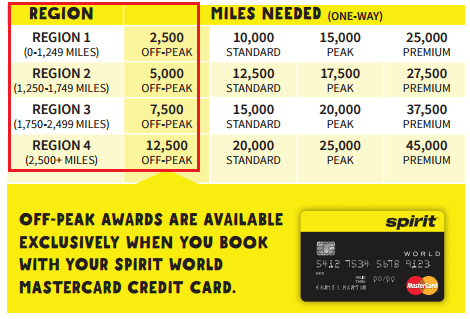

Good morning everyone. As part of my 8 card App-O-Rama in July, here is an update to my Bank of America Spirit Airlines Credit Card application. Before I share my success story about denial letters and reconsideration calls, let me explain why I would ever want to fly on Spirit Airlines, let alone get a Spirit Airlines credit card. The answer is quite simple. Spirit Airlines has a distance-based chart (accidentally mislabeled as a region-based chart) and by having the Spirit Airlines credit card, you are able to book off-peak award prices. This distance-based chart does not matter if the flights are non-stop or not.

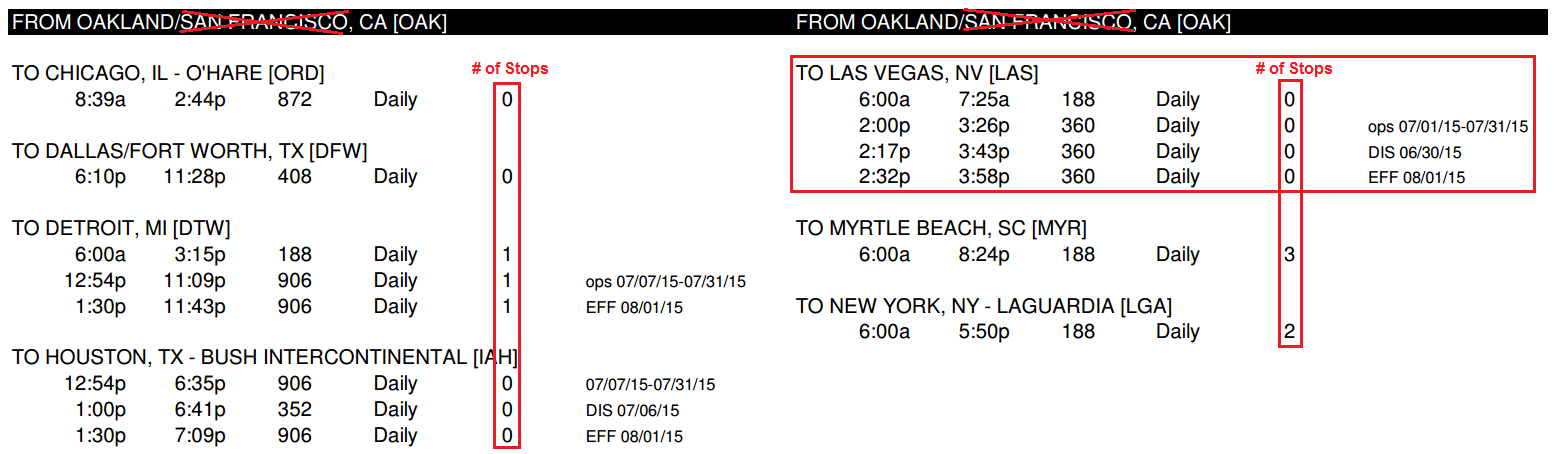

Since I live in the Bay Area, Oakland Airport is my closest Spirit Airlines airport (I’m not sure why they mention San Francisco since it is 100% in Oakland. I crossed out San Francisco so no one would get confused.) They offer non-stop service from Oakland to Chicago (ORD not MDW), Dallas (DFW not DAL), Houston (IAH not HOU), and Las Vegas (LAS). I would never want to be on a Spirit Airlines flight that has 2-3 stops, so Myrtle Beach (MYR) and New York City (LGA) are out of the question. I like the 4 non-stops to Las Vegas, but there are no non-stop flights after 2:32pm. Come on Spirit, add some evening flights to Vegas! It is interesting that Spirit Airlines does not fly OAK-LAX, since only Southwest Airlines flies that route.

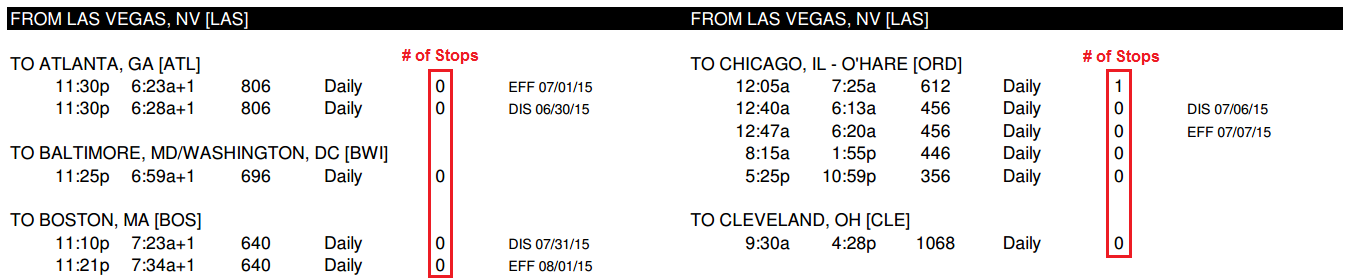

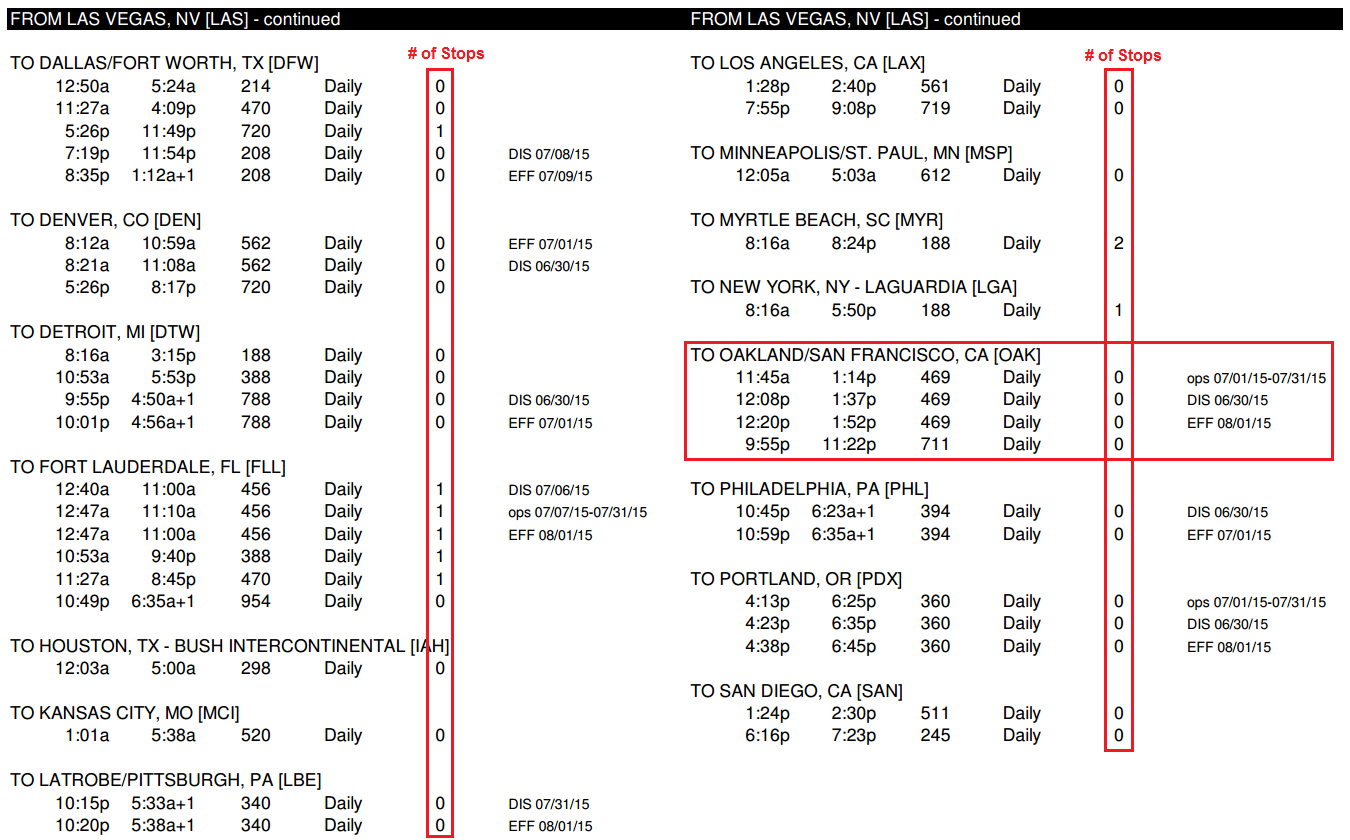

Once you get to Las Vegas, there are plenty of non-stop flights to choose from. I don’t necessarily have any plans to book any upcoming Spirit Airlines flights, but I’m sure I will find a use for Spirit Airlines miles someday. If you want to see the entire Spirit Airlines flight map, click this PDF link.

The Spirit Airlines sign up bonus is simple: receive 15,000 miles after your first purchase (similar to the Bank of America Alaska Airlines Credit Card). If you make a dummy Spirit Airlines booking, you will see an offer on the checkout/payment screen that also includes a $100 statement credit after spending $500 in 3 months. The $59 annual fee is waived the first year. So by applying for this credit card, I will get 15,000 Spirit Airlines miles and a $100 statement credit with no minimum spending requirement or annual fee. Pretty good deal, right?

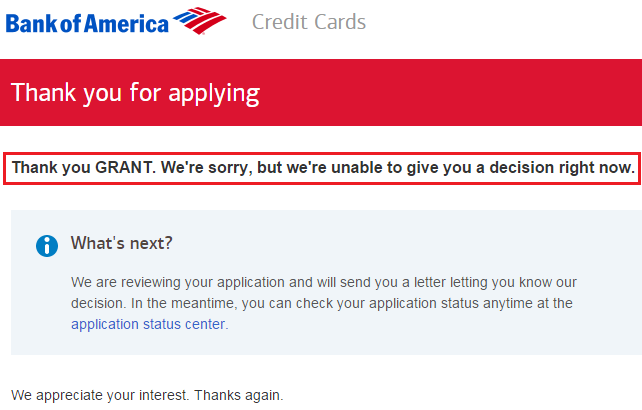

During my App-O-Rama, I was instantly approved for the Bank of America Alaska Airlines Credit Card (which I wrote about here: Strange Approval for Bank of America Alaska Airlines Credit Card (Credit Lines Lowered/Moved). I then tried my luck and applied for the Bank of America Spirit Airlines Credit Card by making a dummy booking on Spirit Airlines’ website. Unfortunately, my application went to pending.

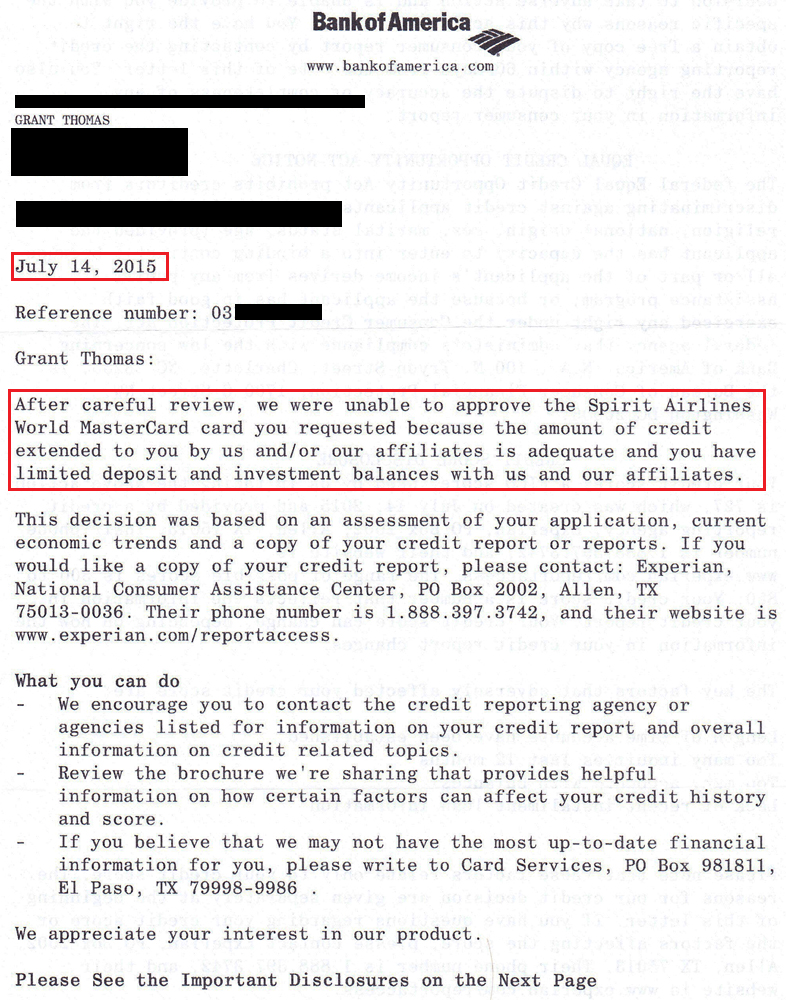

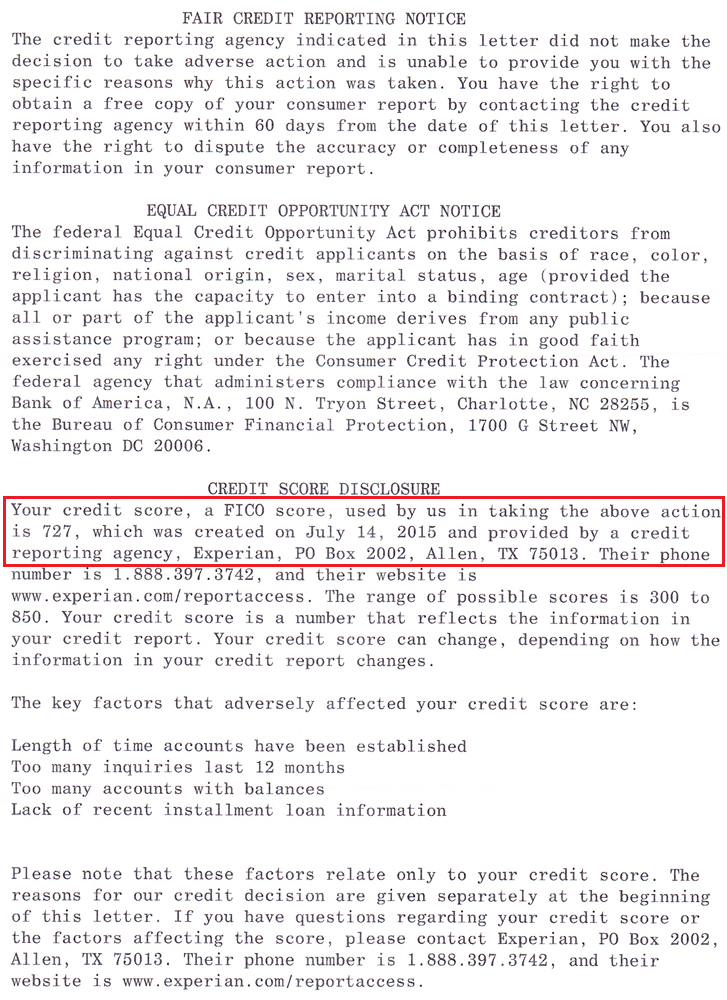

After calling the Bank of America reconsideration department (phone number found on Doctor of Credit’s website), I was told that Bank of America could not approve my application. I had “too many” Bank of America credit cards (4 including the recently approved Bank of America Alaska Airlines Credit Card). I offered to transfer some of my credit line from my Better Balance Rewards or Virgin Atlantic credit cards, she said no. I offered to close those credit cards, she still said no. It didn’t sound like I was making any progress on the call, so I thanked her for her time and hung up. A week later, I received the following denial letter (dated July 14, 2015) from Bank of America.

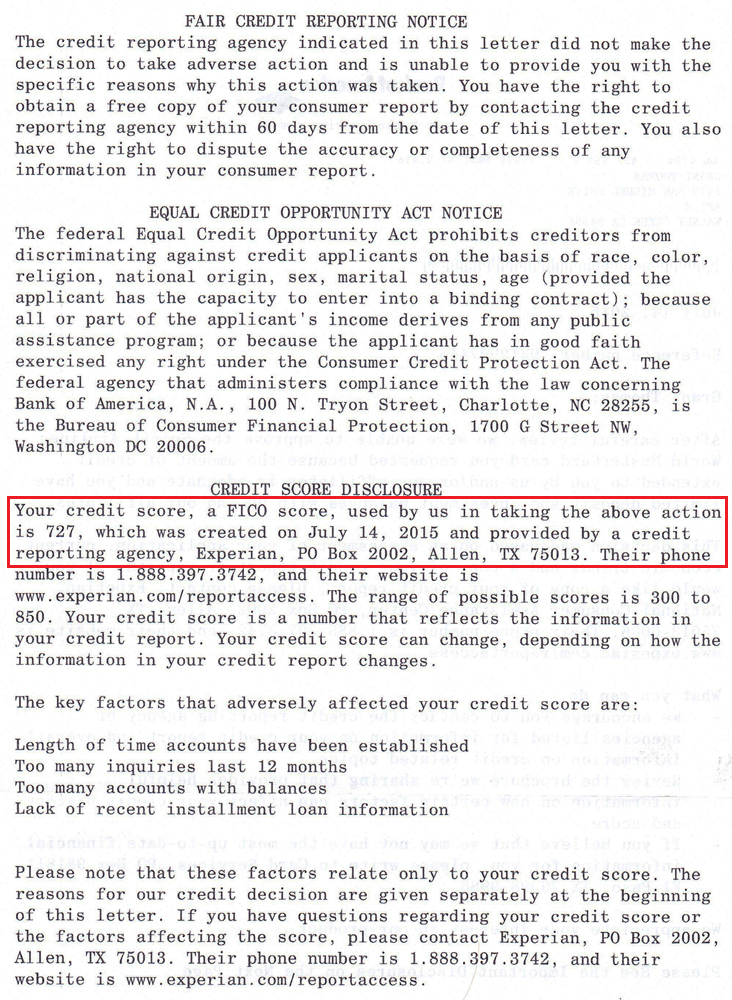

On the denial letters, I like when the credit card company mentions which credit bureau they used and the credit score that was shown.

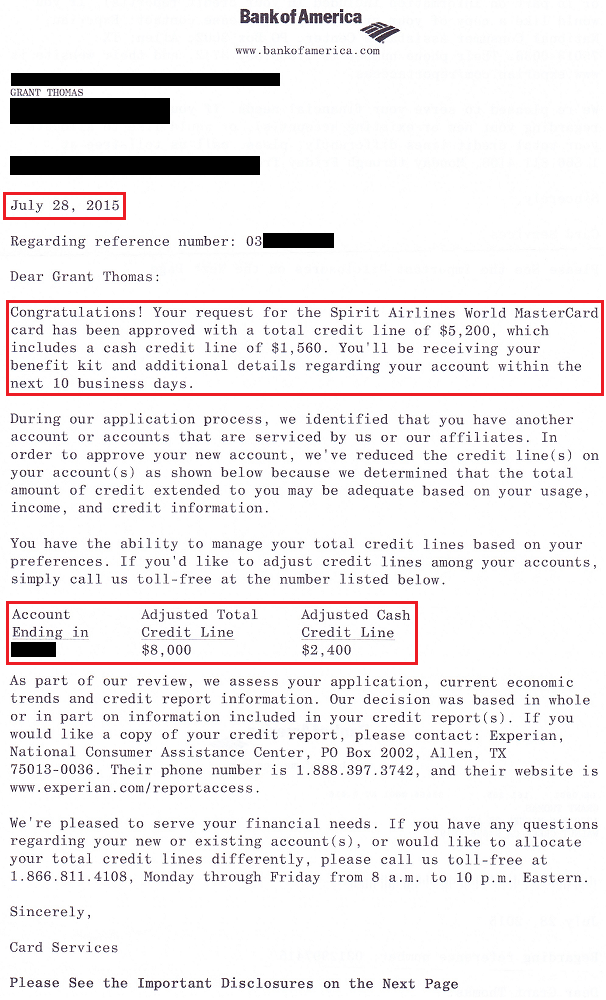

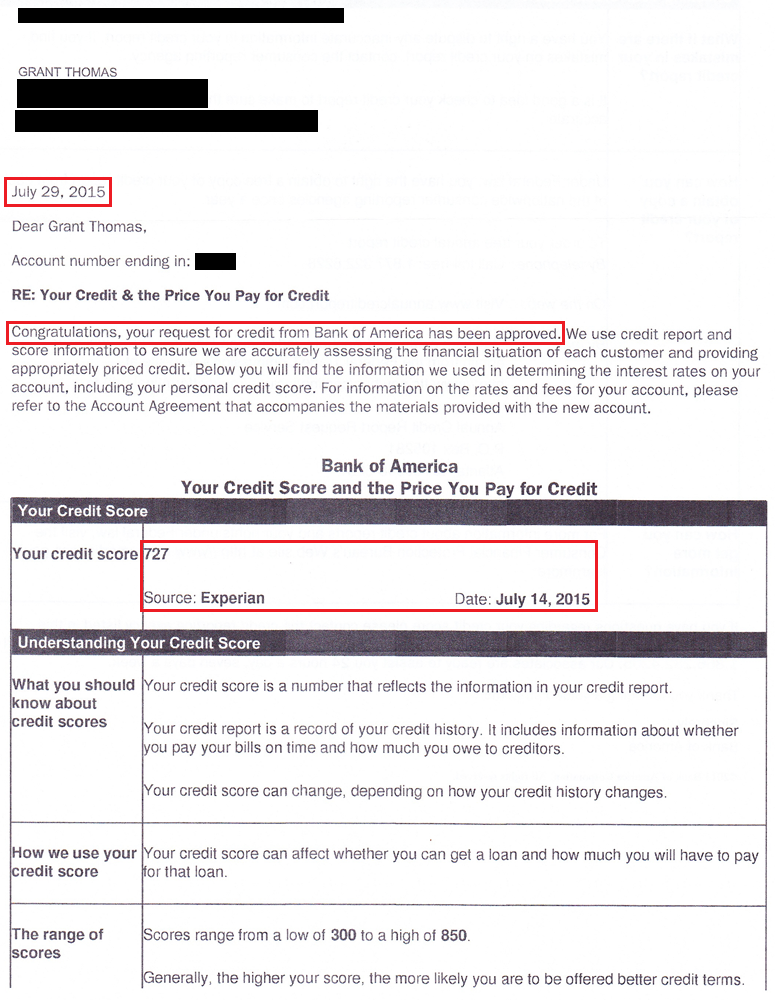

After I received the denial letter, I called the same reconsideration phone number as before and pleaded my case to the credit analyst. I explained that I did not want any more credit, I only wanted to move credit lines around from existing Bank of America credit cards. After looking at my accounts, she was about move $1,000 from my recently approved Bank of America Alaska Airlines Credit Card to approve my Bank of America Spirit Airlines Credit Card. Somehow I ended up with a $5,200 credit line (I’m not sure how the math worked on that one, but I am not complaining). A few days later, I received my approval letter (dated July 28, 2015).

Again, Bank of America posted my Experian credit score from my original application date (July 14). It’s nice to see that Bank of America did not do another hard pull to view my credit report.

I also received a letter from Bank of America (dated July 29, 2015) that my credit card request was approved. It doesn’t mention the name of the card, just the last 4 digits of the card. I have not received the card yet. It would be great if Bank of America would send out the card at the same time as the approval letters.

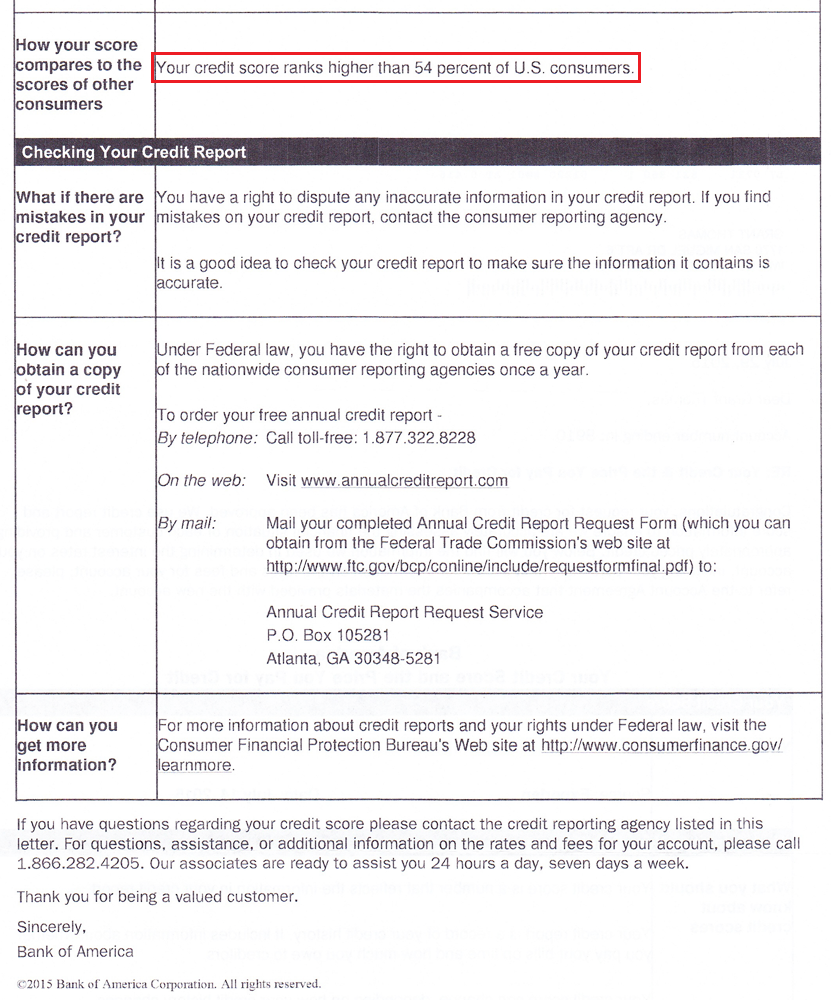

On the back side of that letter, it said my Experian credit score is 54% higher than other US consumers. I guess that is good, but I thought my score would be better than 54% of US consumers. If they are basing that on the score of 727 on its own, I guess that makes sense. I would probably argue that my credit report is much better than 54% of US consumers though.

If you have any questions, please leave a comment below. Have a great day everyone!

P.S. I just submitted a comment on Spirit’s Hate Thousand Mile website to receive 8,000 free Spirit Airlines miles.

Hey Grant,

I just got the same denial letter after applying for Alaska card.

This is my first BOA card and have no other relationship with them.

What would be the best recon strategy since I can’t offer to move CL?

Thanks!

Ask them why you were denied and explain away their worries.

Grant, Thanks. I hit a similar problem with BoA.

Just curious how often do you do your App-O-Ramas

I typically do App-O-Ramas every 3-4 months but I might space them out even more.

My late Uncle Floyd would have loved this story because he always used to talk about pigs getting fat and hogs getting slaughtered.

Haha, he sounds like a great guy. I’m sure he is dearly missed.

Spirit is actually starting OAK-LAX service this fall, I believe in the November timeframe

Oh excellent, thank you for the update.

Only 2 flights to Vegas: 188 and 360.

From where? What date are you referring to?

Grant, it’s sad to see a day where you publish such a long post on getting a Spirit Airlines card. It must be the beginning of the end.

This card is not for everyone, but it does provide value to some people. I’ve never flown Spirit, but I am definitely interested in trying it out. Hopefully the underlying message about BofA’s reconsideration process provided some value. Have a great day :)

I agree with RL. There is no reason anyone in their right mind would fly Spirit, let alone apply for the card. Just suck it up and pay the $80 for a RT to Vegas and don’t waste your inquiries on stupid cards such as this. That’s probably why you’re even in a predicament like this – an excessive amount of applications on worthless cards.

Since I was already approved for the BofA AS card, I figured this was a free shot at another BofA card. I definitely wouldn’t recommend going out of your way to apply for this card. Thank you for your feedback and have a great day :)

great work Watson! dedication and persistence –all traits of a great churner!

Haha, thank you. Just another day’s work :)

The Spirit card is like Capital One – good for the bonus and that’s about it.

I foresee booking several flights to Las Vegas for last minute bachelor and bachelorette parties for friends too. Sign up bonus is everything.

Spirit does have a close-in fee that makes it less useful for last-minute award flights, not to mention the restrictiveness of the off-peak calendar. That being said it definitely can offer value, just be sure to use the card once every three months.

I didn’t see any mention of close in fees. Does that apply for members with a credit card? The off peak calendar is interesting, I might do a post about that, but I’m worried the Spirit Airlines haters will get mad at me :/

Cool! Thanks for the post. Using the same techniques you did after being denied (I also have 4 other BOA credit cards), called the reconsideration line and was approved for the BOA Travel Rewards Card.

Excellent, glad your persistence paid off like mine did :)

Already called BOA/Spirit for reconsideration… came back NO again!!! :(

Can I try again…?

Keep trying. If it’s worth applying, it’s worth fighting for the recon approval :)

Pingback: Travel Predictions for 2016 Part 1: Airlines and Hotels | Travel with Grant

Pingback: Spirit Airlines Credit Card Holders: Find Off-Peak Award Tickets & Avoid Award Booking Fees | Travel with Grant