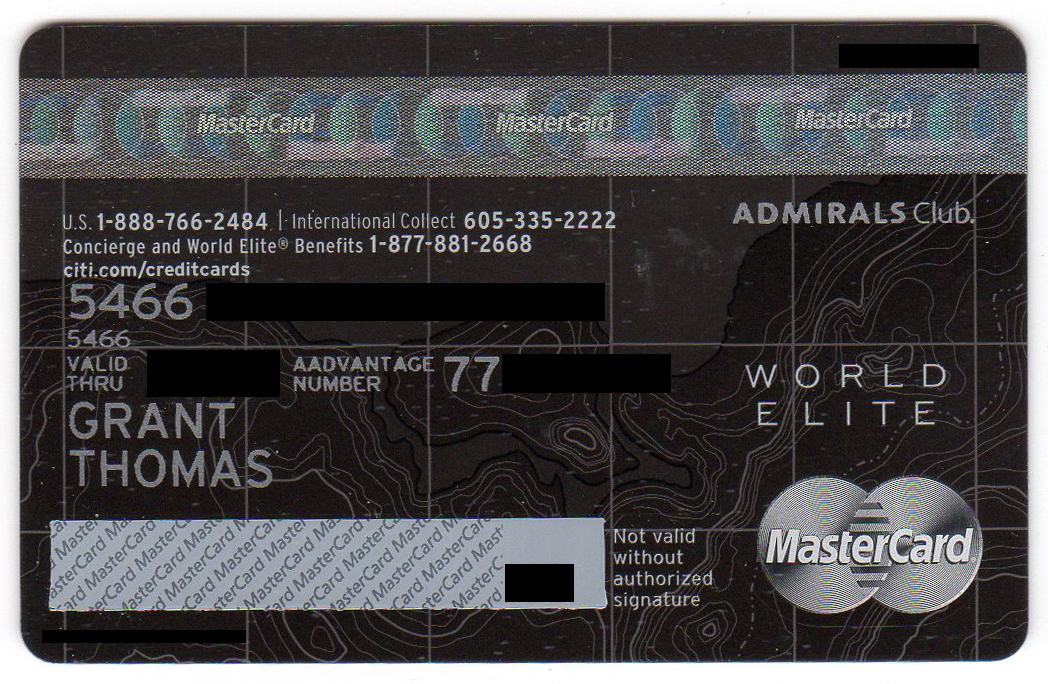

Good Thursday morning everyone, here are some random news articles for you. Recently, I wrote about the newly redesigned Citi American Airlines Executive Credit Card (link) and commented on the fast that the new design did not have an Admirals Club logo on the card. Over the weekend, I visited the Admirals Club in SFO and the front desk agent told me that Citi forgot to include the Admirals Club logo on some of their new Executive Cards. I called Citi and they sent me a new card via FedEx Overnight. Here is what the back of the card looks like with the Admirals Club logo in the upper right corner. If you have the old-new Executive Card, you can call Citi and request a new-new Executive Card.

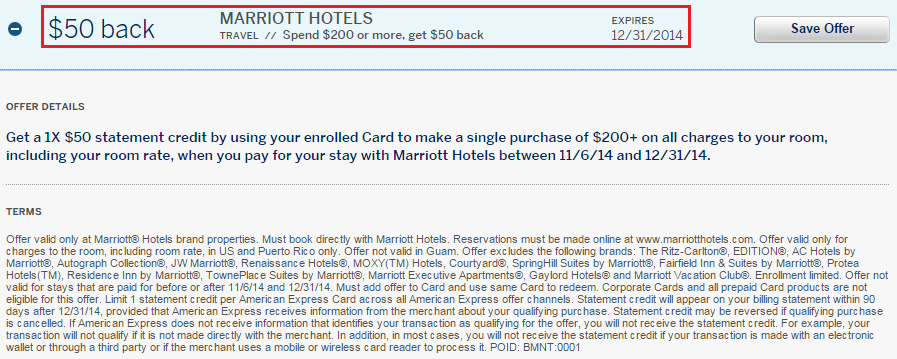

American Express is on a roll with their AMEX Offers. I wrote about the new offers this week (post 1 and post 2) but apparently AMEX is still rolling out new offers. The latest offer to grab my attention is the Marriott Hotels offer, spend $200+ and receive a $50 statement credit.