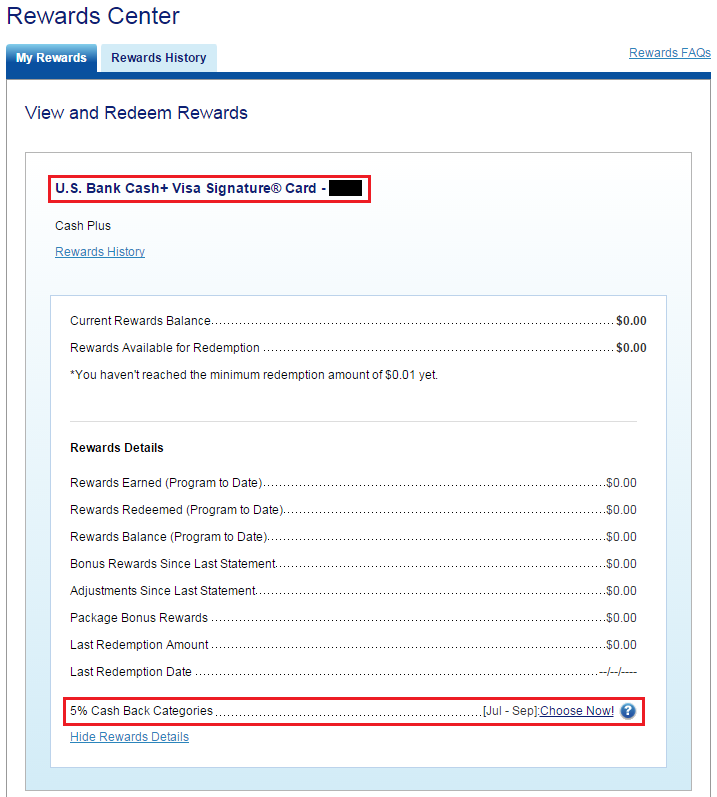

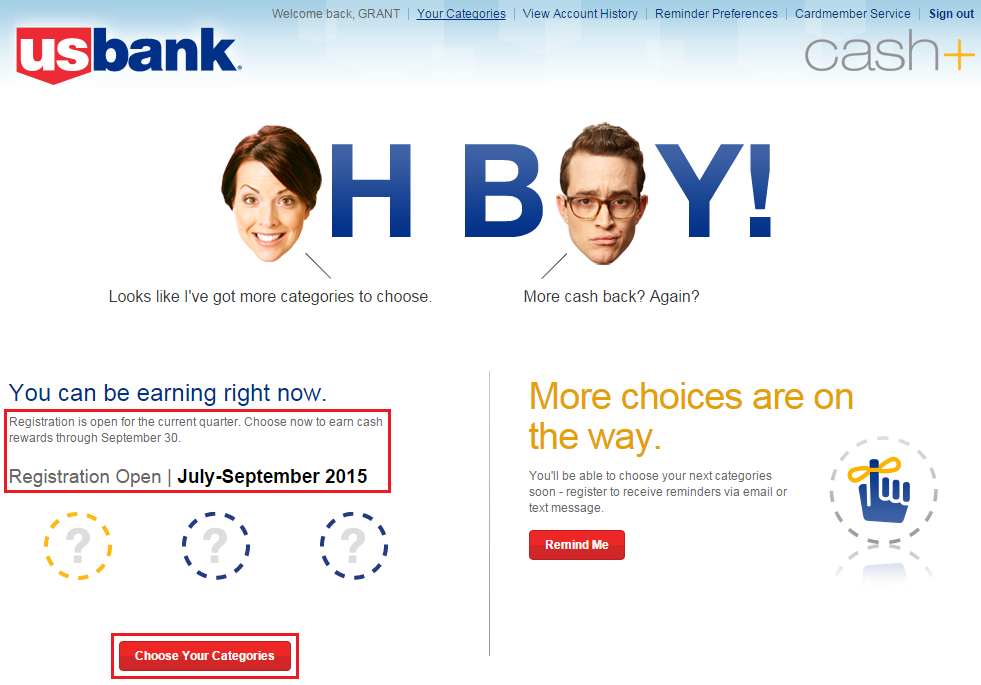

Good afternoon everyone. I was recently approved for a US Bank Cash Plus Credit Card (still waiting for the card to arrive in the mail). However, the credit card already shows up on my US Bank online account with a link to enroll in Q3 cash back categories. This is my first time looking at US Bank’s cash back categories and here are my thoughts on the enrollment process and the cash back categories.

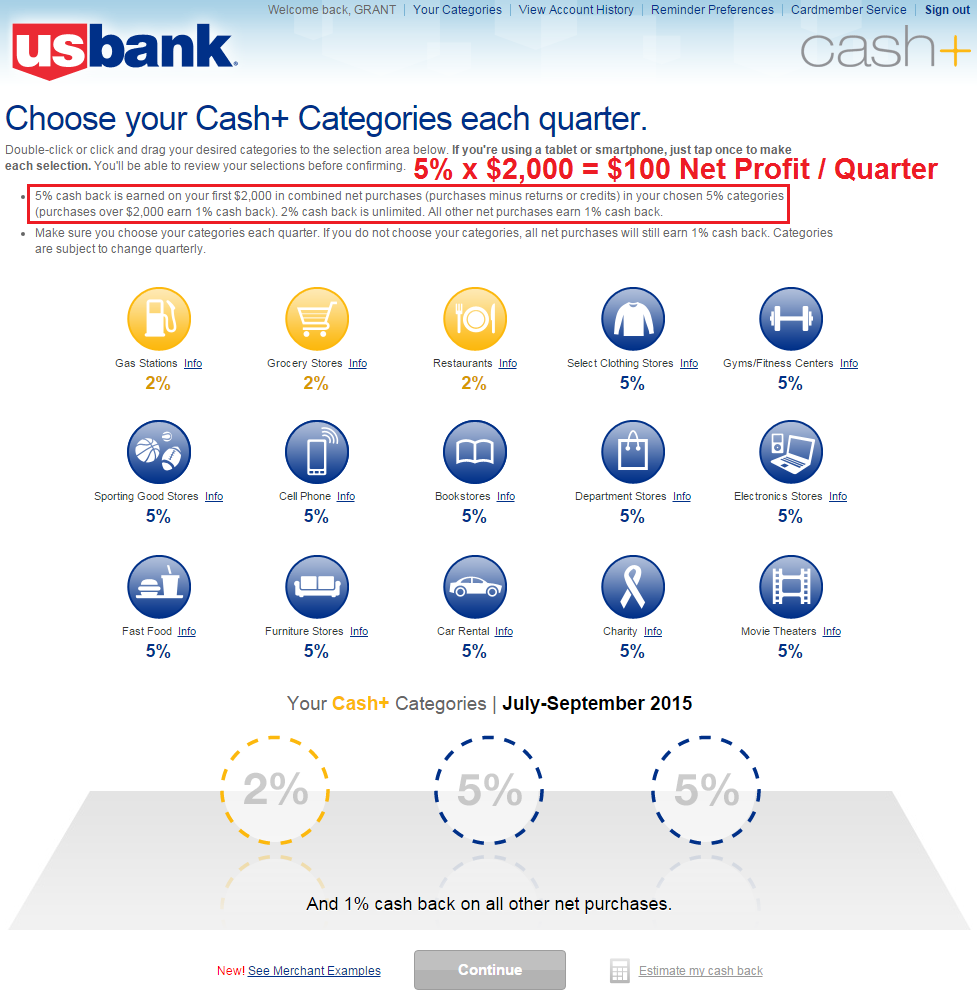

I need to pick a 2% cash back category and two 5% cash back categories (US Bank Cash Plus website). How hard could that possibly be?

The list of cash back categories is listed below. Unfortunately, there is a combined cap of $2,000 spent on 5% cash back categories per quarter. Doing the math, 5% x $2,000 = $100 profit per quarter. To make this a viable MS opportunity, I need my MS costs to be less than $100. I think there are too many categories for the average consumer (and MS blogger) to evaluate to decide which categories to select.

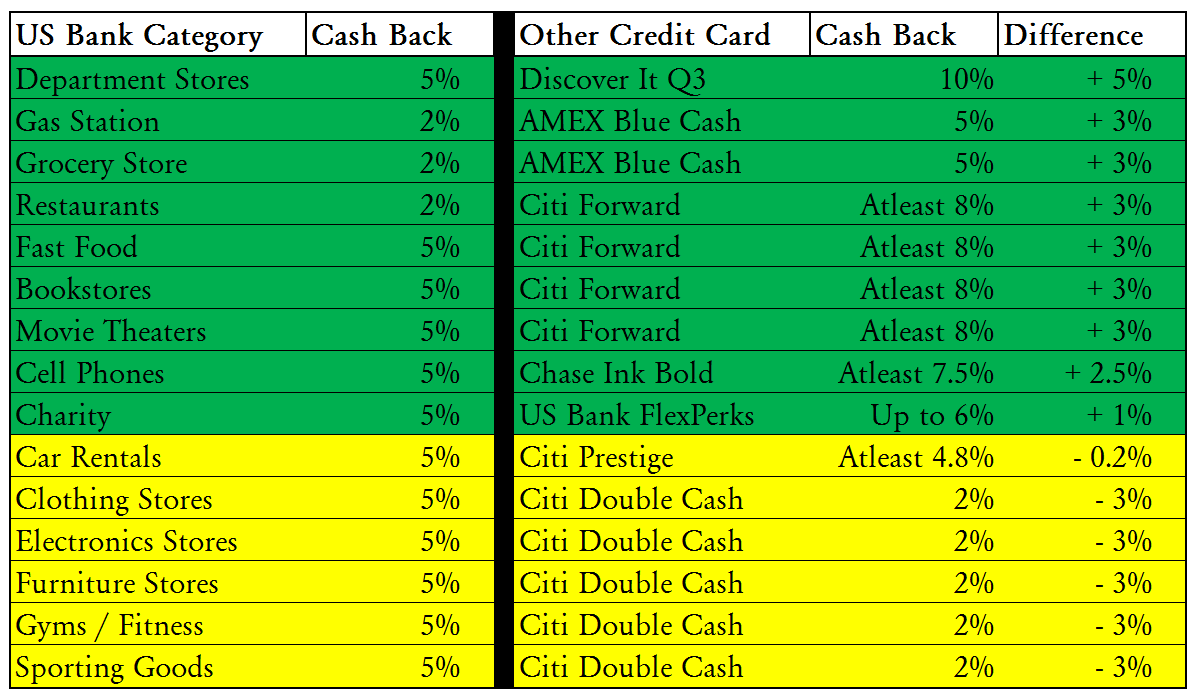

I also don’t like to go out of my way to use a specific credit card if it has cash back categories that match one of my everyday credit cards. To illustrate that example, I put all the US Bank Cash Plus Q3 categories on a spreadsheet and compared the categories to my other credit cards and their corresponding cash back rates. Let me explain all the green cells where my existing credit cards offer better rewards than the US Bank Cash Plus Q3 categories:

- Discover It @ Department Stores: Q3 cash back category is 5% at department stores too, doubled to 10% after the first year

- AMEX Blue Cash @ Gas Stations & Grocery Stores: Offers 5% at grocery stores.

- Citi Forward @ Restaurants, Fast Food, Bookstores, and Movie Theaters: Offers 5x Citi Thank You Points (Citi TYPs worth at least 1.6 CPP for AA/US/Codeshare flights, 5 x 1.6 = 8%)

- Chase Ink Bold @ Cell Phones: Offers 5x Chase Ultimate Reward Points (Chase UR worth at least 1.5 CPP, 5 x 1.5 = 7.5%)

- US Bank FlexPerks Visa @ Charity: Offers 3x FlexPoints (FlexPoints worth up to 2 CPP for airline redemptions, 2 x 3 = 6%)

I will now take a look at the remaining US Bank Cash Plus Q3 categories to see if there are any opportunities for MS.

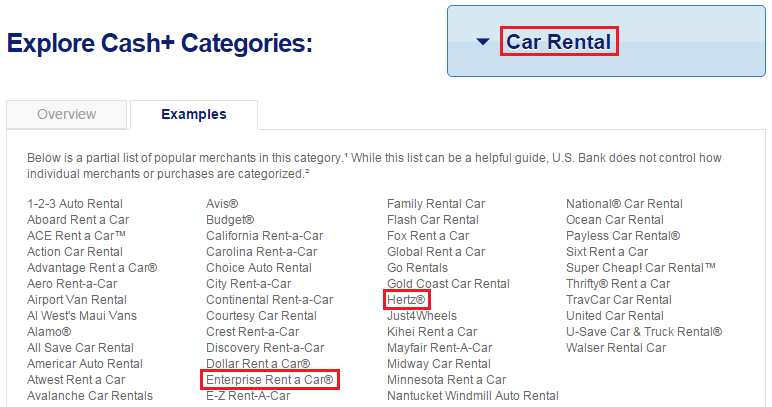

I have 2 upcoming rental car reservations with Hertz and Enterprise. Since the Citi Prestige offers 3x Citi Thank You Points (Citi TYPs worth at least 1.6 CPP for AA/US/Codeshare flights, 3 x 1.6 = 4.8%), this is essentially a tie in my book. I would rather use my Citi Prestige for my upcoming Hertz and Enterprise car rentals.

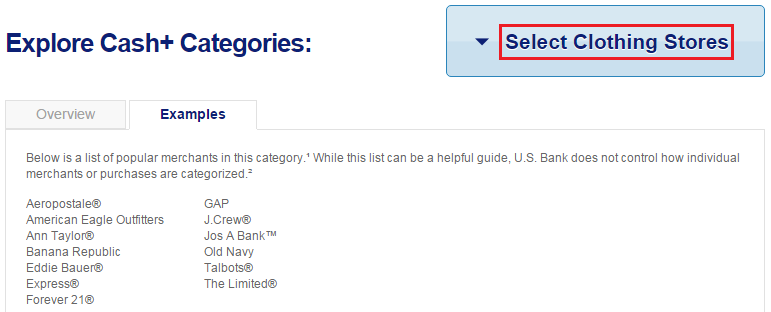

Clothing stores is next. I don’t shop at these stores and if I did, I could probably buy gift cards from a gift card reseller for more than a 5% discount.

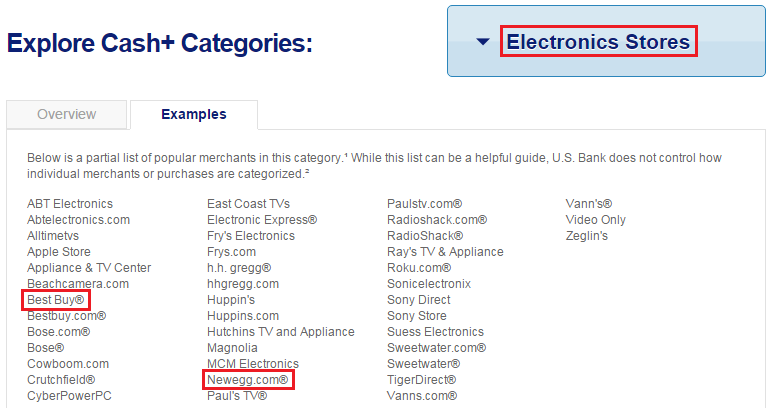

Electronic stores is next. This is the most interesting category to me since it includes Best Buy (known to sell VGCs) and Newegg.

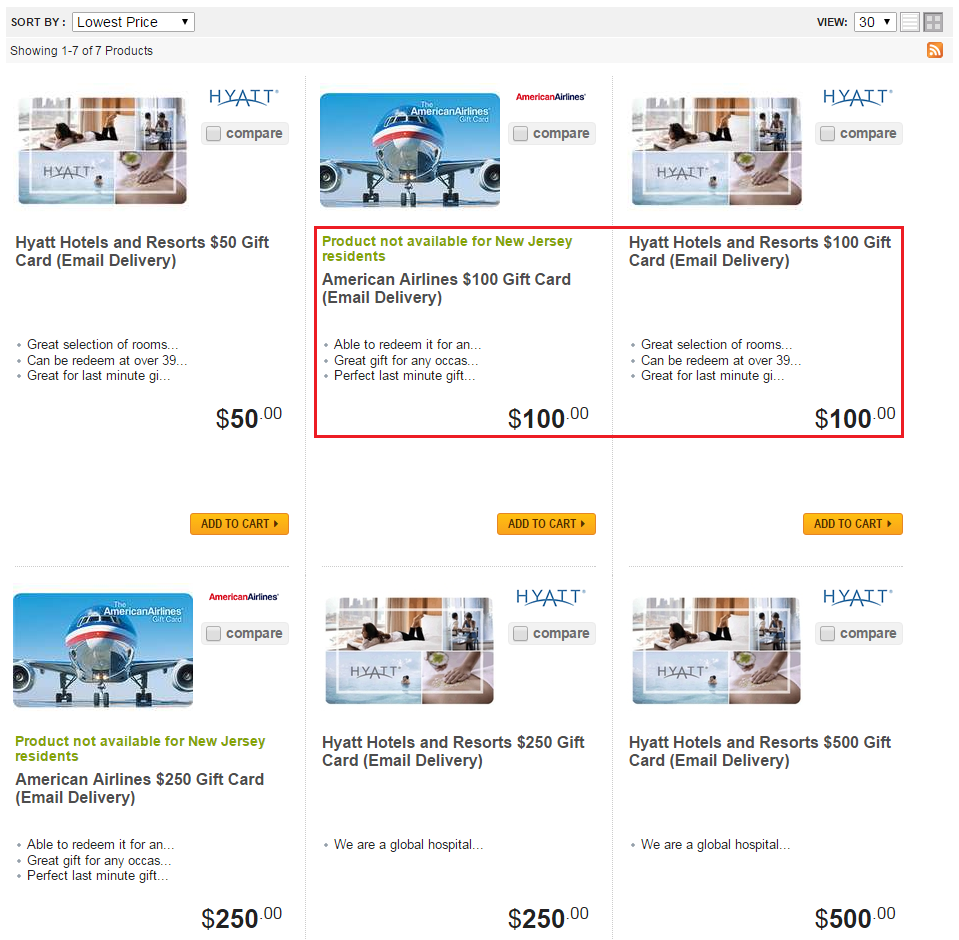

Assuming you don’t live in New Jersey, you can buy $100 American Airlines eGift Cards from Newegg and get 5% cash back. Hyatt has a few eGift Cards for sale on Newegg too.

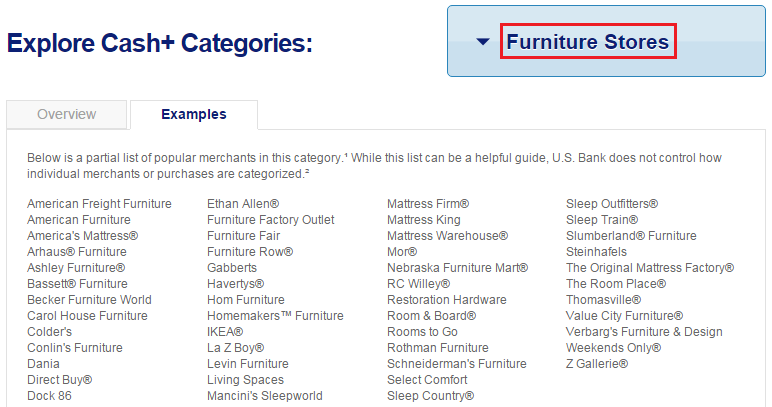

Furniture stores is next. I live in an apartment, so there is no room for new furniture. Pass.

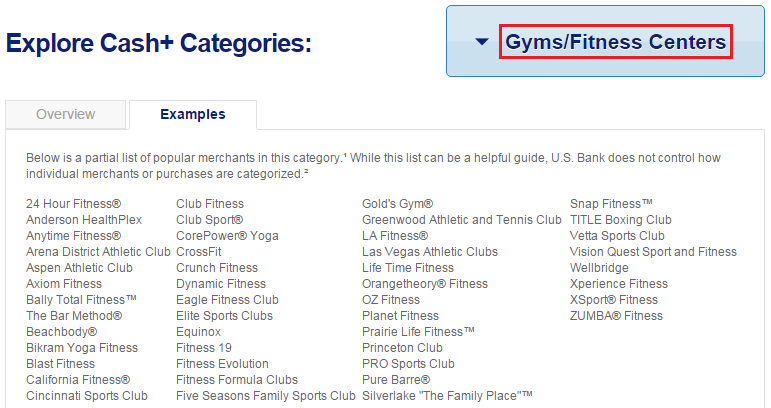

Gyms and fitness centers are next. I don’t go to a gym (I’m too busy blogging). Pass.

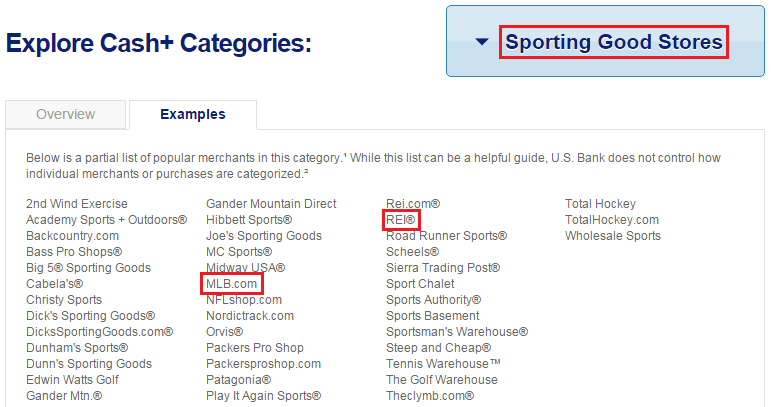

Last but not least, sporting good stores. I’m curious if MLB tickets purchased through MLB.com will earn 5% cash back. REI also has some cool camping gear and warm weather gear (perfect for my upcoming trip to Europe in January).

As you can tell from above, there are no amazing cash back categories for me this quarter. I still don’t know which categories to choose. Do you have any advice or recommendations?

If you have any questions, please leave a comment below. Have a great weekend everyone!

I’d go for Electronic Stores + Department Stores, then buy VGC at Best Buy, and VGC at Sears. You’re going to use up the Discover $1500 really quickly (I finished it within a week of the quarter starting), so another card to reach $1500 on will be nice!

Great advice Ester. I actually haven’t maxed out Discover It this a quarter yet. Which Best Buy and Sears did you go to? You can DM me if you don’t want to state publicly. Thank you.

I think that you should use a CSP or United Explorer — if you have them — for US rentals as those cards primary insurance and as such, provide greater protection that the secondary coverage provided by the Cit or US Bank products discussed above.

I no longer have a CSP or United CC. Any other CC recommendations?

Yeah, you should have kept one of them! LOL!

Actually, if you do have an AMEX Platinum, you should sign up for the enhanced Primary auto coverage that they charge an extra $25.00 for the entire rental. It is worth the extra $$ for peace of mind.

I think I have that protection plan linked to my Amex Plat Card but I’ve never used it before.

You probably don’t as you actually have to opt in to obtain it and then they charge you an extra $25 for the insurance after each rental. You would remember it if you had as you would see the charge after every rental.

I remember enrolling in the program, but I’ve never used my Amex Plat to pay for a rental car.

Then, you should be good to go.

Yes, you won’t get a bonus on the spend and you will be paying an additional $25 for the rental, but at least for me, I prefer to have the peace of mind of having primary insurance on the car rental when in the USA — outside of the USA it does not matter as the secondary insurance commonly provided by the other cards, becomes primary insurance.

One other thing you might want to consider depending on where you are renting, etc. and that you might be using your AMEX Plat card for the rental, is the Sync Offer with SIXT that is presently on the table.

Sixt — a German outfit — is mainly found in Europe, but they have made some inroads in South Florida and who knows where?

If you are renting in an area where they have a presence, and their initial rental is competitive, then the Sync offer may make it more so, and inasmuch as your would be using an AMEX Plat card for the rental, then you should see if a Sixt car rental makes sense for you on your trip!

Good luck!

No Sixt for me. Using hertz from Las Vegas.

Too late for that now :/

Why do you say citi prestige gives out 3 thank you points for car rentals? For some reason I had that in my mind too, but I just did a car rental and I didn’t get 3 thank you points.

Maybe Citi Premier is 3x on rental cars, I think I mixed up the card bonus categories.

Nope, its the standard 2 points for travel/tranportation like the CSP.

I think that you are confusing the Premier to the Prestige that does give a 3X bonus, but that is only on Hotels and Airfare!

AMEX Blue Cash @ Gas Stations & Grocery Stores: Offers 5% at grocery stores.====> the Old Blue Cash?

Do you always use Citi Forward for restaurants including fast food chains and always get 5% back?

I am curious as I don’t have those two cards…

Yes, the Amex Old Blue Cash. Sorry for the confusion.

Citi Forward is 5x at all restaurants (from fast food to fine dining), but that card is no longer available.

Pingback: New Staples Visa Giftcards, US Bank Cash+ Q3 Categories, Carshare & New Marriott Expiration Policy - Doctor Of Credit

Pingback: 1 Month Approval Process for US Bank Cash Plus Credit Card | Travel with Grant

NewEgg no longer earns 5% in Electronics despite still being explicitly listed.

Good catch Steve! Have you reached out to US Bank to investigate or get your missing cash back?