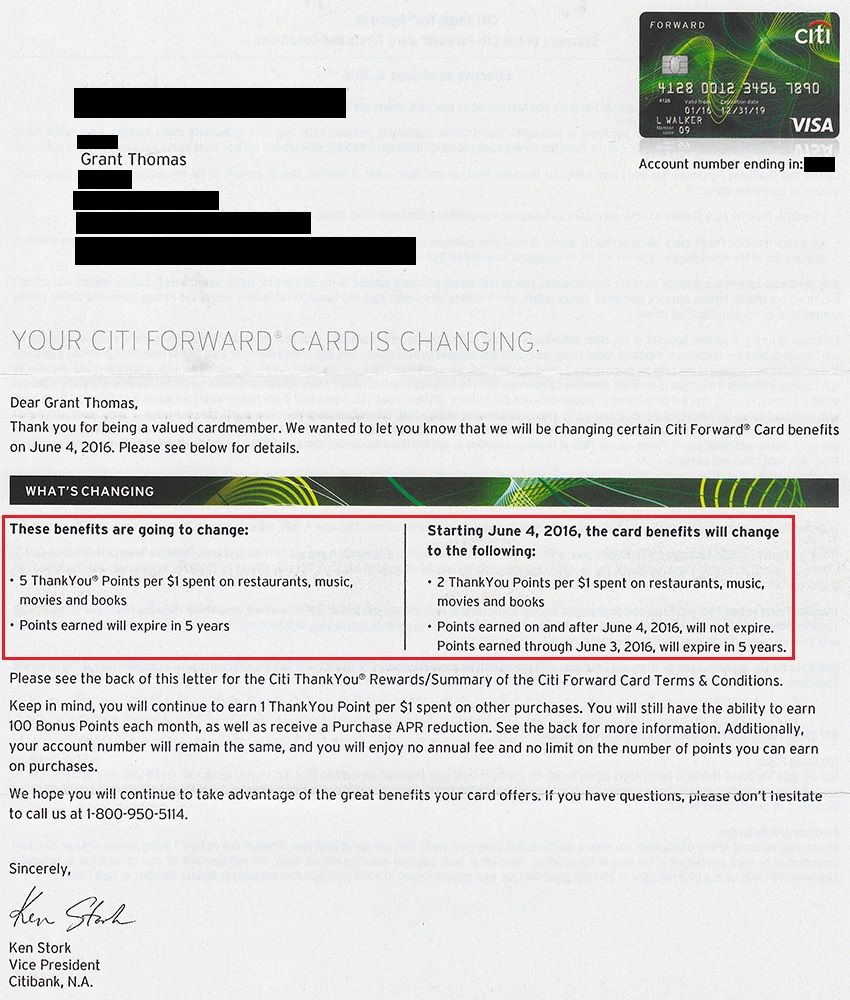

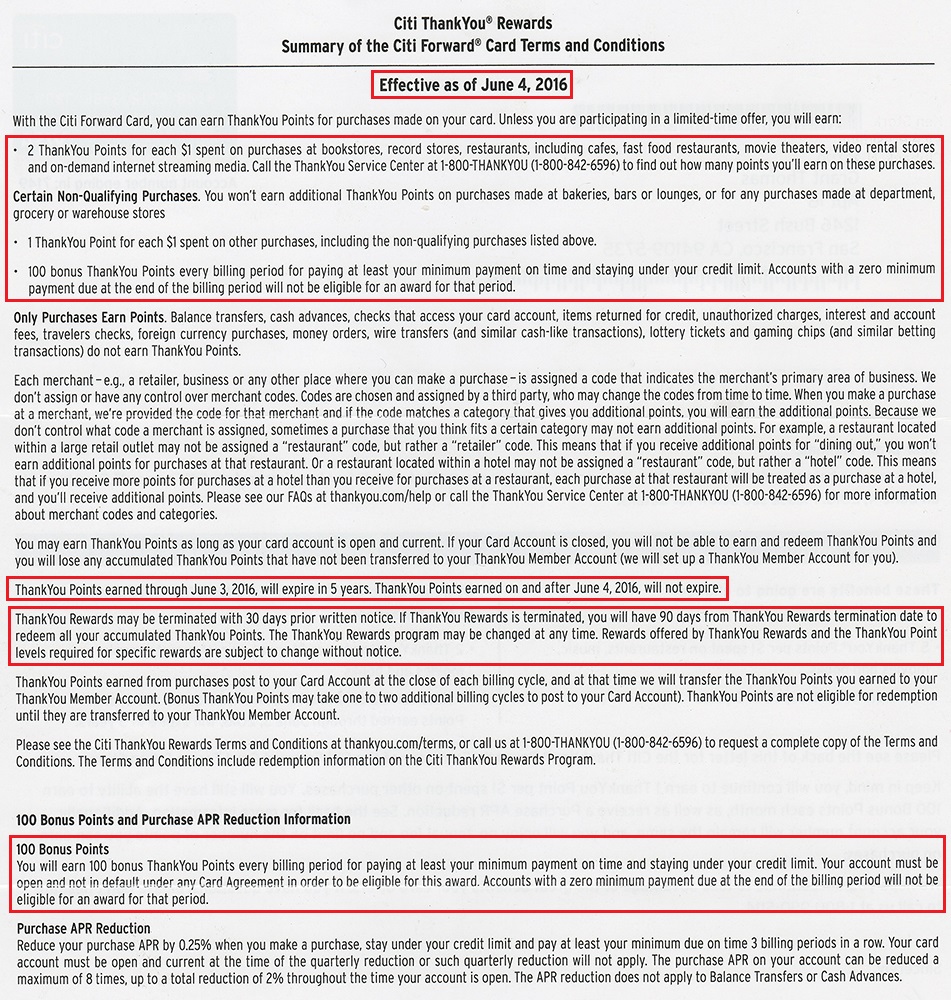

Good morning everyone, I hope you all had a great weekend. I know this is old news, but my beloved Citi Forward Credit Card is changing (for the worst) on June 4, 2016. Since the very beginning, I have been a huge fan of my Citi Forward Credit Card. I have enjoyed the perks of earning 5x Citi Thank You Points on all restaurant, music, movie, and book purchases. Unfortunately, the good times are ending abruptly on June 4, 2016, when the 5x categories are going to be downgraded to 4x 3x 2x categories.

As a consolation prize, Citi is extending the expiration period on Citi Thank You Points from 5 years to forever. *sarcasm* Thanks Citi, I really appreciate that my Citi Thank You Points never expire.

On the backside of the letter, the full terms and conditions are listed. Luckily, Citi is still offering 100 bonus Citi Thank You Points on every statement for paying my bills on time. I don’t think this benefit will be around forever. Prove me wrong, Citi!

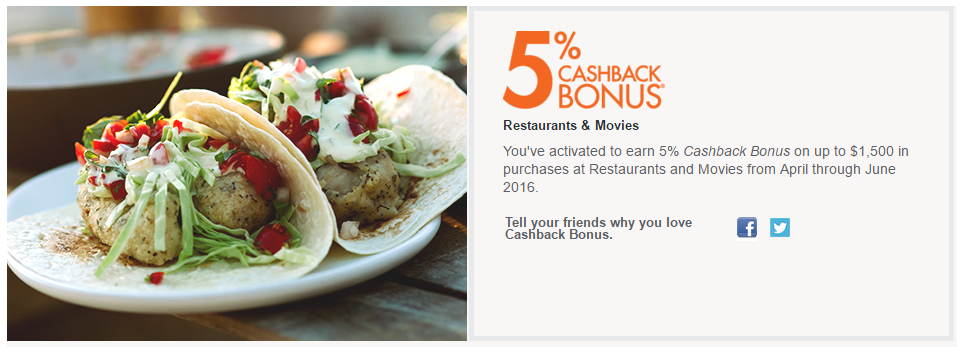

For those with a Discover It Credit Card, you can currently earn 5% cash back (or 10% cash back if you signed up for the double cash back promo last year) on restaurants and movie theaters. I wrote about this perk in My Q2 Rotating Cash Back Category Credit Card Strategy. Unfortunately, Q2 ends on June 30, so we will need to find another go-to credit card for restaurant purchases starting on July 1.

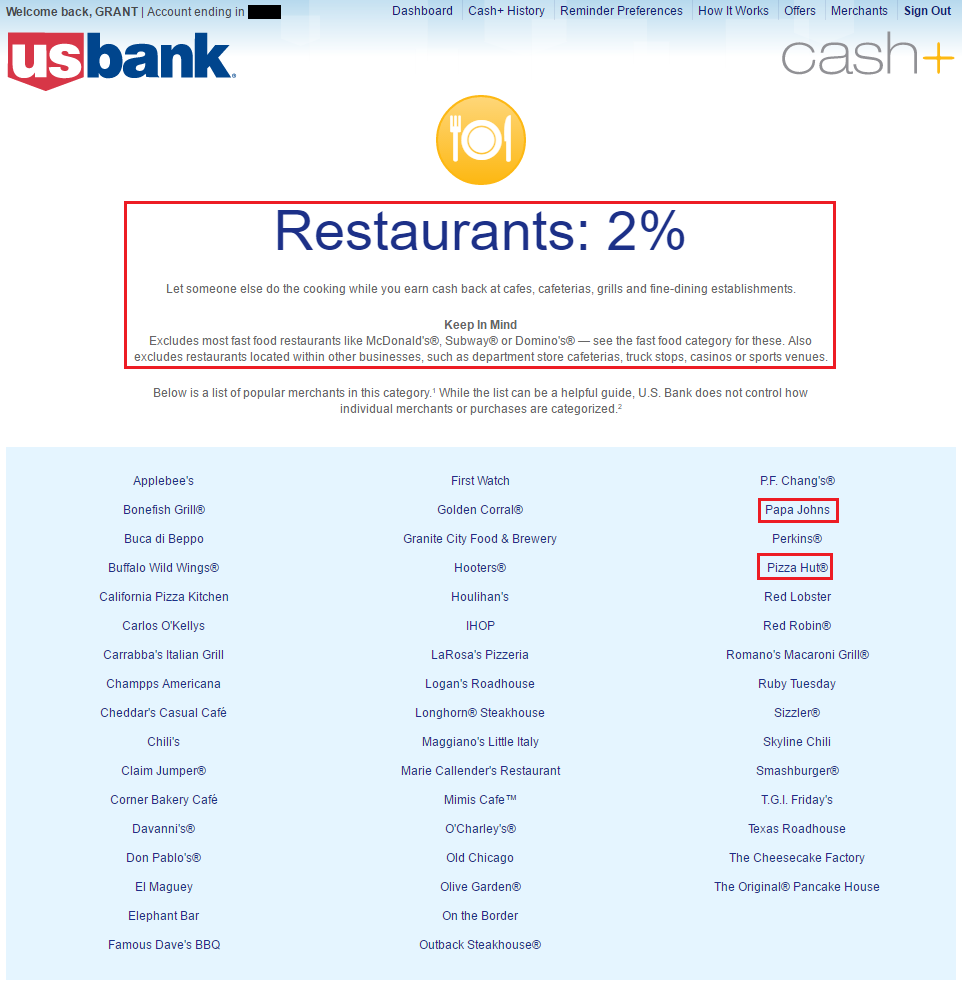

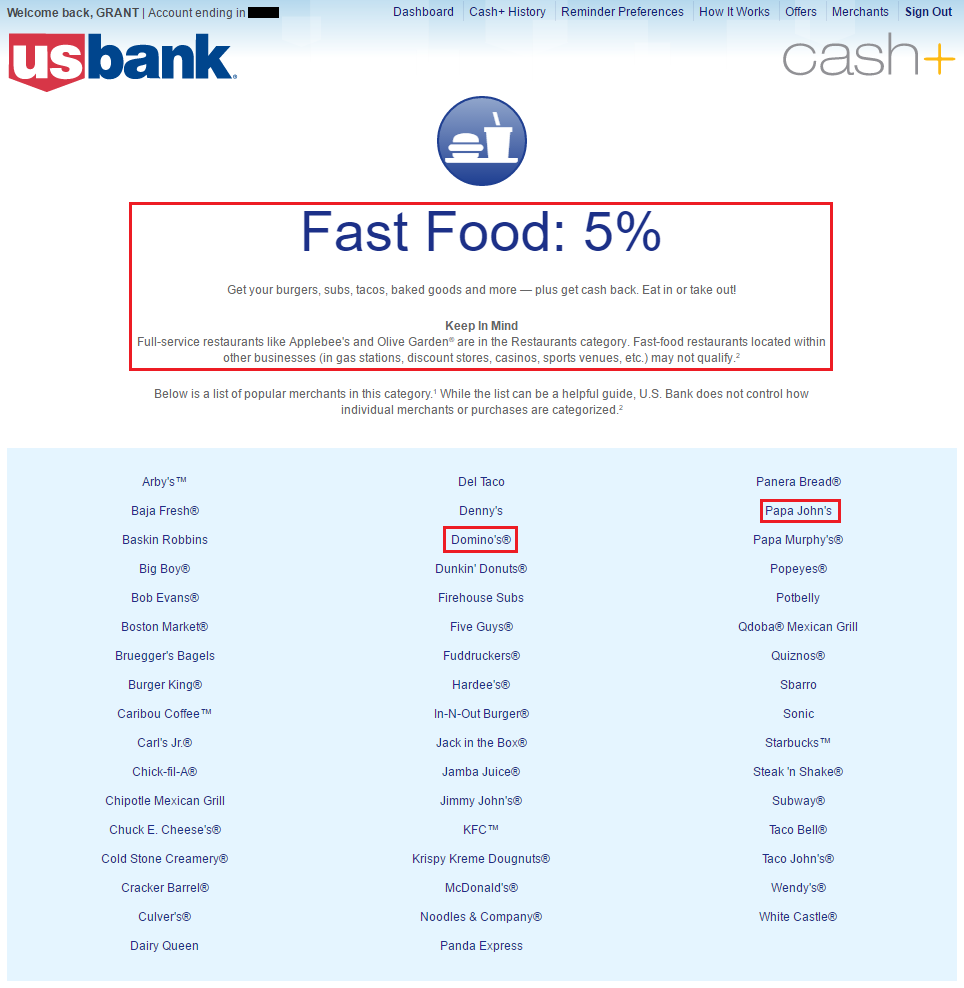

My US Bank Cash Plus (Cash+) Credit Card has been getting pretty dusty lately, but I decided to look at the 2% and 5% cash back categories for Q2. For Q2, the US Bank Cash Plus (Cash+) Credit Card offers 2% cash back at restaurants. The one line I found really funny is that the 2% cash back category of restaurants “excludes most fast food restaurants like McDonald’s, Subway or Domino’s.” Apparently Domino’s is considered a fast food restaurant (see the below fast food category), but Papa John’s and Pizza Hut are considered restaurants. I’m not sure what the logic is behind that decision, but I would love to hear someone argue with a US Bank rep that Domino’s, Papa John’s, and Pizza Hut are basically the same type of restaurant.

For Q2, the US Bank Cash Plus (Cash+) Credit Card offers 5% cash back at fast food restaurants. The one thing I found funny in this category is that Papa John’s also appears as a fast food restaurant. Based on this logic, I should get 2% and 5% cash back for all of my Papa John’s purchases. Side note: if anyone from US Bank is reading this post, please hire me to proofread your promotions – I promise I will do better than the team you currently have in place.

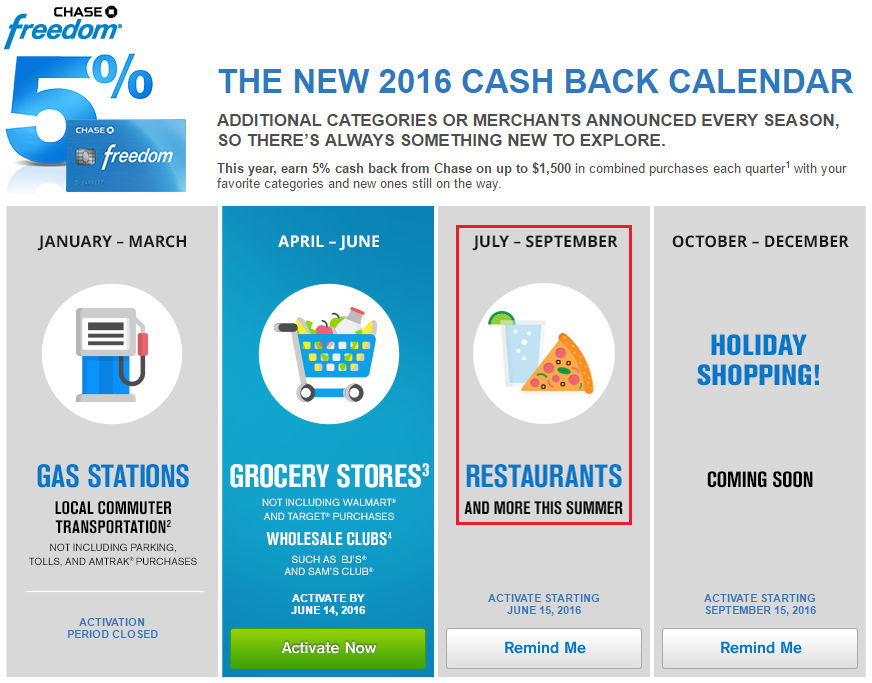

Even though the Discover It Credit Card and US Bank Cash Plus (Cash+) Credit Card offer 5% or 10% cash back for restaurants in Q2, we need to start thinking about Q3 categories. Luckily, the Chase Freedom Credit Card is going to offer 5% cash back (actually 5x Chase Ultimate Reward Points) at restaurants and more in Q3 (July 1 through September 30). I don’t know what the “more” category/categories will be, but I’m fine with just restaurants for Q3.

I don’t know what I will do in Q4 (October 1 through December 31), but I will hopefully figure it out before then. If you are not interested in rotating cash back category credit cards, I did find a few credit cards that offer bonus points at restaurants throughout the year.

Citi Thank You Premier Credit Card (terms and conditions):

2 ThankYou Points for each $1 spent on purchases at restaurants (including cafes, bars, lounges and fast food restaurants), and on select entertainment, including live entertainment, live theatrical productions, concerts, live sporting events, movie theaters, amusement parks (including zoos, aquariums, circuses and carnivals), tourist attractions (including museums and art galleries), record stores, video rental stores and on-demand internet streaming media;

Certain Non-Qualifying Purchases. You won’t earn 2X Points for purchases made at bakeries, restaurants/cafes inside certain department, grocery, discount and convenience stores or warehouse clubs, sporting camps, public and private golf courses, country clubs (including membership fees), stores that sell musical instruments, video game arcades, bowling alleys, stores that primarily sell video games/accessories, charitable organizations that provide live entertainment, bookstores, and sports complexes where you participate in the sport.

Chase Sapphire Preferred Credit Card (terms and conditions):

2 points: You’ll earn 2 points total for each $1 spent when your card is used for purchases in the travel category or the dining at restaurants category (one additional point on top of the 1 point per $1 earned on each purchase). You may see “2X” in marketing materials to refer to the 2 points total you earn for each dollar you spend in these categories. We may offer you ways to earn bonus points through the program. You’ll find out more about the number of bonus points you can earn and any other terms at the time of the offer.

What types of merchants are in the ‘restaurants’ category?

Merchants in the restaurants category are merchants whose primary business is sit-down or eat-in dining, including fast food restaurants as well as fine dining establishments. Please note that some merchants that sell food and drinks located within larger merchants such as sports stadiums, hotels and casinos, theme parks, grocery and department stores will not be included in this category unless the merchant has set up such purchases to be classified in a restaurant category.

American Express SimplyCash Business Credit Card (terms and conditions):

You may select your 3% rebate category from the following seven categories: (1) airfare purchased directly from airlines, (2) hotel stays (excluding timeshares, banquets, and events), (3) purchases from select major car rental companies listed at americanexpress.com/rewards-info, (4) purchases at U.S. gas stations, (5) purchases at U.S. restaurants, (6) U.S. purchases for shipping, or (7) U.S. purchases for advertising in select media. For more details on these categories including important terms and limitations, please go to americanexpress.com/rewards-info. You may select your 3% rebate category from the list described above within the first two months of Card Membership.

To receive additional rewards on a restaurant purchase, the purchase must be at a restaurant located in the United States. You will receive additional rewards in the restaurant category when you purchase at restaurants located in the U.S. You will NOT receive additional rewards for purchases made at a restaurant owned by a U.S. company but located outside the U.S. (e.g. Hard Rock Café in Paris). You also will NOT receive additional rewards at nightclubs, convenience stores, grocery stores, or supermarkets. You may not receive additional rewards at a restaurant located within another establishment (e.g. a restaurant inside a hotel, casino, or event venue). For example, purchases made at a restaurant located within a hotel may be recognized as a purchase at a hotel, not a restaurant.

3 more options to consider:

- Purchase restaurant gift cards at office supply stores using a Chase Ink Bold/Plus/Classic/Cash Card and earn 5x Chase Ultimate Reward Points.

- Purchase restaurant gift cards at grocery stores and pharmacies using an American Express Blue Cash Preferred Credit Card (6% cash back) or an American Express “Old” Blue Cash Credit Card (5% cash back).

- Purchase restaurant gift cards from a gift card reseller (search Gift Card Granny first).

If I forgot to mention any credit cards that have a good restaurant bonus, please let me know. If you have any questions about any of the credit cards mentioned above, please leave a comment below. Have a great day everyone!

P.S. If you are interested in any of the credit cards listed in the post, you can learn more about and apply for the credit cards by clicking through my credit card affiliate links. Thank you for your support!

Have you tried to call Citi about some sort of retention offer for the Forward in spite of the massive deval? I got a sweet 2 extra TYP on every $1 last May, so I am waiting until then so it’s been 12 months…but would love to hear if they’re giving any sort of consolation?

I plan on calling in early June to see what type of retention offer is available on my Citi Forward CC.

Ink also gets 2x on restaurants.

Thank you Tonei, I think a lot of hotel credit cards also offer 2x on restaurants (Chase Hyatt CC).

Ink Cash I think, not Ink Plus/Bold?

I think all the Ink cards have the same earning rates, just different earning caps.

I don’t think that’s right. I have the Ink plus and the 2x is gas and direct hotel bookings.

Gotcha, that sounds right. I’m getting all my credit card rewards mixed up.

Pingback: The best credit cards for restaurants, Amazon.com, and movies - Frequent Miler

Pingback: Massive Recap: Alaska & Virgin America Compared, Good Customers, Shutdowns, 5k Free TYP & Much More - Doctor Of Credit

Pingback: American Express Changes to Card Updates, Forex Fees & Annual Fee Refunds

Pingback: My Retention Offers for Citi Forward, Premier, Prestige & AA Platinum Credit Cards

Pingback: Citi Forward Converting to Citi Thank You Preferred on January 9, 2018 (Conversion Letter & Details)

Pingback: My Long Term Citi Credit Card Plans & Citi Forward to Citi Preferred Conversion