Good morning everyone, I hope your weekend is going well. A few days ago, I wrote about my Midyear Review: My 2024 Airline, Hotel & Credit Card Predictions (as predicted, my success rate was terrible). Thankfully, my success rate when it comes to credit card retention offers is much better. Let me ask you a question, if you could make $50, $100, or $150+ from making a phone call, would you do it? If you said yes, then you should make credit card retention offer calls.

In this post, I will share my thought process when it comes to making retention offer calls and then share my midyear results. Here are my thoughts:

1. I call every time a credit card annual fee posts to my account. I have also found that no annual fee business credit cards sometimes have retention offers, but I haven’t had much luck with no annual fee personal credit cards. Lastly, I try to call a few days after the annual fee posts to my account, but several weeks before the credit card payment is due.

2. Before the call, decide whether you will keep or close a credit card if you do not receive a decent retention offer. For example, there are certain credit cards that are worth the annual fee, so I plan on keeping the credit card open regardless if I get a retention offer or not. This is due to bonus categories, card benefits, or referral possibilities. Conversely, there are certain credit cards that are not worth the annual fee and I would need to get a decent retention offer to justify keeping the credit card open. I probably applied for that credit card for the sign up bonus and haven’t used the credit card or benefits since meeting the minimum spending requirements.

3. Call the phone number on the back of the credit card and navigate the phone tree to get to a rep. If you say “close a card”, or press 0 a few times, that usually does the trick. Generally speaking, calling Monday – Friday during normal business hours has worked best for me. The retention department at some credit card companies is not open 24/7.

4. Once the rep answers, here is my go to line for personal credit cards: “Hello, I just noticed that the $XXX annual fee posted to my account. My wife wants me to close the credit card to avoid paying the annual fee, but I really like the credit card and want to keep it open. Is there any way you can waive the annual fee or see if there are any retention offers available?” Feel free to substitute wife with husband, spouse, partner, best friend, sister, mom, dad, etc. For business credit cards, I say, “Hello, I just noticed that the $XXX annual fee posted to my account. I haven’t received enough benefits to justify paying the annual fee, but I really like the credit card and want to keep it open. Is there any way you can waive the annual fee or see if there are any retention offers available?”

5. Listen to the retention offers (if any are available). If you receive an offer, ask if there are any other offers available. Then decide which offer works best for you. If you do not receive an offer, either proceed to close the credit card or keep the credit card open. For the latter, I usually say something like, “Thank you for reviewing my account. Let me think about the decision over the next few days. If I decide to close the credit card, I will call back. Thank you for your help.” There is no requirement that you make a decision on that call and I’ve never had a rep pressure me into making a decision during the call.

6. If you accept an offer, set a reminder to look for the refunded annual fee or statement credit on your upcoming credit card statement. If you need to meet a spending requirement to complete the retention offer, create a plan to complete the spending requirement and then set a reminder to look for the retention offer to post.

7. You can wait a few weeks to see if the refund or statement credit posts to your account, but remember to pay your credit card bill by the due date to avoid interest and fees.

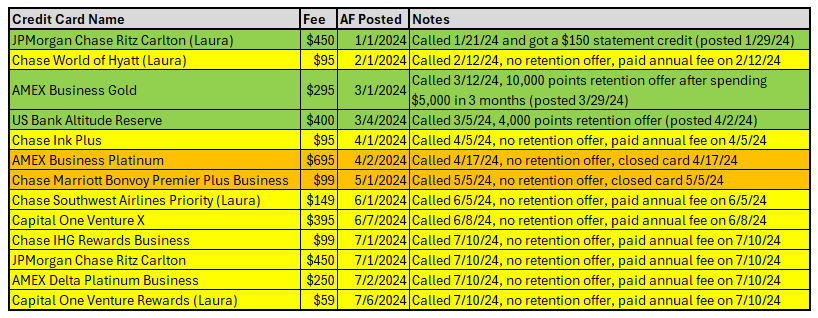

With all that said, here are my midyear credit card retention offer results for Laura and myself:

The first quarter of the year was more productive than the second quarter of the year, but Laura received a retention offer for $150 on her JPMorgan Chase Ritz Carlton Credit Card, I received 10,000 AMEX Membership Rewards Points (worth $125-$150) on my American Express Business Gold Card, and 4,000 US Bank Altitude Reserve Points (worth $60 toward Real Time Rewards) on my US Bank Altitude Reserve Credit Card.

In previous years, I have received the same $150 statement credit from my JPMorgan Chase Ritz Carlton Credit Card, Laura has received a $59 statement credit on her Capital One Venture Rewards Credit Card, and I received a $595 statement credit on my American Express Business Platinum Card (back in 2021). For the Chase Marriott Bonvoy Premier Plus Business Credit Card (that is no longer available), I closed this credit card because I wanted to apply for the American Express Marriott Bonvoy Business Credit Card (which I did a few days ago for the 5x 50K Free Night Certificates sign up bonus).

It only takes a few minutes to call to see what retention offers are available and it can be a financially rewarding call. If you follow the 7 steps from above, I can almost guarantee that you will receive a decent retention offer. If you do, please share your results in the comments section below. If you get a couple of “No’s” along the way, do not get discouraged, you are just that much closer to hearing a “Yes!” on an upcoming call. Also, just because you got a “No” this year, doesn’t mean you won’t get a “Yes” next year.

If you have any questions about my retention offer results or my thought process, please leave a comment below. Have a great weekend everyone!

Like you, I have had no luck with Capital one, – what are your reasons to keep it?

That is Laura’s oldest and primary card. I think she should apply for the Capital One Venture X and then product change or close her Venture Rewards.

Amex Gold Personal, 15,000 points with $2k spend in 3 months

Amex Everyday Preferred, 10,000 points with $2,5k spend in 3 months

No other offers so far!

Those are pretty good offers, thank you for sharing your data points. Have a great weekend :)