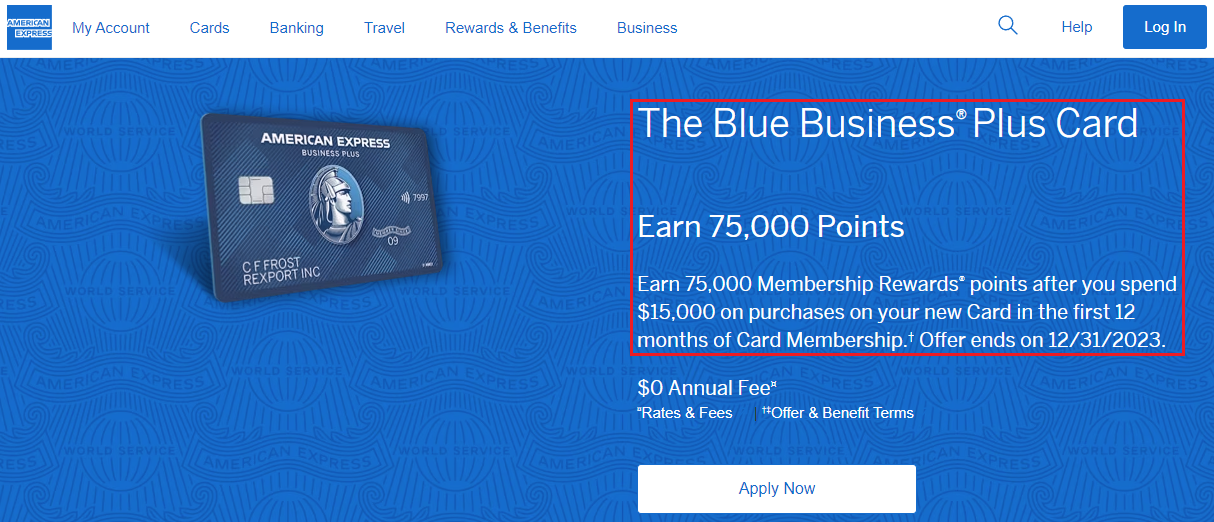

Good afternoon everyone, happy Friday! A few weeks ago, I applied for 6 new credit cards in my most recent App-O-Rama (which doesn’t work as well as it used to work, back in the good ol’ days), but I wanted to share my results and reconsideration calls. Warning: I don’t recommend applying for multiple cards in the same day (“do as I say, not as I do”). With that said, I started with the American Express Blue Business Plus Credit Card that has a 75,000 American Express Membership Rewards Points signup bonus after spending $15,000 in 12 months. Check out this Doctor of Credit post for more info.

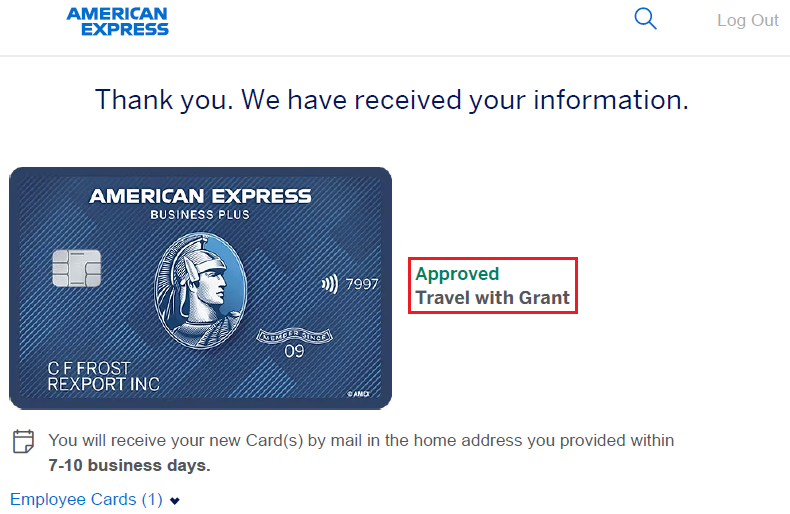

I already have a BBP so I was curious if I could pick up a second BBP and I was instantly approved! I was 1/1 at this point. Since I have existing AMEX cards, there was no credit check.

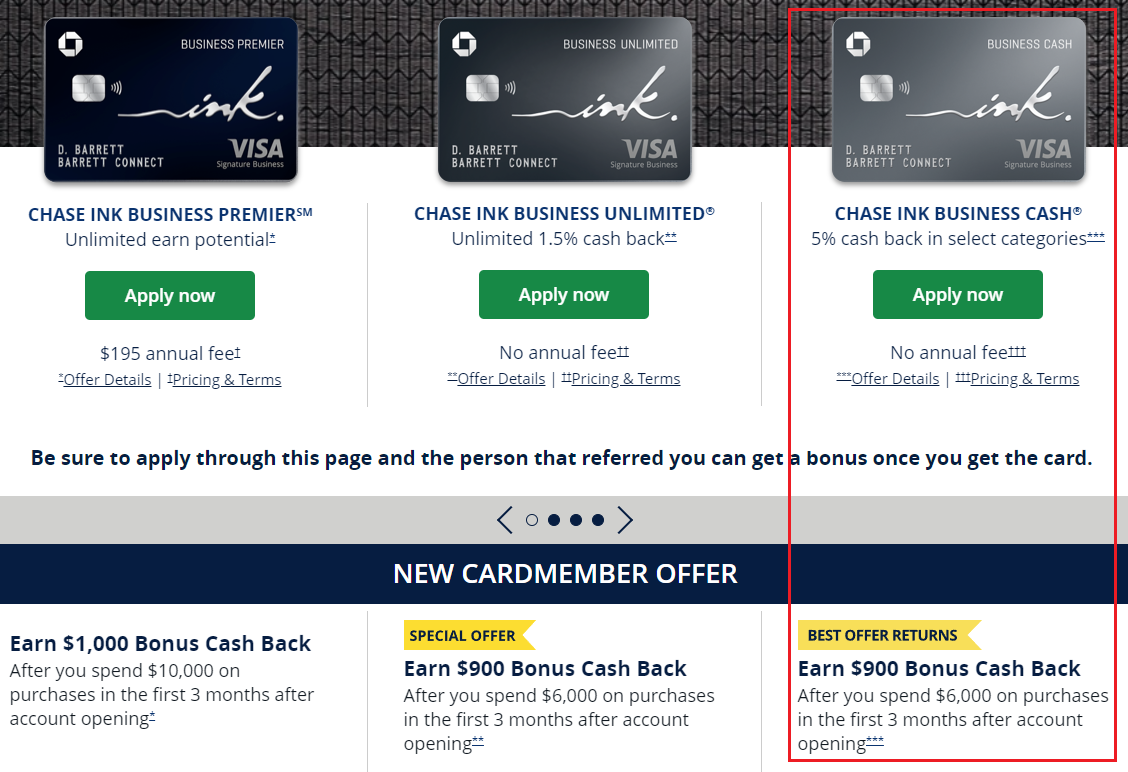

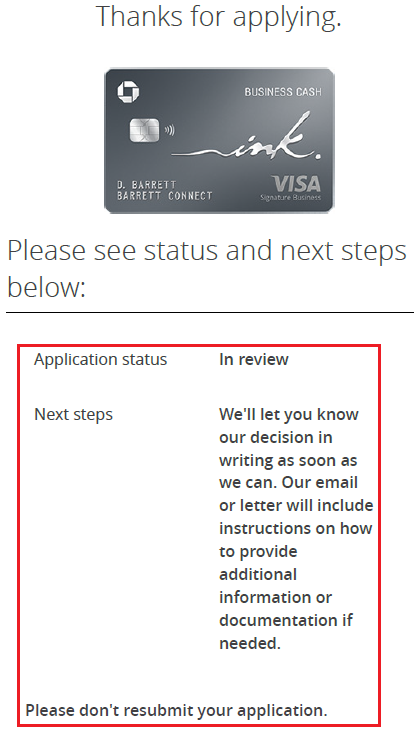

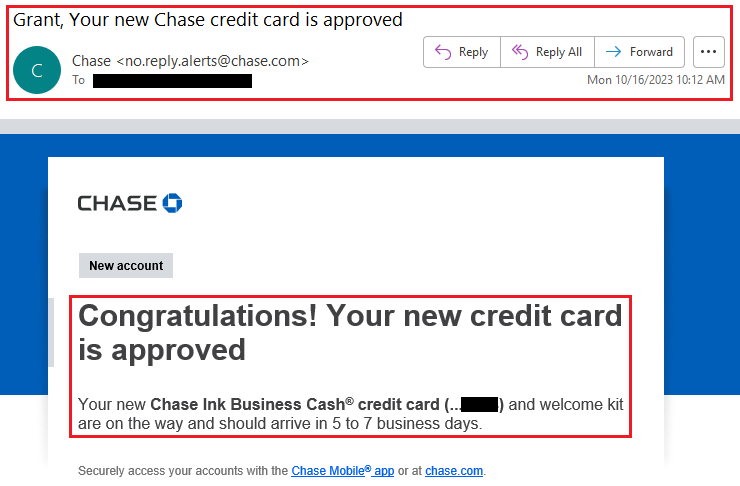

Up next, I applied for the Chase Ink Business Cash Credit Card that has a 90,000 Chase Ultimate Rewards Points signup bonus after spending $6,000 in 3 months.

Unfortunately, my application was not instantly approved, so I decided to wait a few days and see what would happen with this application.

3 days later, my application was approved without contacting Chase. This is my 5th Chase business credit card (I already have the Ink Plus (no longer available), Ink Preferred, Marriott Business (no longer available), and IHG Business cards). I was 2/2 at this point.

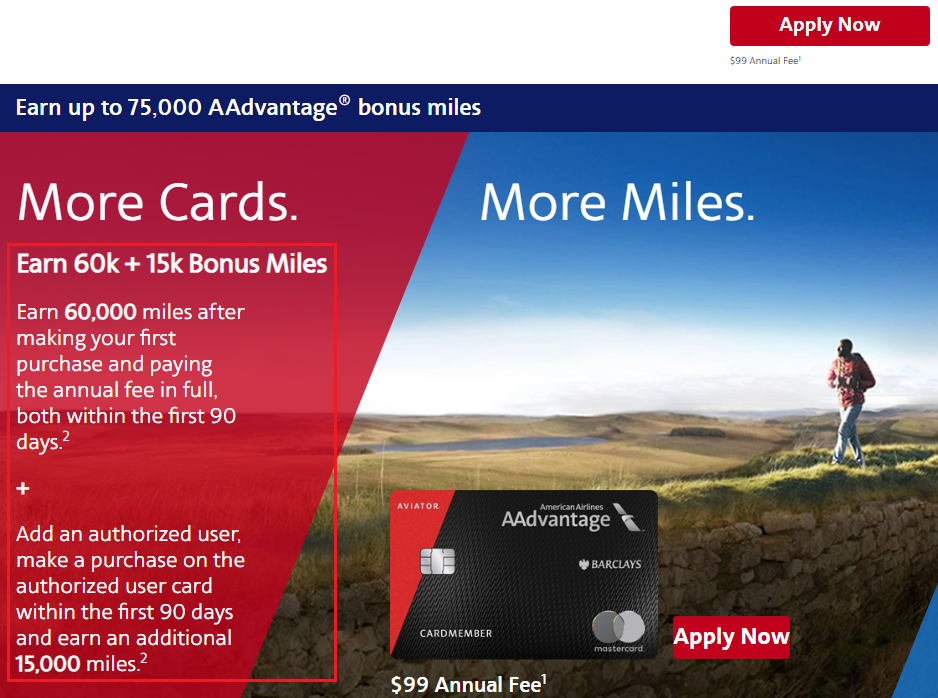

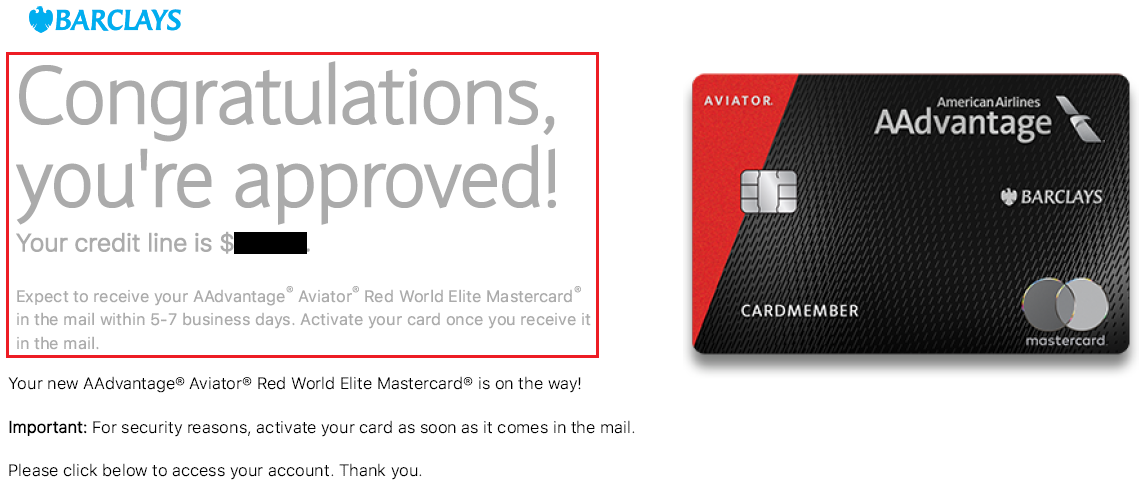

Up next, I applied for the Barclays AAdvantage Aviator Red Credit Card that has a 75,000 American Airlines Miles sign up bonus after adding an authorized user and making a single purchase on your card and the authorized user card.

Luckily, I was instantly approved! I was 3/3 at this point. I had 3 other Barclays credit cards when I applied for this card (Wyndham Earner Business, Wyndham Rewards (old card, no longer available), and AAdvantage Aviator Business).

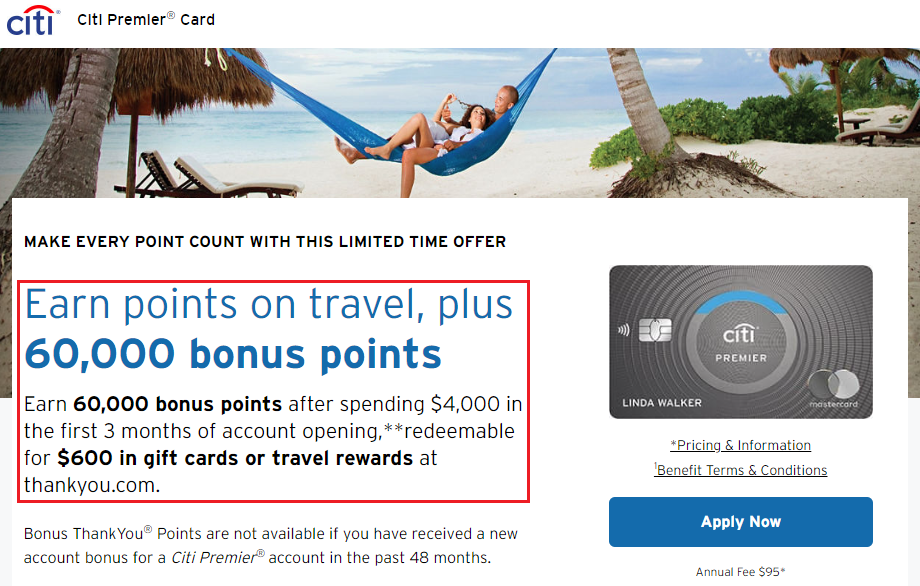

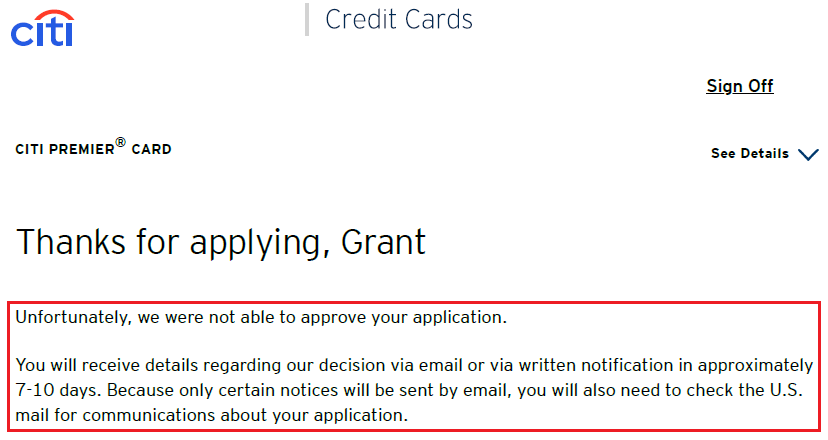

Up next, I applied for the Citi Premier Credit Card that has a 60,000 Citi ThankYou Points sign up bonus after spending $4,000 in 3 months.

Unfortunately, I struck out here since Citi did not approve my application. I called the Citi reconsideration department but was told that they couldn’t share the reason with me and that I had to wait for the letter in the mail. When I received the letter, it said that I had “too many recent inquiries” and when I called the reconsideration department back, they told me there was no way to override that decision. Frequent Miler just posted a possible reason for my denial: Possible Citi 5-day rule causing denials for “too many inquiries”. At this point, I already had 7 other Citi cards and was hoping to get a second Citi Premier. I was 3/4 at this point.

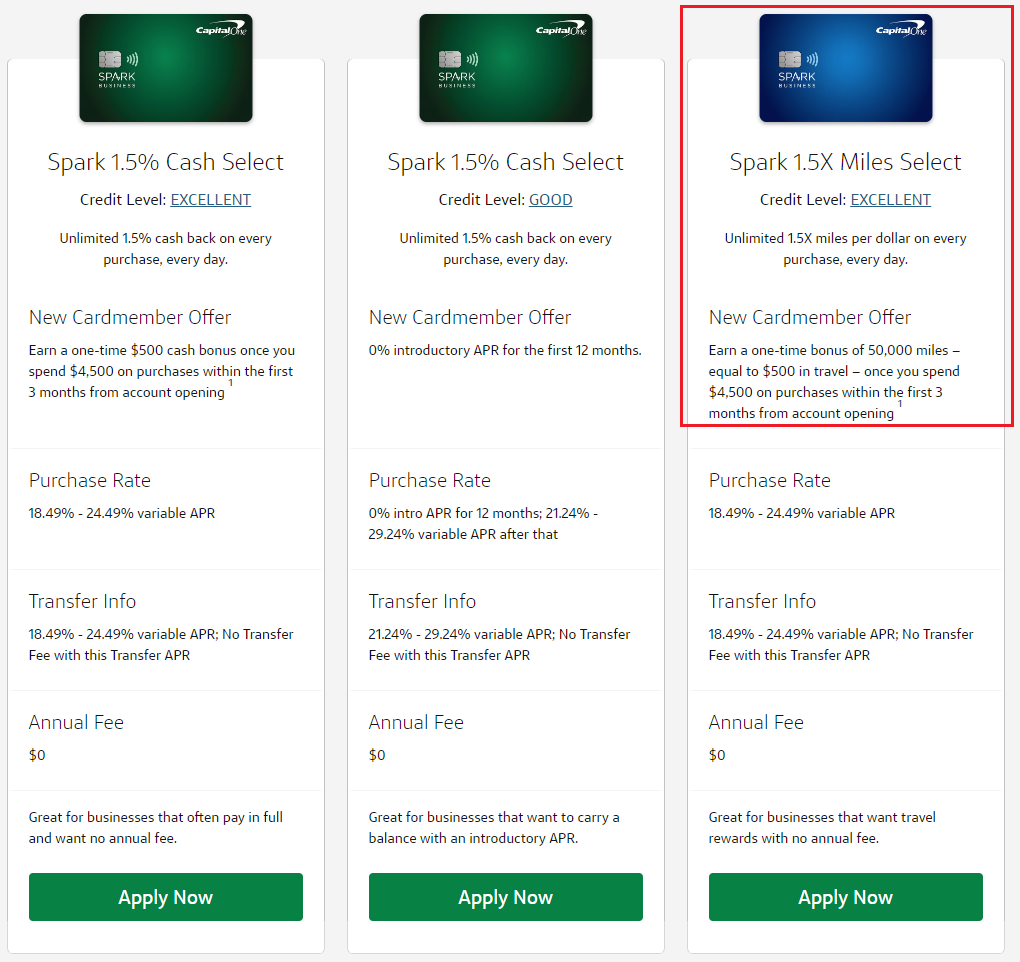

Up next, I applied for the Capital One Spark Miles Select Business Credit Card that has a 50,000 Capital One Miles sign up bonus after spending $4,500 in 3 months.

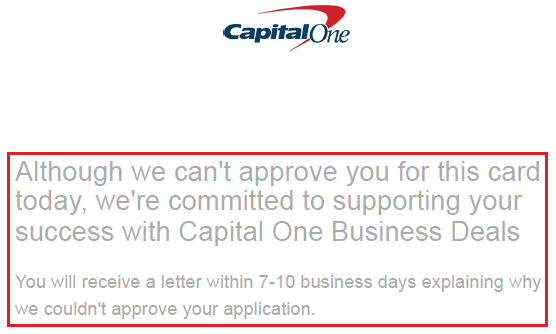

Unfortunately, I struck out here since Capital One did not approve my application. I called the Capital One reconsideration department but was told that they couldn’t share the reason with me and that I had to wait for the letter in the mail. At this point, I already had the Capital One Venture X Credit Card and Capital One Spark Cash Select Business Credit Card. I haven’t received the letter yet, so I called back to see if they would let me move credit from my existing Capital One business credit card to this card, but was told that is not possible. I don’t think there is much hope for me with this card. I was 3/5 at this point and decided to stop applying for any more cards.

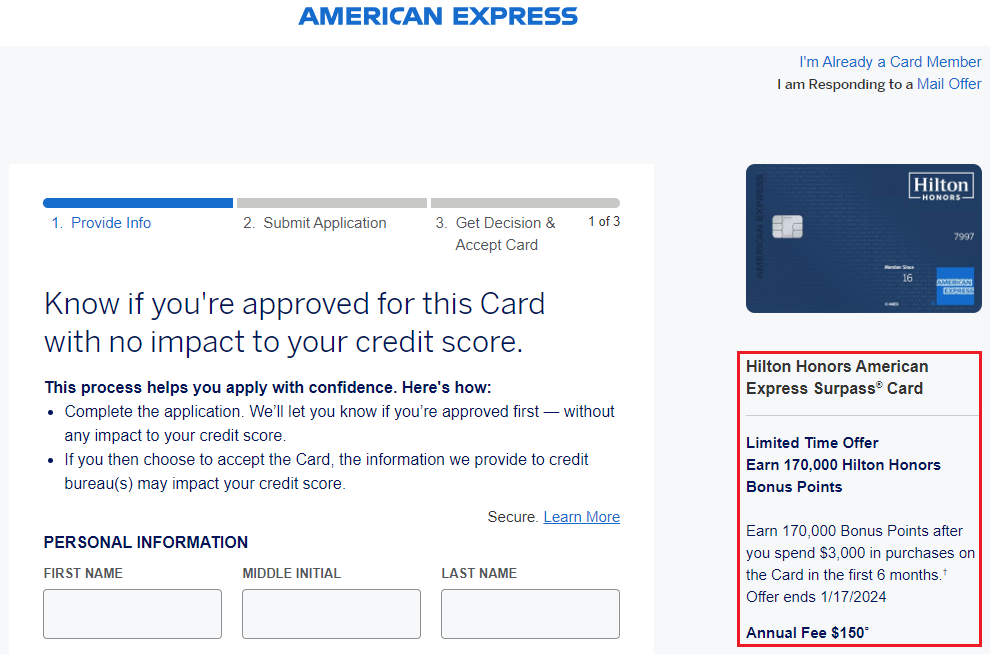

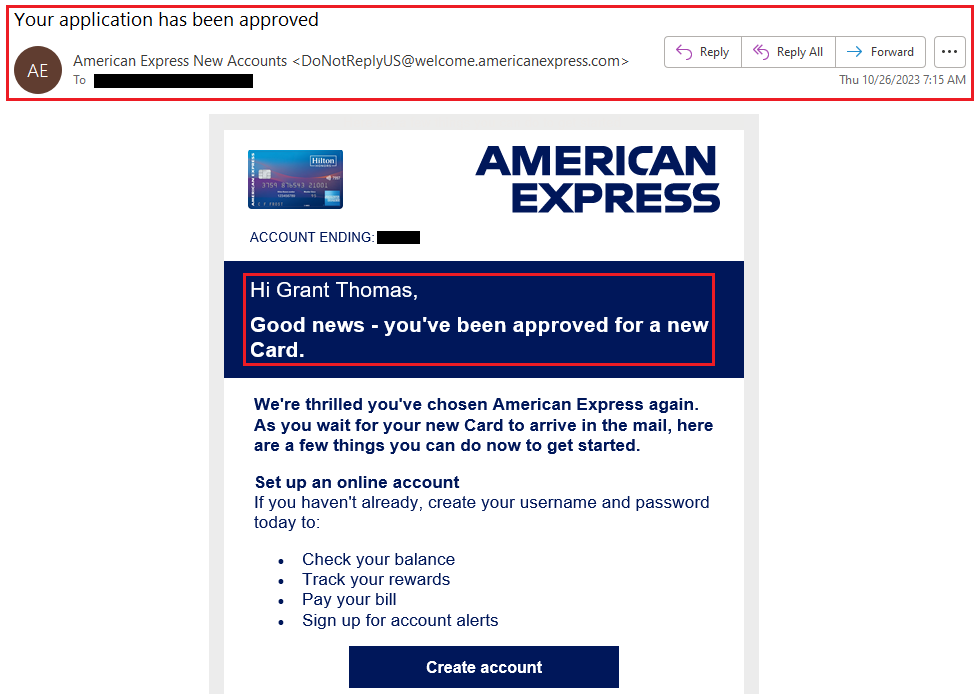

About 2 weeks after applying for the 5 cards above, Doctor of Credit wrote a post about American Express Hilton No Lifetime Language Offers and the American Express Hilton Honors Surpass Credit Card that had a 170,000 Hilton Honors Points sign up bonus after spending $3,000 in 6 months. I had the Surpass card years ago but now I only had the no annual fee American Express Hilton Honors Credit Card. I decided to apply for this card and see if I would get the pop up or get approved. As mentioned above, since I have existing AMEX cards, there was no credit check.

My application was initially declined since I had too many existing American Express credit cards (no open credit card slots), so I called the American Express reconsideration department and asked if I could move my credit limit from my no annual fee Hilton card to this new Hilton Surpass card. The agent said yes and proceeded to close my Hilton card and move the credit to my new Hilton Surpass card. I received the approval email after the call. By now, I was 4/6 at this point and *really* decided to stop applying for any more cards.

To summarize, here are the 4 new credit cards, sign up bonus, and minimum spending requirements:

- American Express Blue Business Plus Credit Card – 75,000 American Express Membership Rewards Points – $15,000 in 12 months.

- Chase Ink Business Cash Credit Card – 90,000 Chase Ultimate Rewards Points – $6,000 in 3 months.

- Barclays AAdvantage Aviator Red Credit Card – 75,000 American Airlines Miles – first purchase.

- American Express Hilton Honors Surpass Credit Card – 170,000 Hilton Honors Points – $3,000 in 6 months

Between property taxes, home / car / life insurance, home improvements, and everyday spending, I should be able to knock out these sign up bonuses within the given time frames. I have already completed the minimum spending requirements for the Chase Ink Cash and Barclays Aviator Red cards and am now working on the Hilton Surpass card. I have a Hilton stay next week, so I am excited to test out the $50 statement credit / quarter at Hilton properties. If you have any questions about any of the credit cards mentioned above, please leave a comment below. Have a great weekend everyone!

Been so long since I’ve looked at Chase due to 5/24. Is that still a rule? How do biz cards work in whatever equation exists?

Yes, 5/24 is still a thing. You can apply for Chase biz CCs when you are under 5/24 and they do not add to your 5/24 score. I was under 5/24 when I applied for the Chase Ink Cash, but I should be over 5/24 now, at least for the next few months.

Which credit card tracking site is best for seeing what you’ve actually acquired in the past 24 months?

So if you’re over 5/24 you cannot be accepted for Chase biz cards?

I keep a spreadsheet of all my credit card applications, including personal and business, whether approved or declined, and that’s what I do. You can also mix and match data from the credit bureaus and credit card portals, like Chase Credit Journey and Discover Credit Scorecard.

nice haul, thanks for the write up. I presume you applied for all except the hilton card at the same time, rather than waiting for a reply for each?

Hi Tom, yes, I applied for the first 5 credit cards on the same day probably within a 20-30 minute period. Glad you enjoyed the post :)

When you applied for a 2nd Amex Blue Business Plus, did you click the button that says login for a shorter application? If I do the login it says the offer (50k) is no longer available. But I guess without it I may be approved and still receive 50k.

Hi Nun, for my second BBP, I did not click the sign in for a shorter application and filled in the complete application.