Updated at 10:30am PT on 6/8/23: Here is a Chase Paze FAQ page and a US Bank Digital Services Agreement page (scroll down to “Using Paze”).

Good afternoon everyone. I went down a deep rabbit hole that started with an email from Wells Fargo and ended with me finding details of Paze – a new digital wallet service from Zelle’s parent company (Early Warning Services). Follow me down the rabbit hole as I explain more about Paze. The journey began when I received this email from Wells Fargo about updates to the Online Access Agreement. I clicked the link to view the Summary of Changes to see if there was anything noteworthy.

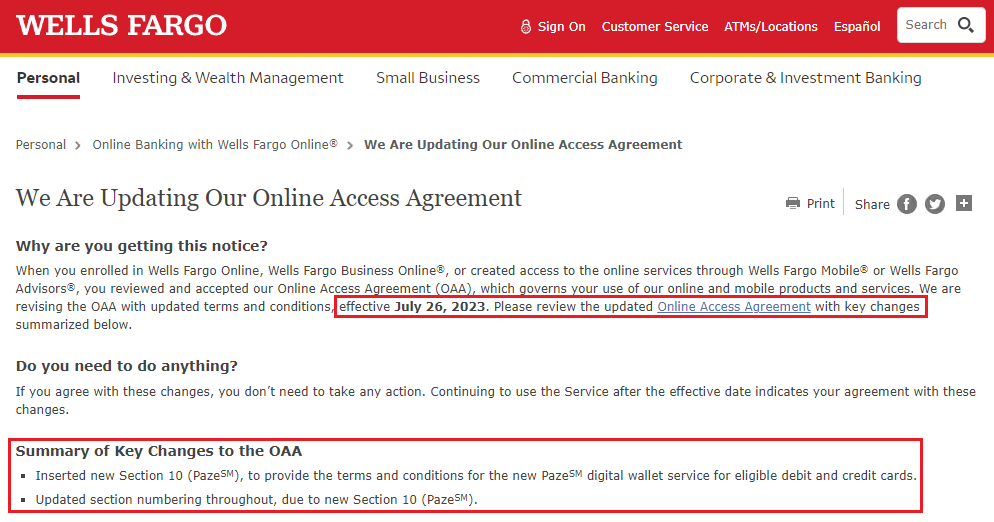

The landing page looked as exciting as you would expect regarding an update to the Online Access Agreement. The Key Changes section mentioned Paze and said “Section 10 (PazeSM), to provide the terms and conditions for the new PazeSM digital wallet service for eligible debit and credit cards.” Anything to do with a new digital wallet service and credit cards sparked my interest, so I clicked the Online Access Agreement link to learn more.

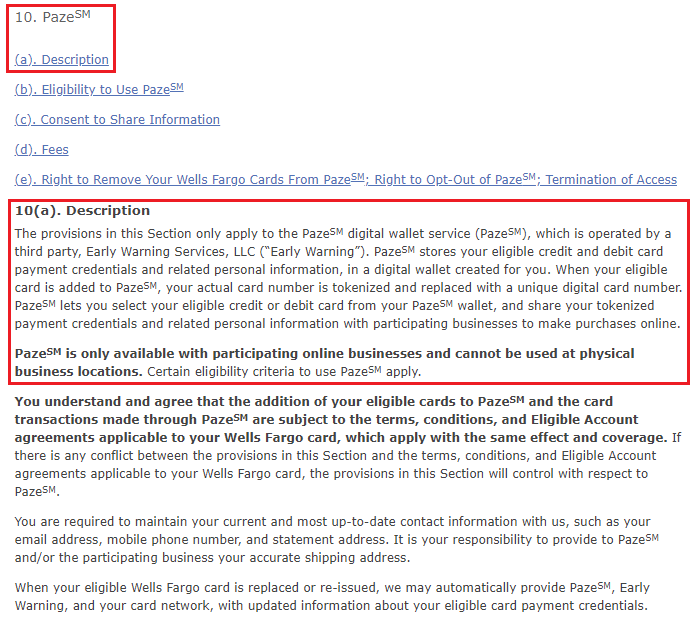

I then scrolled down to Section 10: Paze to learn more. The description really caught my attention:

The provisions in this Section only apply to the PazeSM digital wallet service (PazeSM), which is operated by a third party, Early Warning Services, LLC (“Early Warning”). PazeSM stores your eligible credit and debit card payment credentials and related personal information, in a digital wallet created for you. When your eligible card is added to PazeSM, your actual card number is tokenized and replaced with a unique digital card number. PazeSM lets you select your eligible credit or debit card from your PazeSM wallet, and share your tokenized payment credentials and related personal information with participating businesses to make purchases online.

PazeSM is only available with participating online businesses and cannot be used at physical business locations. Certain eligibility criteria to use PazeSM apply.

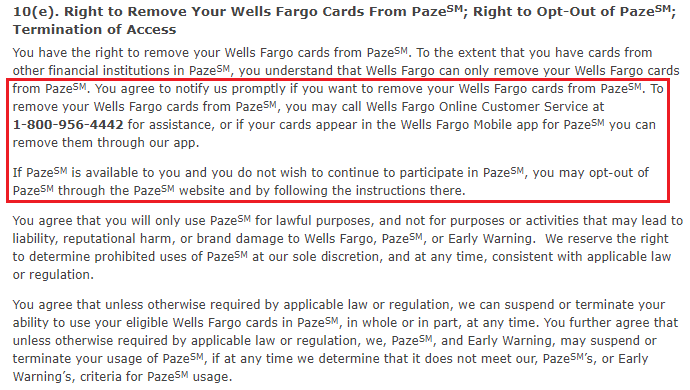

Section 10(e) mentioned instructions on how to remove your credit and debit cards from Paze, so it sounds like your eligible cards will automatically be added to Paze.

You have the right to remove your Wells Fargo cards from PazeSM. To the extent that you have cards from other financial institutions in PazeSM, you understand that Wells Fargo can only remove your Wells Fargo cards from PazeSM. You agree to notify us promptly if you want to remove your Wells Fargo cards from PazeSM. To remove your Wells Fargo cards from PazeSM, you may call Wells Fargo Online Customer Service at 1-800-956-4442 for assistance, or if your cards appear in the Wells Fargo Mobile app for PazeSM you can remove them through our app.

If PazeSM is available to you and you do not wish to continue to participate in PazeSM, you may opt-out of PazeSM through the PazeSM website and by following the instructions there.

For those unfamiliar, Early Warning Services is the parent company of Zelle (P2P payments).

Here are some stats about Zelle. It’s very impressive that Zelle works with over 1,800 financial institutions.

The Paze Wallet / Paze digital wallet service is “offered by seven of the nation’s largest banks” and “more than 150 million debit and credit cards will be eligible in late 2023.”

Here is the Paze homepage. Details on here are pretty sparse.

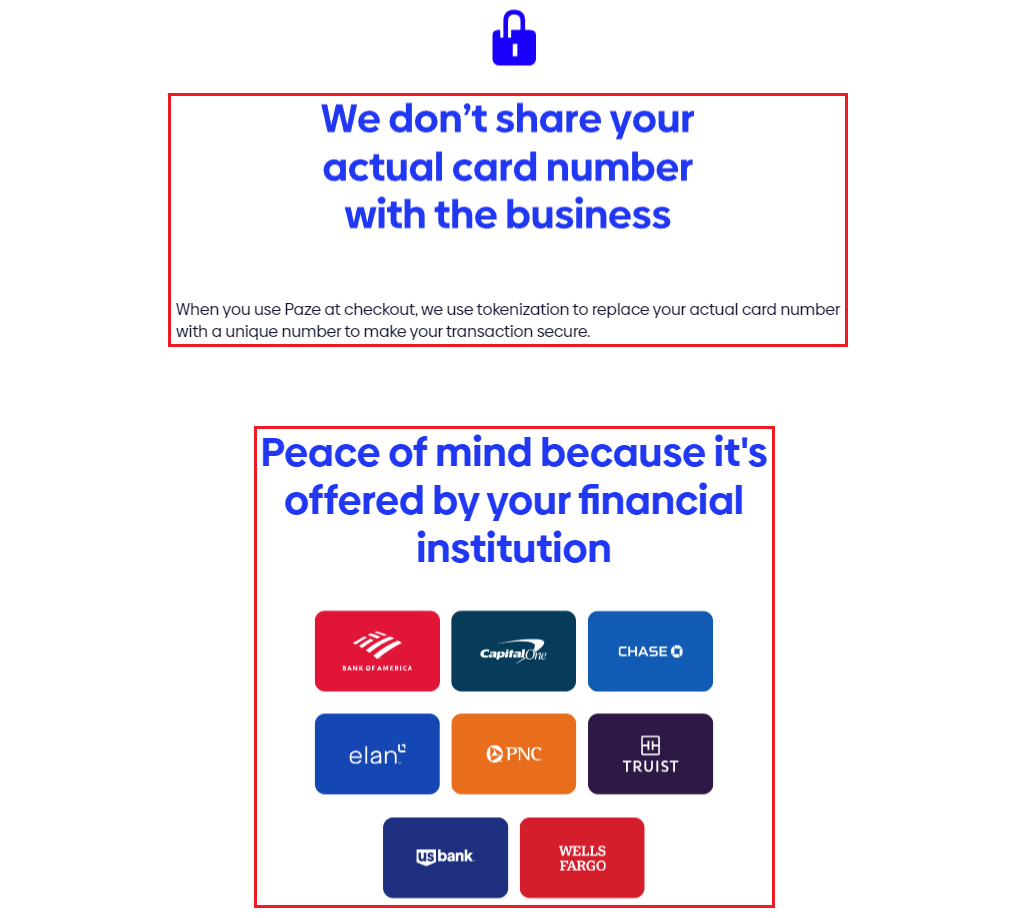

Here is how Paze works: “When you use Paze at checkout, we use tokenization to replace your actual card number with a unique number to make your transaction secure.” This sounds a lot like ApplePay / Google Pay and should reduce the number of credit cards compromised in data breaches.

You can also see the 8 financial institutions that will work with Paze. It’s nice to see Bank of America, Capital One, Chase, US Bank and Wells Fargo – all of which offer cash back and travel reward credit cards. Noticeably missing are American Express, Barclays, Citi, and Discover. We will need to wait and see if they use Paze.

I am all for more payment methods / digital wallets, so I am excited to see how Paze works and how many businesses support Paze. If you have any questions, please leave a comment below. Have a great day everyone!

Is there anyway that you can fix your site to display the full rss feed like most other websites on boardingarea?

Hi Lisa, let me check with the BoardingArea IT team and see if they can get that fixed. Thank you.

Hello Grant, thank you for the article, it saved us all a lot of valuable time. And let’s face it, most people just bypass all of that kind of reading and research, much to their dismay. My question is the safety and security of the third party that will have initial access to our card numbers. What is stopping hackers and future scammers from figuring out a way to steal our information straight from them?

Hi Christine, there is always a risk that hackers will try to steal the information from financial institutions. Hopefully the data is encrypted and difficult to access, but we won’t know for sure until something bad happens.