Good morning everyone, happy TGIF (Thank Grant it’s Friday). I want to share my recent experience applying for 3 credit cards on March 11, 2016. Here are the 3 credit cards I applied for, along with their bonuses as of 3/11/2016:

- Chase Ink Plus Business Credit Card – 60,000 Chase Ultimate Reward Points after spending $5,000 in 3 months.

- Citi Hilton HHonors Reserve Credit Card – 2 free weekend night certificates after spending $2,500 in 4 months.

- Bank of America Amtrak Guest Rewards Credit Card – 20,000 Amtrak Points after spending $1,000 in 3 months.

I applied for all three credit cards at the same time and got 2 pending decisions (Chase and Citi) and a denial (Bank of America).

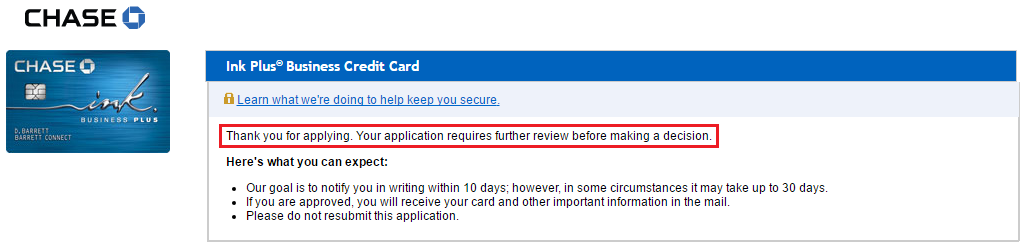

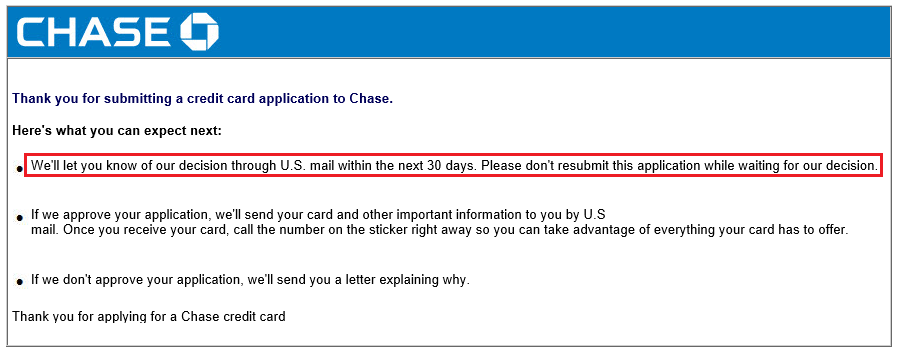

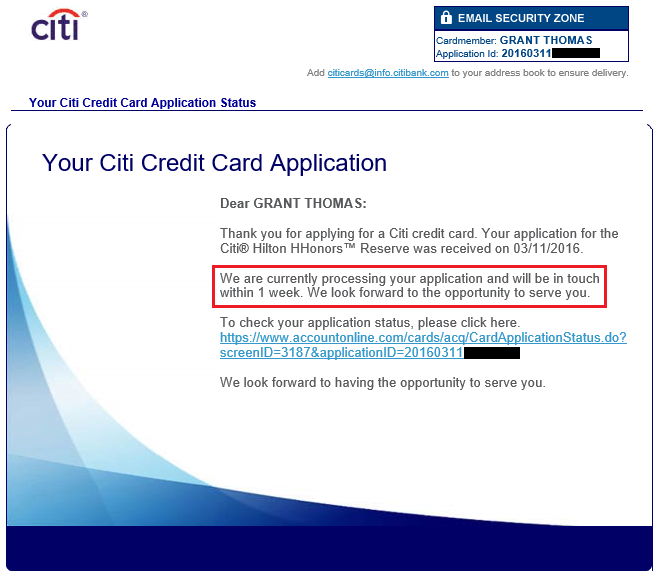

Shortly after submitting my Chase Ink Plus Business Credit Card application, I received the following email that said that a decision would be made within 30 days. I’ve read several reports that said I should not call Chase’s business credit card reconsideration department, so I decided to wait it out and see what happened.

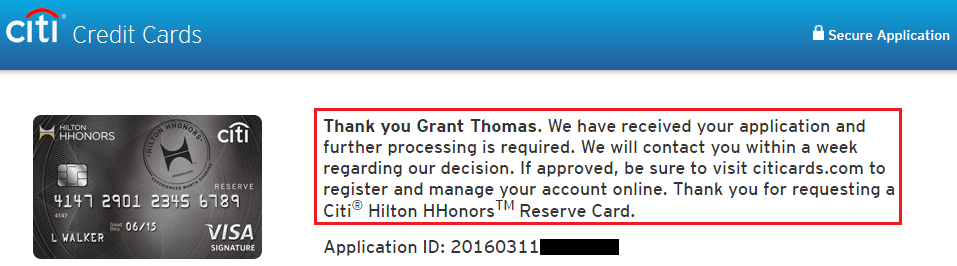

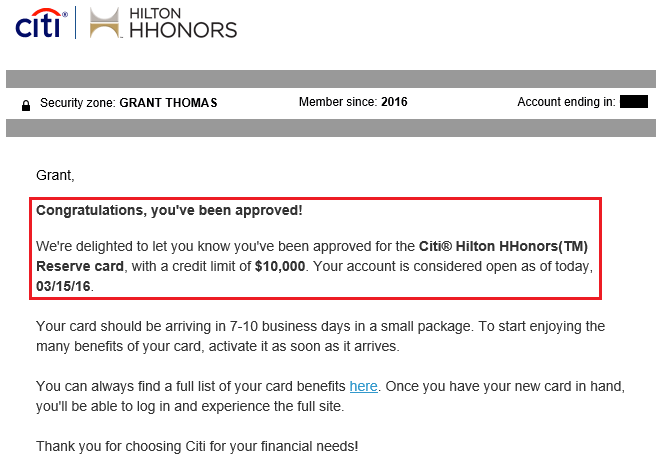

Up next, I received an email regarding my Citi Hilton HHonors Reserve Credit Card application. I called Citi’s reconsideration department on Friday (3/11/2016), but their systems were down, so I called back again on Monday (3/14/2016).

During my call with Citi, the reconsideration rep told me that I was approved for the credit card with a $4,000 credit line. I asked if I could transfer $6,000 of available credit from my unused Citi Double Cash Credit Card and she processed that request right away. My new Citi Hilton HHonors Reserve Credit Card was approved with a $10,000 credit line on 3/14/2016 and I received the credit card in the mail on 3/21/2016.

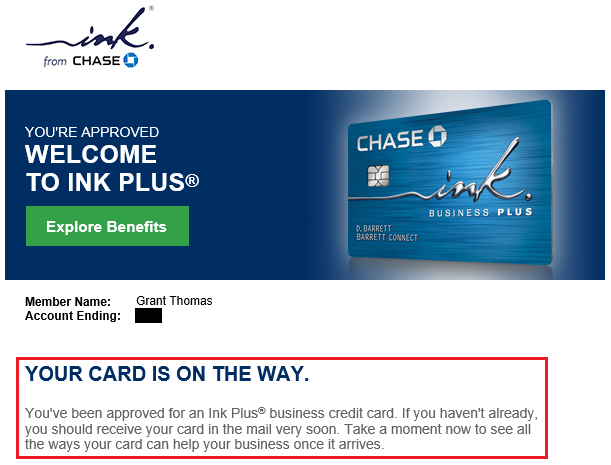

On Monday (3/21/2016), I received an email from Chase letting me know that I was approved for the Chase Ink Plus Business Credit Card. After I read the email, I called Chase and asked if they could expedite the credit card to me. The rep was very helpful and said he would send it out via UPS Next Day Air and I received the credit card on Wednesday (3/23/2016).

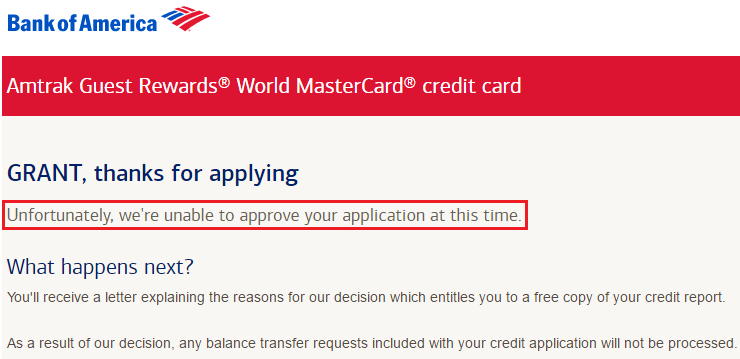

So what happened with my Bank of America Amtrak Guest Rewards Credit Card? I called the reconsideration department and tried to find out. The rep was not super helpful and said that Bank of America was unable to approve me for any new credit cards. Before the call, here were my available Bank of America credit cards and credit lines:

- Alaska Airlines – $8,000

- Better Balance Rewards – $1,000

- Spirit Airlines – $5,200

- Virgin Atlantic – $5,000

- WorldPerks Travel Rewards Business – $18,500

- Total credit line of $37,700

After speaking with the reconsideration rep, I called the Bank of America credit card customer service department and asked the rep to lower all my credit lines. Here are my credit lines after the call:

- Alaska Airlines – $1,000

- Better Balance Rewards – $1,000

- Spirit Airlines – $1,000

- Virgin Atlantic – $1,000

- WorldPerks Travel Rewards Business – $10,000

- Total credit line of $14,000

I reduced my total available credit from $37,700 to $14,000, a decrease of 63%. I called the reconsideration department again and told them that I just reduced all my credit lines. I asked if they could reevaluate my application and after a short hold, the rep came back and told me that I was still declined. I give up, clearly Bank of America does not want me to get another credit card. I will try again in a few months after I close my Alaska Airlines and Virgin Atlantic credit cards when the annual fees post. Hopefully I will have better luck next time.

If you have any questions about my recent credit card applications, please let me know below. Have a great weekend everyone and happy Easter!

P.S. If you are interested in applying for any of the credit cards mentioned in this post, please take a look at my credit card affiliate links. I greatly appreciate your continued support.

My ink was denied

Bummer, did Chase ask for any business documents?

Was your Ink for a new business or existing business? To your knowledge are the people getting approved by not calling recon for the Ink applying using new businesses? I was denied for a second Ink over two years ago after calling in so the denials are nothing new.

For this Chase Ink Plus, I used my blog and business EIN. My blog is almost 3 years old and has revenue and expenses. I’m not sure if most people are using new or existing businesses.

Tried for UA business and personal on 2/28, due to the impending 5/24 rule. No word on personal yet, but a couple days ago got a declined letter on business card for too many new accounts. Tried recon yesterday, but no luck. Did all the usual, with reasons for wanting the card outside bonus, offered to shift credit lines, asked for suggestions, all for naught. Any advice? I’m fresh out of ideas.

Hmm, you can try writing a letter, but I’m not sure that would do much. How established is your business? Did they ask for any financial information?

Yikes on the limit reduction not working out for boa. They can be picky. And don’t give up after only 1 recon! Mine took 4!

The last recon call was brutal. The guy suggested I learn more about my credit score and credit report by visiting a Khan Academy link. So lame.

I’ve signed up for 4 credit cards since July 2014, and was an authorized user on a 5th credit card in June 2015. Since I closed my authorized user card last June, I wonder if Chase would still count it as a 5th credit card. It seems to be worth it to apply anyway, since I have nothing to lose.

Also, do you think there a better chance of getting approved if I apply in branch? Since I don’t have an Ultimate Rewards credit card, I really want one.

I’ve inly applied for checking accounts and a BofA biz checking account in branch. The application process can take 30-60 minutes, depending on the banker. I think you improve your odds by applying in branch. I’m sure your AU credit card does not count toward your 5th credit card.

Grant Did you get approved for the UR chase card even with the 5/24 rule?

I don’t think the 5/24 rule affects business cards yet, only personal Chase cards that earn UR points.

Thanks your right. I’m so used to moving the points via sapphire card.

No worries :)

They did not ask any business docs , I got letter stating too many new accounts

Oh gotcha, I’m not sure you can overturn that decision.

I was also declined for BoA card. Tried reconsider but never worked

Darn, BofA used to be so easy to get new credit cards.

Why would you ever reduce credit lines without any guarantees of approval ? And btw why would you ever apply for the spirit card? That may have cost you this . The 1.5 point credit card would I believe be a better choice than the Amtrak.

Reducing the credit lines was a very drastic act on my part which I had hoped would convince Bank Of America that I was serious about getting the card. When I applied for the spirit airlines credit card the Amtrak credit card did not exist.

I don’t like BofA. I have:

USAA AMEX … 13.9% APR – $10k limit

USAA Visa … 12.9% APR – $12k limit

USAA MC … 15.9% APR – $9k limit

Chase Slate … 0% APR until Feb 2017, then 17.9% – $5k limit

AMEX Starwood – 17.2% APR with a $20k limit

Then there is BofA…$1k limit at 22.9%.

Yikes, I do t like BofA credit cards and bank accounts much. Not great experiences.

Yea, I proactively reduce my credit lines before applying for bofa cards now.

Does that tend to work most of the time?