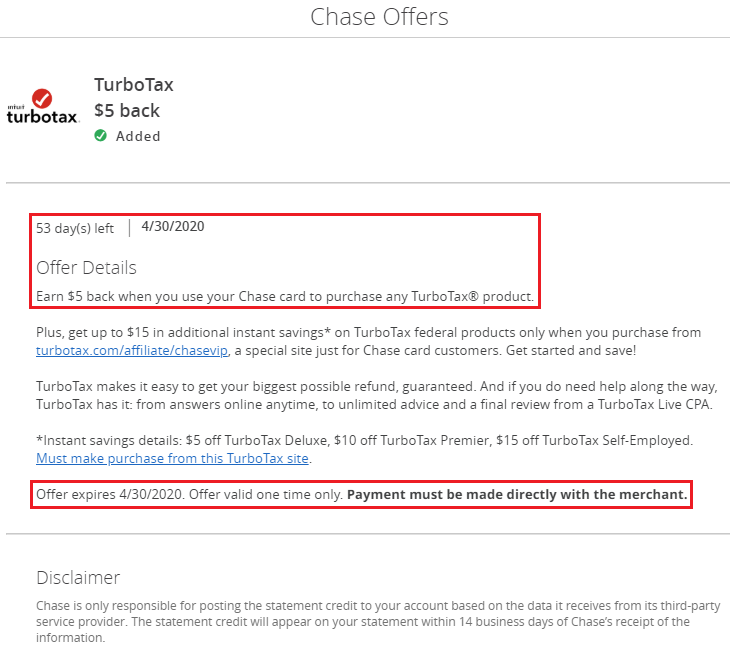

Good afternoon everyone. If you are working on your taxes this weekend and using TurboTax, don’t forget about the $5 TurboTax Chase Offer. $5 is not much, but it’s better than nothing. The Chase Offer expires on April 30, 2020, and should be triggered with any TurboTax purchase. I saw the same TurboTax offer on all my personal Chase credit cards but I decided to add and use the offer on my Chase Sapphire Reserve Credit Card since Chase Ultimate Reward Points are more valuable than Marriott, Hyatt, or IHG points.

I finished my taxes a few days ago with TurboTax and used their E-File feature to electronically submit my taxes to the federal government and California state government. E-File is free for the federal government, but cost $24.99 to E-File with the California state government. I am not sure if this price is the same for all states, but I only have experience with California. Anyway, I paid the $24.99 with my Chase Sapphire Reserve on March 4, 2020.

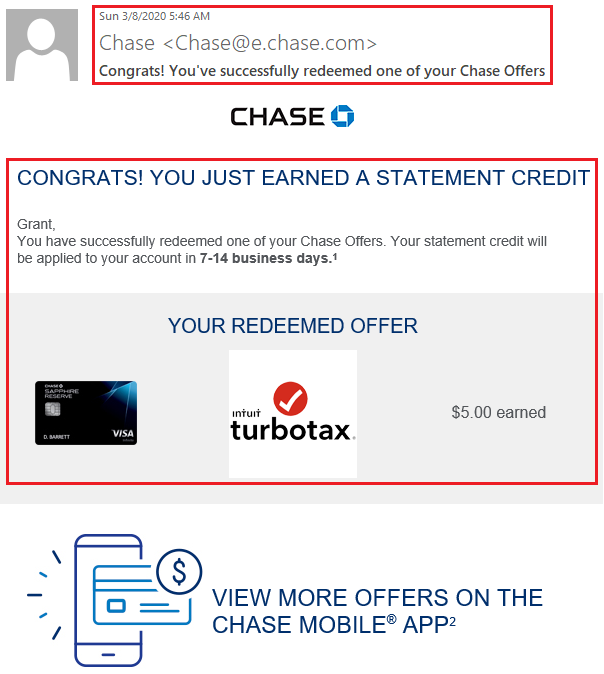

4 days later, on March 8, 2020, I received this email from Chase letting me know that I earned the $5 TurboTax statement credit. The $5 credit should post to my credit card in the next 7-14 business days, but Chase Offers usually post in 2-3 days from the date the email arrives.

If you have any questions about this Chase Offer, please leave a comment below. Have a great day everyone!

I need help filling my taxes