Good morning everyone, I hope your week is going well. A few days ago, I was in Daytona Beach, Florida, when the news broke about the changes to the Delta credit cards (read Frequent Miler’s post about the changes). I currently have the American Express Platinum Delta SkyMiles Business Credit Card and was excited about the new benefits. In this post, I will talk about the new $120 Resy Credit and my experience using the Resy credit.

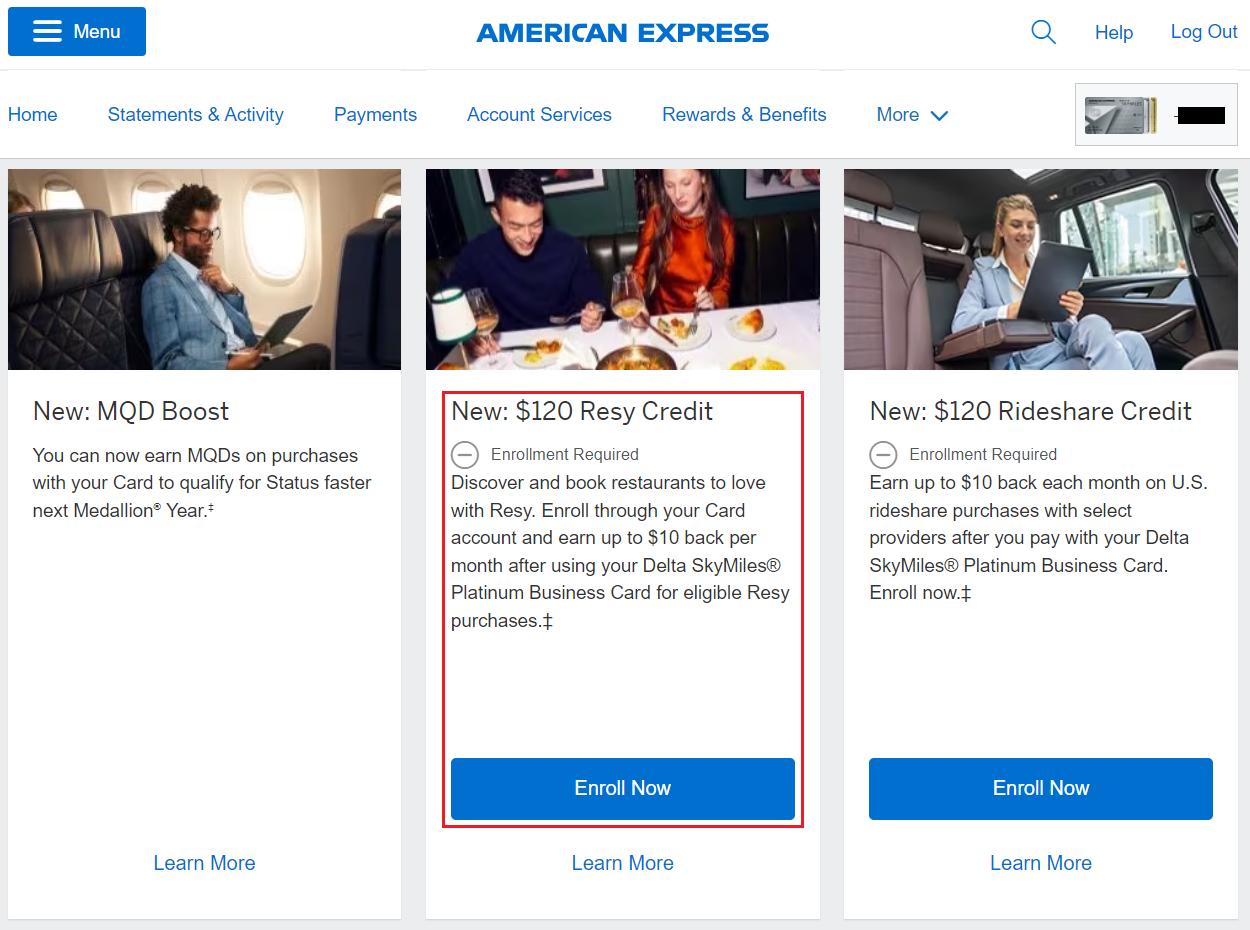

First things first, you need to log into your American Express online account, go to the Benefits tab, and enroll in the $120 Resy Credit. While you are there, you should also enroll in the $120 Rideshare Credit too.

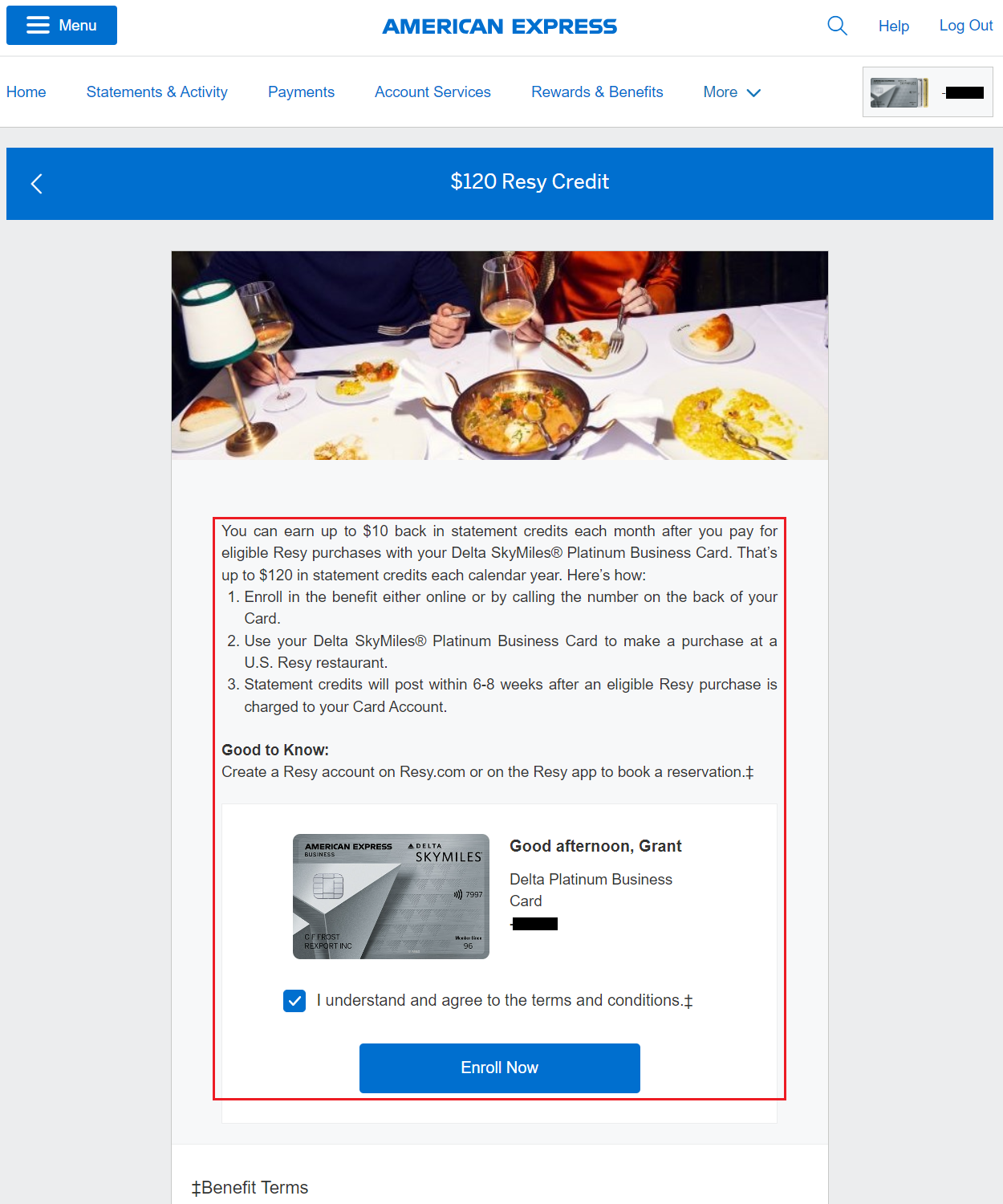

The $120 Resy Credit is a $10 / month statement credit that you receive after you spend $10+ at a Resy restaurant. Scroll down, check the box, and click the Enroll Now button.

Here are the complete terms and conditions for the $120 Resy Credit:

Enrollment is required to receive this benefit. Only the Basic Card Member or Authorized Account Manager(s) on a Delta SkyMiles Platinum or Platinum Business American Express Card Account can enroll in the benefit. Please note, enrollment may take up to 24 hours to take effect on your Card. Enrolled Basic Card Members can earn up to $10 in statement credits each month when the Basic Card or an Additional Card on the enrolled Account is used to pay for eligible Resy purchases. Eligible Resy purchases can be made by both the Basic Card Member and Additional Card Members on the enrolled Card Account. However, the total amount of statement credits for eligible Resy purchases will not exceed $10 per month, for a total of $120 per calendar year in statement credits, per Card Account.

Eligible Resy purchases include purchases at U.S. restaurants that offer reservations on Resy.com and the Resy app, and purchases made directly on Resy.com or in the Resy app. Restaurants must be live on Resy.com or the Resy app at time of purchase to be eligible for the statement credit and are subject to change at any time. Purchases made via Resy Pay and purchases of Resy OS restaurant management software are not eligible.

Please allow 6-8 weeks after an eligible Resy purchase is charged to the enrolled Card Account for statement credit(s) to be posted to the Account. Please call the number on the back of the Card if statement credits have not posted after 8 weeks from the date of purchase. American Express relies on the merchant’s processing of transactions to determine the transaction date. The transaction date may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, the January statement credit would be applied. Transactions received more than 120 days from the transaction date will not be considered eligible Resy purchases.

If American Express does not receive information that identifies the transaction as an eligible Resy purchase, the Basic Card Member will not receive the statement credit. For example, the transaction may not be eligible if it is not made directly with the merchant, if it is made at a merchant located within another establishment (e.g. a restaurant inside a hotel or department store), or if it is for a non-dining purchase (e.g. merchandise or gift card). Only one statement credit per transaction will be issued. In addition, in most cases, Basic Card Members may not receive the statement credit if the transaction is made with an electronic wallet or through a third party (such as an app store) or if the merchant uses a mobile or wireless card reader to process it.

To be eligible for this benefit, Card Account(s) must not be canceled and not past due at the time of statement credit fulfillment. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide statement credits and may reverse any statement credits provided to you. If you are enrolled in the benefit and replace your Card, please check the Benefits section of your americanexpress.com account, mobile app or call the number on the back of your Card to confirm your continued enrollment in the benefit. For additional information, call the number on the back of your Card.

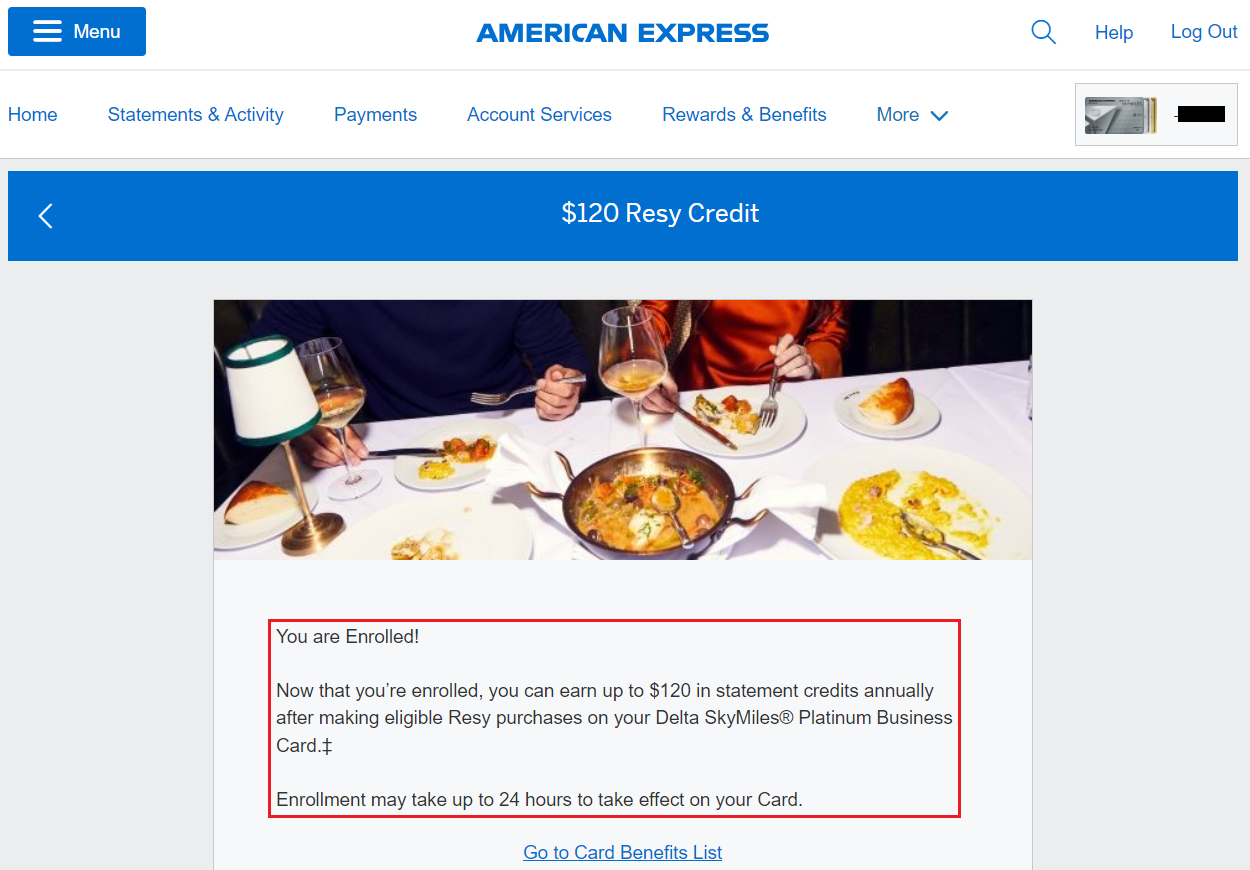

After you enroll, you will see this message. It also mentions that “Enrollment may take up to 24 hours to take effect on your Card” so don’t try to use the $10 Resy Credit right away.

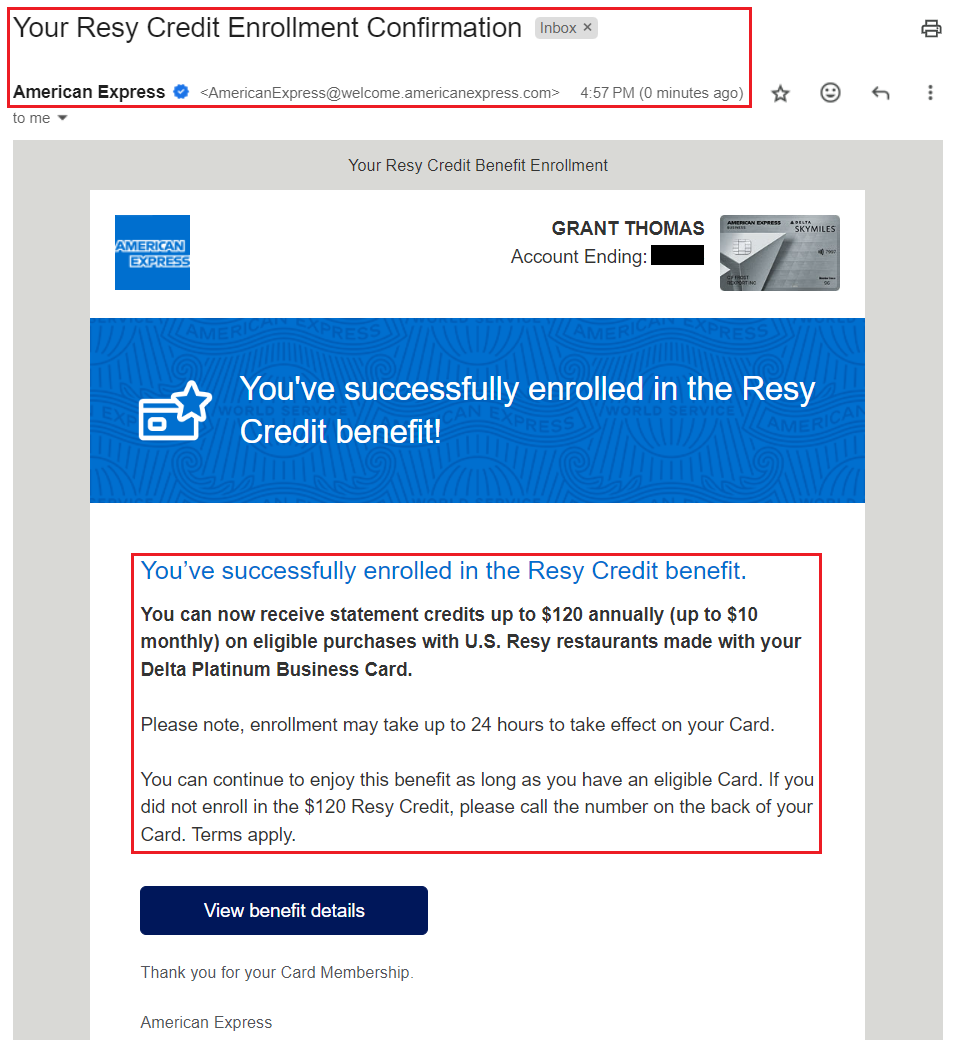

You will also receive a confirmation email after you enroll in the Resy benefit. I enrolled at 4:57pm ET on Saturday.

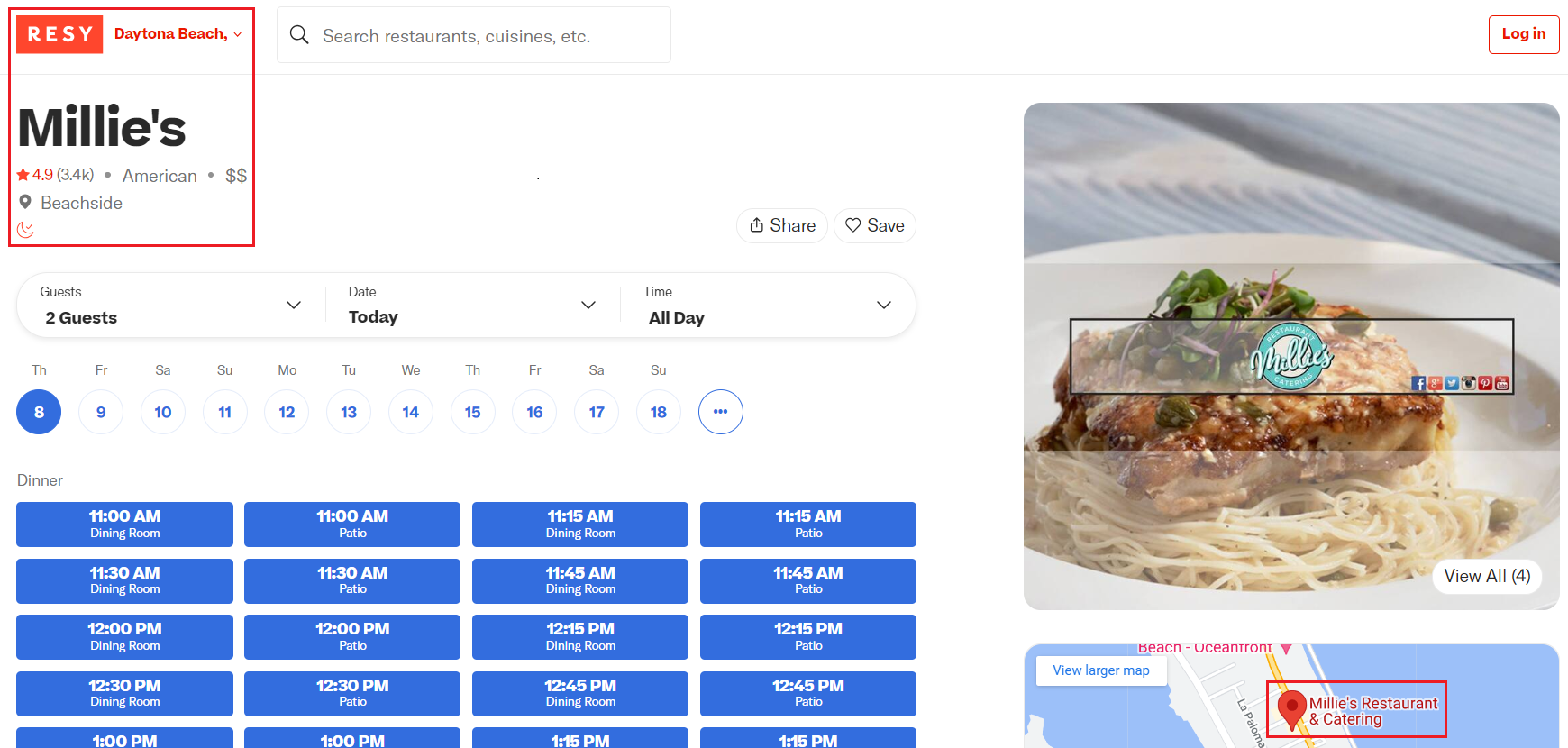

I looked on the Resy website and found only 1 Resy restaurant close by: Millie’s Restaurant & Catering. I checked out the menu and decided to get the Alligator Ribs (since I can’t get these back home in California). We went to the restaurant around 4:30pm ET on Sunday (which is technically less than 24 hours from enrollment, but close enough). I didn’t have my Delta credit card with me, but I was able to add the card to my Apple Wallet and use ApplePay at the restaurant for a to go order.

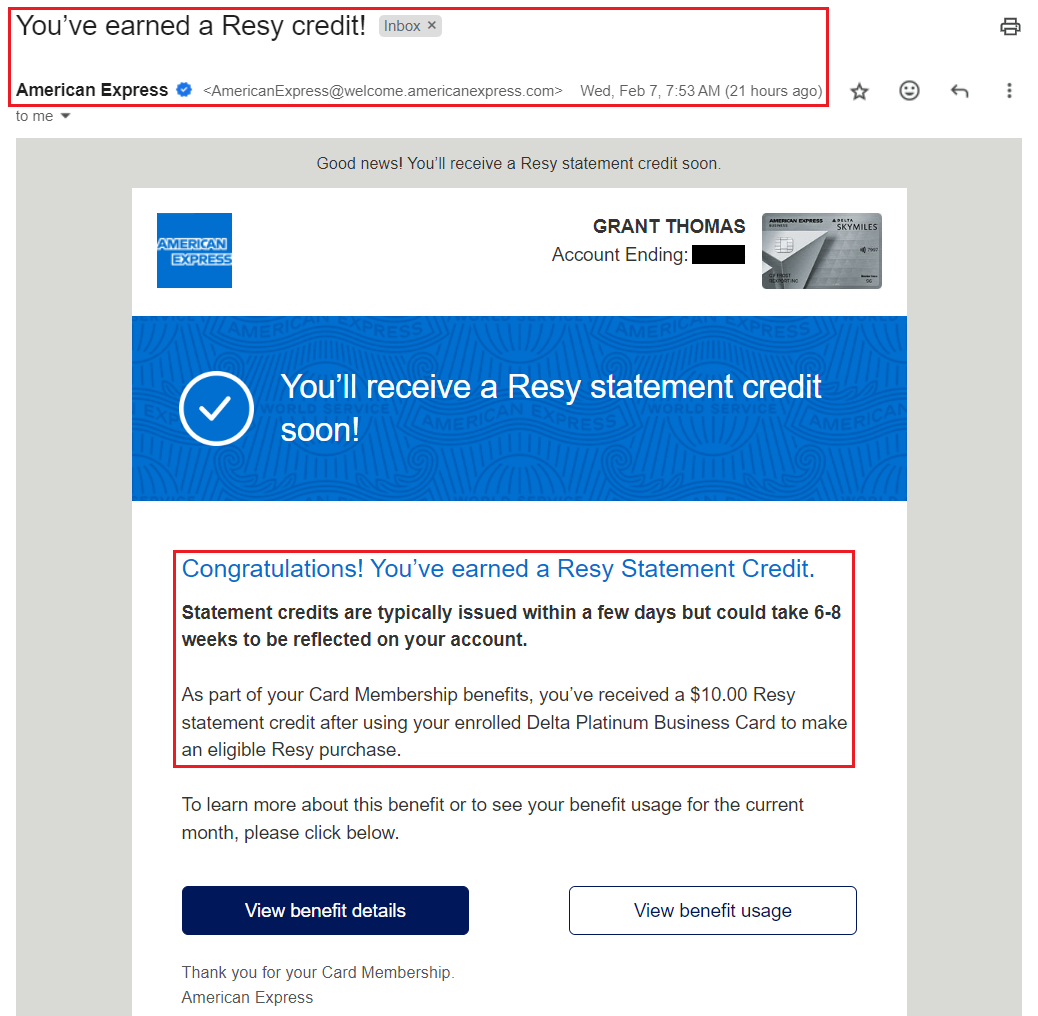

3 days later, I received an email from American Express that said I had earned the Resy credit.

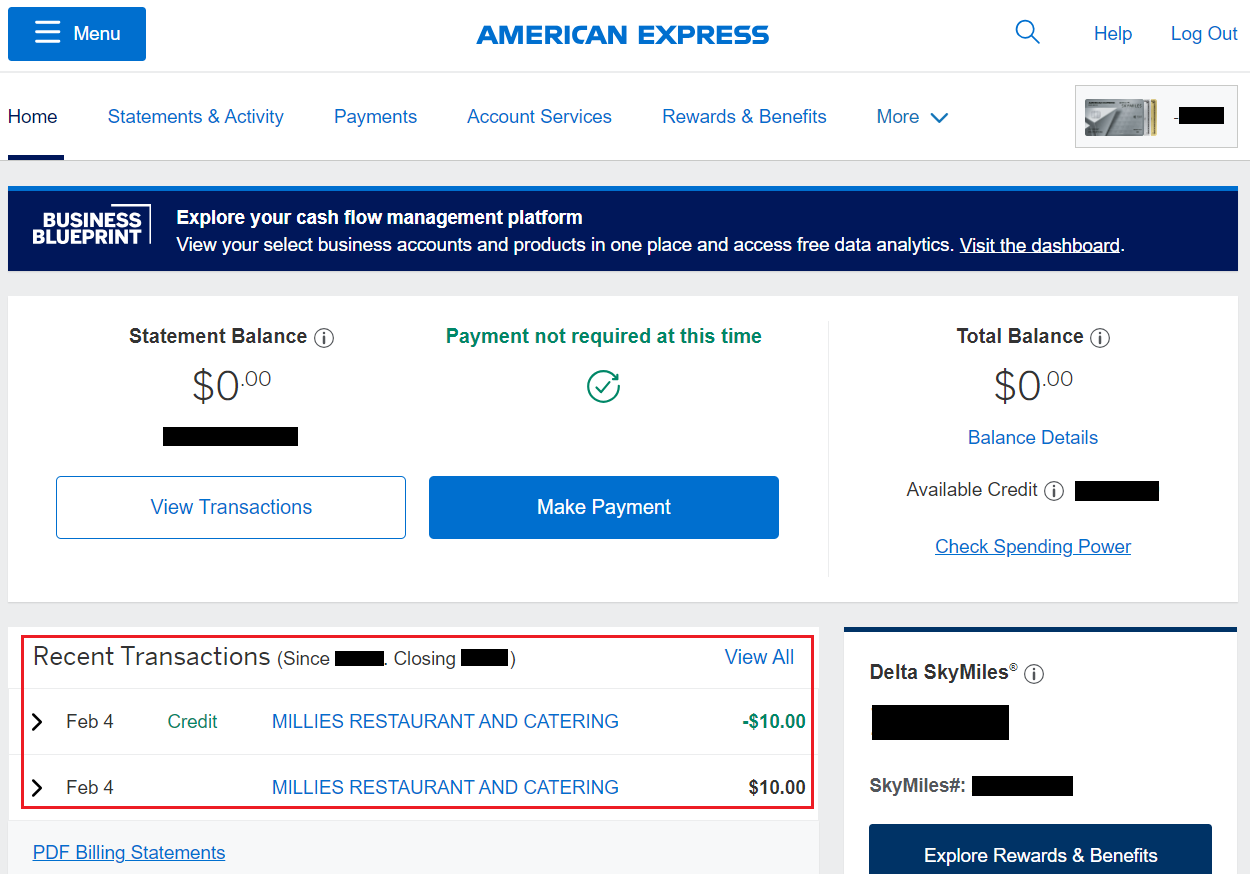

The following day (today), I logged into my American Express account and saw that both the $10 Millie’s purchase and the $10 Resy Credit posted.

The credit is pretty easy to use, you do not need to create a Resy account or link your Delta credit card to your Resy account. I just wish there were more Resy restaurants to pick from, but that will depend on your city. If you have any questions about the $10 Resy Credit, please leave a comment below. Have a great day everyone!

Glad this worked for you, Grant. I enrolled Thursday when the benefit launched, used it Friday night (even securing our table by making a Resy reservation) and still nada nearly a week later. This is so Amex. The Resy Amex Offer last fall took months to post for one of the two restaurants. I miss the old days when Amex posted things semi-immediately.

Hi Carl, AMEX Offers seem to post very quickly or very slowly, with no rhyme or reason. I’m not sure what causes the delay but it’s frustrating that the credits do not post at a steady cadence. Hopefully your Resy credit posts soon.

Any ideas how to get value from these credits for those who have no Resy restaurants nearby? This is yet another new AMEX coupon geared towards those living in big cities.

Hi Benjamin, that’s a great question. I haven’t figured out any workarounds besides dining at a Resy restaurant. If you have friends or family in other cities that have a Resy restaurant, you could consider getting them an AU card to spend $10 at a Resy restaurant every month. Not sure how practical that is, but that’s my only suggestion.

I grabbed a beer at a local bar (I live in Astoria, NY) and it came out to $10.13 (tip included in that). The credit posted a day later. Worked like a charm!

That’s awesome, glad your beer and tip triggered the $10 Resy credit :)