Are you taking advantage of Europe being on sale these days? I know many readers are heading over the pond. If Italy is in your plans, either now or sometime in the next year or so, be sure to read this post. After all, who doesn’t plan on visiting Italy sooner or later. I’ve got four Italian destinations for you, so let’s get started. In Part 1, I talked about Venice and Milan; in Part 2, I talked about Florence, and what to see/do/eat in those cities. In this post, I’ll share tips with you about Rome, so let’s dig in.

ROMA (Rome, Italy)

Trevi Fountain in Rome, Italy. Image source: http://www.cntraveler.com/destinations/rome

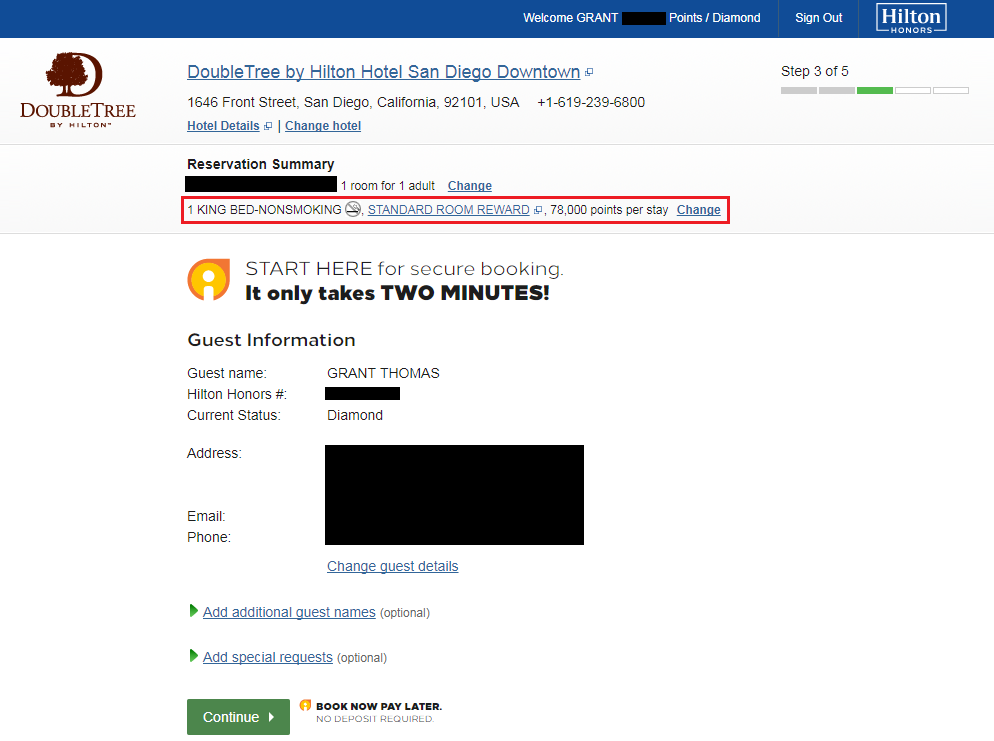

To begin, let me talk about taking the train from Florence to Rome. Usually, I use Trenitalia train service, which is owned by the Italian government. I heard about Italotreno which is a competitor and offers relatively new high speed train service. I had heard that the main advantage was that it cost less. However, that’s only if you buy your ticket ahead of time, so beware of this. I did decide to give them a try, even if the cost was the same as Trenitalia. Their trains were late and there was insufficient storage for luggage. So sure, the savings might be worth it, but if you don’t buy your train ticket ahead of time, I still prefer Trenitalia. Actually, I think next time I’ll try BlaBlaCar, the long distance carpooling service!

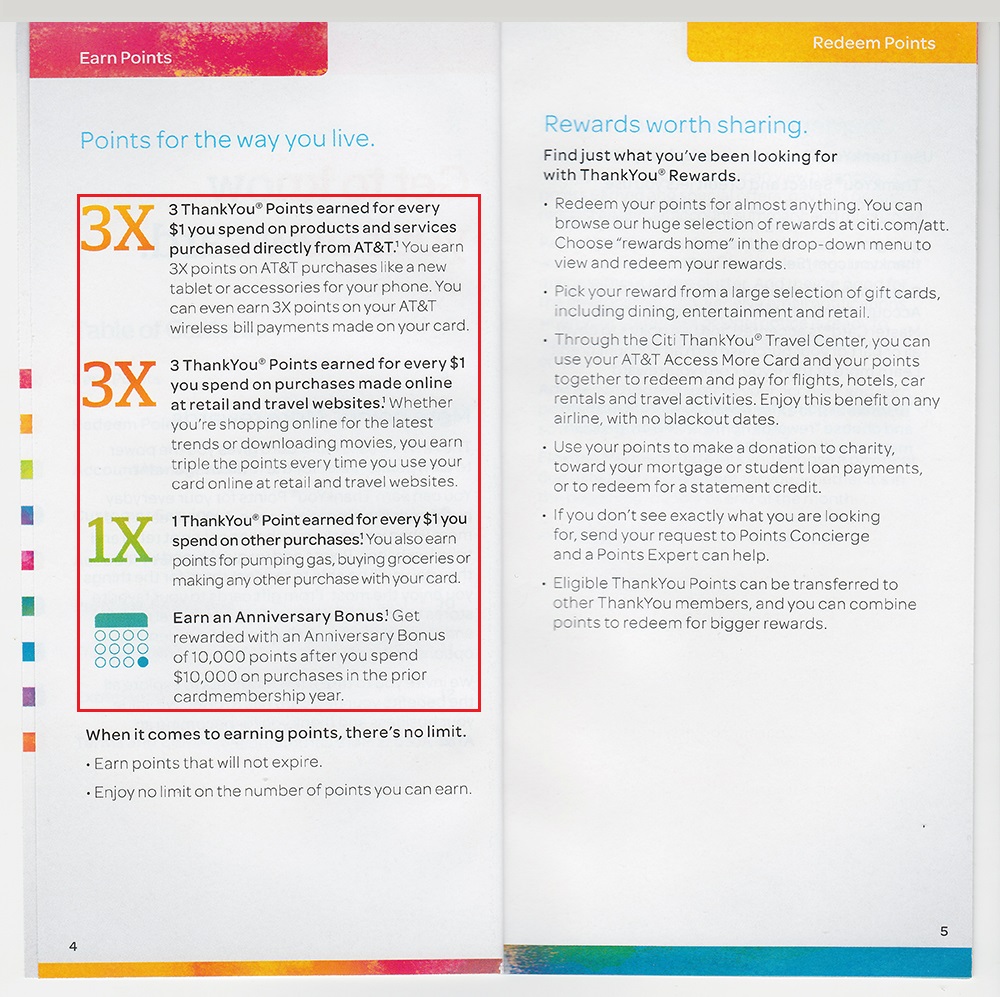

For lodging, I stayed at Hotel Mozart which was recommended to me by my cousins. The hotel is near the Spanish Steps on Via Condotti, which if you’re at all familiar with Rome, you’ll know is a busy part of Rome. Do make sure to ask for a quiet room. My cousins warned me about asking for a quiet room, so I did just that and didn’t have any issues with noise. The room was lovely, the concierge Rosella was very helpful, and Alex at the front desk had a great sense of humor! The breakfast spread is included with the price of the room and it was everything and more that you could want. There’s a music conservatory on the same street, so I enjoyed hearing opera being sung when I was in my room during the day. The hotel is priced on the high side, but like Hotel La Scaletta in Florence, if you use your Citi Prestige Credit Card 4th night free benefit, the cost is offset.

Breakfast at Hotel Mozart in Rome, Italy. Image source: http://www.hotelmozart.com/en/gallery/

Continue reading →