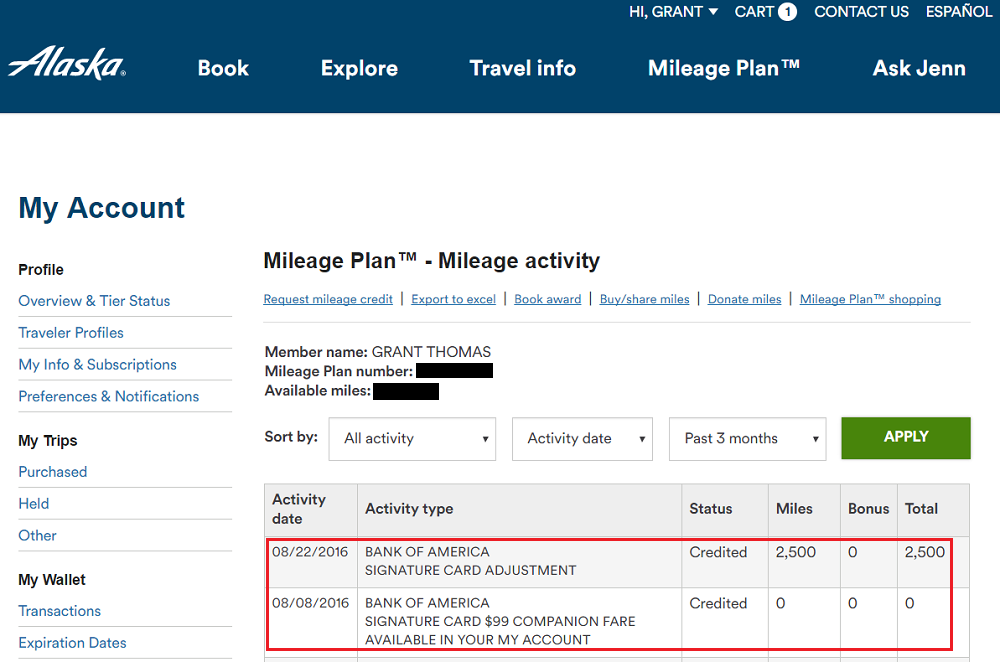

Good afternoon everyone, I hope your Labor Day Weekend is going well. I have 2 data points to share regarding retention offers on my Bank of America Alaska Airlines Visa Signature Credit Card and US Bank Club Carlson Business Credit Card. When you pay the $75 annual fee on the Bank of America Alaska Airlines Visa Signature Credit Card every year, you get a $99 Alaska Airlines companion pass that is good for a future Alaska Airlines flight. My annual fee posted in early August and I already received the $99 Alaska Airlines companion pass, but I wanted to see if I could get the $75 annual fee waived too. After a long talk with the Bank of America retention department, I was only able to get a 2,500 Alaska Airlines miles retention offer – no annual fee waiver or statement credit. The 2,500 Alaska Airlines miles posted a few weeks after my call and I just called Bank of America to close the credit card, so I wouldn’t have to pay the $75 annual fee. The agent didn’t want me to close the credit card, so she convinced me to convert it to a no annual fee Bank of America Travel Rewards Credit Card instead.

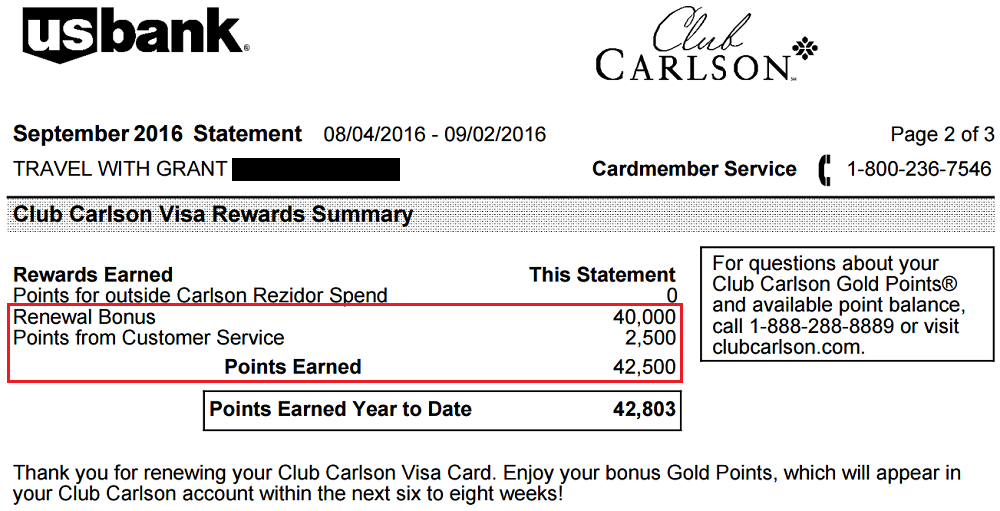

In other news, my US Bank Club Carlson Business Credit Card $60 annual fee just posted to my account last month. I called the US Bank retention department to get the $60 annual fee waived or get a $60 statement credit to offset the annual fee. Both options were rejected, but the agent did offer me 2,500 Club Carlson points to keep the credit card open. I pressed her to see if there were any other offers available, but 2,500 Club Carlson points was the most she could offer. In exchange for paying the $60 annual fee, I received 42,500 Club Carlson points (2,500 bonus points and 40,000 anniversary points) which I should be able to redeem for way more than $60.

If you have received a similar or better retention offer on your Bank of America Alaska Airlines Visa Signature Credit Card or US Bank Club Carlson Business Credit Card recently, please let me know. If you have any questions, please leave a comment below. Have a great weekend everyone!

I was able to get 5k on the AS Biz card from BofA. Still ended up cancelling it a few months later. Then got it again :)

5,000 AS miles on the BofA AS Biz CC is a good retention offer. They might have better retention offers on biz CCs than personal CCs.

Same deal as you back in April or so. Got the 2,500 miles offer(which is very good for no spend), it posted, then I converted one to Cash Rewards and the other to Travel Rewards.

You might be able to convert this to the Asiana card as well.

Hmm, since you can convert to a BofA AS CC to a BofA branded CC, you might be able to concert to a cobranded CC. What’s so special about the Asiana CC?

Club Carlson is pretty much worthless if you have no plans to visit Northern Europe – can’t even use my free nights in North America. will be cancelling my card.

There are some low end Radisson and Country Inn hotels in the US, but the best Radisson Blu hotels are in Europe. If you have unused Club Carlson points, you can always transfer them to me for free :)

I got 5K on the AS personal but I put a decent amount of spending on the card

Oh nice, that’s a pretty good retention offer. How much spend did you put on the card? Hoe long have you had the CC? How long ago was that offer?

Around $8K after 11 months.

Oh nice, that’s about $7000 more than I spent on my card.

So you take the 2500 miles and then cancel the card anyway and avoid the $75 annual fee? It’s one thing to get away with it, but it seems rather unethical to me. If you did that to a neighbor, or a small business, would you feel the same way, or is it that you think somehow it’s OK because it’s a big corporation?

2500 points and miles is worth approximately $0 to these companies, so I don’t feel that this is unethical. If you are uncomfortable with this, you can choose not to take the free miles or points. We all have to decide for ourself. Have a great Labor Day holiday :)

Hey Grant,

My annual fee posted on 8/31 and just got the retention offer 9/14. Seems like I have to wait couple of weeks to get miles and have to pay annual fees for now. How many days I have to request for full annual fees refund with account close request??

I think you have 30 days from the date the annual fee posted to cancel and get the annual fee waived.

Pingback: Striking out on Citi Prestige and AMEX Platinum Retention Offers | Travel with Grant