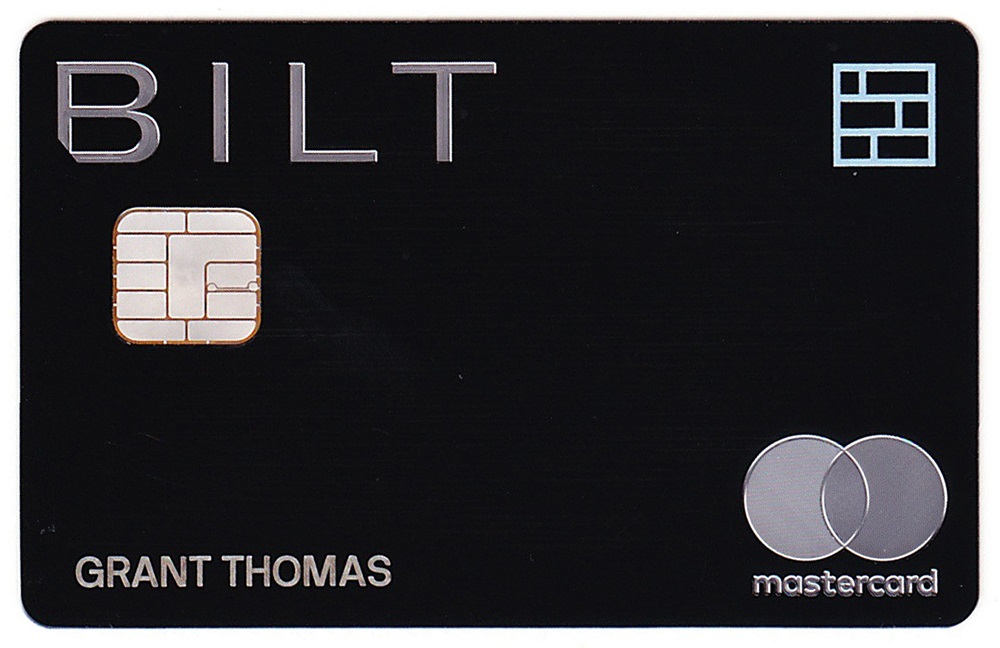

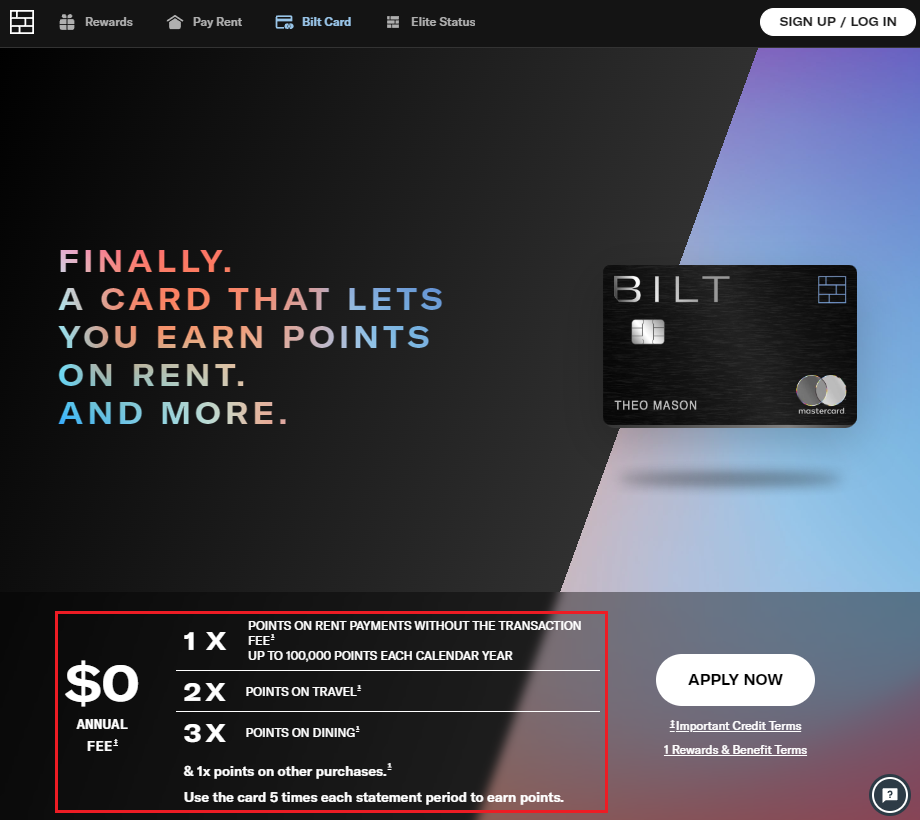

Good morning everyone, I hope your weekend is off to a great start. The Bilt Credit Card has been around for a few years, but I never thought the card was for me. I haven’t paid rent since 2017 and earning 3x on dining, 2x on travel, and 1x everywhere else didn’t excite me. That was until I read Frequent Miler’s post: How Nick built his own Bilt bonus. I finally understood that I could use the Bilt Credit Card without paying rent and still get excellent value from the card. I will explain my earning and redeeming strategy below. But first, let’s go through the application process. Here is the front and back of my shiny new Bilt Credit Card. The card has a very premium look and feel to it, but has no annual fee.

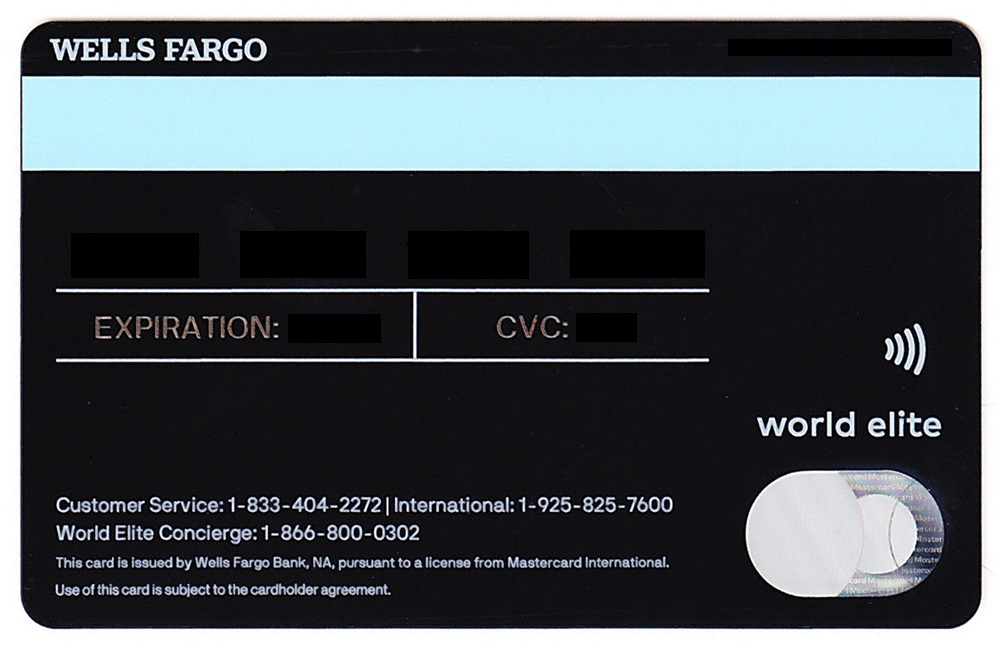

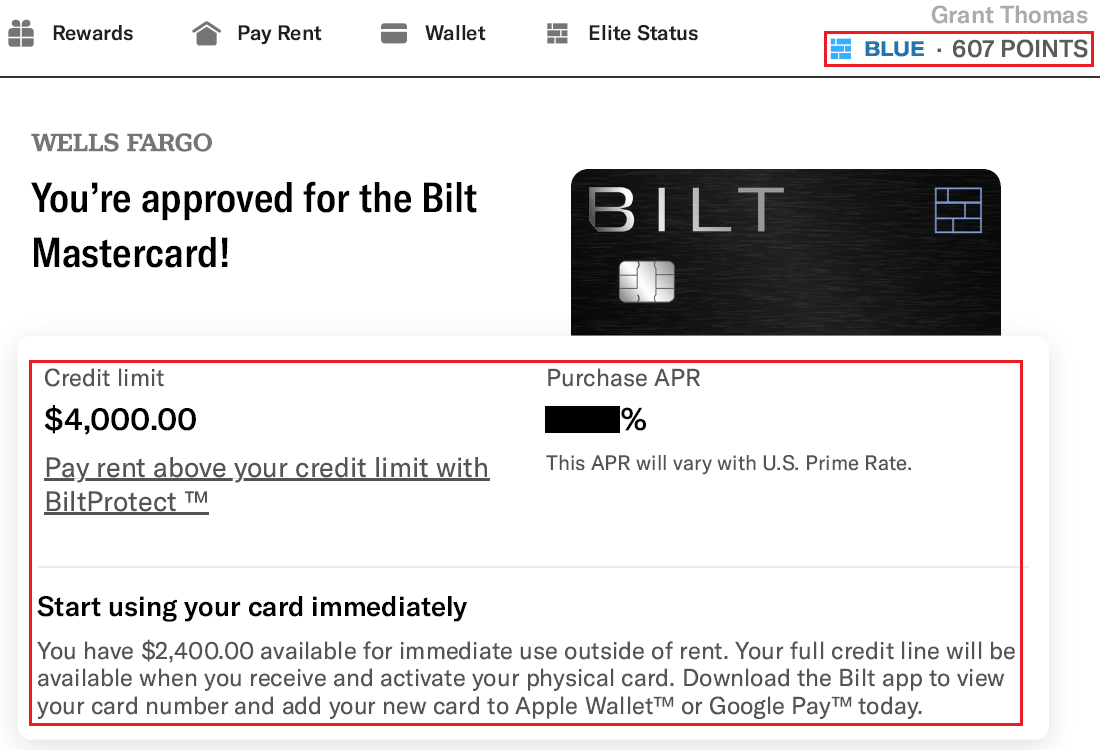

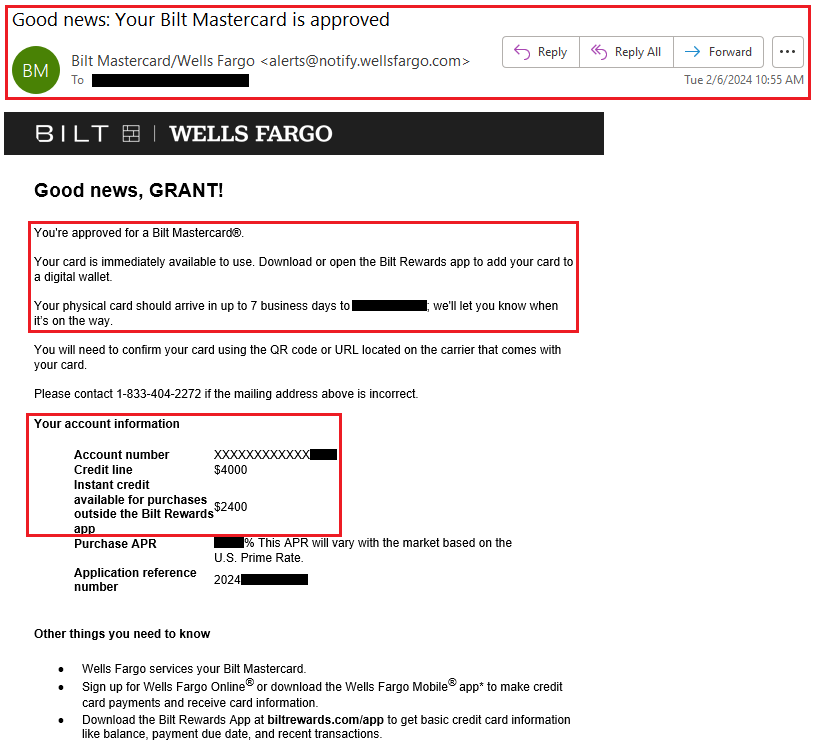

I applied for the card through a referral link, I went through the Bilt / Wells Fargo identity verification process, and I was instantly approved for the card on Tuesday morning (2/6). I was surprised to see that I was only approved for a $4,000 credit limit since I applied for 2 other credit cards after the Bilt Credit Card and was approved for a $22,000 credit limit on a Bank of America Air France / KLM Credit Card and a $17,200 credit limit on a Barclays JetBlue Plus Credit Card. If you do not want to wait for your card to arrive in the mail (and I highly recommend that you wait), you can add your card to your mobile wallet and use a subset of your credit limit right away ($2,400 in my case).

I also received an approval email that said my new card would arrive in the next 7 business days. The email also showed my $4,000 credit limit and the $2,400 credit limit I could use right away.

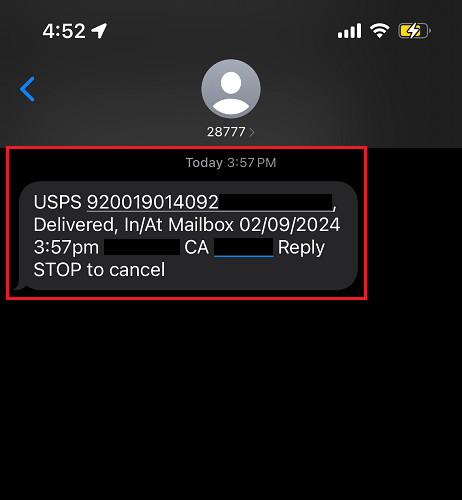

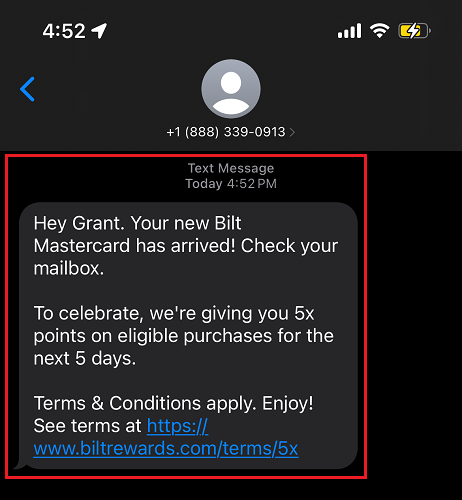

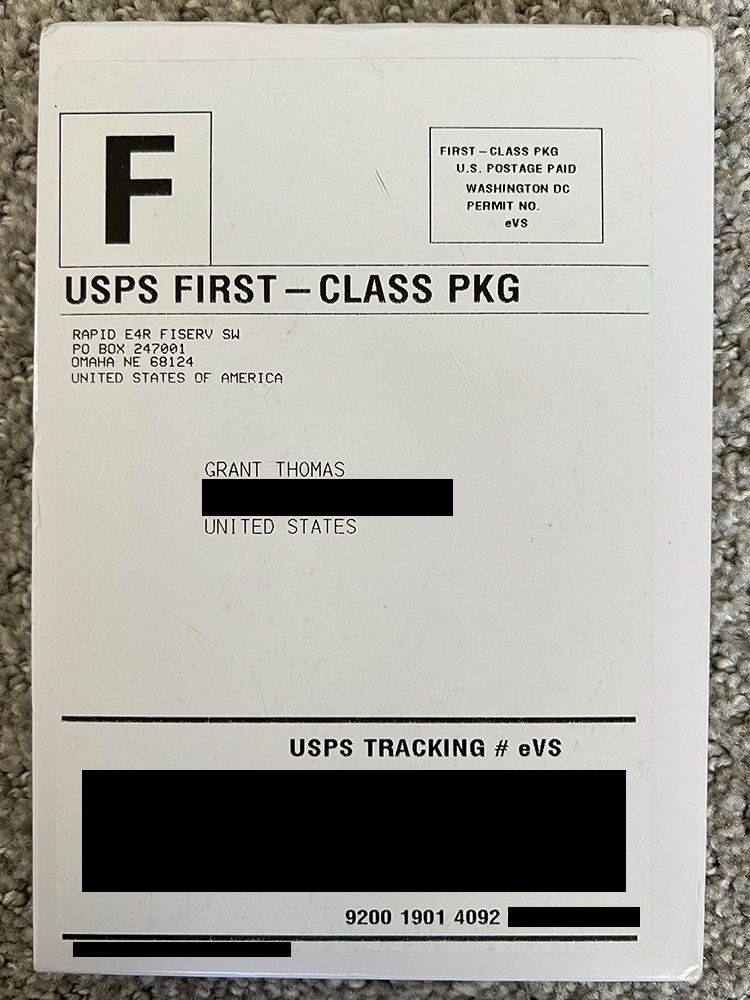

I never received an email from Bilt when my new card was mailed, but I did get a text and email shortly after the card was delivered. I always wondered how Bilt knew when their card was delivered, but since Bilt ships the card in a small box with USPS First Class Mail tracking, it is easy for them to know when it gets delivered. The package was delivered at 3:57pm on Friday (2/9) and Bilt sent me a welcome text an hour later at 4:52pm.

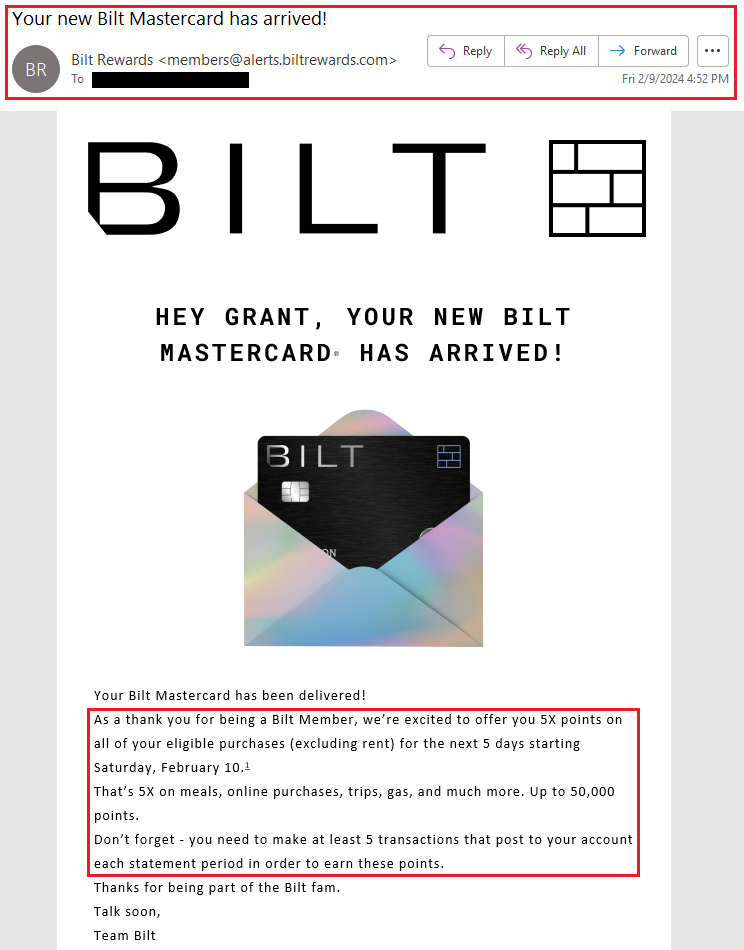

I also received a welcome email from Bilt that said I was eligible for “5X points on all of your eligible purchases (excluding rent) for the next 5 days starting Saturday, February 10. That’s 5X on meals, online purchases, trips, gas, and much more. Up to 50,000 points.” To maximize the “sign up bonus,” you need to spend $12,500 in order to earn 50,000 bonus Bilt points. It was interesting that my card arrived late in the day on Friday and that the spending offer started on Saturday. I wonder if the card is delivered late in the day, the spending offer will start the next day. Alternatively, if my card was delivered early in the day, would the spending offer start the same day?

Let’s get to the card unboxing now. Here is the small white box that the card was shipped in. It came from RAPID E4R FISERV SW in Omaha, Nebraska. I’m impressed that the card arrived in California 3 days after approval. If you live closer to Omaha, Nebraska, your card should arrive even quicker.

Inside the white box, there was a smaller black box. I pulled the pink part out from the right side of the box…

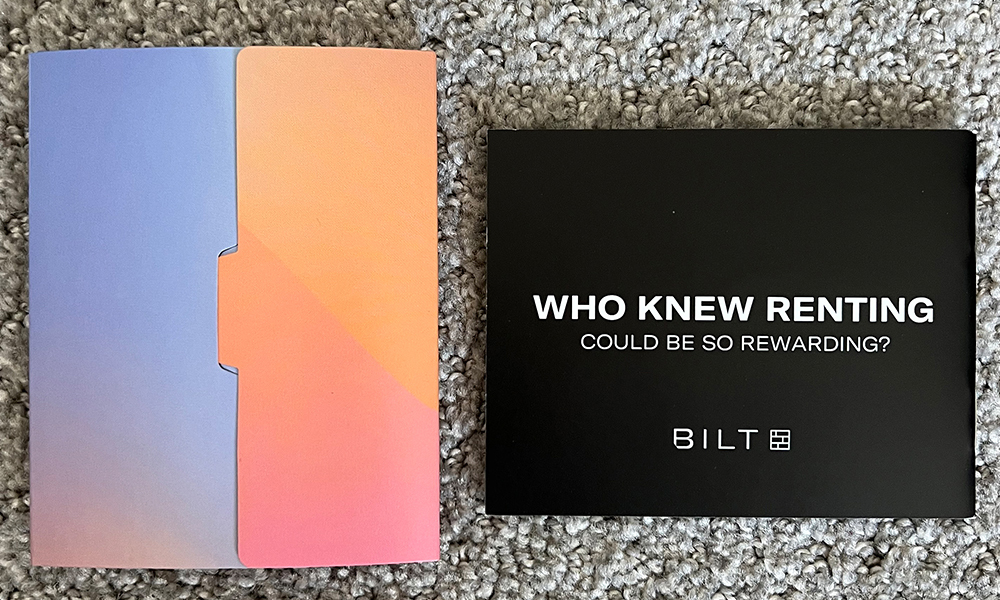

…and the Bilt Credit Card popped out from the left side. Bilt really put a lot of thought into the design of this card packaging, including the messaging on the back of the box. I’ve seen some really cool credit card unboxings, but those were all ultra premium credit cards. Remember, the Bilt Credit Card has no annual fee.

On the right side, inside the colorful box, there is information about the Bilt Rewards program and the various features of the program.

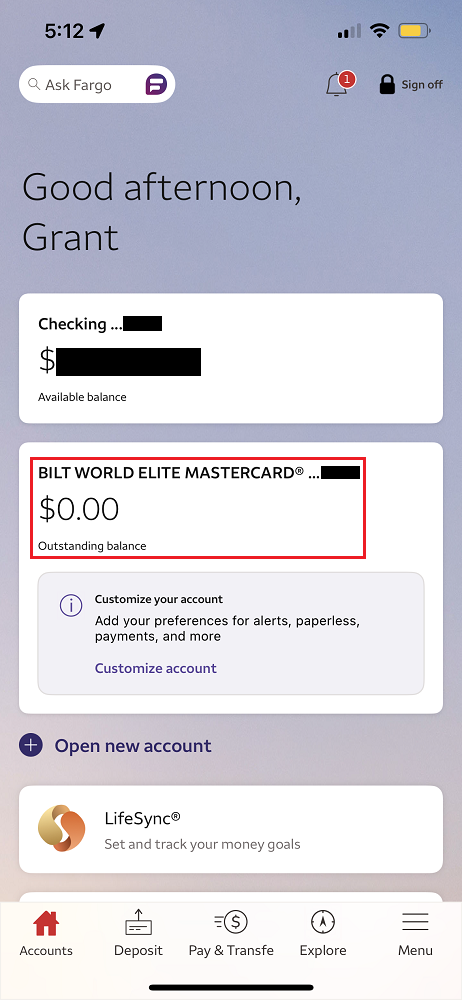

I activated the card online and it instantly appeared in my Wells Fargo online account. This is convenient since Wells Fargo is my primary checking account, so paying my Bilt Credit Card will be easy.

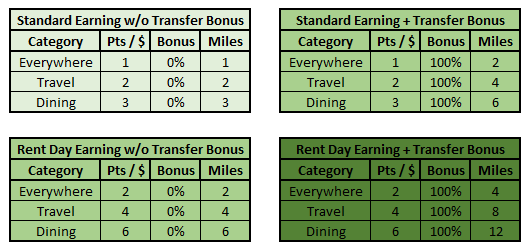

Let’s go back to the card earning structure: 1x everywhere, 2x on travel, and 3x on dining.

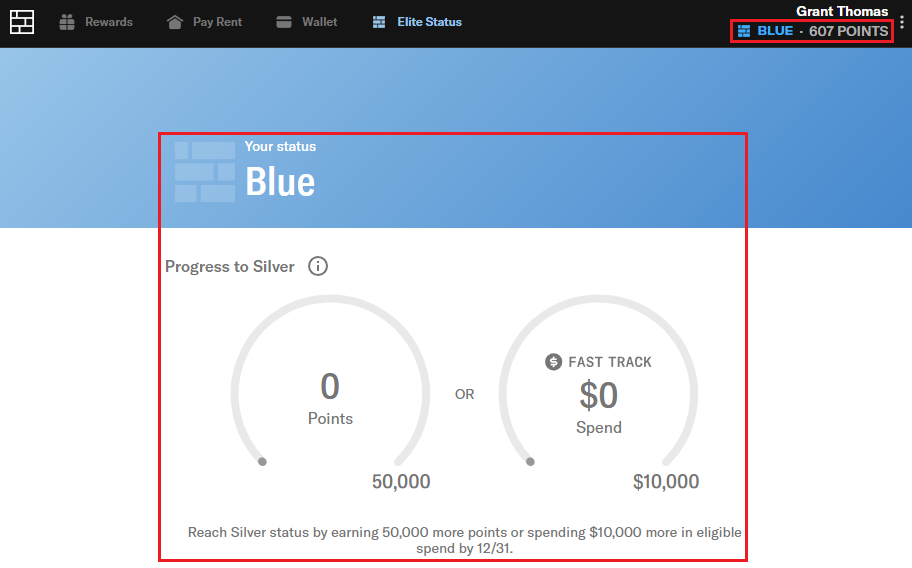

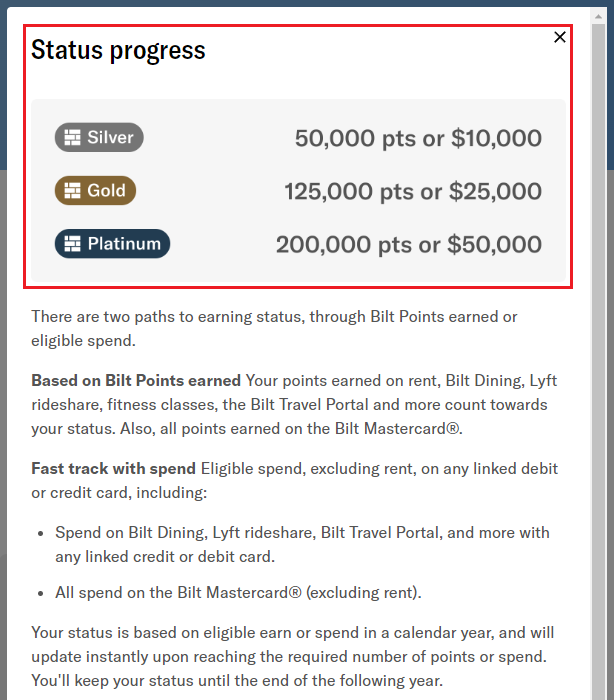

All new Bilt members start with Blue Status. Once you earn 50,000 Bilt Points or spend $10,000 on the Bilt Credit Card, you will achieve Silver Status. I should achieve Silver Status after spending $12,500 to max out my “sign up bonus.”

To reach Gold Status, you will need 125,000 Bilt Points or spend $25,000 on the Bilt Credit Card. And to reach Platinum Status, you will need 200,000 Bilt Points or spend $50,000 on the Bilt Credit Card. Here is more info about Bilt elite status tiers.

Every month on Rent Day (the first day of the month), Bilt card members earn double the usual spend and there is usually a transfer bonus to one of their partners. The amount of the transfer bonus is dictated by your level of Bilt Status. Lately, members with Silver Status have received 100% transfer bonuses to the specific Bilt partner on Rent Day. The sweet spot on the chart is to use your card to earn on Rent Day and then subsequently redeem your Bilt Points on another Rent Day (Bilt Points cannot be earned and redeemed on the same day).

For example, Dining is usually 3x, but on Rent Day, Dining is 6x. If you redeemed those 6x points with a 100% transfer bonus, you would receive 12x miles. Alternatively, if you earn your points outside of Rent Day (1x, 2x, and 3x), but transfer those points on Rent Day with a 100% transfer bonus, those points become 2x, 4x, and 6x miles. Even better, if you achieve Gold Status, the transfer bonus is usually 125% and if you achieve Platinum Status, the transfer bonus is usually 150%. You can really juice up your earning if you spend on Rent Day and achieve high level Bilt Status.

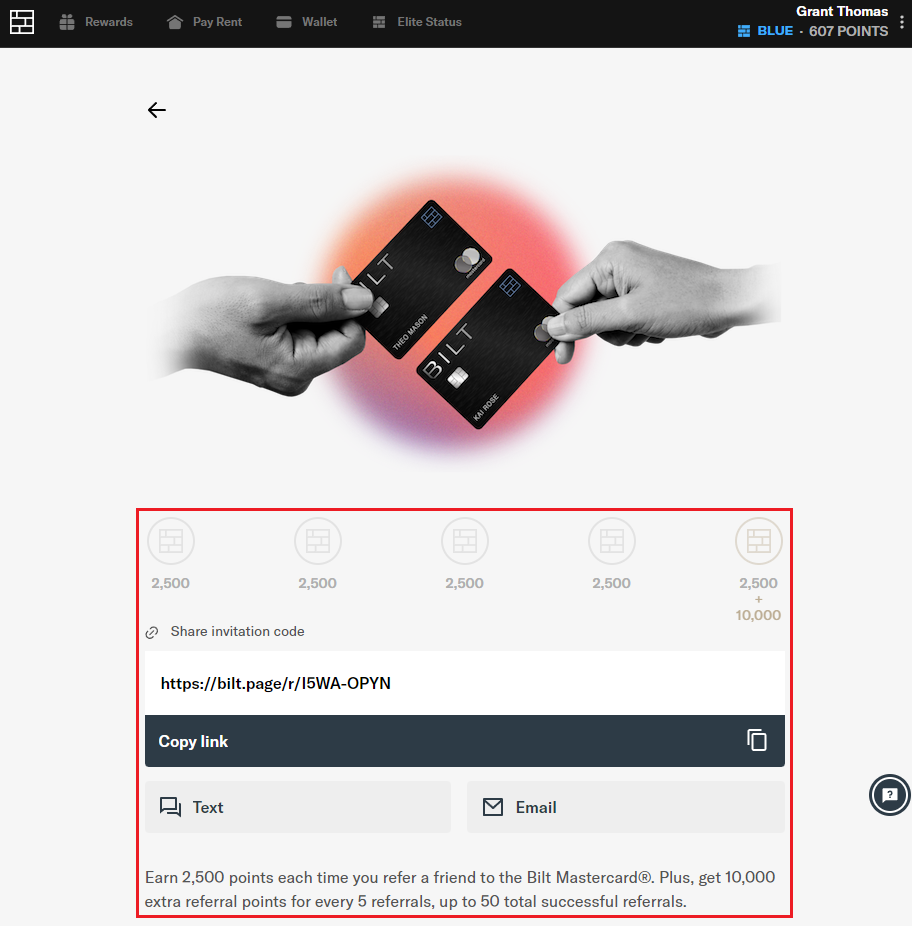

If you are interested in signing up for the Bilt Credit Card, here is my referral link. I really appreciate your support and I will earn 2,500 Bilt Points when you are approved.

If you have any questions about the Bilt Credit Card or Bilt Status, please leave a comment below. Have a great weekend everyone!

P.S. If you liked this post, I recommend reading my other credit card unboxing posts (sorted by date):

Interesting. I also got my card yesterday – but my 5x clock started yesterday per the email. I got my email at 3:01PM EST.

Hi John, that’s really interesting. So you got your Bilt card and email around 12pm PT and your 5x spend started immediately, whereas I got my Bilt card around 4pm PT and my 5x spend started the next business day.

Did you get an email that your Bilt card was mailed before the card was delivered?

With such a small credit limit, how can you meet the 12,5k spend in 5 days?

That’s a good question. I guess I will need to make some purchases and pay it off right away to free up the credit line. Not sure if that is possible.

Any idea if you can product change a WF cobranded card to Bilt?

Good question Dan. I’ve never heard any data points about that, but I would call Wells Fargo to find out. Worse they can say is no. Let me know what you find out. Thank you.

Maybe I missed it, but what’s your earning/use strategies? OK to be vague in detail.

I don’t have an exact earning structure since I don’t pay rent. I did put my $96 HOA monthly payment on my Bilt Card and try to make large purchases on the first of the month with this credit card.

For the redemption side, I have recently transferred a few points to my Alaska Airlines account to top up for an award. I am waiting for a useful transfer bonus in the coming months.

Awesome post, thank you for sharing your experience! This is greatly helping me plan before I apply

You’re welcome, good luck with your Bilt CC application :)