Good afternoon everyone, I hope you had a great weekend. I called about retention offers on a few different credit cards today and wanted to share my results. Please make sure to scroll to the bottom of this post and read my tips on making retention calls. I took a page out of Frequent Miler’s playbook (My $575 phone call (complete in 20 minutes)) and called about these 4 credit cards:

- Chase Hyatt Credit Card ($75 annual fee posted December 1)

- JPMorgan Chase Ritz Carlton Visa Infinite Credit Card ($450 annual fee posted July 1)

- Chase Marriott Bonvoy Premier Plus Business Credit Card ($99 annual fee posted May 1)

- American Express Business Platinum Charge Card ($595 annual fee posted December 2)

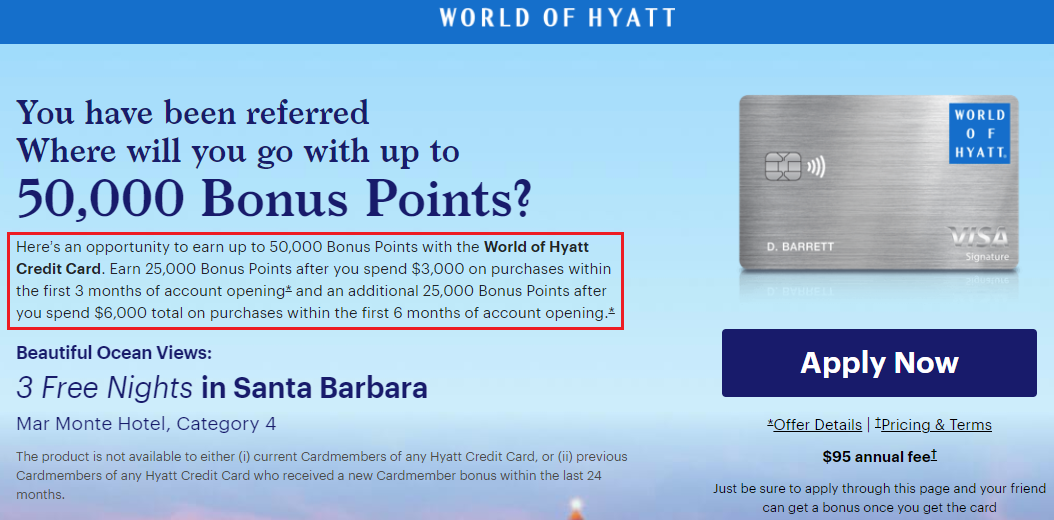

Since the old Chase Hyatt Credit Card is product changing to the new Chase World of Hyatt Credit Card on January 11, 2021, I decided to call Chase and ask about a retention offer. This is a huge ask that I knew was never going to fly, but I tried anyways. I told the Chase rep that I was planning on closing my old Hyatt credit card and was going to apply for the new World of Hyatt credit card in a few weeks since I could earn up to 50,000 World of Hyatt Points with the new sign up bonus. Instead of going through the process of closing one card and applying for the other card, I asked if Chase could provide some bonus World of Hyatt Points to forgo the sign up bonus. Nope, that was not possible. At that point, I asked the rep to close that credit card and transfer the credit limit over to another Chase personal call. I am 0 for 1 at this point, onto the next call.

Next up, I called Chase to discuss the $450 annual fee on my JPMorgan Chase Ritz Carlton Visa Infinite Credit Card that posted back in July. I told that rep that my wife recently received the Chase Marriott Bonvoy Boundless Credit Card that came with 5 Free Night Certificates and that we were using her credit card much more often. Since we were not using the Ritz Carlton credit card as often, I asked if there was a way to waive or reduce the annual fee. The rep checked their computer and said the best they could do was offer me a $100 statement credit. I gladly accepted that offer. Now I was 1 for 2.

On the same call, I asked the rep to look at $99 annual fee on my Chase Marriott Bonvoy Premier Plus Business Credit Card that posted back in May. I gave the rep the same spiel as before – we are using my wife’s Marriott credit card much more often, so I was hoping to waive or reduce the annual fee. The rep checked their computer but said that I would need to speak with someone from the Retention Department. After a 5 minute hold (how many other people are calling into the retention department today?), I spoke with a nice rep. I repeated the spiel but the rep said that my credit card didn’t have any retention offers. Since my annual fee was billed in May, the rep suggested calling back around May to see if there were any new offers. Darn, now I was 1 for 3.

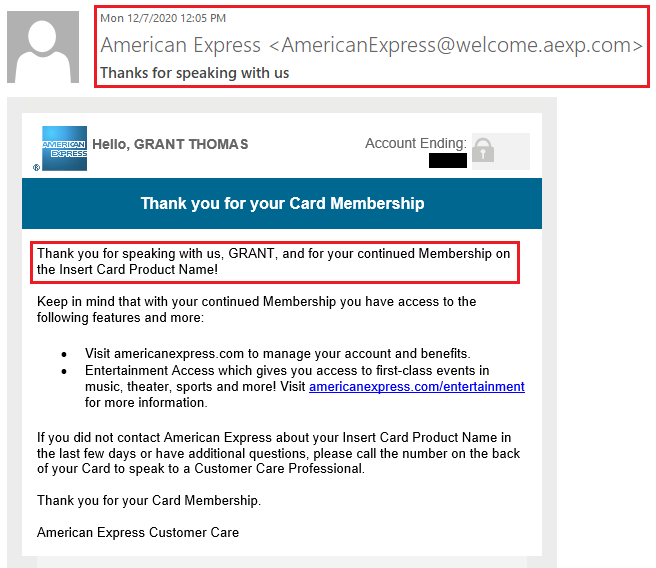

Last but not least, I called American Express to discuss the $595 annual fee that just posted to my American Express Business Platinum Charge Card. I told the first rep that I was considering closing my card and they transferred me to an account specialist. I told the account specialist that I really enjoyed using the $20 monthly wireless credit, the $20 monthly shipping credit, and the extra $200 in Dell credit this year. I asked if those benefits were going to be extended into 2021. The rep said that no decisions or announcements have been made about special 2021 benefits. I then said that I really liked this card and get great value out of this card most years when I travel and visit Centurion Lounges and that I really didn’t want to close the card. At that point, the rep said that American Express was offering select cardholders a $200 appreciation credit if they pay the annual fee and keep the card open. I gladly accepted the offer and the rep read off the terms of the offer. I thanked the rep for their help. After the call, I received this email from American Express. It would be a little better if the system would automatically replace “Insert Card Product Name” with the actual name of the card. Either way, I I was now 2 for 4 in terms of retention offers.

To summarize, I spent 25-30 minutes total across all the calls and will receive a total of $300 in statement credits in the next 1-2 billing cycles. That is a pretty good return on my time and I look forward to making future retention calls next year when more annual fees start posting to my accounts. If you have any questions about making retention calls, please leave a comment below. Have a great day everyone!

P.S. Here are some retention call tips:

- Write down or make a mental note of the rep’s name and say their name a few times in your conversation (“Thank you for your help Grant, I really appreciate it!” “Hi Grant, I have a few questions about this credit card and need some help.”) Reps speak to hundreds of people every day / week and they like to feel appreciated and will go out of their way to help you.

- Call during the week and during normal business hours. The best reps work the best shifts and some departments are only open certain hours of the day. If you call outside business hours, on weekends, late at night, or on holidays, those reps are usually not as familiar with retention offers and where to look for offers in your account.

- Call right after your annual fee posts, that is when you have the most leverage (you want to keep the credit card, but you don’t want to pay the annual fee, and the credit card company wants to keep you as a customer).

- Tell the rep about the features of the credit card that you like, but explain why you did not get enough value from the benefits to justify the annual fee. Explain why you are not using the credit card and the benefit as often (not travelling as often as before, spouse got the same or better card, you opened a new credit card that you are using more often, etc.)

- Before you make the call, decided if you want to keep or close the credit card, assuming you get no retention offer. If I get no retention offer and I really want to keep the credit card open, I will tell the rep that I will think it over and call back later if I decide to close the credit card (this helps if you call right after your annual fee posts, not the day the annual fee bill is due).

- If it fits the conversation naturally, you can mention how long you have been a cardmember, how you always pay your bills on time, and that you have referred a few friends and family members to this credit card.

- In general, the more you spend on the credit card, the better your chances are of getting a good retention offer.

- For Citi specifically, Citi’s system usually has several retention offers for each credit card, so don’t be afraid to ask if there are any other retention offers available.

- If you get a spend $X, get Y points, make sure you write down the start and end dates, the amount you need to spend, and the bonus you should receive. Follow up if you do not see the bonus on your account 1-2 months after completing the spending offer.

- Any other tips I am forgetting?

I got $150 from Ritz Carlton.

$50 from Hyatt

00 from CSP.

Hi Manny, looks like you beat me on both of those CCs. Did your annual fees post recently?

On my Amex Delta Gold Biz I was offered $150 statement credit for $2,000 spend. The fee is $95. I don’t expect to be flying Delta very often. With the difficulty of getting MOs at Walmart I’m hesitant to keep the card. What would you do?

Hi Al, hmm, that’s a good question. Assuming you spent $2,000 on a 2% cash back card, that would be a $40 opportunity cost. Getting $150 for spending $2,000 is equivalent to earning 7.5% cash back on everyday spend, which is a great deal. How long do you have to spend $2,000?

Here’s the full offer: If I keep the card, without any spend requirement, I would receive a $50 statement credit. And if I $2k spend within 92 days, then they would give a further $100 credit. The annual fee is $95.

I don’t value the card benefits that much at this point in time as I don’t know how often I’ll be flying Delta and saving bag fees. So, it’s really like $55 for $2,000 spend, only 2.75%? Ok, but I still have to divert spend to this card which is not easy to manufacture these days.

Hi Al, would you consider downgrading to the no annual fee AMEX Delta Blue CC? That will keep your card open and then you can always upgrade back to a different AMEX Delta CC when you want to start traveling again.

Do you recommend upgrading my chase marriott to ritz? I should be able to triple dip the $300 fee maybe. And the $300 is useable on groceries till end of the month?

Yes, I recommend upgrading to the Ritz Carlton CC is you can. The $300 airline reimbursement can be used for groceries this year through December 31. I’m not sure if there will be anything special for next year, Chase has not said anything about 2021 for the Ritz Carlton CC.

I just upgraded my card a few days ago and already see the $95 fee refund. Will I get the free night when they charge the $450 fee or do i have to wait a year? Thanks.

Hi Lynn, I wish I knew the answer but you may need to call Chase to find out. I think the free night and annual fee should post at the same your previous Marriott CC annual fee and free night posted (usually the same month printed on your CC).

okay, thanks!

I got the free night on the same anniversary of the original card. The upgrade certificates posted when I upgraded though. AF was also charged on my original anniversary date.

Thanks for sharing your data points Eleanor. That sounds similar to my experience too.

What is the advantage to upgrading later on – wouldn’t I be better off re-applying to get another SUB or getting the personal version?

You would be better applying for a new CC to receive the sign up bonus. Just make sure you haven’t had that CC before so you are eligible for the sign up bonus.

Pingback: Year End Checklists, 2020 Key Tax Law Changes, Airbnb IPO, AA Elite Enhancements, Amex Shutdowns - TravelBloggerBuzz

Pingback: My Best Practices for Closing a Credit Card