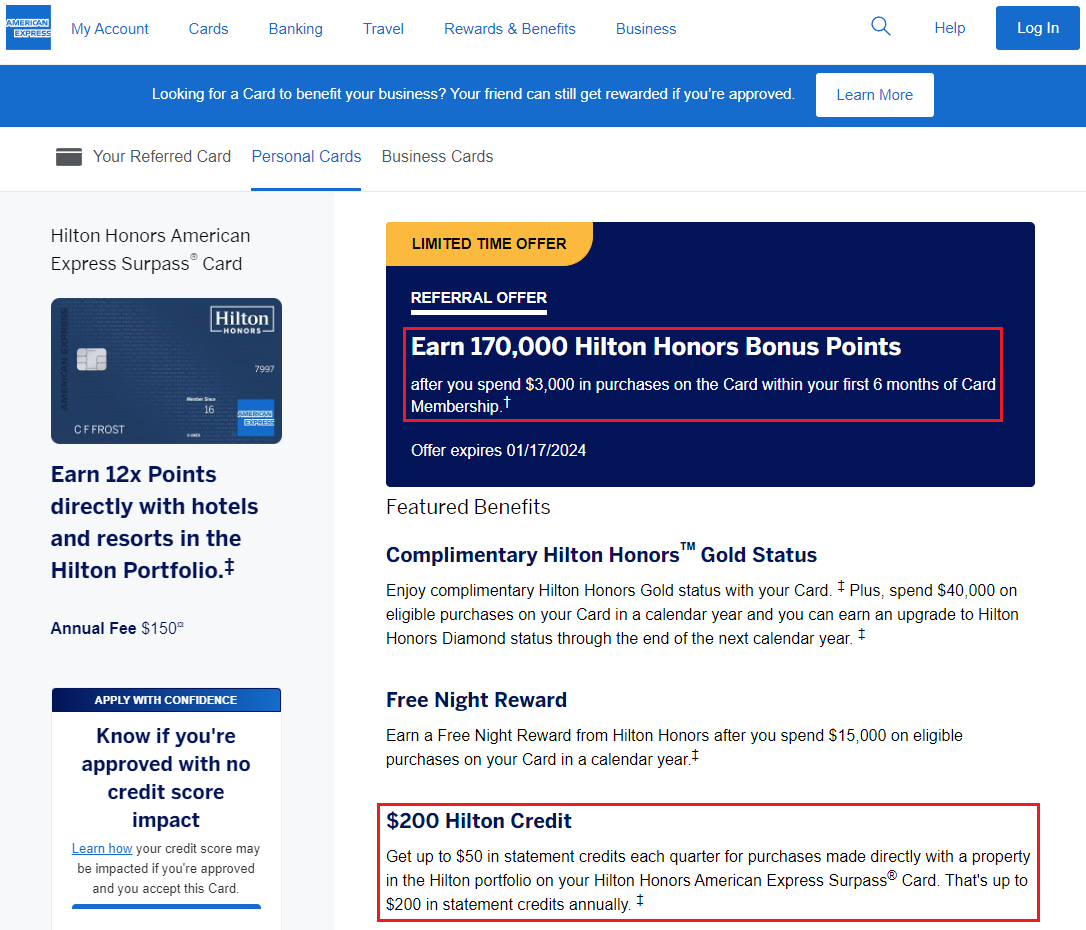

Good morning everyone, I hope your week is going well. A few weeks ago, I wrote about My 6 Credit Card App-O-Rama: Results & Reconsideration Calls. In that post, I shared that I was approved for the American Express Hilton Honors Surpass Credit Card (referral link) that currently offers a 170,000 Hilton Honors Points sign up bonus after spending $3,000 in 6 months and a $200 Hilton Credit ($50 credit per quarter). If you have had the Surpass card before, here is the No Lifetime Language offer for the Hilton Surpass (this is the link I used since I had the Surpass a few years ago). In this post, I wanted to discuss the $200 Hilton Credit and share my experience with the credit.

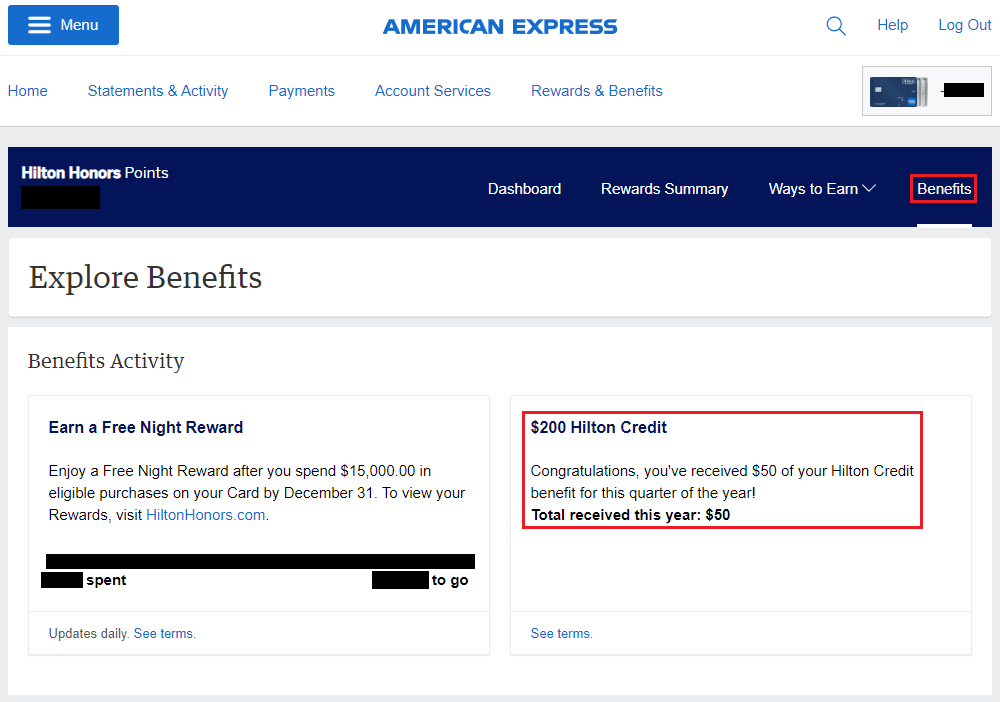

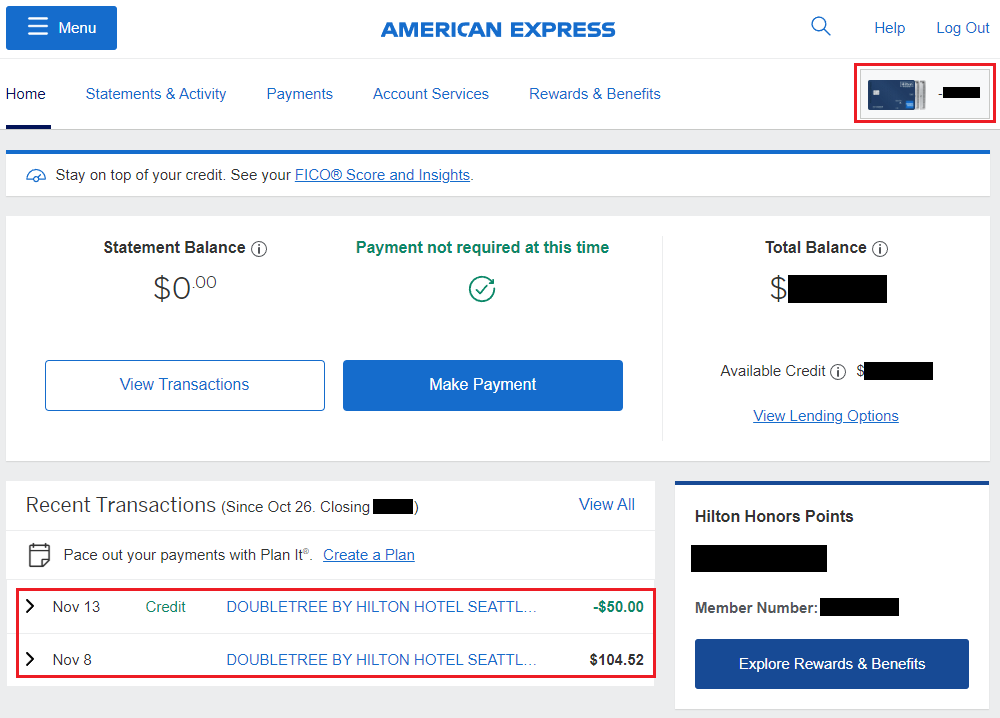

To learn more about the $200 Hilton Credit, sign into your American Express online account, select your Surpass card, and click on the Benefits link. As you can see, I already received the $50 credit for this quarter.

Scroll down and click on the Learn More link in the $200 Hilton Credit tile.

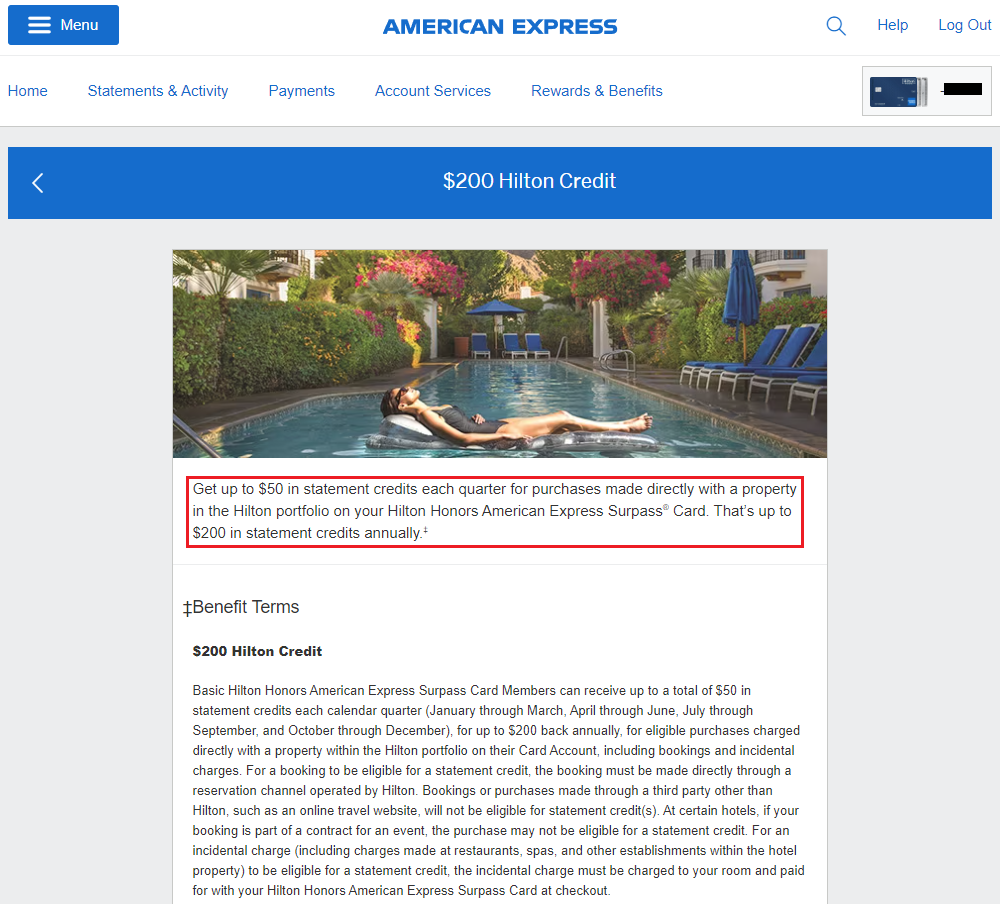

Here are all the details of the $200 Hilton Credit.

Here are the complete terms and conditions for the $200 Hilton Credit:

Basic Hilton Honors American Express Surpass Card Members can receive up to a total of $50 in statement credits each calendar quarter (January through March, April through June, July through September, and October through December), for up to $200 back annually, for eligible purchases charged directly with a property within the Hilton portfolio on their Card Account, including bookings and incidental charges. For a booking to be eligible for a statement credit, the booking must be made directly through a reservation channel operated by Hilton. Bookings or purchases made through a third party other than Hilton, such as an online travel website, will not be eligible for statement credit(s). At certain hotels, if your booking is part of a contract for an event, the purchase may not be eligible for a statement credit. For an incidental charge (including charges made at restaurants, spas, and other establishments within the hotel property) to be eligible for a statement credit, the incidental charge must be charged to your room and paid for with your Hilton Honors American Express Surpass Card at checkout.

Eligible purchases can be made by both the Basic and any Additional Card Members on the Card Account. However, the total amount of statement credits for eligible purchases will not exceed $200 per Card Account per calendar year. Please allow 8-12 weeks after the eligible purchase is charged to your Card Account for statement credit(s) to be posted to the Account. Please call American Express at the number on the back of your Card if statement credits have not posted after 12 weeks from the date of purchase. To receive this benefit, your Card account must not be cancelled or past due at the time of statement credit fulfillment. Statement credit(s) may not be received or may be reversed if the purchase is cancelled or modified, or if you engage in abuse or misuse in connection with the benefit.

American Express relies on the merchant’s processing of transactions to determine the transaction date. The transaction date may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, the January statement credit would be applied. American Express also relies on information provided to us by the merchant to identify eligible purchases. If American Express does not receive information that identifies your transaction as eligible for this benefit, the Basic Card Member will not receive the statement credit. For example, your purchase will not be eligible if it is not made directly with Hilton (e.g., if a purchase is made at a restaurant or convenience store within a Hilton property). Basic Card Members may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as eligible, if a transaction is made with an electronic wallet or through a third party (such as an app store), or if the merchant uses a mobile or wireless card reader to process it.

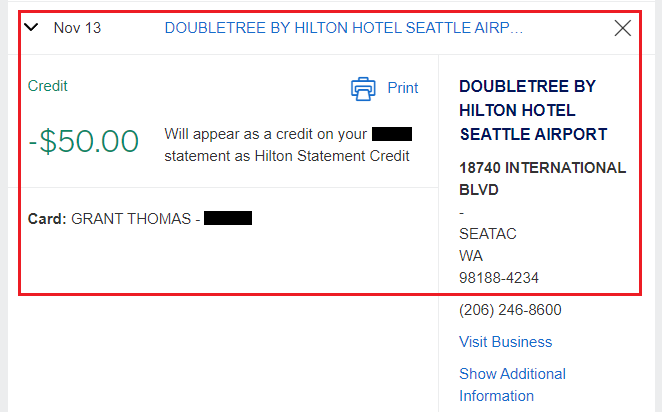

A few months ago, I booked a stay at the Hilton DoubleTree by the Seattle Airport. I checked into the hotel on November 6 and was able to change the card on file to my Surpass card. The hotel was great: free airport shuttle, free warm chocolate chip cookies, $30 food and beverage credit, and a quiet / comfortable room. I checked out on November 7 and the hotel charge posted to my Surpass card on November 8. 5 days later, on November 13, the $50 Hilton Credit posted to my account.

Here are some more details on the $50 Hilton Credit.

Since the annual fee on this card is $150 and you get a $50 Hilton Credit each quarter, you can break even if you stay at a Hilton property 3 out of 4 quarters of the year. Even if you are staying on Hilton Points or using a Free Night Certificate, if you charge $50 to your room (parking / spa / restaurant / etc.) you should be able to use the $50 Hilton Credit during your stay. If you don’t stay at a Hilton property every quarter, you will have to get more creative to trigger the $50 Hilton Credit each quarter. You might have luck buying a $50 Hilton gift card from the front desk, but that is YMMV. If you have any questions about the American Express Hilton Honors Surpass Credit Card (referral link) or the $200 Hilton Credit, please leave a comment below. Have a great day everyone!

I got the Surpass card in July when the annual fee was $95. I did not have a Hilton stay for the 4th Q so I went to the front lobby of a Hilton Garden Inn and purchased $40 worth of candy bars. I was reimbursed within a few days.

Hi Harv, thank you for sharing your data point, I am glad buying food / snacks at the front lobby triggered the Hilton credit.

I got $52 worth of candy on Dec 15th .credit is not posted yet. Double tree.

Hi R, I’ve heard that the credit is taking 1-2 weeks to post, so you should see the credit by the end of this month. Shen it does post, let me know how many days it took for you.

Happy holidays!

Checked out of a Canopy in Dallas on 12/25, still no statement credit.

Hi Robert, I had a Grubhub purchase post on 12/25 and just received the credit on 1/3, so I think AMEX is being slow to post statement credits lately. It should post in the next few days. Then you will need to confirm that the credit counted toward your Q4 2023 credit not Q1 2024 credit.