Good afternoon everyone. A few months ago, I upgraded my Chase Marriott Bonvoy Boundless Visa Signature to JPMorgan Chase Ritz Carlton Visa Infinite. Fast forward to March 1 and the $450 annual fee posted to my Ritz Carlton credit card. Over the last few weeks, I was trying to decide if I should keep this credit card and pay the $450 annual fee or downgrade to the Marriott Bonvoy Boundless credit card which only has a $95 annual fee (but comes with a 35K Marriott Bonvoy free night certificate).

The biggest reason for me to downgrade this credit card was the loss of the Visa Infinite Discount Air Benefit which allowed me to save $100 on roundtrip domestic flights for 2 or more passengers. I used that benefit a few times last year and was looking forward to using it a few times this year to offset the $450 annual fee. Unfortunately, that benefit abruptly disappeared in early January 2020.

With that benefit gone, the remaining 2 benefits worthwhile to me were the $300 annual travel credit and the 50K Marriott Bonvoy free night certificate. As of today, I already redeemed the free night certificate for a hotel in New York City in June and used ~$85 of the $300 annual travel credit.

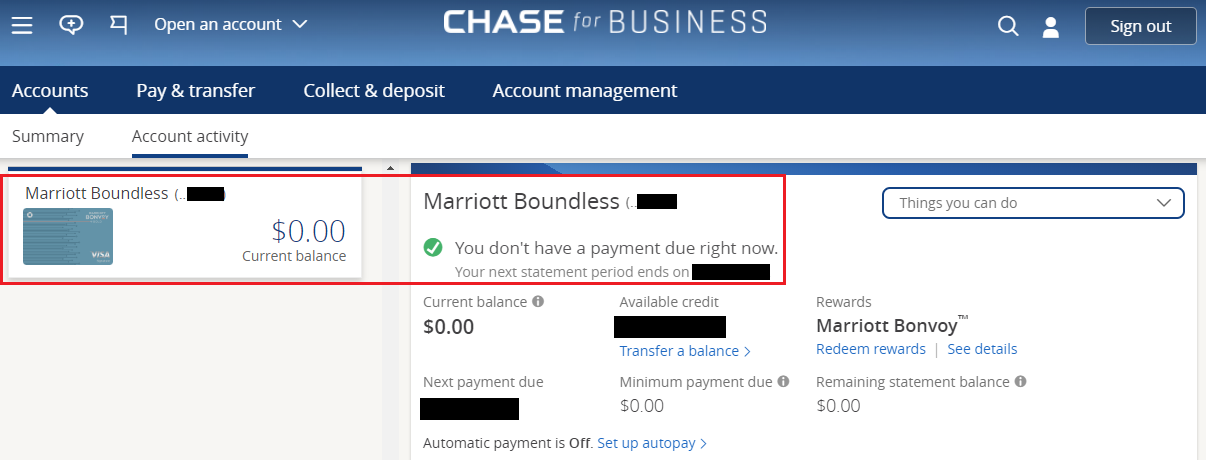

I called the JPMorgan Chase customer service number to see if they could waive the annual fee, but that was not possible, so I suggested downgrading to the Marriott Bonvoy Boundless credit card. After a few minutes, the downgrade process was completed. I will receive the new credit cards in the next week and the $450 annual fee would be refunded back to my account in the next few days ($450 annual fee was refunded the following day). Here is what my Marriott Bonvoy Boundless card looks like in my Chase online account.

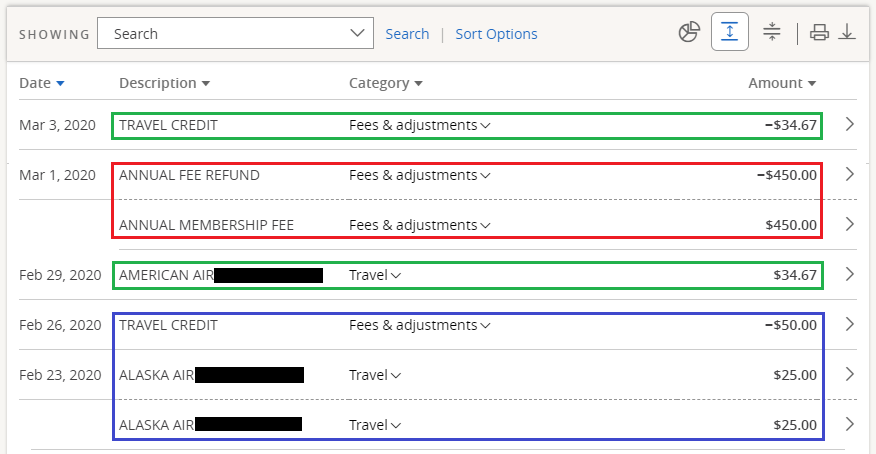

Here are my recent transactions. The $450 annual fee posted on March 1 and I called JPMorgan Chase on March 18. It looks like they backdated the annual fee refund to March 1. I did use the $300 annual travel credit to cover the $50 of Alaska Airlines same day change fees and for an American Airlines seat upgrade. I wish I would have paid for all my American Airlines seat upgrade fees with my Ritz Carlton credit card instead of using up my American Express Gold Card $100 Airline Fee Credit. This American Airlines flight is in early July, so who knows if I will even go on that trip. I have to wait and see.

If travel returns to normal at some point, I still have the ability to upgrade back to the Ritz Carlton credit card in the future. If you have any questions about the downgrade process, please leave a comment below. Have a great day everyone.

P.S. Craig from Middle Age Miles wrote about another Marriott Bonvoy card today as well: Keep or Cancel – Amex Marriott Bonvoy Business Card. Check out that post if you have that credit card.

Hi Grant – Thanks for the shout-out and the link.

On your RC Visa card downgrade, I understand where you’re coming from, particularly in the pandemic-induced world of the present. As you know, in general we consider the RC Visa card to be a strong keeper for us. The fact that your decision was different in your situation is a great example of how everyone can take the analysis that we provide, apply it to their own situation, and come up with the decision that’s right for them.

I always appreciate your credit card articles – and frankly, I may appreciate most the ones where we reach different conclusions because our circumstances are different. Thanks for the good analysis and for sharing! ~Craig

Hi Craig, thanks for commenting. I agree, it’s good to have differing opinions since we highlight what’s important to each of us. Is the main reason you keep the RC because of the unlimited Priority Pass membership for your family? With less and less people traveling and more and more lounges closing, seems like Priority Pass is not important at the moment. Is there another reason you plan on keeping your RC?

Setting aside for a moment our current crisis, we keep the RC Visa because:

* As you mentioned, best-in-class Priority Pass for primary cardholder and all AUs (me, Philly, and 5 MAM kids)

* $300 travel credit

* 50k annual FNC

* Occasional use of the $100 property credit for RC stays, which only seems to require booking with a Member Rate, not some artificially higher rate

* Occasional use of the Club Level Upgrade certificates (which can be very valuable in the right circumstance)

* We’re grandfathered at a $395 AF (I know, lucky)

* This year we got a $150 statement credit as a retention offer

For us, these benefits still make the RC Visa an incredibly powerful card, despite the very unfortunate loss of the Visa Infinite airfare benefit (which we’d been using 6-8 times/year!).

I’m glad to hear that you take advantage of most of the other benefits. I am just too cheap to pay for Ritz Carlton stays, so I haven’t taken any advantage of those benefits. Sounds like the card is still a keeper for you. Hope the lower annual fee lasts forever for you.

Hi Grant, just came across this article when doing some research. You mentioned that you got the 50k anniversary night after upgrading. I’m currently deciding myself whether it is worth upgrading my Marriott Bonvoy Boundless card to the Ritz Carlton card in the future once travel hopefully resumes some sense of normalcy. Basically, I wanted to clarify that you did not receive the 35k anniversary night for the Bonvoy Boundless card. However, you did receive the 50k anniversary night, correct? Also, it appears that you never had to pay any portion of the annual fee, as after it posted, you downgraded the card. If you could just provide a short timeline of how both the anniversary nights posted and the annual fee(s) for the cards posted during the upgrade and downgrade process, it would be really appreciated! Content like this is really helpful and I’ll definitely be turning to your site as a resource going forward!

Hi Jeremy, thank you for the great questions. I have product changed / upgraded / downgraded this card so many times that I lost track of when free nights posted, when annual fees posted, and what my anniversary date is for this card. It looks like Chase does do prorated annual fees for upgrades / downgrades. Did you already read this post? https://travelwithgrant.boardingarea.com/2019/11/12/why-did-i-upgrade-my-chase-marriott-bonvoy-to-jpmorgan-chase-ritz-carlton/

What is the general rules around downgrading and upgrading. I upgraded to the RC CC a few months ago but at some point soon I need to downgrade it and then re-upgrade it. I want to get the SUB for the Bonvoy Brilliant but I realized after the fact I can’t hold the RC card within 30 days before applying so if I downgrade do I need to wait a full year to upgrade? and do I need to wait a year from upgrading to downgrade? Ideally I would downgrade, apply for BB and then like a week later upgrade again but I feel like that might not work and/or look good on Chase’s side. Any thoughts on this?

That is a very good question and I think I’m a little confused. Have you consulted Frequent Miler’s eligibility chart to see if your plan should work? https://frequentmiler.com/marriott-card-eligible/