I did a 5 card app-o-rama early Thursday morning and here are my thoughts, suggestions, tips, tricks, and ways to improve your reconsideration calls.

Always have a plan and stick to your plan. You don’t have to sign up for credit cards the first day or week to get the sign up bonus. Most bonuses last a few weeks or months and often come back a few times throughout the year. I always recommend waiting at least 3 months since your last credit card application (or app-o-rama in my case) before your next app-o-rama. My last app-o-rama was on November 18 (link) and I got the following 6 cards:

- US Bank Club Carlson Personal Credit Card

- Bank of American Alaska Airlines Personal Credit Card

- American Express Platinum Mercedes Benz Personal Credit Card

- Citi Dividend Cash Back Credit Card (converted old Citi AA Card)

- Chase IHG® Rewards Club Select Credit Card

- Hilton Honors™ Surpass® Card from American Express (upgraded from American Express Hilton HHonors Credit Card)

Since my last app-o-rama, there have been a few new cards on my radar. When planning your app-o-rama, make a list of all the cards you want to get. Then organize them in the order in which you want to get them. Ask yourself, “If I could only get 1 card, which card would it be?” For me, that was an easy question. I am going for the Citi American Airlines Executive Credit Card with 100,000 American Airlines miles after spending $10,000 in 3 months.

Next ask yourself, “If I could get only 2 cards, which cards would they be?” Since you already know which card is your #1 card, you only need to think about the next best card. For me, I wanted to go for a Chase Ink Bold Visa, since I have only had the Chase Ink Bold Mastercard and my annual fee is coming due in 2 months. I got the Visa card for the same business. I’ll explain more later.

The next question you should ask yourself is, “Are there any great sign up bonuses that are ending soon that I would be bummed about not getting?” For me, I had my eye on the US Bank FlexPerks Credit Card with the Winter Olympics promo sign up bonus.

The next question you should ask yourself is, “Are there any business credit cards that are similar to personal credit cards that I have that come with a good sign up bonus?” For me, I got the Alaska Airlines Personal Credit Card last app-o-rama, so I wanted to go for the Alaska Airlines Business Credit Card this time.

The next question you should ask yourself is, “Do I have any credit cards that have annual fees coming soon that I can move credit from in order to get approved for a new card with a good sign up bonus?” This may or may not apply to you.

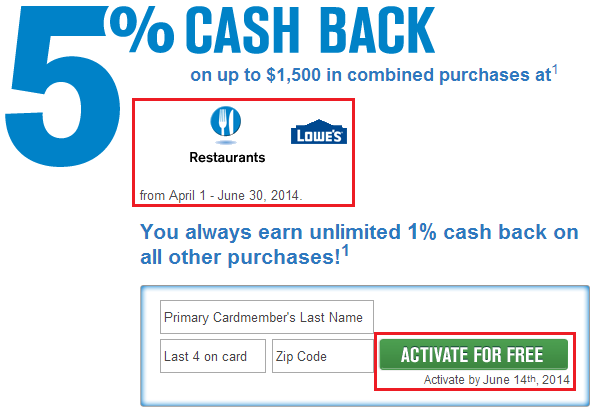

Lastly, I believe everyone should have 5% rotating cash back credit cards. They have no annual fee, you can keep them forever, and they usually have great ways of earning cash back. Since I already had the Chase Freedom Credit Card (registration for Q2 rotating cash back categories start today) and the Citi Dividend Credit Card, I had to go for the Discover It Credit Card. Which I did get approved for.

Now for the exciting stuff, are you ready? Let’s go!

#1 – Citi American Airlines Executive Credit Card – 100,000 American Airlines miles after spending $10,000 in 3 months

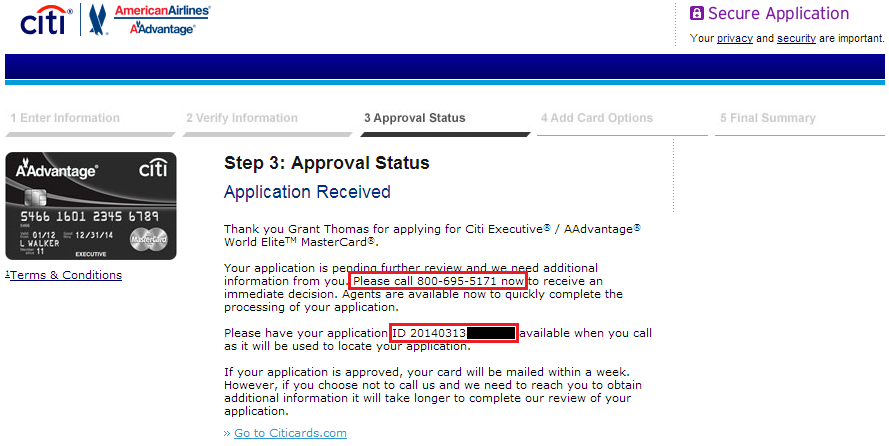

After applying, I received a pending application status, requiring me to call the 1-800 number and speak with the credit application department.

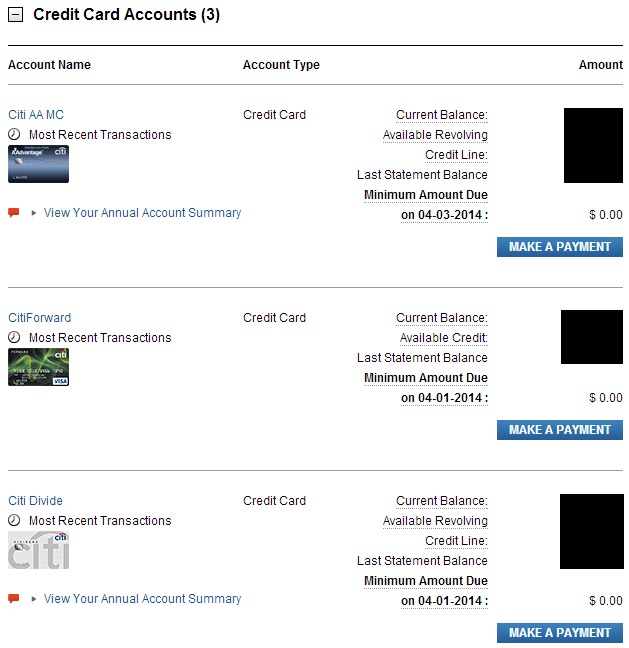

After verifying some personal information, the rep said I was approved for a $5,000 credit line. Great, I was approved! Low credit line, not great. Since I have 3 existing Citi credit cards, I was able to move credit from those cards and raise my credit limit to $10,000. Much better!

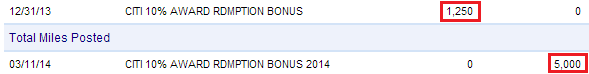

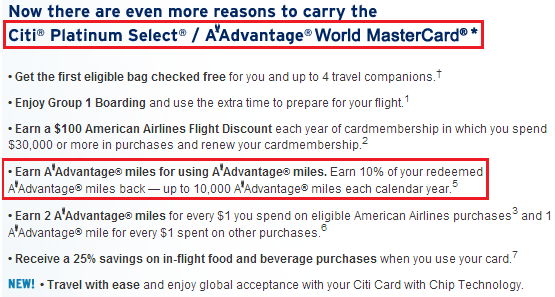

I was going to close my existing Citi American Airlines World MC Credit Card, but asked the rep if the new Citi American Airlines Executive Credit Card had the 10% rebate on redeemed miles. He seemed surprised by the question. He looked into it on his screen, I did the same on mine. Neither of us could find that sentence. So just to be safe, I decided to keep that card open so I could take advantage of the rebated American Airlines miles.

I think I got 6,250 American Airlines miles rebated for having the Citi American Airlines World MC Credit Card. Not bad, I guess.

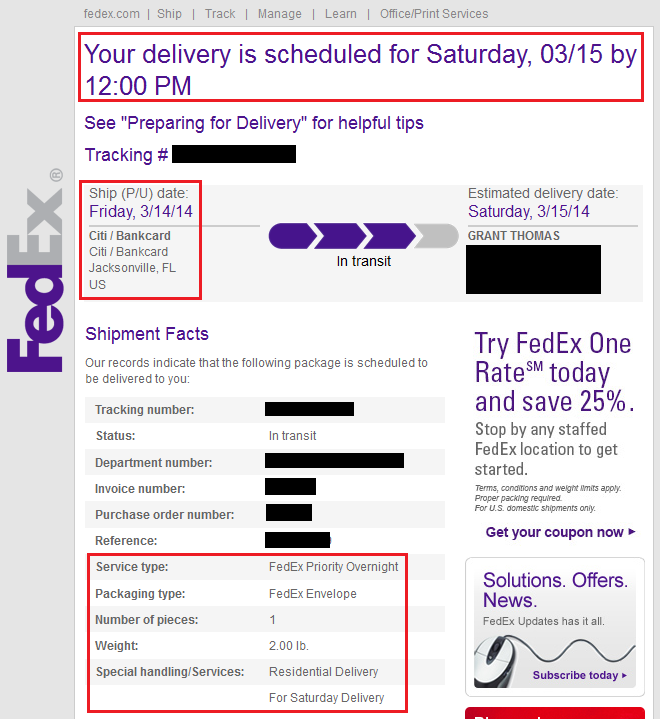

Yesterday I received this email from FedEx alerting me that a package (credit card envelope) was heading my way. Looks like Citi wants me to start using this card ASAP. You got it Citi!

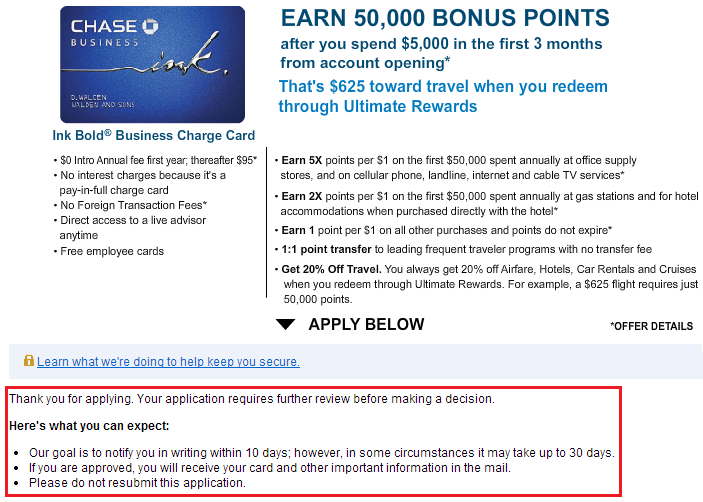

#2 – Chase Ink Bold Visa Business Charge Card – 50,000 Chase Ultimate Reward Points after spending $5,000 in 3 months.

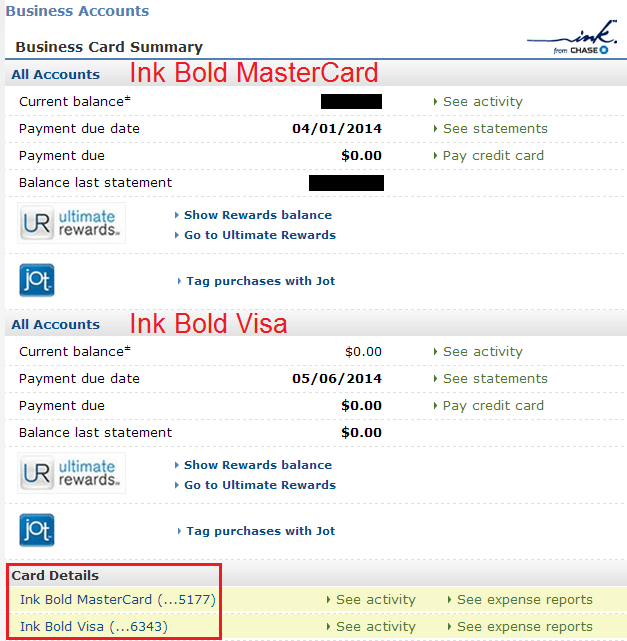

The main reason for applying for this card is because it is a Visa. Since I currently have a MasterCard, they are considered different product. Different products offer new sign up bonuses. I have had my Ink Bold MasterCard for almost 2 years, so I figured getting the Ink Bold Visa would be easy. I knew I would probably have to call the reconsideration department and explain my case, but I was confident I could do it. Lo and behold, I got another pending application.

After calling the reconsideration department, he asked me a few questions about my business (annual revenue for 2011, 2012, and 2013), the nature of the business, and why I wanted a Visa. I told him some of my vendors do not accept MasterCard and I wanted to earn Chase Ultimate Reward Points for those purchases. I’m sure he has heard that reason many, many times. Always be truthful and don’t be afraid to say that your business is new, you have little or no revenue, and explain that you want to keep personal and business expenses separate.

He thanked me for my past history with Chase and offered to open a the new card for me. I am not exactly sure how it works with 2 Ink Bold cards attached to the same business, do they both take from the same “pre-approved spending limit” pool? I’ll have to find out when the new card arrives.

In a few months when my annual fee comes due for my Ink Bold MasterCard, I will probably downgrade to a Chase Ink Bold Classic or Cash (no annual fee cards).

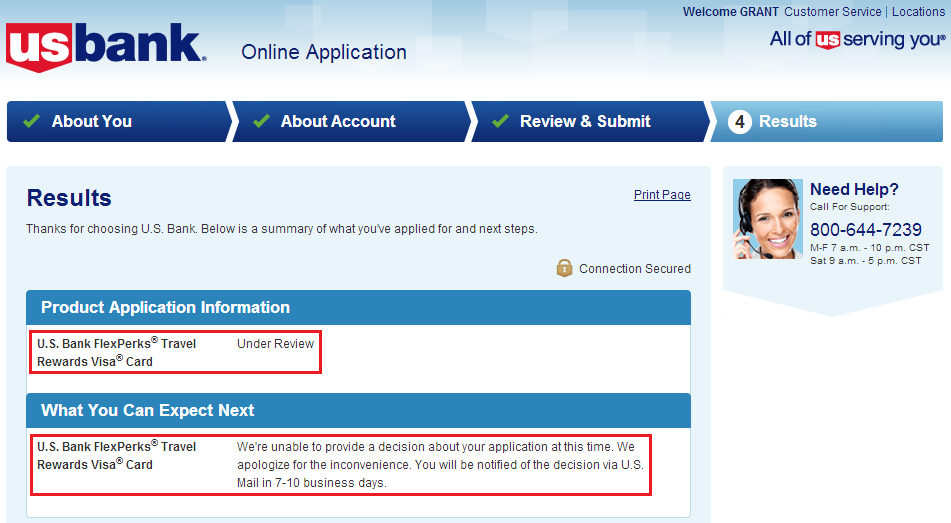

#3 – US Bank FlexPerks Travel Rewards Credit Card – 27,450 FlexPoints after spending $3,500 in 4 months

I applied for this card during the 2012 Summer Olympics promo but was not approved for the Visa Signature version of the card. Instead, US Bank approved me for the regular Visa card with a lower sign up bonus. Why do you do this to me US Bank?!?!

Again, I was met with a pending application status. I tried calling the reconsideration department but was told that it takes 2-3 business days for the credit analysts to review the application. At this point, I feel like there is a 20% chance of getting approved for the card. They will pull my credit and see all the other recent inquiries from Thursday morning. I will try calling on Monday morning and see if I can convince them to approve me for this card.

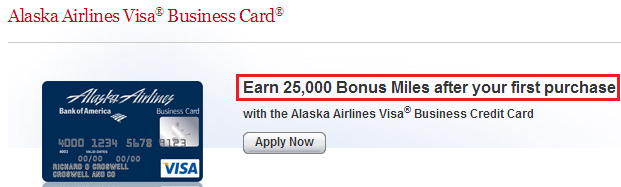

#4 – Bank of American Alaska Airlines Business Credit Card – 25,000 Alaska Airlines miles after your first purchase

This card has a $75 annual fee (not waived), so you are essentially buying 25,000 Alaska Airlines miles for $75, or 0.3 cents per mile. What a great deal!

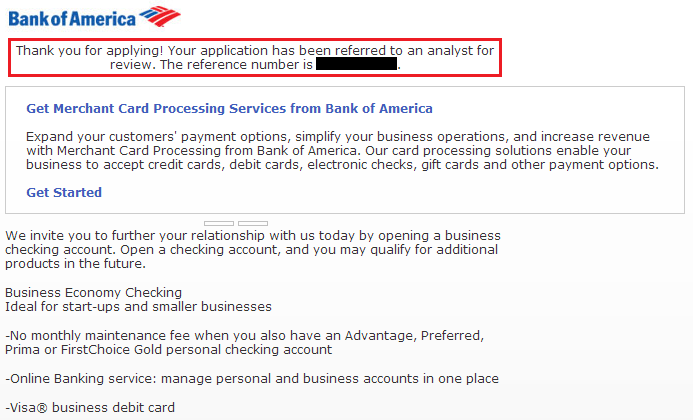

Unfortunately, I got another pending application status. I called the reconsideration department and talked about my business for almost 20 minutes. He asked a few questions about my business and then a few questions about my personal income. At the end of the call, he approved me for a $5,000 credit line on the business card.

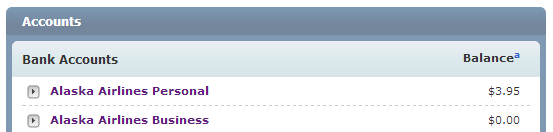

Woo hoo, 2 Alaska Airlines credit cards.

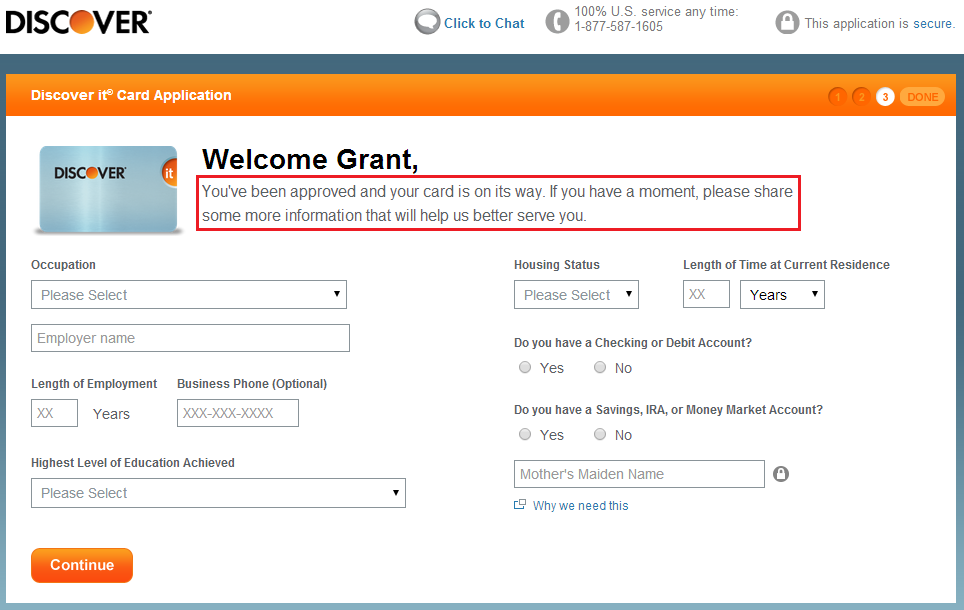

#5 – Discover It Credit Card – $150 Cash Back / Statement Credit after spending $750 in 3 months

This card completes my cash back card trifecta, joining my Chase Freedom Credit Card and Citi Dividend Credit Card. I have a page for all the rotating cash back cards here. The strange thing about Discover is that they will approve you for a card before you finish entering all your personal/financial information.

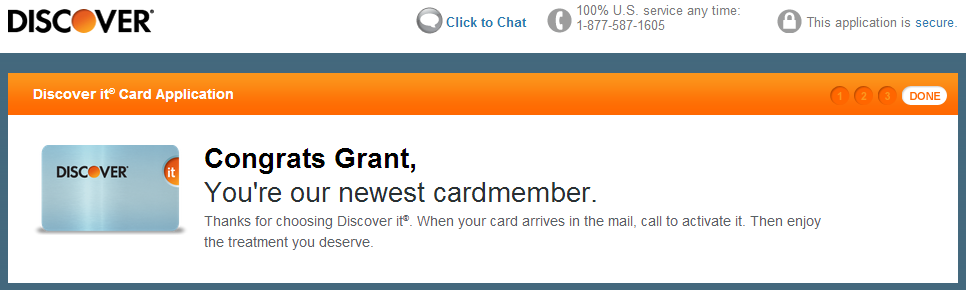

Anyways, I am approved!

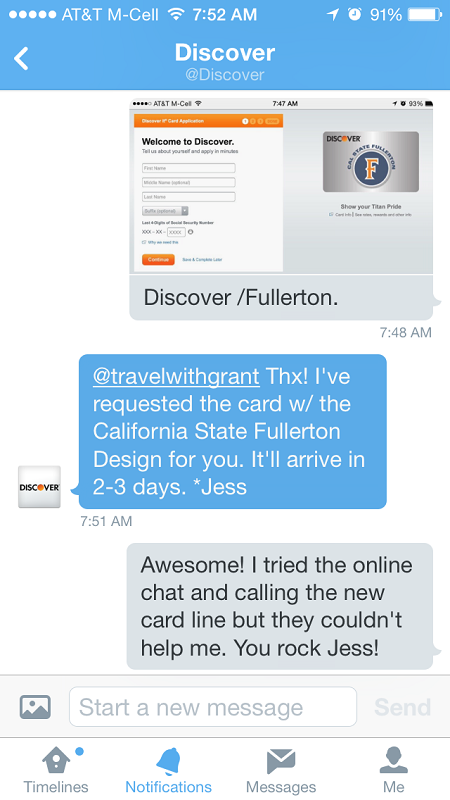

At this point, I remember getting a targeted mailing from Discover for the Discover It with a Cal State Fullerton design (my alma mater).

I tried live chatting with Discover and calling the new accounts department at Discover, but they were unable to help me get the Cal State Fullerton design. My last hope was Twitter. I don’t know about you, but I love Twitter! Not just because I own 7 shares of TWTR stock, but because I love how fast the service is on Twitter. I sent a tweet to Discover and within a few minutes, I received a response to send them a DM (direct message). After exchanging a few messages, I was able to get the Cal State Fullerton design on my card. How awesome is that?!?!

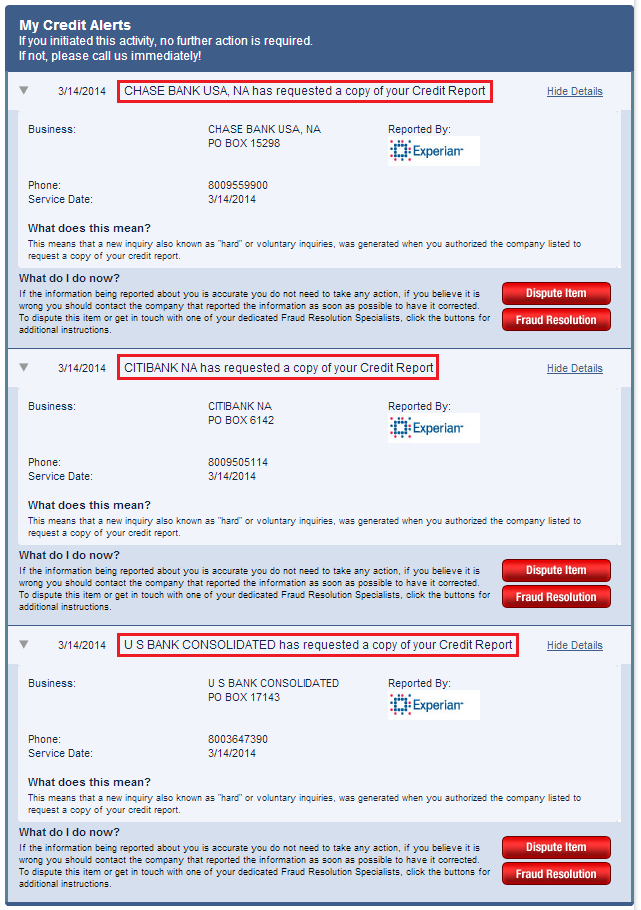

Yesterday afternoon, I received an email from Experian letting me know that there has been recent activity regarding my credit report. I logged in and can see that Chase, Citi, and US Bank all pulled from Experian. I guess Bank of American and Discover pull from another credit bureau. I got 1 year of free credit monitoring from Experian by signing up after the Target data breach was first announced.

If you have any questions, please leave a comment below. Have a great weekend everyone!

Ding, dong! I think the FedEx guy is here with my new Citi American Airlines Executive Credit Card is here, gotta run!

Hi Grant,

Great post as usual , thx ;)

I wanted to hear what’re ur thoughts about my recent personal experience with Citi:

I applied for the AA executive and got it no problem.. I had the AA Gold for a year and the annual fee was 1 month away.. So, I called Citi to move my credit line (10k) to my Citi Hilton CC (no annual fee) to keep my total credit line.. So the agent put me on hold for few minutes and told me that I was not approved to move my credit line and to wait for letter in mail for explaination..

I was thinking “what the.. Huh???”

He was not able to provide more info so I asked for his super.. When I spoke w the super I asked what did they mean by “approval”? And apparently they treated my request to “move” credit line as a request to “increase” credit limit on my Hilton CC and ran a hard pull !!

Since when did moving credit line require hard pulls?? I moved credit from CC with chase in the past and never had such problem..

Anyway, I got the letter in the mail saying “too many inquiries” ..

So now I have a “credit denial” on my history and I am really p****d off..

I have had some really great experiences with Citi and some really bad experiences with Citi (they took 2+ months to convert an old Citi AA card into my Citi Dividend card). I don’t think your credit report will say “credit denial.” Every time you apply for a credit card, they do a hard pull, called a credit inquiry. The credit inquiry will stay on your credit report for up to 2 years, but it won’t say whether you were approved or denied for a credit card. If I applied for 5 credit cards from 5 different banks, I would get 5 new credit inquiries. Regardless if I get approved for all 5 or denied for all 5, my credit report will look the same.

Back to your comment, did you end of getting the Citi AA Executive card or did the deny you completely?

I had no problem getting approved for the AA Executive, got it already.

The problem was with the process of moving credit line from my Old AA Gold to my old Citi Hilton in preparation to cancel the AA Gold as I mentioned!

Why can’t citi “simply move” credit line? Why do they have to run a credit inquiry in order to do so?

I see the problem. Have you tried to call them back and ask that they move the credit over? Some reps aren’t as experienced as others, so maybe you had a new rep on the phone.

Yeah, i thouht about that, and I did try to call again to see if I would get a different response but I got the same reply.. They were just treating the request to move credit line as if I was asking for an increase in credit limit.

Do you have low credit limits on some of your cards? They may not be able to move credit from one card to another because your card limits are already as low as they can go. Is that possible?

No, both cards have 10k credit limit!

That is just really bizarre! I don’t know what to say. Maybe try sending Citi a secure message from your account or contacting them on Twitter?

Grant,

Great post!

I have a Chase Ink Bold Mastercard, which was opened in November 2012. I would, also, like to get the Ink Bold Visa and will probably need to call the reconsideration line. I need to have a good reason to get the card and was thinking maybe the Visa Savingsedge program. Any thoughts or other suggestions?

Thanks.

On the reconsideration call, I *wouldn’t* mention the Visa SavingsEdge program. Just let them know that you want a Visa business card for those merchants who do only accept Visa. You could also mention some of the cardmember perks of the Visa (you might have to look those up).

Thanks for the info!

Out of curiosity, why wouldn’t I mention the Visa SavingsEdge Program?

Thanks.

It might sound like the only reason you are going for the Visa is so you can earn more bonus points with the Visa SavingsEdge. They might not like to hear that.

Thank you, I really appreciate your advice!

Thank you Charles, I will have to check out the Visa Savings Edge program, I don’t know much about it yet.

Grant,

Do you suggest applying credit card monthly or multiple at the same day?

I usually do 3-5 cards at a time every 3-4 months.

Pingback: Travel with Grant Meet Up Next Saturday Night (March 29) at In-N-Out (Tustin District) | Travel with Grant

Pingback: App-O-Rama Update: US Bank FlexPerks Travel Rewards Credit Card Finally Arrived | Travel with Grant

Pingback: Which Credit Score is the Most Accurate? | Travel with Grant

Pingback: Planning for Retention Bonuses for a Chase Ink Bold MasterCard and an SPG American Express Credit Card | Travel with Grant

Pingback: Barclays Sign Up Offers: $400 Barclaycard Arrival, 50,000 Lufthansa Miles, 35,000 Hawaiian Airlines Miles, and 40,000 US Airways Miles | Travel with Grant