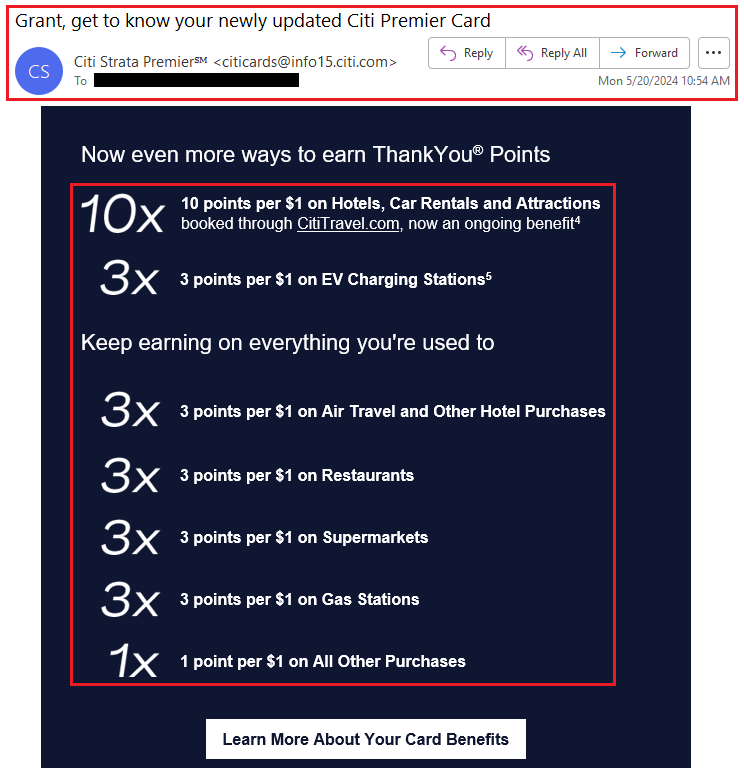

Good afternoon everyone, I hope you had a great weekend. Yesterday, I wrote my Deep Dive into Citi Strata Premier Credit Card Earning Categories & Travel Protections (Rental Car, Trip Interruptions & Lost Luggage). I wrote about the various travel-related earning categories and covered the 4 main travel protections on the new-ish Citi Strata Premier Credit Card. In this post, I will compare those earning categories and travel protections with the US Bank Altitude Reserve Credit Card. As a reminder, the Citi Strata Premier (CSP) earns 10x on hotels, car rentals, and attractions booked through the Citi Travel Portal and 3x on air travel, travel agencies, hotels, gas stations and EV charging stations.

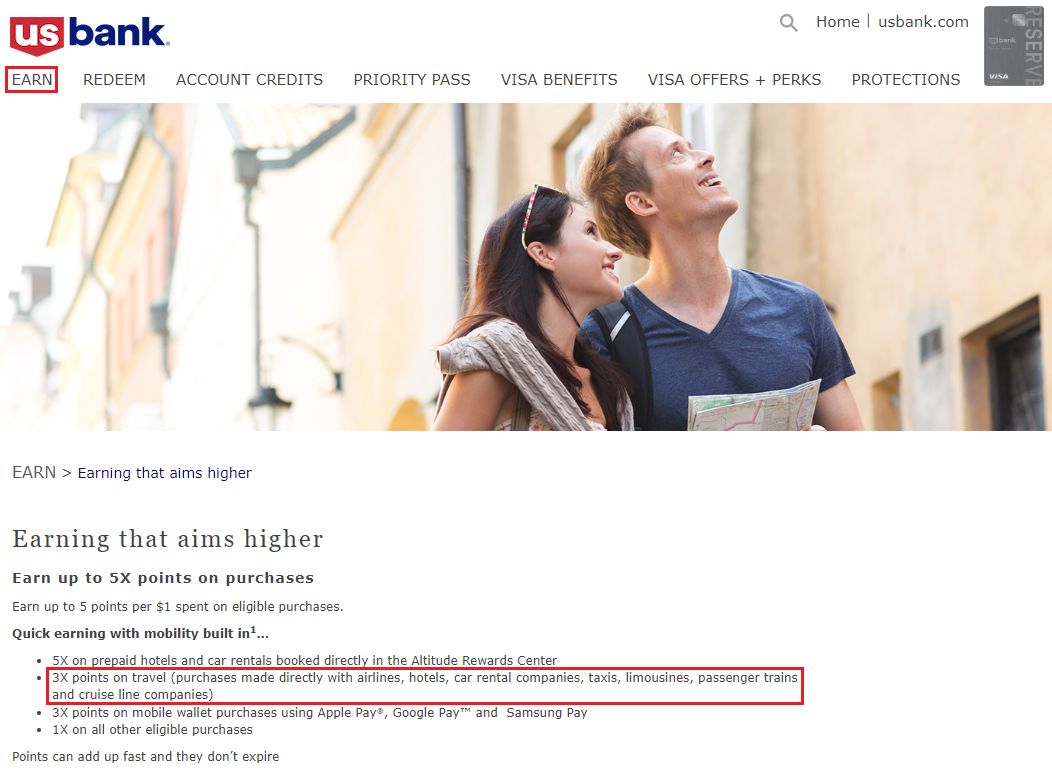

In comparison, the US Bank Altitude Reserve (USBAR) earns 5x on hotels and car rentals booked through the US Bank travel portal and 3x on purchases made directly with airlines, hotels, car rental companies, taxies, limousines, passenger trains, and cruise line companies. If we exclude the items that need to be booked through the various travel portals, both the USBAR and CSP have similar travel-related earning categories with some slight differences. Let’s call this round a tie.

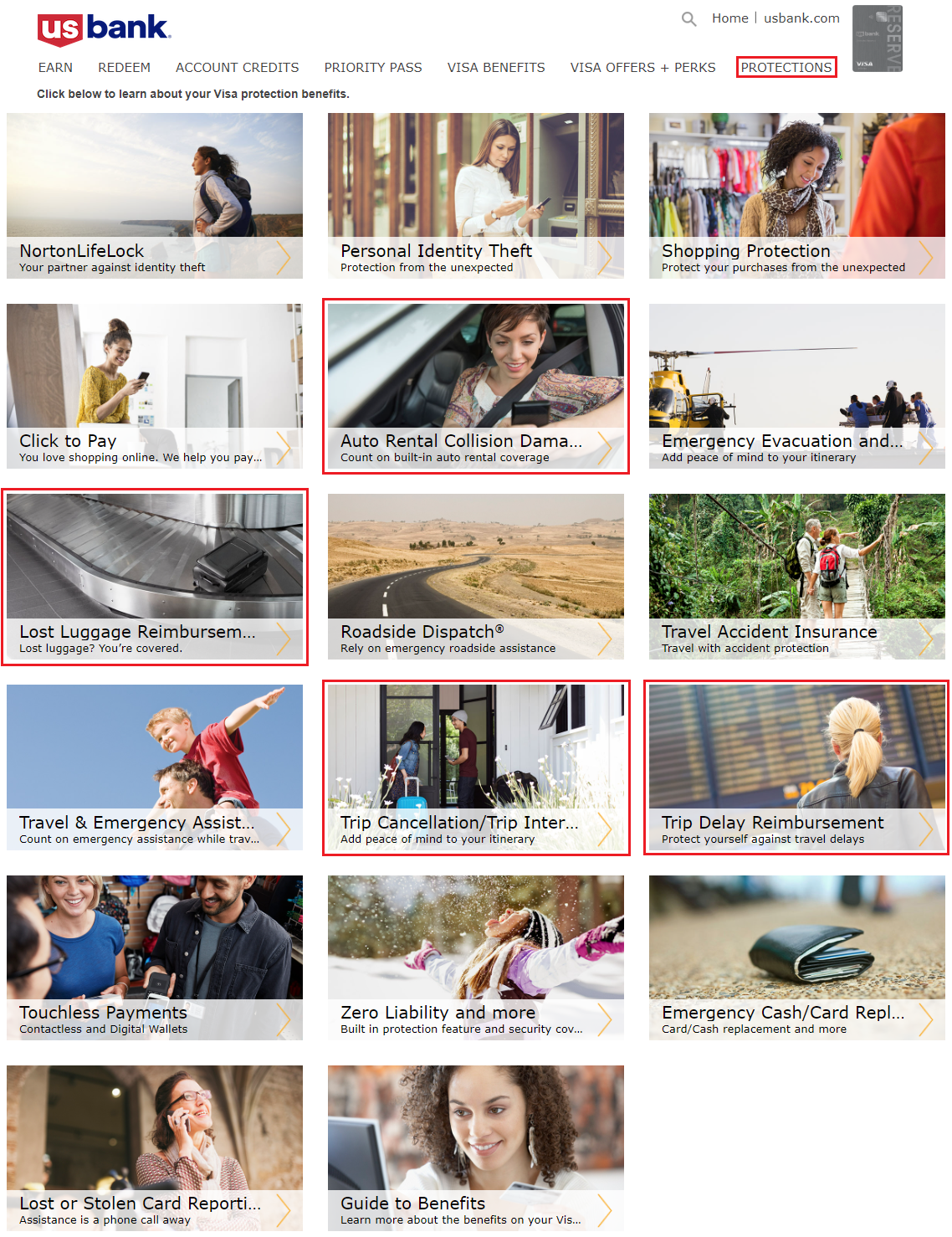

To do an apples to apples comparison, I will look at these 4 travel protections on the USBAR:

-

- Auto Rental Collision Damage Waiver

- Trip Cancellation/Trip Interruption

- Trip Delay Reimbursement

- Lost Luggage Reimbursement

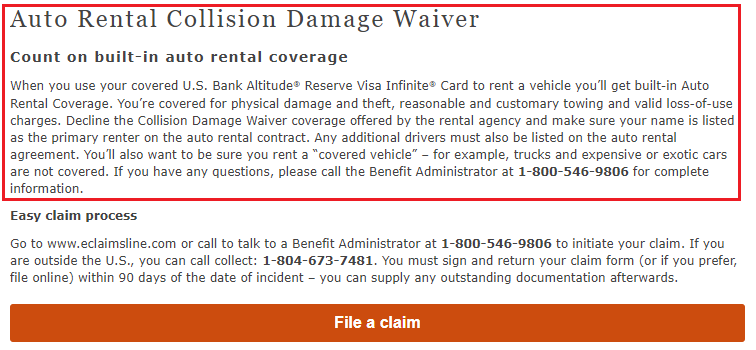

Auto Rental Collision Damage Waiver – this benefit provides primary rental car collision damage waiver (CDW) coverage both domestically and internationally, compared to the CSP’s secondary coverage domestically and primary coverage internationally. I had a pretty good experience submitting a $685 rental car claim a few months ago (How to Submit Primary Rental Car CDW Insurance Claim with eClaimsLine / Card Benefit Services (US Bank Altitude Reserve Credit Card). The USBAR wins this round.

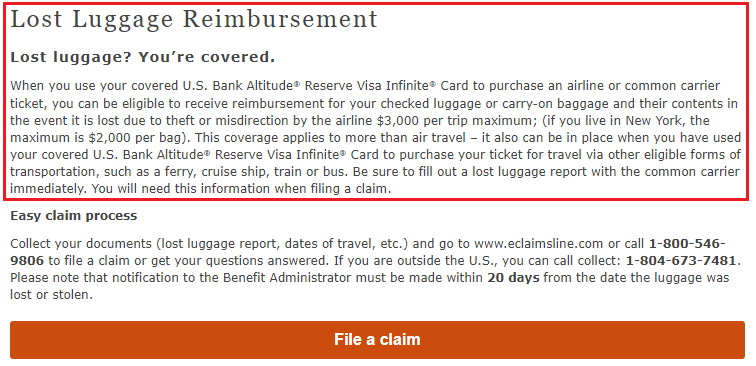

Lost Luggage Reimbursement – this lost luggage reimbursement is almost identical to the CSP, so let’s call this round a tie.

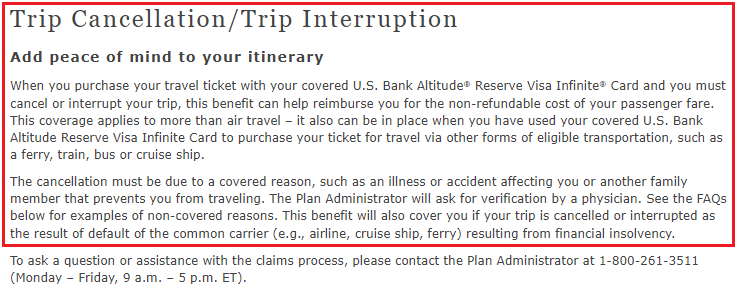

Trip Cancellation/Trip Interruption – this trip cancellation / interruption coverage sounds very similar to the CSP, but does not specify if round trip travel is required and sounds less strict, so the USBAR wins this round.

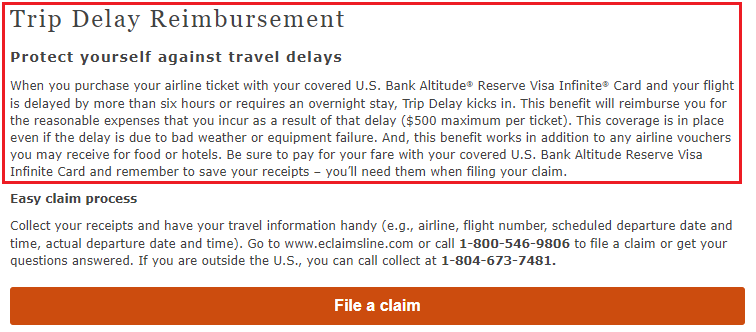

Trip Delay Reimbursement – this coverage mentions a 6+ hour delay or an overnight stay and says the $500 / ticket is in addition to any vouchers you receive for food or hotels. This benefit is better than the CSP so the USBAR wins this round too.

The CSP has a $95 annual fee, but you can offset that if you are able to use the $100 Hotel Credit on a $500 hotel booked through the Citi Travel Portal. The USBAR has a $400 annual fee, but comes with a $325 Annual Credit that covers “eligible travel purchases and dining, takeout and restaurant delivery purchases.” I tend to use the $325 credit without trying in the first 1-2 months after the annual fee posts, which brings the effective annual fee down to $75. The USBAR also provides a $100 Global Entry / TSA PreCheck Credit every 4 years (My Easy 2 Day & $100 Global Entry Renewal Process) along with a Priority Pass Select Membership that comes with 8 visits, that still includes Priority Pass restaurants and experiences. There are also several Visa Infinite benefits that are available, including a concierge, Luxury Hotel Collection, a golf benefit, and discounts on rental cars. Based on all those benefits, USBAR wins this round too.

In terms of redemptions, the CSP has 16 airline and hotel transfer partners compared to 0 for the USBAR…

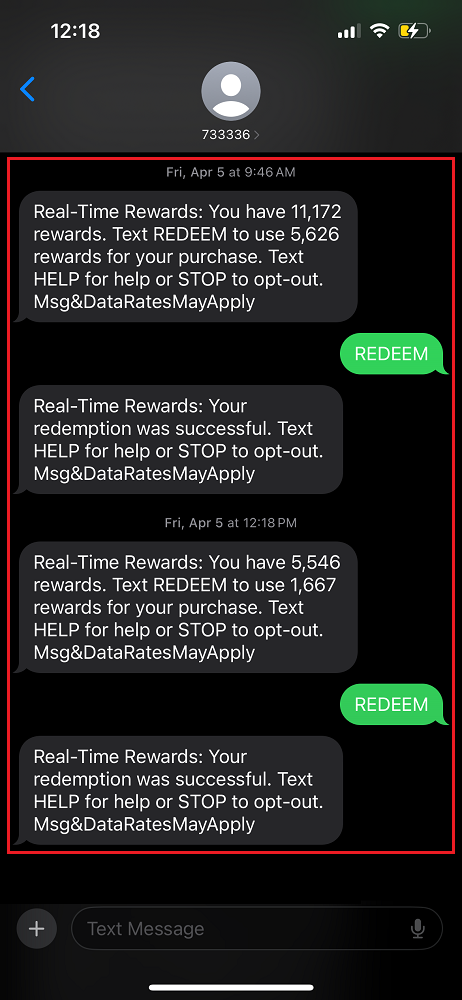

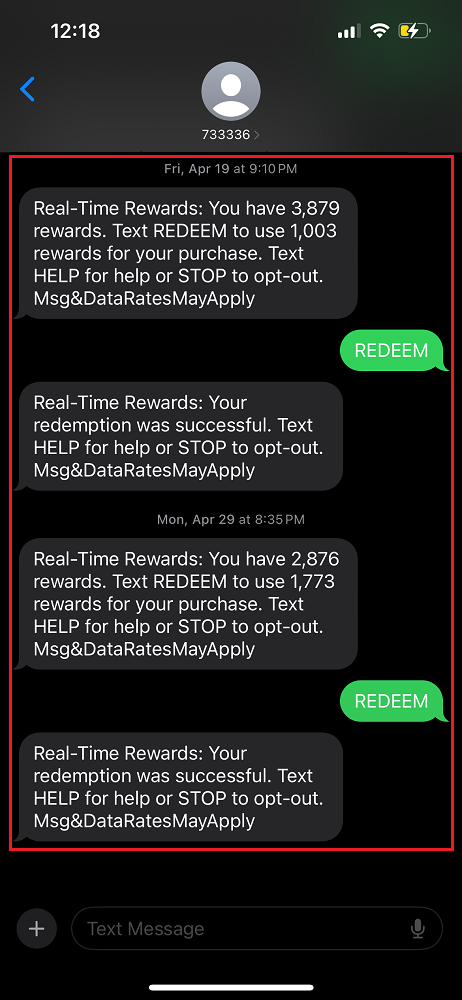

But USBAR has access to Real-Time Rewards. You can redeem USBAR points for 1.5 CPP toward purchases made in select categories, like airlines, rental cars, hotels, and cruise lines. I love the ability to buy airline tickets directly on the airline website or app, or pay the taxes/fees on award tickets, or spend on other miscellaneous airline expenses to earn 3x USBAR points and also have the ability to use Real-Time Rewards to cover the cost. For example, a $150 airline ticket will earn 3x USBAR points (150 x 3 = 450 USBAR points) and you can then redeem 10,000 USBAR points with Real-Time Rewards to offset the purchase. All you have to do is text REDEEM when you get the Real-Time Rewards text and the statement credit will show up on your account in 1-3 days.

As much as I like earning 3x Citi TYPs on certain travel purchases, I would not trade 3x Citi TYPs for 3x USBAR points because I know I will get a flat 1.5 CPP on many travel purchases and do not need to worry about transferring TYPs to airline or hotel partners. With all that said, the only reason I keep the CSP each year is for the ability to transfer TYPs to Citi’s 16 airline and hotel transfer partners. I do not put any spend on the CSP and prefer to earn TYPs with Citi’s other credit cards: 2x everywhere on the Citi Double Cash, 5x at select categories on the Citi Custom Cash, and purchases under $5 on the Citi Rewards+. I wish the newly relaunched CSP changed my view, but the new improvements have not convinced me. Maybe when the Citi Strata Elite comes out, that will be enough to dethrone the USBAR, but I am not holding my breath.

If you have any questions about my comparison of the CSP and the USBAR, please leave a comment below. Have a great day everyone!

Thanks for sharing. My only hang up is every time I read CSP I think Chase Sapphire Preferred.

I 100% agree, my brain kept going to that as well when I was working on this post.

Hi Grant,

What is your experience with booking through the US Bank – Altitude Rewards Center? Are they reliable when weather cancels flights? In general can they be trusted? Thank You.

Hi Greg, I haven’t used the US Bank Altitude Rewards Center to book any travel. Generally, I don’t like use OTAs, and I prefer to book directly with the airline or hotel.

If there are weather or schedule issues, you will need to work with them and not the airline, so that just adds another layer of complexity.