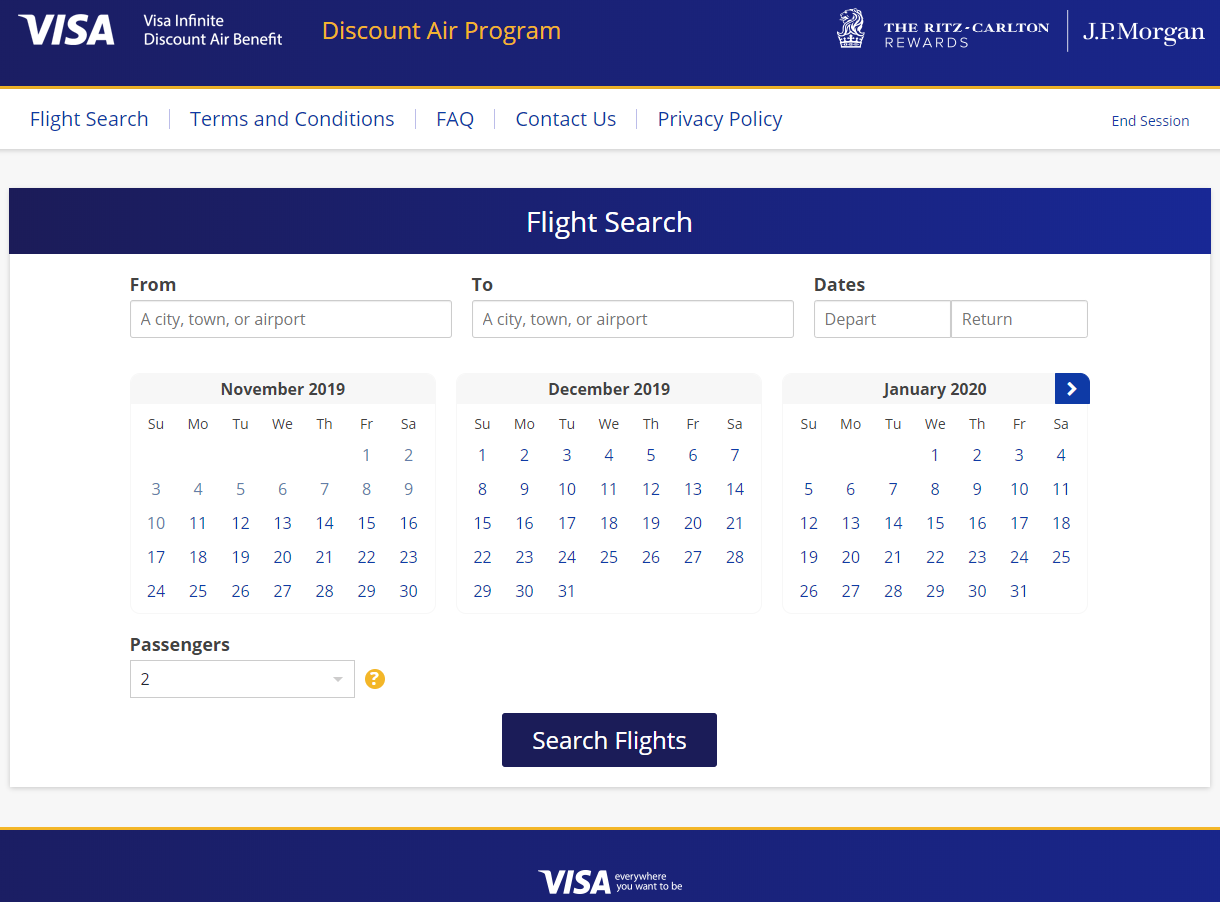

- Visa Infinite $100 Discount Air Benefit (more details)

- Priority Pass Select membership (more details)

- Rental car privileges at National, Avis and Silvercar (more details)

As I mentioned at the beginning of this post, my main reason for upgrading to the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card was the $100 Visa Infinite Discount Air Benefit. You need to enter your 16 digit credit card number on visadiscountair.com/ritzcarltoncard. I tried to access the Visa Infinite Discount Air Benefit website a few minutes after I upgraded, but my credit card number was not in the system yet.

3 days later, I tried again and it worked. Therefore, you may need to wait a few days after you upgrade to have access to the Visa Infinite Discount Air Benefit website.

If you have any questions about upgrading to the JPMorgan Chase Ritz Carlton Visa Infinite Credit Card or regarding the $100 Visa Infinite Discount Air Benefit, please leave a comment below. Have a great day everyone!

Has the annual fee posted yet?

Not yet, but I assume in the next few days it will.

Might take a few months to post, actually.

Got it, good to know. Thank you.

Is there any other card besides marriott boundless that you can upgrade to the ritz card?

I think it has to be in the Marriott family of credit cards issued by Chase to be eligible for the upgrade.

I upgraded 6 months ago and the reps cannot confirm whether I will receive a 35k or 50k free night certificate this time around. ♂️

Interesting, the free night certificate should post within 8 weeks of when your annual fee was charged. Did you already pay your annual fee when you completed the upgrade?

I paid it the month before my anniversary date of 11/14. Still haven’t seen a cert

Hmm, sometimes when you product change a credit card mid year, the annual fee and credit card benefits have wildly different posting dates.

Hey man, I know SEO is important, but can you please try to avoid keyword stuffing so much? It seriously makes the posts next to unreadable. I’m actually reading your articles less because of it.

Also, speaking as someone who owns a blog, it’s not as helpful in google rankings as you think.

Hi Mike, thank you for the feedback. I will do better in the future. Have a great day.

This was a genius move! Happy to hear the Ritz card still exists.

Thank you Dan, but I’m not sure how much longer this credit card will still be around. If you want it, I recommend upgrading sooner rather than later.

I love this card… I got this card years ago when it was available with 2 free nights cert. I’ve got my wife to apply when it was available with 3(!) free nights as a signup bonus. Good old days. Had a free 5 night stay at Ritz Carton Kapalua. I ended up keeping mine for the value of visa air discount. It can get pretty crazy. Sometimes Alaska has short haul sale out of new Paine Field near my house (40 min north of Seatac) and round trip saver fare often goes below $100 per ticket. On recent PAE to PDX route, it was about $70 round trip. Bought 2 pairs at $140 each for my family of 4, with $100 discount per pair, each ticket ended up costing just $20 each. and Alaska gives you min 500 miles per segment so on this trip, each of us earned 1k miles each. That’s like buying alaska miles at 2cent per mile and flying for free. Need I say more?

plus no annual fee on authorized user and each users can get priority pass with ‘unlimited’ guest. As long as they keep the benefit, I will gladly renew this card.

You are definitely getting great use out of your Ritz Carlton CC! I originally signed up for the CC when the sign up bonus was 140,000 Marriott points. That was my largest sign up bonus ever. I got tired of trying to game the system with the $300 airline reimbursement credit so that is why I downgraded to the Marriott Bonvoy Boundless CC. Times change, I’m married now, so I love taking advantage of the $100 Visa Infinite discount air benefit. Plus paying for seat upgrades and the occasional checked bag can be reimbursed :)

I thought the $100 discount is applied to the total cost of the itinerary, not per ticket?

I believe the math is 2 x $70 = $140 – $100 discount = $40. He books 2 tickets at a time, so each ticket costs $20.

I thought he bought for family of 4 and the rules the flight has to have card holder name.

I’m not sure of the details but maybe his spouse also had the CC and booked 2 tickets using their CC.

I’ll just pile on here with two other reasons I really dig this card:

1. Primary auto coverage (we don’t have Chase Sapphire cards, and with the Chase Business Ink you always have to ask yourself whether, with a big claim, you could honestly tell the adjuster it was a business trip).

2. Same CID number on same-numbered cards with AUs. In the two-player game, where you are the responsible player and are often doing stuff in P2’s accounts, it is wonderful to be able to look at your Chase Ritz-Carlton card and pull these numbers. Example: Booking AA award tickets, where even the annoying $5.60 per leg fees have to be billed to a credit card with the mileholder’s name on it.

Apologies/warning: In my post just above, for some reason there is a word that has a link associated — I didn’t put it there; or at least I didn’t mean to put it there — but it is there. When I clicked it, it went to a random travel site, so I think it is harmless. Anyhow, mea culpa.

W-h-a-t the h-e-c-k is going on here with these imposed l-i-n-k-s?

It is a WordPress plugin that adds links to certain words or phrases. Just ignore it.

I always use my CAR for rental cars, but I think he coverage is the same on the Ritz Carlton CC.

What is the same CID number?

The 3-digit code on the back by the signature. Maybe I’m calling it by the wrong name. So many acronyms in this business!

Ahh got it. I call it CVC (card verification code) or CVV (card verification value).

How would you compare it to the Sapphire Reserve and or the Bonvoy Brilliant?

They are different cards. I have a Chase Sapphire Reserve which I love to use to pay for flights when I fly by myself.

I think I’m going to apply for the Bonvoy Bold (player two got a SUB for 50k points after spending 2K) and then upgrade/product change to the Ritz after the 12 month waiting period

That is a good plan :)

How soon can you product change? I applied for chase bonvoy card last month and in the process of completing the minimum spend. Thanks

I recommend waiting a year from the date you got approved to request a product change.

Forgive me, is this the only way to get the Ritz card? I googled it and it looks like you can still apply. Ornis it a different product with a similar name? Thanks!

As far as I know, upgrading is the only way to get the Ritz Carlton CC. What link are you seeing that shows you can still apply directly for this CC?

Apologies, it was just a Marriott landing page with the card info and a login button for existing users I think. I thought it was a button to apply haha. Oh well, thanks

No worries, the landing pages can be confusing some times.

Pingback: Unboxing my Upgraded JPMorgan Chase Ritz Carlton Visa Infinite Credit Card: Card Art & Welcome Letter

I really want this card now because of the CNB nerf. Do you recommend that I even apply for the Marriot Bonvoy Boundless because it seems like you have a feeling that this card will be killed as well.

If you don’t already have a Chase Marriott Bonvoy CC, I don’t think you will be able to apply for one and then immediately upgrade to the Ritz Carlton CC. I believe you need to wait 12 months from getting the Chase Marriott Bonvoy CC and then upgrading. A lot can happen in a year.

Yeah that’s my hesitation. Use up a 5/24 slot for something that might not pan out :/

Don’t use up a 5/24 slot unless you really want a Chase Marriott Bonvoy CC in the first place. Lots of better CC out there to get.

Pingback: Upgraded JPMorgan Chase Ritz Carlton Visa Infinite Credit Card $300 Annual Travel Credit for 2019 Still Available

How long did you have the Bonvoy CC before applying for an upgrade to Ritz Carlton? I only stay at the R-C and don’t ask why I didn’t apply when it was actually active to the public. Mistake. Also, does the club level upgrade benefit still exist?

Hi Fadi, this is a little tricky, but I hope this timeline makes sense:

I applied for the Ritz Carlton CC in Dec 2014 (140k Marriott Rewards Points), then I downgraded to the Marriott Premier CC in Dec 2017 (came with 25K free night certificate), then I upgraded to the Marriott Premier Plus CC in June 2018 (came with 35K free night certificate), then that was renamed the Marriott Bonvoy Boundless in March 2019 (came with 35K free night certificate), then I upgraded to the Ritz Carlton CC in Nov 2019 (comes with 50K free night certificate).

I’ve never used the club level upgrade benefit, but they still exist. I get 3 every year that I don’t use. Let me know if you have any other questions.

Now that the $100 airfare discount feature has been eliminated, what will you downgrade to?

Hi Gene, the Visa Infinite Air Benefit was one of my all time favorite credit card benefits and I will surely miss it dearly. I am not sure what I am going to do with my Ritz Carlton CC long term.

Hi Grant, do you still remember when did you get the FN after upgrading to the R-C card in Nov, 2019? And what is the annual fee posted? Is it pro-rated or just $450, regardless of your previous anniversary date?

Hi Rachel, when I upgraded to the Ritz Carlton CC in November 2019, I received a prorated annual fee refund of $71.28 that was backdated to 9/1/2019. The $450 annual fee posted on 3/1/2020. I received the 50K Free Night Certificate on 12/18/2019. I received the second 50K Free Night Certificate on 12/18/2020. Please let me know if you have any other questions.

Pingback: I Downgraded my JPMorgan Chase Ritz Carlton to Chase Marriott Bonvoy Boundless ($450 AF to $95 AF)

Can you upgrade to Ritz from Marriott no annual fee version?

I believe so. If you cannot directly upgrade, you should be able to indirectly upgrade to a Marriott Bonvoy Boundless CC and then again up to the Ritz Carlton CC.

When you upgraded from Bonvoy Boundless to Ritz-Carlton, you said you kept the same cc#. On your credit report, did it show up as a closed account and a newly opened account? Or on your credit report, did it show as one, continuous account?

Good question Jon, since the CC number stayed the same, it shows as a single continuous account on my credit reports.

Pingback: My June 1 Checklist of Credit Card Credits (Shipping, Wireless, Restaurants, Groceries & More)

Do you think you will keep it for long time.?

Does it have a 10k limit?

Also, do you recommend an upgrading to the Ritz.?

Hi Sa, if I can take advantage of all the Ritz Carlton CC features, use up the $300 travel credit, and get good value out of the 50k free night certificate, I think I will hold onto the Ritz Carlton CC for a few years. But I always re-evaluate the CC every year when the annual fee posts to see if it is still a keeper.

Yes, my card has a $10,000 credit limit. You can easily reallocate credit limits among your personal Chase CCs.

If you like the benefits and think it is worth the annual fee, I think it is worth upgrading to. If you don’t like it after the first year, you can always downgrade back to a cheaper Marriott Bonvoy CC.

Do you think I’d get the 300 credit to use for groc / dining if I upgraded now? When did your annual fee appear and did you get the cert right after? Thanks for your help.

Hi Lynn, yes, I think if you upgrade now, you have until the end of the year to use the $300 airline incidentals credit (which also includes grocery and dining purchases this year). The annual fee posted randomly, but not at the same time I upgraded. The free night certificate posted 1-2 weeks after I upgraded. Please let me know if you have any other questions.

Thanks so much for taking time to answer. Think I’ll wait until my fee posts on Dec,1st, then upgrade and take advantage of the $300 credit this year and hopefully next year.

That sounds like a great plan. I believe you need at least a $10,000 credit limit to upgrade to the Ritz Carlton Visa Infinite CC, but Chase will let you move around credit if you need to. Let me know how the upgrade goes for you.

When you upgraded, did you get a new card issued, and if so was it the extra-heavy metal version or the more lightweight metal version? I’m looking for a wallet stuffer. Thanks! And thanks for continuing to respond to people for so long!

Hi Laurence, when I first upgraded to the Ritz Carlton CC, the card was really thick, but subsequent cards are not as heavy or thick.

Pingback: How to Top Off Marriott Free Night Certificate with up to 15,000 Marriott Bonvoy Points

Pingback: My 2 Unsuccessful Retention Offer Calls for Chase Marriott Bonvoy Premier Plus Business & AMEX Gold