Good afternoon everyone, I hope your week is going well. There have been lots of new credit card launches and major credit card changes in the month of July, but in this post, I am going to focus on the changes to the US Bank Smartly Credit Card and US Bank Altitude Reserve Credit Card (no longer available for new applicants). Doctor of Credit wrote about the various changes to the Smartly cards here: [Varies By Cardholder] U.S. Bank To Nerf Existing Smartly Cardholders On September 15.

US Bank Smartly Credit Card – Changes coming September 15, 2025

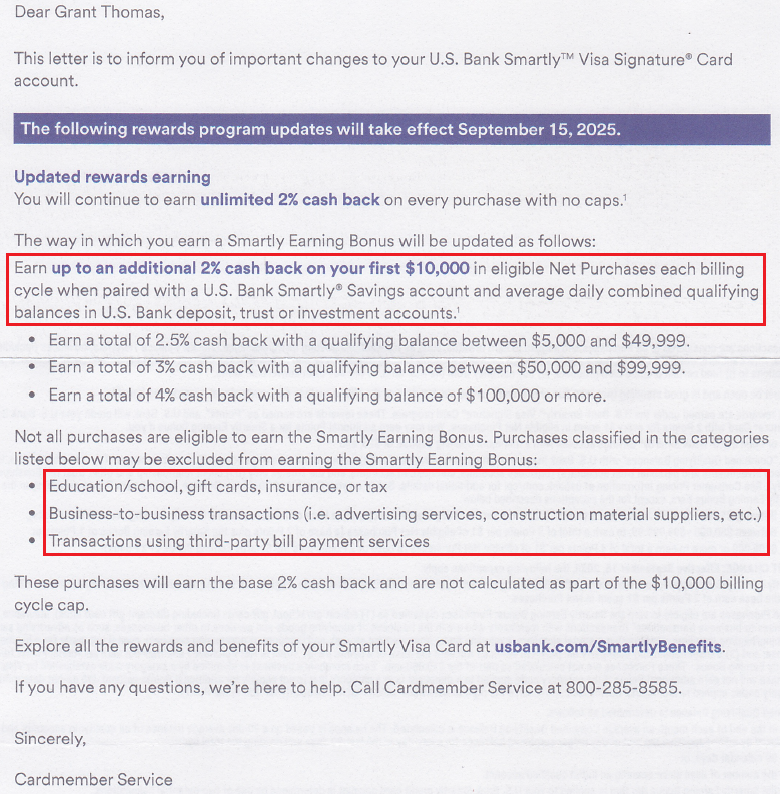

I have 2 Smartly credit cards from product changes in January 2025 from a US Bank Cash+ and a US Bank Altitude Connect. Luckily, I received the “better version” letter for both of my Smartly cards so that I can keep earning 4% with $100K in investment / retirement accounts with US Bank. Effective September 15, 2025, my credit card rewards will be capped at $10K spend / month and will not work on education, school, gift cards, insurance, tax, business-to-business transactions, and third party bill payment services.

Here is the back of the letter with more details regarding the 4% earnings. I currently have $20 in my US Bank checking account and $20 in my US Bank savings account, but to play it safe, I will raise those limits to $30 each to complete the first bullet. I will not make any changes to my Roth IRA held with US Bank since the balance is currently over $100K.

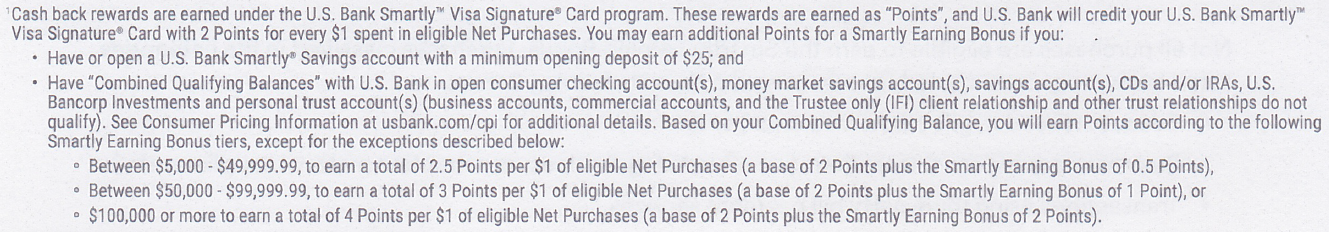

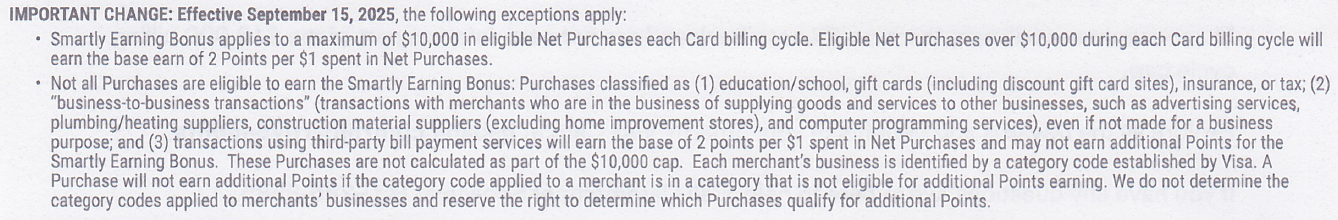

Here are more details about the excluded categories. Unfortunately, there is not a lot of details about the excluded categories, so it will be kind of trial and error to see which purchases fall into various excluded categories.

To see how these changes will affect me after September 15, I downloaded my credit card transactions for both of my Smartly cards from January 2025 through today. I combined the transactions and then attempted to identify any transactions that might be included in US Bank’s excluded list. Here are my findings:

- $13,298.65 – combined net spending (all purchases and returns).

- 4% cash back on $13,298.65 = $531.95

- $237.15 – any purchase that might be categorized as education / school, including Teachers Pay Teachers and donations to Parent / Teacher Association (2% of all purchases).

- $322.01 – any purchases that might be categories as gift cards, including gift cards purchases through AARP, Amazon, and Amazon gift card balance reloads (2% of all purchases).

- $4,701.44 – tax payments made to the federal government and state government, plus services fees (35% of all purchases).

- If I exclude all possible excluded transactions, I would have $8,038.05 in net spending.

- 4% cash back on $8,038.05 = $321.52, I would also be well under the $10K spend / month cap.

Based on these numbers, keeping and using both of my Smartly cards is worthwhile, I just have to remind myself not to use these cards in the excluded categories.

US Bank Altitude Reserve Credit Card – Changes coming December 15, 2025

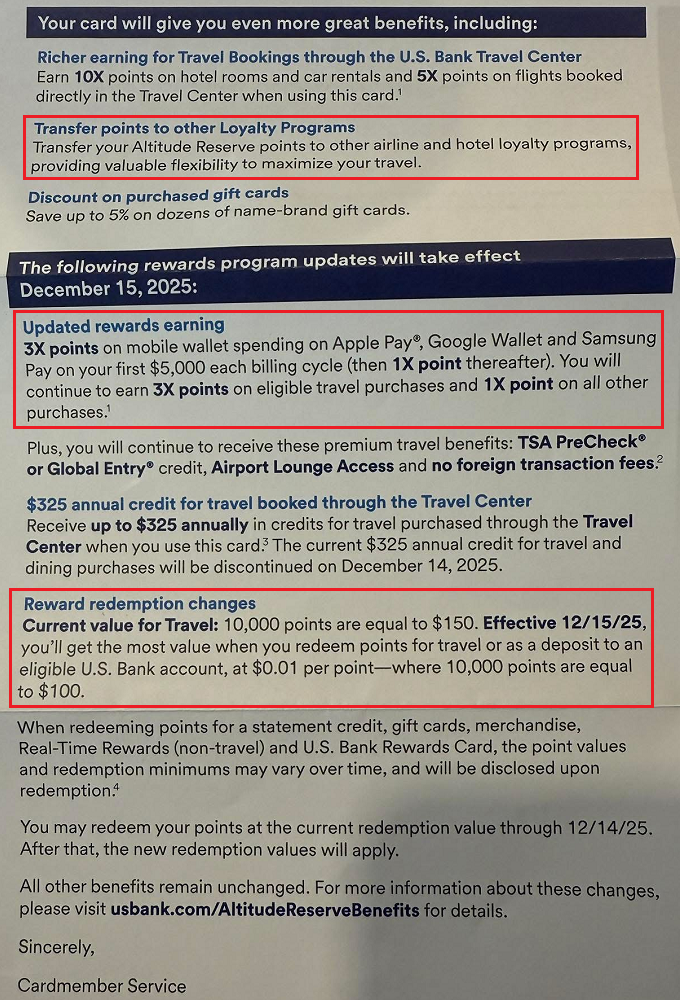

Up next, let’s discuss the changes coming to my beloved US Bank Altitude Reserve on December 15, 2025 (thanks to Doctor of Credit for the below image). That date is exactly 3 months later, so we may see more changes from US Bank come on March 15, 2026. It is exciting to hear that US Bank is launching airline and hotel transfer partners, but the loyalty programs and transfer ratios were not announced yet. The 3x mobile wallet spending cap goes from unlimited to $5,000 per billing cycle, which is plenty for me (except the one time I paid a $5,000 down payment on a car purchase with this card). Thankfully, there is no cap on the 3x travel purchases. One of the biggest disappointments is Real Time Rewards decreasing in value from 1.5 cents to 1 cent.

I am hoping the transfer partners make up for this loss. If not, I will make some airline purchases before the December 15 deadline to trigger the Real Time Rewards and use up my remaining US Bank points.

To see how these changes will affect me after December 15, I downloaded my credit card transactions for my Altitude Reserve from July 30, 2024, through today. Here are my findings:

- $28,008.76 – combined net spending (all purchases and returns), which is about $2,334 per month.

- 4.5% cash back (via Real Time Rewards) on $28,008.76 = $1,260.39.

- 3x US Bank points on $28,008.76 = 84,026 points that I could transfer to their travel partners.

I plan on keeping and using my Altitude Reserve, unless the loyalty programs and transfer ratios are terrible. If they are terrible, I will need to reevaluate my plan and see if I need to shift spend to my 2 Smartly cards. If you have either credit card, what are your plans for the cards throughout the rest of the year? Please share your plans in the comments section below. Have a great day everyone!

I dumped my USBAR as they stated I had no product change options (I called like 4 different times). I didn’t want to pay the $400 with the changing terms. So, card has now been cancelled. This was a PC from Altitude Connect in which I somehow got a sign up bonus, and two $325 travel/dining credits for one annual fee, so I can’t complain to much.

Smartly was PC’d from Cash+ and I got the good nerf and because of that I plan to transfer some investments back to them and use it again. I had transferred out the brokerage to Ally because Ally’s brokerage promo dwarfed the amount of extra cashback I was getting on the Smartly. I also have a Citi ShopYourWay where I’ve been getting like 14% on gas groceries restaurants since like April.

Even with the excluded categories, 2% might be good enough for the convenience of one card – though for things like taxes and insurance I typically tend to just throw those on new cards for sign up bonuses.

Hi TJ, sorry to hear you dumped your USBAR CC, I plan on keeping mine, assuming the airline transfer partners are decent. Pretty cool that you got a Altitude Connect bonus and 2 x $325 travel / dining credits, you definitely came out ahead there. Moving assets to USB was pretty easy. I’m not that impressed with their Investment UX, but I’m keeping the same Vanguard Index Funds I originally held with Vanguard. I love getting 4% everywhere with my USB Smartly CCs. I was sad to hear that taxes and insurance won’t earn 4% cash back, but I will gladly pick up another sign up bonus for those payments.