Good afternoon everyone, happy Friday! In the first week of July, I had 5 credit card annual fees post to my accounts, totaling over $1,000. As part of my credit card / travel hacking philosophy, I call the credit card company every time an annual fee posts and see if there are any retention offers available, then I decide if I will keep the card open for another year or close the card.

Here are the 5 credit cards and the results of each retention offer call:

| Credit Card Name | Annual Fee | Date Posted |

| Chase IHG Rewards Business Credit Card | $99 | 7/1/2025 |

| JPMorgan Chase Ritz Carlton Credit Card | $450 | 7/1/2025 |

| American Express Marriott Bonvoy Business Credit Card | $125 | 7/2/2025 |

| American Express Delta Platinum Business Credit Card | $350 | 7/2/2025 |

| Laura’s Capital One Venture Rewards Credit Card | $59 | 7/7/2025 |

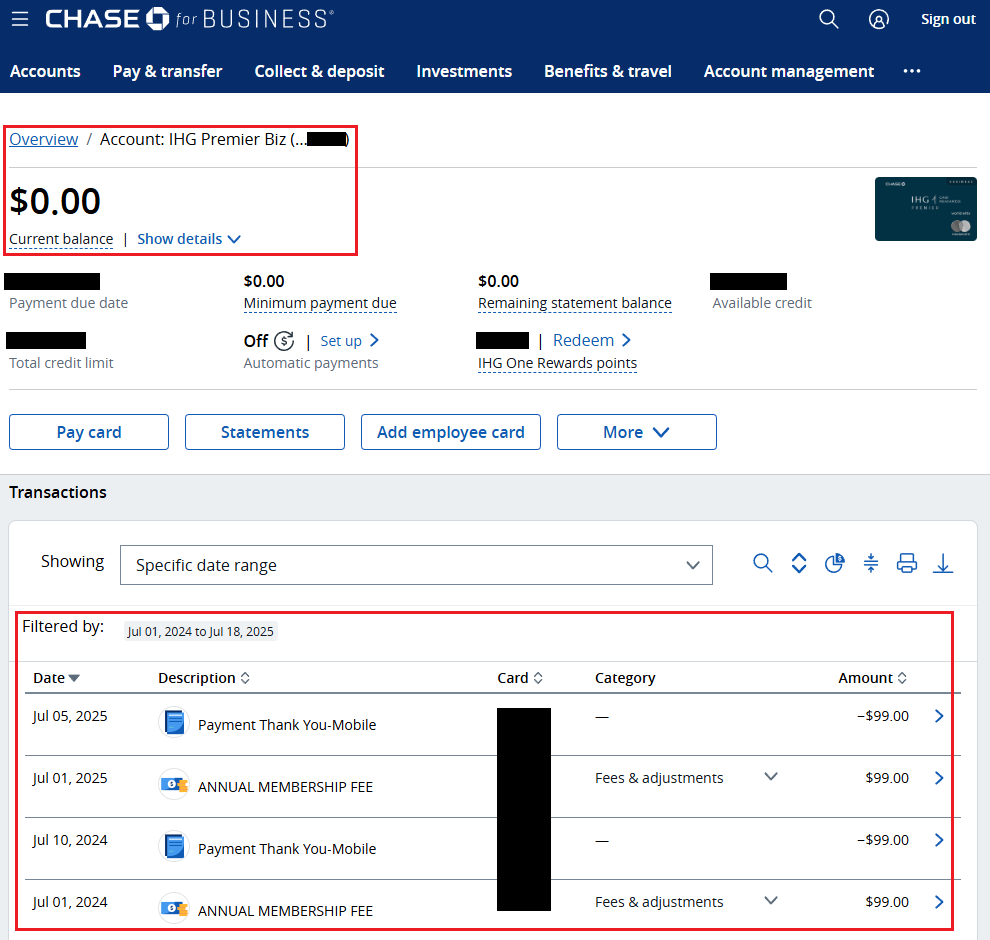

Chase IHG Rewards Business Credit Card ($99 annual fee)

Unsurprisingly, when I called Chase to ask about retention offers, there were no retention offers available, but I decided to keep the Chase IHG Rewards Business Credit Card open for the annual IHG 40K Free Night Certificate (worth $150 – $200 to me). I really don’t use this credit card. As you can see, since July 1, 2024, through today (July 18, 2025), the only transactions on this credit card are the $99 annual fees and the $99 credit card payments.

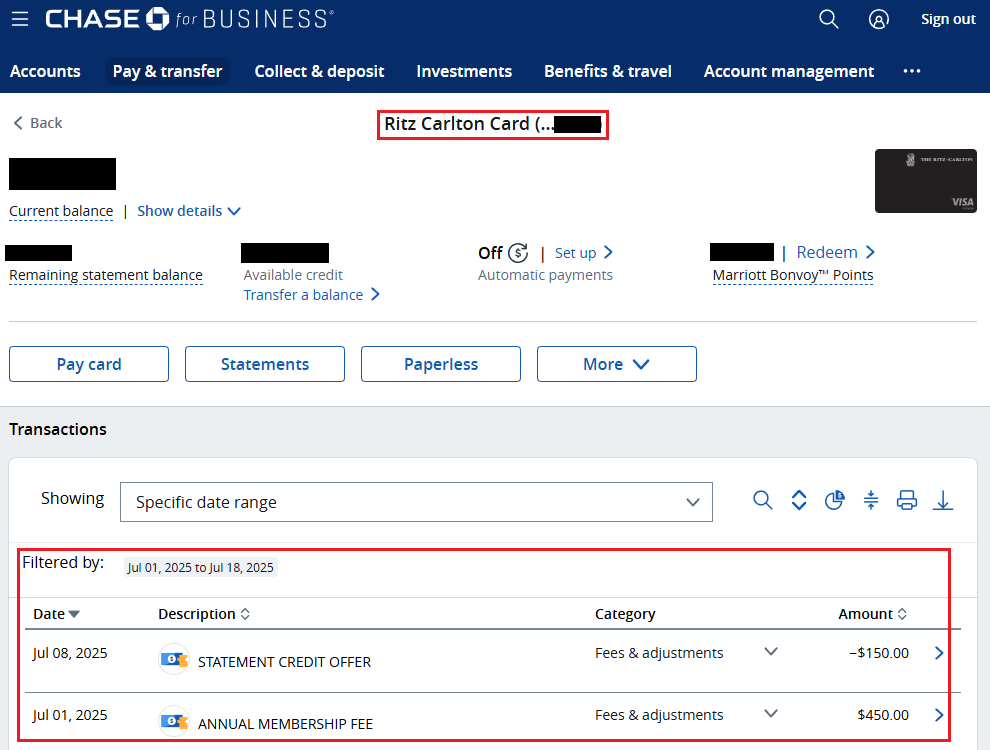

JPMorgan Chase Ritz Carlton Credit Card ($450 annual fee)

Aside from the 85K Marriott Free Night Certificate (worth $300 – $500 to me) and the $300 airline incidental credit, I only put an occasional Marriott parking or resort fee charge on this credit card. When I called Chase, I explained to the rep that my wife and I were expecting a baby girl in August and that we didn’t know how much travel we would do in the next 12 months. I asked the rep if there were any retention offers available to lower the annual fee. The rep congratulated my wife and I on our baby girl and then said there was a $150 statement credit retention offer available. I gladly accepted the retention offer and thanked the rep for their kind words.

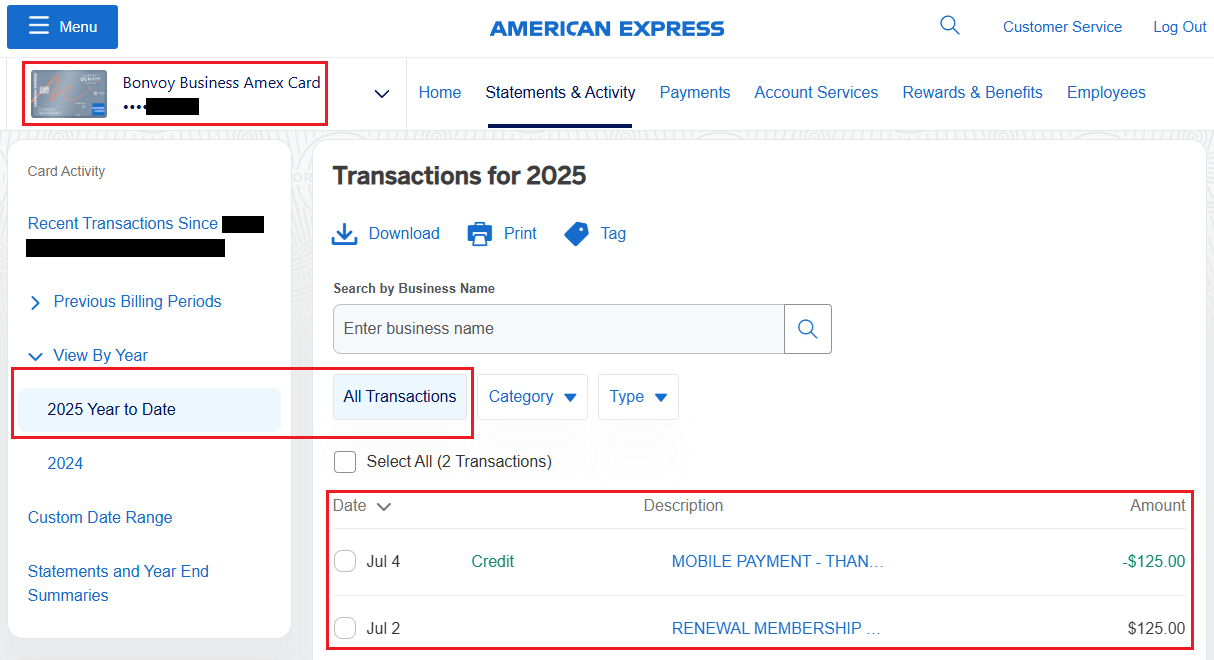

American Express Marriott Bonvoy Business Credit Card ($125 annual fee)

Unsurprisingly, when I called AMEX to ask about retention offers, there were no retention offers available, but I decided to keep the American Express Marriott Bonvoy Business Credit Card open for the annual Marriott 35K Free Night Certificate (worth $150 – $250 to me). The 15 Marriott Elite Nights also stack with the 15 Marriott Elite Nights from my JPMorgan Chase Ritz Carlton, so I always start the year off at 30 elite nights toward yearly and lifetime status. I really don’t use this credit card. As you can see, 2025 Year To Date through today (July 18, 2025), the only transactions on this credit card are the $125 annual fee and the $125 credit card payment.

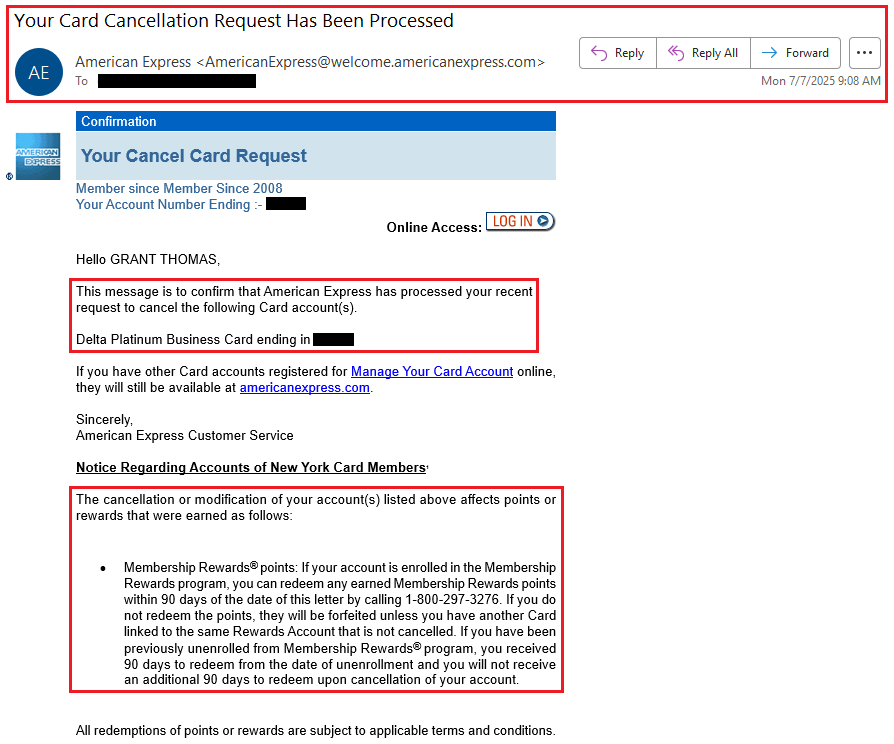

American Express Delta Platinum Business Credit Card ($350 annual fee)

The American Express Delta Platinum Business Credit Card comes with a lot of benefits… for the right person / business. The 15% Delta SkyMiles award ticket discount was the benefit that originally attracted me to this credit card, but I recently redeemed all my Delta SkyMiles for an award ticket for my parents, so I have less than 1,000 Delta SkyMiles left. The Delta Companion ticket is great, but there are limited routes from SFO and we won’t be travelling as much in the next year due to having a baby. Lastly, the $200 Delta Stays credit was hard for me to *mentally use* since I prefer staying at chain hotels where I can use hotel points or hotel free night certificates. I am excluding the value of the Delta checked bag benefit, early boarding benefit, and elite status benefit since I didn’t use any of those benefits in the last year. I reiterated those concerns to the AMEX rep and said that this credit card is great for the right person / business, but that I wasn’t a good fit for the card. The rep did offer me a retention offer of 10,000 Delta SkyMiles after spending $3,000 in the next 3 months, but I wasn’t interested in that offer and proceeded to close the card. Interestingly, when I received the card cancellation email, it mentions Membership Rewards Points, but this Delta credit card doesn’t earn Membership Rewards Points.

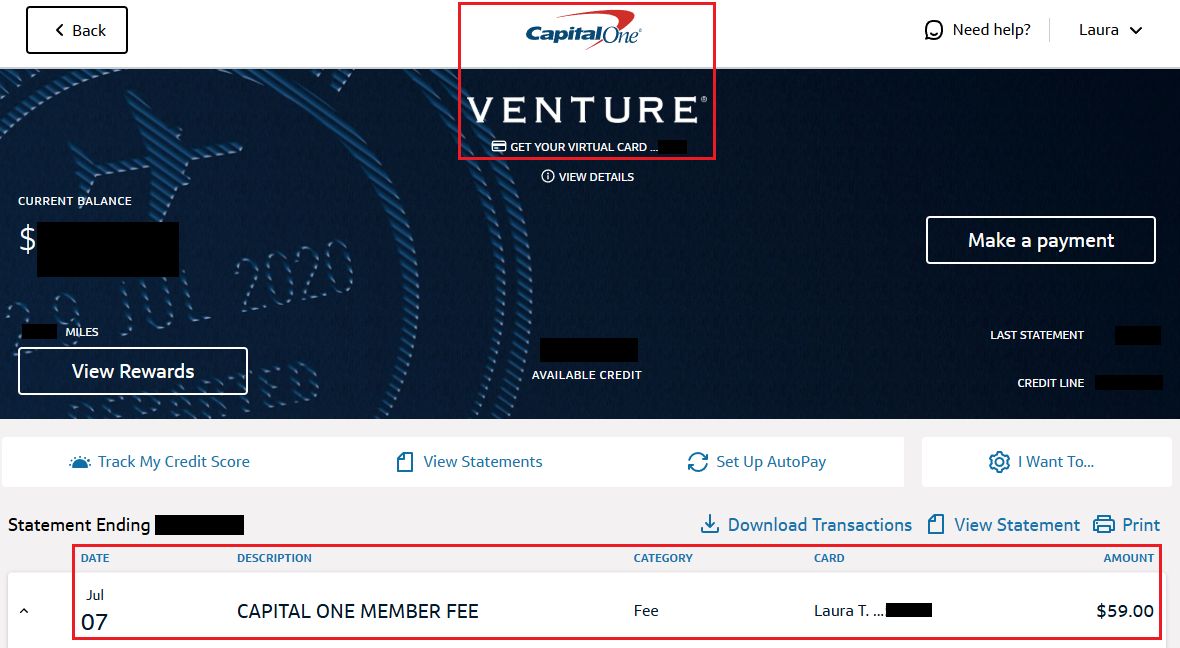

Laura’s Capital One Venture Rewards Credit Card ($59 annual fee)

The Capital One Venture Rewards Credit Card is Laura’s oldest credit card and the card she uses the most. She called Capital One and asked if they could waive the annual fee (which they have done in previous years). Unfortunately, the rep was not able to see any retention offers and the only option was to close the card. She declined that offer and kept her card open. Due to the recent Capital One Venture X Credit Card changes regarding guest access to Capital One Lounges, Laura should apply for her own Venture X card when we start travelling more so that she can have free access to the lounges (along with the $300 annual travel credit and 10,000 anniversary Capital One Points).

Those are the credit cards I have with annual fees posting in July. If you have any questions about any of the credit cards or retention offers, please leave a comment below. Have a great weekend everyone!

Hi Grant – Thanks for the update on retention offers. This is interesting and relevant for everyone.

Anecdotally, we have not been doing as well recently with Amex retention offers as we used to. My last 2 offers on business cards have been for 10k MR / $5k spend / 3 months. One was a Biz Green and one was P2’s Biz Gold.

For what it’s worth, we kept both cards for strategic reasons. On the Biz Green, this was its first anniversary and i kept it for 2 reasons – one, in hopes of getting an upgrade offer soon; and two, to hopefully stay in Amex’s good graces for future approvals (I.e., no pop-up jail). On the Biz Gold, it was also the first anniversary. We were able to stack the retention offer with an AU offer of 15k MR / $4k spend / 6 months. We got 2 AU cards, which will result in an excellent stack for restaurants over the next few months. Maybe it will also help to keep P2 out of pop-up jail, as she seems to teeter on the brink of it all the time.

One other card that received a lower-than-usual retention offer recently was my USBank Altitude Reserve. I’ve had this card since 2018 and I love the 3x earning on mobile payments. In previous years, I’ve always gotten a retention offer of 5k points. This year, though, they only offered 1k points. I took it and kept the card open, but this was a real disappointment.

Hey Craig, thanks for sharing your recent retention offer experiences. I hope you and P2 can stay in AMEX’s good graces for your upgrade offers and new card bonuses.

Last year, I accepted an upgrade offer on an AMEX Biz Platinum, so I need to wait for 12 months from upgrading so that I can downgrade to the AMEX Biz Green to get a partial refund on the $695 annual fee.

I also have an AMEX Biz Gold that I don’t plan on keeping, so I will close that card unless I get a pretty generous retention offer.

I’m surprised your USB AR only had a 1,000 point retention offer. I have had good luck getting 5,000 points retention offers every year. I do spend a ton on that card, so that seems to help.

Best of luck on your future retention offers :)

Update on my Amex Business Green situation that I mentioned in my comment above – Shortly after I accepted the retention offer of 10k MR / $5k spend / 3 months, an offer popped up in my account to add Authorized Users, with a bonus of 15k MR / $4k spend / 6 months for each AU up to 5. I got 2 AU cards using this offer, which should give me a return of 6x MR on all spend if I spend exactly $8,000 on the AU cards. The math is 10k MR from the retention offer, plus 15k MR from AU card #1, plus 15k MR from AU card #2, plus 8k MR from the regular 1x earning on the card = 48k MR for $8k spend. The cost to get this was paying a $95 annual fee, which is a business expense. I’m quite happy with this, since it involves no new card applications or accounts and especially since the timing pairs well with 3rd quarter estimated tax payments. It could be even better if I also had an upgrade offer, but no luck on that front so far!

Hi Craig, that is a great job stacking multiple offers with AMEX and should be really easy for you to hit with a few large tax payments in Q3.

Are there special perks of the Venture versus converting to another card like the Savor? I swapped out the second Quicksilver for a Savor card when CapOne acquired the Wally World cards. I enjoyed the rewards on walmart.com, but 1.5% wasnt compelling when the wallets already full of category cards, with a 2% as backup.

Good question, I’m not as familiar with the various Capital One credit cards but I like the ability to visit Capital One Lounges and having access to Capital One transfer partners with a basically $0 annual fee card.

Hi Grant

I always find it interesting to follow the process and analysis people undertake to determine whether to drop or retain particular credit cards. Excellent article and response by Craig T,

Thank you Greg. Do you have any of these 5 credit cards? If he’s, are there any different decisions you would have made?