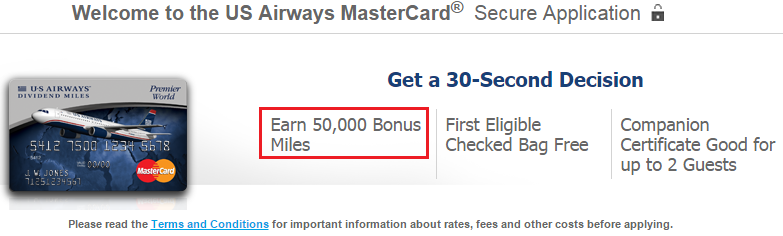

Good morning everyone, happy April Fool’s Day. No pranks today for me, I don’t have time for those. Before I went on my RV road trip, I did a mini App-O-Rama in mid March and it’s been almost 2 weeks, so I can now share all my results. If you have been reading my blog for a while, you probably know about my ongoing battle with Barclays. I have applied for 5-6 Barclays credit cards over the last 2 years or so and have been denied every time. Since the Barclays US Airways Credit Card is going away very soon, I thought I would try for that card one more time. The sign up bonus is 50,000 US Airways miles (now those are 50,000 American Airlines miles) after your first purchase.

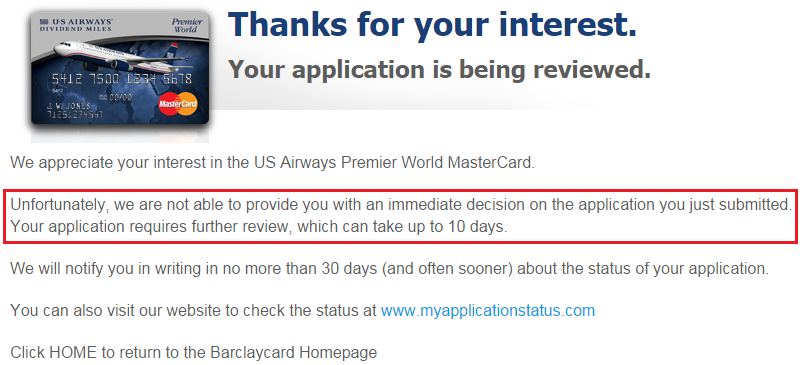

After applying for that credit card, I got a pending result which is never a good sign. I checked the online Barclays credit card application status page and it looks like I was denied again. I also received a letter from Barclays that I had “too many new accounts.”

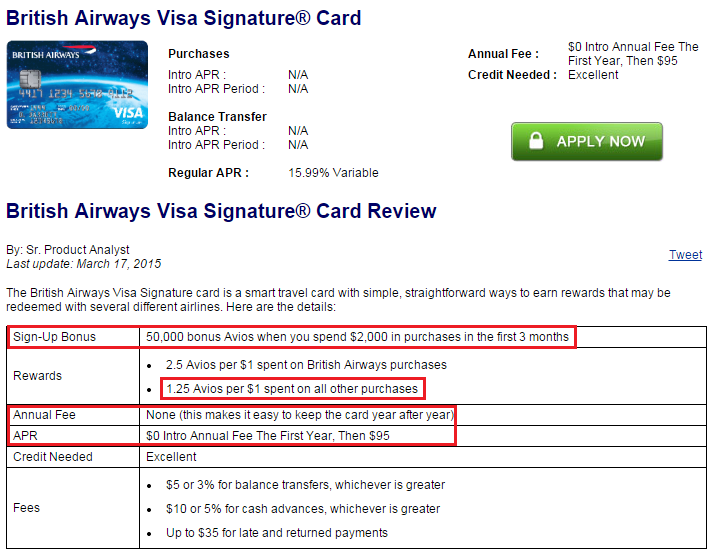

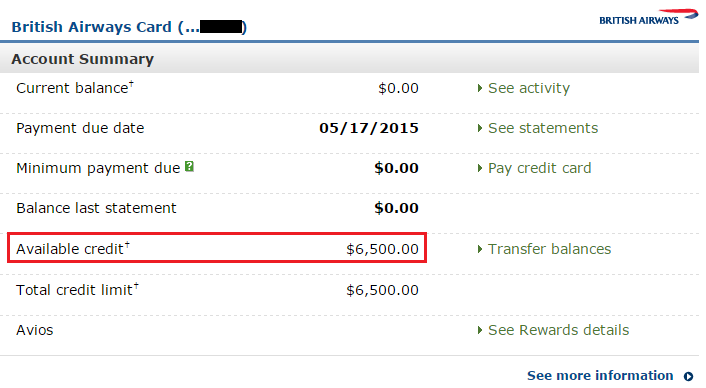

Moving on to Chase, who currently loves me. I was getting low on British Airways Avios and it had been more than 2 years since I was originally approved for the Chase British Airways Credit Card, so it was time to apply again. The sign up bonus is 50,000 British Airways Avios after spending $2,000 in 3 months with no annual fee the first year.

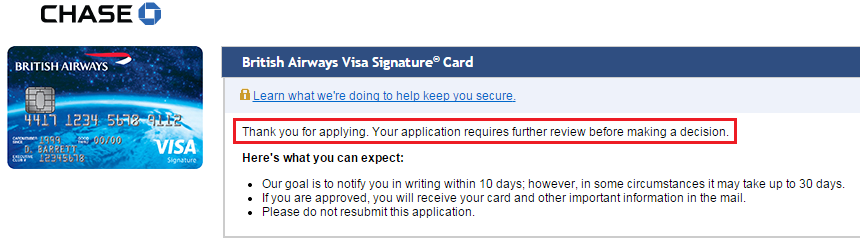

I got another pending result, so I called the Chase reconsideration department to see what was going on. After placing me on hold for 2 minutes, I was approved with a $2,000 credit limit.

After receiving the credit card in the mail, I called Chase and asked to move the full $4,500 credit line from my Chase Southwest Airlines Premier Credit Card over to the Chase British Airways Credit Card, raising my credit limit to $6,500. This also closed my Chase Southwest Airlines Premier Credit Card, which I did not need anymore.

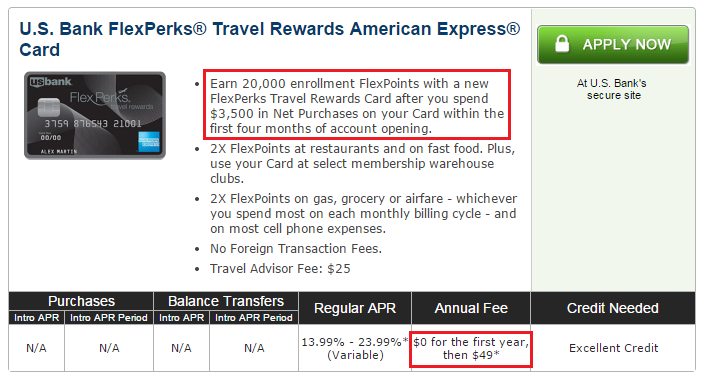

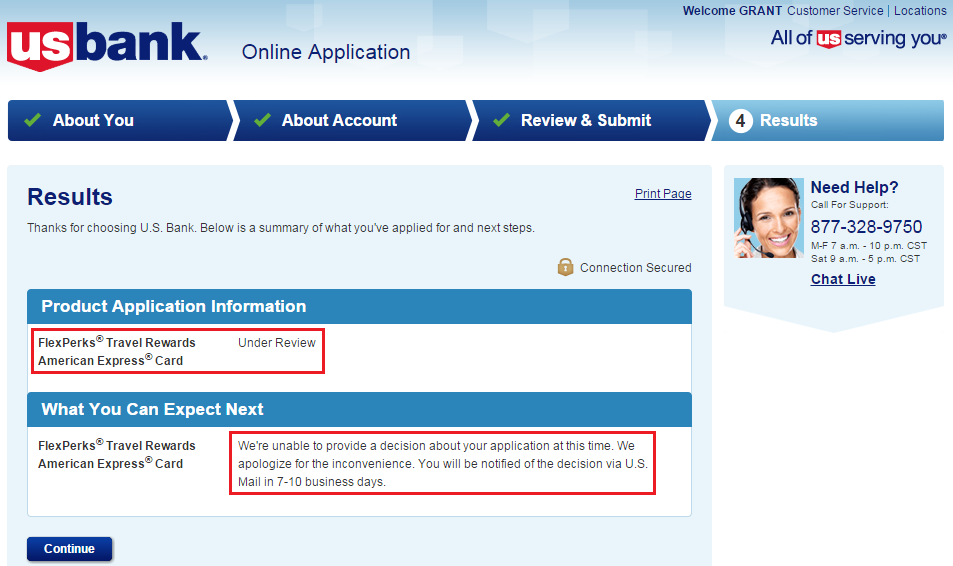

Up next was the US Bank FlexPerks AMEX Credit Card. The sign up bonus is 20,000 FlexPoints after spending $3,500 in 4 months with no annual fee the first year. I just cashed in a big chunk of FlexPoints for my United Airlines first class flight from Denver to San Francisco (more info on that soon), so I needed some more FlexPoints.

After applying, I received another pending result, so I called the US Bank reconsideration department and asked if there was any other information they needed. The rep said my application looked good and the credit department would approve me the following day.

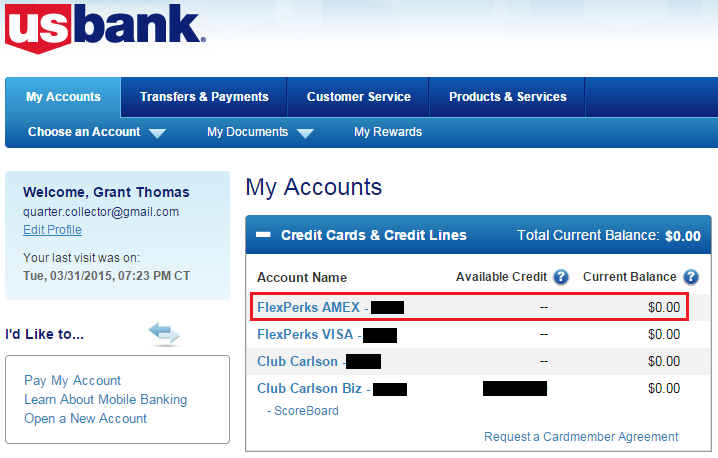

I had not received any emails or letters in the mail about the credit card, but after 7 days, the new credit card showed up in my US Bank online account (I changed the names on all my US Bank credit cards). I am still waiting for the credit card to arrive in the mail.

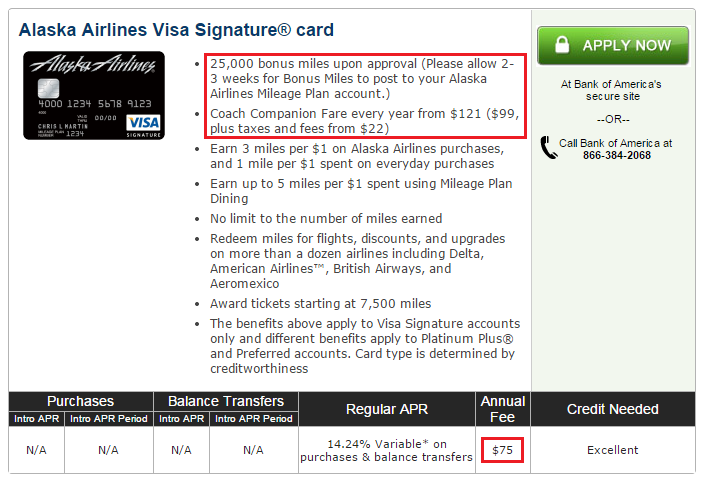

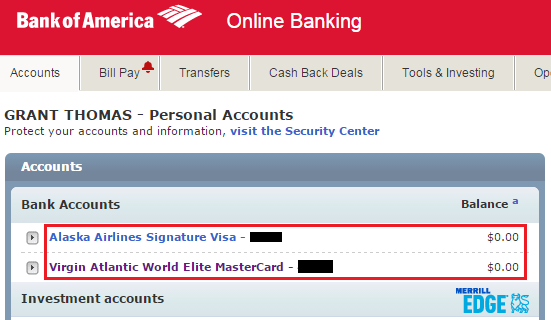

Up next, I applied for the Bank of America Alaska Airlines Credit Card. I recently closed my Alaska Airlines personal and business credit cards and had no open accounts with Bank of America. The sign up bonus is 25,000 Alaska Airlines miles on approval (you receive the miles before you even receive the credit card in the mail) with a $75 annual fee.

No surprise, I received another pending result. I called the Bank of America reconsideration department and asked if they needed any additional information from me. After looking at my application for a minute, the rep said I was approved with an $11,000 credit limit. I asked why I wasn’t instantly approved online and he did not know.

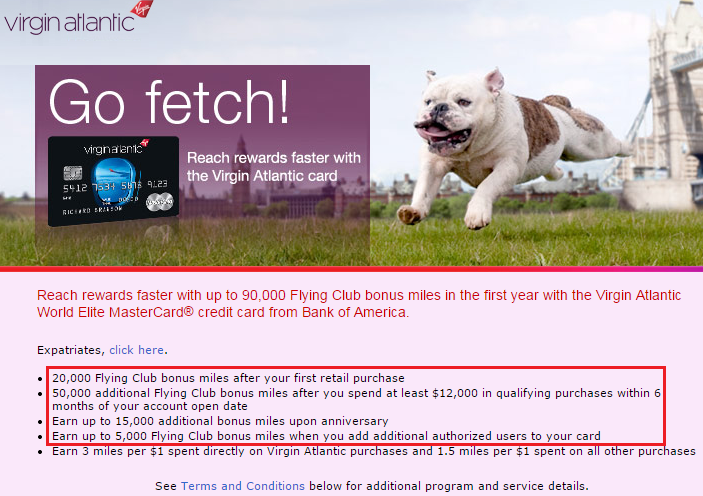

My friend Nigel reminded me that Bank of America combines inquiries if made on the same day, so I decided to go for a Bank of America Virgin Atlantic Credit Card. The sign up bonus is 20,000 miles after your first purchase, 50,000 miles after spending $12,000 in 6 months, and another 5,000 miles when you add an authorized user. If you pay the $90 annual fee, you will get another 15,000 anniversary miles (I’m not sure if that is worth it or not).

Guess what? Another pending result. I called the Bank of America reconsideration department and spoke to a different rep (thankfully) and he said I was approved with a $1,500 credit limit. Woo hoo?

After receiving and activating both credit cards, I called Bank of America and asked if they could move some of my $11,000 credit limit on my Alaska Airlines credit card to my $1,500 credit limit on my Virgin Atlantic credit card. After answering some income and employer questions, the request was approved. The rep moved $10,000 from my Alaska Airlines credit card, leaving a new credit limit of only $1,000. My Virgin Atlantic credit card now has an $11,500 credit limit, which makes it much easier to meet the higher spending cap without drawing unwanted attention to me.

If you have any questions, please leave a comment below. Have a great day everyone!

P.S. If you are interested in any of the above credit cards, you can find most of the offers from my credit card page here. Thank you for your support.

How long ago did you cancel your Alaska card? Seems it may be churnable if you are applying after recently closing. Also, when i click the link in your P.S. I only see 4 category links, and the Travel link takes me to http://www.creditcards.com. Do you get referral credit through this website? I’m gonna checkout the Flex AmEx.

I closed both Bank of America Alaska Airlines credit cards earlier this month.

If you click any of those 4 links, it will take you to creditcards.com. I receive an affiliate commission for any credit card that you click on and get approved for after clicking those links.

wow so you closed a card and then opened a new one (same exact product) in the same month?

Yes, no problem with Bank of America.

i applied using ur link….called recon and was told that they prefer to do their underweiting manually and that i just had to wait for the decision via mail. odd that they were able to help you right away but told me there was nothig they could do to expedite. think i should HUCA?

I had the same experience with US Bank. The recon department won’t let you speak to the credit underwriters. You just have to wait and see. If you used my referral link, I should be able to tell you in a week if you were approved. If you used my affiliate link, I should be able to tell you in 2-3 days. Good luck!

what’s the difference between referral and affiliate? I clicked on the link like you told me to up above. since it was a 3rd pty site i assume affilliate?

Yes affiliate. The only difference on my side is the affiliate pays cash while the referral pays FlexPoints (tax free). Either way is fine. Thanks Whitney.

seems All other banks love you except Barclay, i did my app o rama and waiting on 2 cards to be approved other 1 was approved instantly

I guess I can’t complain. If all the other banks love me and Barclays does not, it is not the worst thing in the world.

Grant, do you know if the Arrival Plus can be downgraded to a UPromise card? Or a Barclays Rewards card.

That would be a great question for someone with a Barclays credit card…

You can call Barclays and ask them to downgrade your Arrival Plus to the Upromise or Barclays Rewards Credit Card.

Thank for your reply, Grant (sorry, I didn’t mean to run salt on your wounds. I am sure you will get approved for a Barclays card someday).

Haha someday soon would be great.

I was offered to downgrade to barclay’s reward. They refused to waive the AF for my Arrival +

Thank you for the data point. Did you end up downgrading your Barclays Arrival Plus?

Its worth mentioning that there is a better offer for the Alaska Airlines card that includes a $100 statement credit if you google for the link. Since BofA combines pulls on same day, I simply got 2 Alaska cards :)

I forgot to look for that card. I think I got a card similar to that early last year with the statement credit.

That’s an awesome datapoint, Ralph..when I apply for a BoA card, I will do the same.

How long after applying do Alaska airlines miles post ?

I believe the miles post 7-10 days after approval. I wasn’t checking everyday, so I’m not 100% sure.

Did you mean to leave the last 4 digits in your bank of America pic?

Ehh, I should probably fix it. I will upload the new image when I get home. Nice catch Michael.

Anything news about the Sacramento meetup? :)

I was going to do this weekend, but it is Easter weekend, but the following weekend looks good. How does that sound?

Sounds good to me :)

Cool. I’ll start planning soon.

Nice job Grant, it’s good to hear of your experiences. Sounds like you have the same relationship with Barclays that I have with BofA!

I’m looking forward to my next round of apps later this month…

Good luck with your AOR. Why does BofA hate you?

I’m not really sure…I keep applying, they keep denying. Last two times I applied I called the reconsideration line and I got the same agent who wouldn’t give me any details or encouragement. “Just keep trying” she said. I even called back and got her again (I hung up as soon as I heard her name).

Try freezing some of your credit bureaus. Sorry Jeff.

Good tip. Thanks Grant.

Good luck, I hope it helps.

Grant,

I didn’t see you mention whether or not you called the Barclay reconsideration line? I had the Arrival card, the NFL card and the US Air card. I applied for the Hawaiian Air card, they denied it saying too many accounts, too many inquiries, etc, (which are all true, of course). Even though I had called their reconsid line a year before and gotten nowhere (for a different card), I had read recently that they were being a bit more gracious than in prior years. So I called and it was about as easy as calling Chase. Rep just asked why I had multiple cards with AE and Chase. I said I use those cards for their particular benefits, never mentioning promos of course. He said fine, approved me. A week later Barclay then cancelled my NFL card which I never use. They did this without warning but I was fine with that. I already received the HA card and received the points.

Give them a call if you haven’t and let us know the results. Barclay Reconsid: 866-408-4064

I’ve called in the past but I think I think I will get shutdown again. What do I have to lose? I’ll try one more time if it will make you happy.

Nice round. I recently did an AOR myself–final Barclay’s US Air, BofA Alaska with $100 credit, Chase Hyatt for the 20% rebate, CitiBusiness AA, Amex JetBlue (before it disappears, hey miles don’t expire and you can combine within family), and Wells Fargo Propel (something to load to Serve in May maybe). I was approved by Barclay’s but I only had the Arrival+ and have been using that a LOT. Course I’ve had 3? other US Air cards in the past couple of years. The BofA Alaska is my fourth I think? CitiBusiness AA was over 18 months since cancel so just time for another one.

Nice AOR. Good choice of cards. I’m glad you can get some Barclays CCs. I’ll get a Citi AA Biz CC someday.

why does US bank hide our available credit of each card wish dashes…?

No clue. It makes it seem like there is no credit limit.

why does US bank hide our available credit of each card with dashes…?

Yeah, this is stupid…I have a Cash+ card and I wasn’t sure how close I was to the credit limit…

Yes that is a tricky situation. I haven’t gone over my “credit limit/line” so I’m not sure what happens.

Hey Grant, I was just doing a mini AOR for myself and I realized that some cards, are no longer churnable.. or at least that’s what was implied by the customer rep I talked to at Amex..which I gathered to be true after reading some posts on Deltapoints. Do you happen to keep a list of all the popular MS cards and the rules for churning.. ie. 24 mths from when bonus was awarded for Chase cards?

I think Doctor of Credit has an updated list. From memory, AMEX personal cards are no longer churnable but Chase cards are, just reapply for the card 2+ years after receiving the sign up bonus.

why alaska cards with only 25 k miles bonus?

using it for round trip within US?

I still have 100k alaska miles from 2 alaska cards applied 2 yrs ago.

Wish they were transferrable.

I seem to rack up AS miles and have yet to use them. I’m up to 100,000+ now. You can redeem them for travel on several airline partners.

forgot to add something here to above post, i have 105k Alaska miles but my wife has none. if she applies and get the 25k bonus, can she transfer it to me for free so my balance becomes 130K? Otherwise i don’t know why i would apply for her for 25k only

Don’t believe so. She has to accumulate her own miles. Reasons to apply? Because she can get AS miles too, 25K a pop, and churn the card until she has enough for some future trip on her own.

Exactly! We all have to start somewhere (0 miles).

No you cannot move AS miles between accounts for free. She can start building her like of AS miles too.

never mind guys

Just applied for 2 again and instant approval on one and 2nd approved on phone with. $8k CL each. 50K bonus and $200 SC waiting. Sucks that it wasn’t 50k bonus each like last time I had.

MY 800 score helps works well 1 percent utilization ratio

That’s how you do it… Like a boss!

@karma1234, how quickly did you apply for the second Alaska card? Within a few hours?

Probably right away is my guess.

how many inquiries did you have on your reports ? I am thinking of applying for the us bank flexperks, but not sure what their take is on inquiries.

I applied for 2 cards before applying for the US Bank FlexPerks AMEX and got a credit line over $10,000. No instant approval but they like me :)

were there prior inquiries on your report before those 2 ?

Yes plenty of prior inquiries.

Is kiva still a good way to use the flexperks card on ?

Yes I believe Kiva still pays 3x.

Damn – thanks for this amazing data point!

I don’t think 5 cards is a “mini” AOR! Glad you got so many approvals,

Thanks S. I big AOR would be 7-8 cards.

Thanks for all the info here as well as other useful info on the site! Barclays doesn’t like me either, though they did approve me for two cards when I first applied a few years ago. Oh well :)

Did you take into consideration what credit agency the banks pull from when applying for these cards?

In your opinion (and I’d really appreciate your input on this), how many credit inquiries are “too many”, and do banks actually see those? I have 7 inquiries on each of my three reports, with a few dropping off in May/June. I’m considering a huge app-o-rama including a few of the cards you applied for and my decision to pull the trigger depends in part on trying to get a better understanding of what banks see regarding credit pulls.

I’d appreciate your input if you have a chance. Thanks!

J. Grant

I know some people pay really close attention to which credit bureau is used by each bank and try to bump off old inquiries. I personally don’t care or keep track of this. I live in CA so I think Experian is used most of the time but that doesn’t influence my AOR thoughts at all. I just apply for 1 card from each credit card company and hope for the best. Having existing credit card with each credit card company helps with leverage if you need to do a reconsideration call.

Thanks for replying and your input! Appreciate it.

You’re welcome, let me know if you have any other questions.

Barclays on witch hunt: Check this out, Grant. Without warning, Barclays mails me to inform me they have closed my US Air card immediately (which I have had for just over one year, since Jan 2014). They said they closed my account because I had two many inquiries in the last 6 mos, and too many new accounts open in the last 6 mos.

And they promised me a 5K retention bonus for keeping the acct open, over one month ago, if I spent 3K in 3 mos, which I did, but they did not deliver on that yet.

Then they told me my credit score is 780+ via TU, and that I can call for “recon.” Sure, thanks Barclays for telling my credit score was high, but it does not seem to matter to them.

Ever hear of an existing acct. being closed like this?

Recommendations?

I’ve heard of certain banks closing your credit cards for “perk abuse” but your case seems totally unnecessary. Good luck with the recon call, that sounds like a joke.

whoa! pls keep us updated on what happens. Barclays is one bank I do NOT want to ruin my relationship. is that the only card you have with them? how many inquiries would you say you had in those 6 months? thanks for the heads up!

Hi Grant, does Chase allow us to move ALL of the credit line from one card to another like what you did by moving the full $4,500 credit from Chase Southwest Airlines Premier Credit Card into you new Chase BA card?

Because I think I requested that when I called Chase in the past but the agent said she can’t do that and I have to leave some credit limit on the card that I was transferring the credit limit from.

Also, currently I have two Citi Alaska personal and 1 business cards open. Is it safe to cancel one of the personal Alaska card and ask Citi to move ALL the credit line to other one, then apply for two new Alaska card on the same day?

To move the full credit line, call Chase and tell them you want to move the entire credit line from one card to the other and subsequently close the other card.

I think you are confused since Bank of America issues the Alaska Airlines cards. You can probably call BofA and have them move the credit line from one card to another and subsequently close the other card.

Thanks Grant! yes you’re right, I meant BofA Alaska, not Citi ….. sorry my mind was full of Citi since I just read your post on Citi Prestige increased in-branch offer and keep thinking about it…. :)

Grant, my AA Exec card since the annual fee due in 2 days and I don’t want to pay the annual fee and then ask for refund later because it’s a hassle. So I called Citi and asked the retention rep to move the entire $8000 credit limit from my AA Exec card to my Double Cash card, but the rep said that she can only move $3000 of credit line max from AA Exec to Double Cash. I asked her if she could try again and look if she can move more credit line and she put me on hold while she was trying it again, and came back and told me that it’s still $3000 max of credit line that can be moved, so I took the offer to move that $3000 to my Double Cash and closed the AA Exec.

Did I make the right decision? or should I HUCA next time if I encountered this situation again in the future when trying to move the entire credit line and close the card? Feel a bit uneasy to lose the $5000 credit line with Citi and worry if it affect my relationship with Citi and also affect the chance of getting approved for Citi Prestige since I plan to apply for it in 1-2 weeks. Appreciate your advice.

I think if you wait the full year (after the annual fee posts), then you might have been able to move the full credit line. Since you basically gave $5,000 credit line back to Citi, they can technically approve you for a new card with a $5,000 credit line, so I wouldn’t worry. If you are not instantly approved for the Citi Prestige, just call and see if you can move some credit line around.

Thank you Grant! Please update us on your Citi Prestige application status too!

Will do, so far my application has been faxed from the Citi Branch to the Citi Credit Card Processing Center. It has only taken 5 days to do that…

The application for Citi Gold or Citi Prestige? you have to set up/apply for Citi Gold account first and it would take 2 days, isn’t it…

Not sure if you see my question so I just posted again to bump this comment….

You can apply in-branch for the Citi Gold Checking Account, but you can also apply online or over the phone. The entire process takes about 2 weeks for verification, funding, and receiving your debit card/check book.

I would start applying for the Citi Gold Checking Account about 2 weeks before you plan on applying for Citi Prestige in-branch.