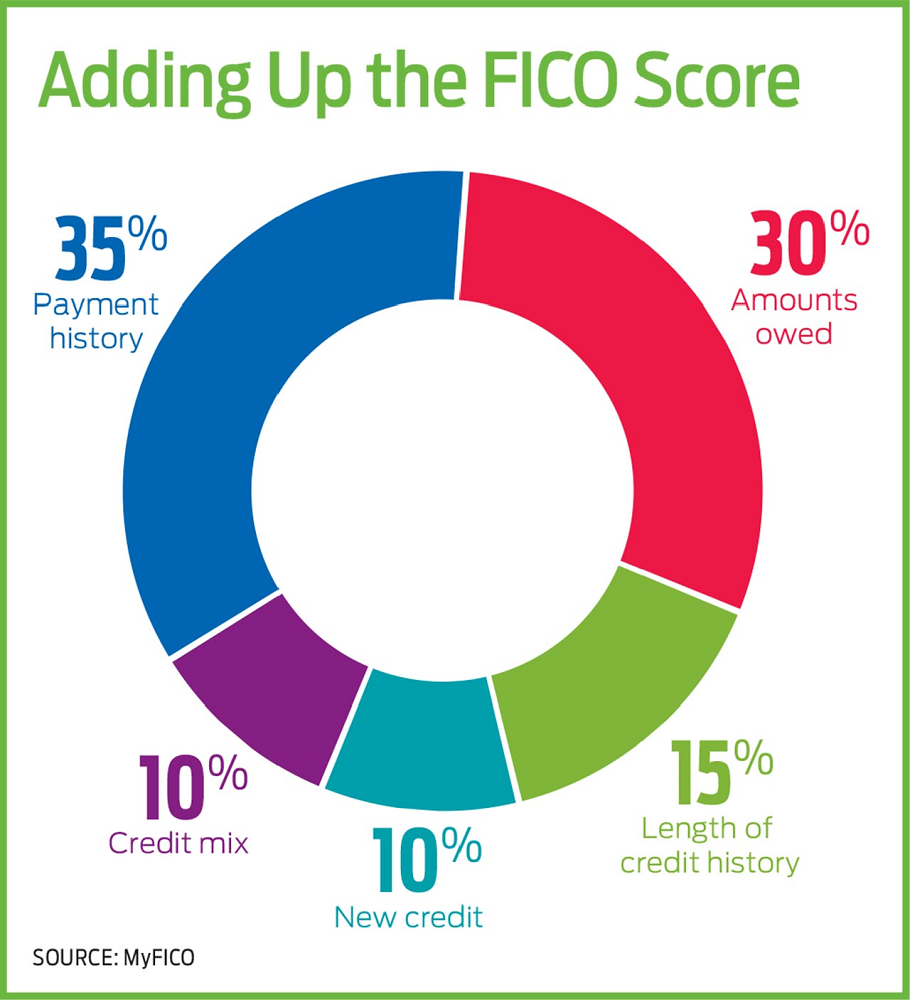

Good afternoon everyone, I hope your weekend is off to a great start. A few days ago, I wrote a post titled I Paid $4,588 in Credit Card Annual Fees in 2019 – Was it Worth it? In that post, I shared the 21 credit cards that I plan on keeping and how I justify paying the annual fees on those credit cards. I felt bad for the 16 no annual fee cards that Laura and I have and decided to write a post about them too. Roughly half of the no annual fee credit cards were downgraded / converted from a credit card with an annual fee. Besides the rewards that some of the no annual fee credit cards provide, keeping no annual fee credit cards open long term is good for your credit score. It improves the length of credit history (average age of accounts), which represents 15% of your total credit score. It also helps with the amounts owed (your credit utilization ratio), which represents 30% of your total credit score. Lastly, it helps with payment history (paying your credit card bills on time), which represents 35% of your total credit score. For more info, check out this Doctor of Credit page.

Image source: https://www.kiplinger.com/article/credit/T017-C000-S002-how-your-credit-score-is-calculated.html

Here are our 16 no annual fee credit cards (sorted alphabetically), along with their current credit limit (combined total credit limit of $136,600), and the original open date (either the date I applied directly for this credit card or the original date of the credit card that was converted to the current credit card). As you can see, we have 4 credit cards from 2014 and 6 credit cards from 2015. These are some of the oldest credit cards we have and we plan to keep them open forever.

| Current Credit Card Name | Credit Limit | Original Open Date |

| AMEX Blue Business Plus | $9,000 | June 2017 |

| AMEX Everyday | $5,400 | July 2015 |

| AMEX Old Blue Cash | $8,800 | September 2014 |

| Bank of America Better Balance Rewards 1 | $1,000 | March 2015 |

| Bank of America Better Balance Rewards 2 | $2,000 | March 2017 |

| Barclays Wyndham Rewards ($0 AF) | $15,000 | August 2017 |

| Chase Freedom (Laura) | $13,400 | March 2018 |

| Chase Ink Cash | $12,000 | March 2014 |

| Citi Costco Anywhere (Laura) | $8,000 | November 2014 |

| Citi Double Cash | $7,700 | February 2015 |

| Citi Rewards+ | $9,500 | April 2015 |

| Discover It 1 | $11,800 | March 2014 |

| Discover It 2 | $8,000 | April 2018 |

| Rakuten Cash Back | $15,000 | July 2015 |

| US Bank Cash Plus | $5,000 | July 2015 |

| Wells Fargo Business Platinum Rewards | $5,000 | March 2019 |

| Total Credit Limit | $136,600 |

I thought it would also be interesting to show whether the no annual fee credit cards on this list were originally applied for or converted from another credit card. For the no annual fee credit cards that we originally applied for, I listed the sign up bonus (or lack of a sign up bonus). For the remaining no annual fee credit cards, I listed the original credit card and their original sign up bonus. As you can see, the 9 original no annual fee credit cards had combined sign up bonuses of 30,000 American Express Membership Rewards Points and $960 cash back. The remaining 7 no annual fee credit cards were converted from various credit cards and had combined sign up bonuses of 60,000 Alaska Airlines miles, 45,000 Wyndham Points, 100,000 Chase Ultimate Rewards Points, 50,000 Citi Thank You Points, and a few hundred Discover It Miles.

| Current Credit Card Name | O or C? | Sign Up Bonus | Original CC & Original Sign Up Bonus |

| AMEX Blue Business Plus | Original | 20,000 MR Points | |

| AMEX Everyday | Original | 10,000 MR Points | |

| AMEX Old Blue Cash | Original | No Bonus | |

| Citi Costco Anywhere (Laura) | Original | No Bonus | |

| Citi Double Cash | Original | $200 Cash Back | |

| Discover It 1 | Original | $150 Cash Back | |

| Rakuten Cash Back | Original | $10 Cash Back | |

| US Bank Cash Plus | Original | $100 Cash Back | |

| Wells Fargo Business Platinum Rewards | Original | $500 Cash Back | |

| Bank of America Better Balance Rewards 1 | Converted | Bank of America Alaska Airlines (30,000 AS Miles) | |

| Bank of America Better Balance Rewards 2 | Converted | Bank of America Alaska Airlines (30,000 AS Miles) | |

| Barclays Wyndham Rewards ($0 AF) | Converted | Barclays Wyndham Rewards ($75 AF) (45,000 Wyndham Points) | |

| Chase Freedom (Laura) | Converted | Chase Sapphire Preferred (50,000 UR Points) | |

| Chase Ink Cash | Converted | Chase Ink Bold (50,000 UR Points) | |

| Citi Rewards+ | Converted | Citi Premier (50,000 Citi TYPs) | |

| Discover It 2 | Converted | Discover It Miles (earned 2x Discover It Miles) |

This last table is probably the most interesting and lists the various credit card benefits for each no annual fee credit and an approximate annual spend from 2019 (sorted highest to lowest). The top 4 credit cards should not surprise you. I put all my large bills on my American Express Blue Business Plus Credit Card since the high balances do not get reported to the personal credit bureaus. We have done a decent job maxing out Laura’s Chase Freedom Credit Card during the last few quarters too. We get 99% of our gas at our local Costco Gas Station using Laura’s Citi Costco Anywhere Credit Card (I prefer to use my US Bank Altitude Reserve Credit Card in-store for the 3x ApplePay transaction). My Citi Double Cash Credit Card comes in nicely when a random store/purchase does not accept American Express.

For the 3 credit cards that I spend $60 per year on, I set up $5 monthly Amazon allowances (basically Amazon gift card balance reloads) so that each month there is a $5 charge that generates a credit card statement. Since I have a Bank of America checking account, I earn $120 cash back for each Bank of America Better Balance Rewards Credit Card (I believe you can apply for this credit card directly, but it’s not possible to convert to this credit card anymore).

The bottom 4 credit cards get $0 annual spend and just gather dust in my drawer. Back in my heavy MS days, the American Express Old Blue Cash Credit Card (no longer available) used to be one of my favorite credit cards. Unfortunately, I do not MS as much as I used to and have started to use my American Express Gold Card as my go to restaurant and grocery store credit card. I recently downgraded from the $75 annual fee Barclays Wyndham Rewards Credit Card to the no annual fee version when the annual fee came due. My second Discover It Credit Card hasn’t gotten any use this year since I haven’t maxed out my first Discover It Credit Card. And the 1.5% cash back Wells Fargo Business Platinum Rewards Credit Card can’t touch my other 2% cash back credit cards.

| Current Credit Card Name | Credit Card Benefits | Annual Spend |

| AMEX Blue Business Plus | 2x MR Points everywhere ($50,000 limit) | $10,000 |

| Chase Freedom (Laura) | 5% cash back at rotating cash back categories ($1,500 quarterly spent limit) | $5,000 |

| Citi Costco Anywhere (Laura) | 4% cash back at Costco Gas, 3% cash back at restaurants, 2% cash back at Costco / Costco.com | $2,400 |

| Citi Double Cash | 2% cash back everywhere | $2,000 |

| Discover It 1 | 5% cash back at rotating cash back categories ($1,500 quarterly spent limit) | $2,000 |

| AMEX Everyday | 20% MR bonus after 20 monthly transaction | $200 |

| Citi Rewards+ | 10% redeemed Citi TYPs, round up transaction to nearest 10 TYPs, 2x Citi TYP at supermarkets & gas stations | $200 |

| Rakuten Cash Back | 3% cash back on Rakuten merchants & in-store cash back merchants | $200 |

| US Bank Cash Plus | 5% cash back at rotating cash back categories ($1,500 quarterly spent limit) | $100 |

| Bank of America Better Balance Rewards 1 | $25 quarterly cash back for making a purchase and paying bill on time (bonus $5 with checking account) | $60 |

| Bank of America Better Balance Rewards 2 | $25 quarterly cash back for making a purchase and paying bill on time (bonus $5 with checking account) | $60 |

| Chase Ink Cash | 5% cash back at office supply stores & internet / cable / TV bills ($25,000 yearly spend limit) | $60 |

| AMEX Old Blue Cash | 5% cash back at grocery stores, gas stations, & pharmacies ($50,000 yearly spend limit) | $0 |

| Barclays Wyndham Rewards ($0 AF) | 3x Wyndham Points at Wyndham, 2x Wyndham Points at gas, utility, & grocery stores | $0 |

| Discover It 2 | 5% cash back at rotating cash back categories ($1,500 quarterly spent limit) | $0 |

| Wells Fargo Business Platinum Rewards | 1.5% cash back everywhere | $0 |

If you have any questions about any of the 16 no annual fee credit cards that we have, please leave a comment below. Have a great weekend everyone!

I have never seen an article like this one and I’ve read a bunch. Very unique. I’ve been tempted to cancel a few cards that don’t get much spend but then I consider the length of credit history with them and change my mind. You have a few that didn’t get any spend on last year that are fairly recent that would have a high chance of going on the chopping block if I were to own them.

There really is no good reason to close credit cards that have no annual fee. They don’t cost anything, could have decent rewards, and help with your credit score. Most credit card companies will let you convert to other credit cards if you ask. Citi and Chase have a few good no annual fee credit cards.

Do you have a link to the app for the Better Balance Rewards? I don’t think it’s available for a direct app and hasn’t been for a while.

Still bummed I didn’t convert more of my cards to this back in the day. Stupid me thought I could only have one.

I searched for a working link but couldn’t find one :(