Good afternoon everyone. A few weeks ago, I wrote Reconsideration Strategy for Credit Card Annual Fees During Coronavirus Pandemic. In that post, I shared all of my credit cards with annual fees that were coming due soon and my plan for retention offers. While I struck out with American Express regarding my American Express Gold Card and American Express Hilton Aspire Credit Card, I did score a sweet retention offer on my Chase Marriott Bonvoy Premier Plus Business Credit Card.

I don’t believe this credit card is still available for new applications, but if you have another Chase Marriott business credit card, you should be able to product change to this card. According to the card benefits, there is really nothing very special about this credit card except for the fact that you get a free night certificate every year that is valid at Marriott properties that cost up to 35,000 Marriott Bonvoy points. If you spend $60,000 on this credit card, you will earn a second free night certificate. The credit card has a $99 annual fee. The annual fee just posted to my account, so I decided to call Chase to see what kind of retention offers were available.

A few weeks ago, Doctor of Credit wrote Chase Making It More Difficult To Receive Retention Offers? In that post, it said that Chase was making it harder to receive retention offers and only provided retention offers when cardmembers were going through the card closure process. I was prepared to close this credit card if Chase didn’t offer any type of retention offer. During the call, I told the rep that the $99 annual fee just posted to my account and that I wasn’t sure if I would keep this credit card because I wasn’t planning on traveling anytime soon. I asked the rep if he could waive the annual fee this year. He checked his system and said that he could offer me a $100 statement credit if I kept the credit card open. The $100 statement credit would post to my account in the next 1-2 billing cycles and that I should pay the $99 annual fee by the payment due date if the statement credit did not post before then. I gladly accepted the retention offer and thanked the rep for his help.

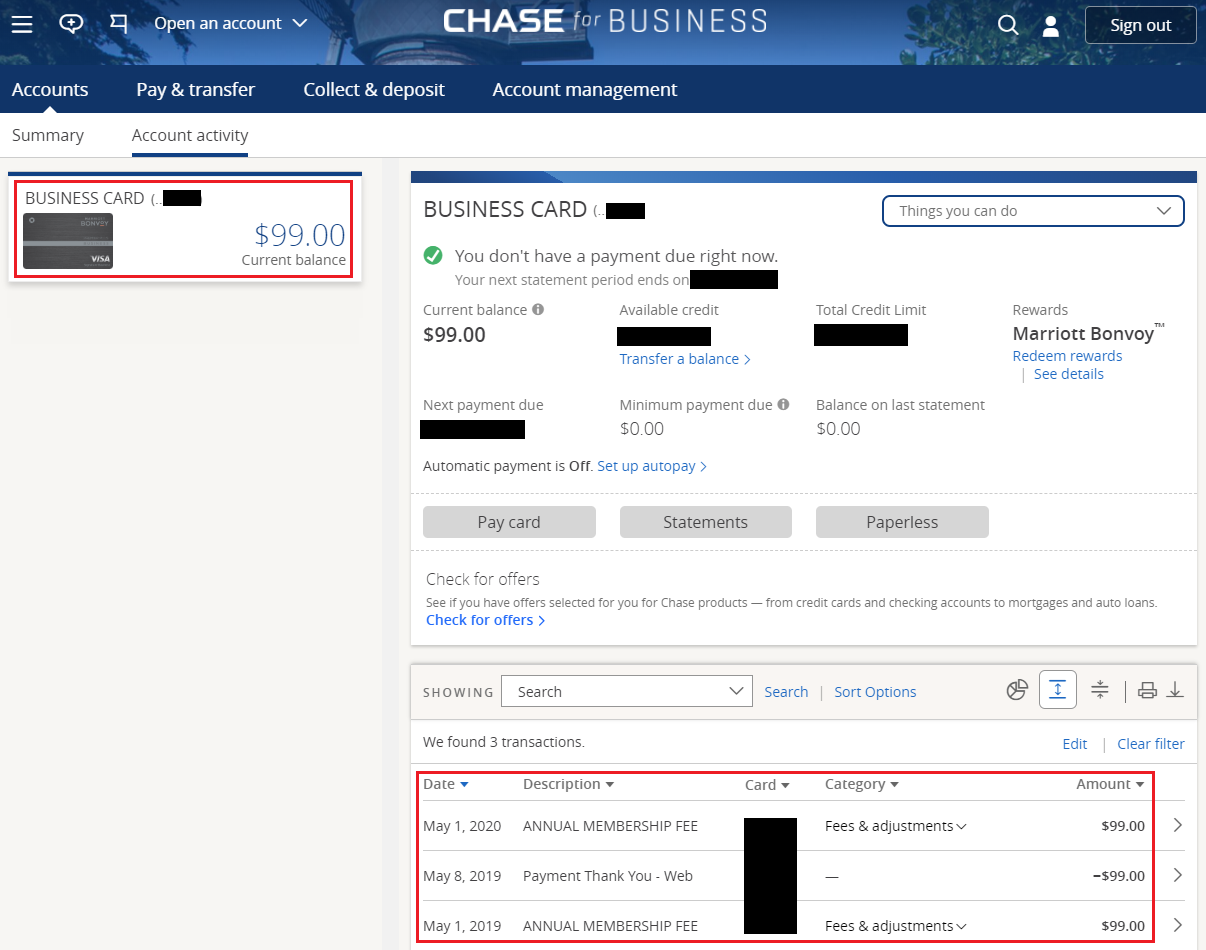

For my data point, I did not have to go through the card closure process, just asking if it was possible to waive the annual fee was all that was necessary. As you can tell by my last 3 transactions on this credit card, I never use this credit card. The last 3 transactions show that my last annual fee was billed in May 2019, I paid the annual fee in May 2019, and my new annual fee was billed in May 2020. I have had this credit card since April 2018 so I am not a long time cardholder either.

Here are 2 other recent data points for Chase. I called Chase regarding the $550 annual fee that posted in April on my Chase Sapphire Reserve Credit Card but I didn’t receive anything other than the automatic $100 statement credit that all CSR cardholders received. My wife also called about her Chase Southwest Airlines Priority Credit Card (her $149 annual fee is scheduled to post on June 1). The rep was only able to offer a 1.99% APR rate which my wife declined. I told her to call Chase next month after the annual fee posted to see if there are any better retention offers available. If you have any questions about Chase retention offers, please leave a comment below. Have a great day everyone!

Another DP…a week ago, I sent a secure msg to Chase saying I was considering closing my Hyatt card. I only use it when I stay at a Hyatt & did that once in the last year. The annual fee is $79, but it comes with a cat 1-4 free anniversary night. No love from Chase. I didn’t say I was going to close it, just that I was considering it. Do you think it makes a difference if I call or send a secure msg?

I don’t have any experience using Chase’s secure message for retention offers. I have both positive and negative experiences with calling. I’m not sure if this is a true, but I think the Chase secure message center reps have less power to make retention offers than the phone reps. Try calling and see if you are offered anything. Good luck!

Thanks for the tip! AF just billed on both mine and my wife’s Marriott biz cards. Called Chase and received same offer on both!

That is great news, glad you got the same retention offer I received. Enjoy your card for another year.

I called the Chase phone # on the back of my Marriott card. I said that my annual fee had recently posted & that I was considering not keeping my card because I wasn’t planning on travelling in the foreseeable future. Could they cancel my annual fee or issue me a credit? The rep politely said that Chase had not made any provisions for that related to COVID, & he was unable to offer either option.

Hi Rick, thanks for sharing your data point on your retention call. If you still have the card open, I would try calling again during the week during normal business hours. Hopefully you get a nicer rep who is willing to help you. If not, you may need to go through the cancellation process on the phone to get the retention offer. Hope the second time is the charm.

Good for you! Mine renew in early March and I’ve closed it already. Just figured 35k is no longer flexible enough to keep any more :(

I was leaning that way too if I didn’t receive any retention offer from Chase.

My husband’s annual fee is coming due on his Marriott Rewards. I had him call the number on the back of the card to see if we had any retention offer. He usually gives them permission to speak to me and then I would handle it. He just hates doing that sort of thing. She adamantly said that he had to do it and that she could not do it with me. That is a first. Success, he received $90.00 to cover the annual fee. I feel he was successful because he said he was going to cancel because we were not going to be traveling any time soon. He did NOT say we were thinking about it. I said that two weeks ago with my AMEX Starwood Card that I would never cancel and was told no retention offer. Different bank yes, but I feel that if they believe you are canceling vs. thinking about it it does make a difference.

Hi Priscilla, thanks for sharing your data points. I’ve never heard of a bank not allowing a spouse to talk on their behalf after giving their spouse permission. That’s a first. But I’m glad your husband was able to get a retention offer on his Marriott CC. If your SPG annual fee posted recently, I would give Amex another call and see if you can get a retention offer. Good luck!

Chase SW Priority Card: My annual fee posted yesterday. I called this morning for an incentive to keep the card. I explained to the rep that I can’t justify paying the annual fee with no travel plans in the foreseeable future due to the pandemic. I was abruptly told that Chase is not waiving the annual fee for this card. I cancelled with surprisingly little (in fact zero) pushback from the rep. Now, I’m having seller’s remorse…

Hi Mark, thanks for sharing your experience with the recent Chase retention call. Try calling back Chase and asking them to reopen the card. It should be possible if the card was closed recently. Please let me know what happens.

Grant, yes, I called back a few hours later and they reinstated the account with no credit inquiry. As you know, this is a money maker card for anyone who even occasionally flies SW. I never intended to actually cancel, but was caught off guard at how easy they let me walk. I figured I’d be transferred to a retention specialist after I told them I was actually cancelling. Phew.

I’m glad you were able to get the card reopened easily. This CC can be worth the $149 annual fee if you can take advantage of the yearly benefits. I’m guessing that SWA isn’t paying Chase to provide retention offers to customers.

Just called the number on the back of my business card and was offered $50 statement credit. Not as good as OP’s $99 but I figured I probably won’t get anything better. Inquired if there was any offer but only the statement credit was available. Took the offer and kept the card since I figured the 35,000 point certificate is worth more than $50.

$50 is better than nothing and i would have done the same thing with you. If you can use the 35k free night certificate well, you can easily exceed $95 in value.