Updated at 6pm PT on 1/2/21: Thanks to everyone who answered the poll question at the bottom of this post. Even though “Do Nothing Until 2021” was the second most popular answer, that is what I decided to do. Hopefully I will be able to make some Citi TYP redemptions in 2021.

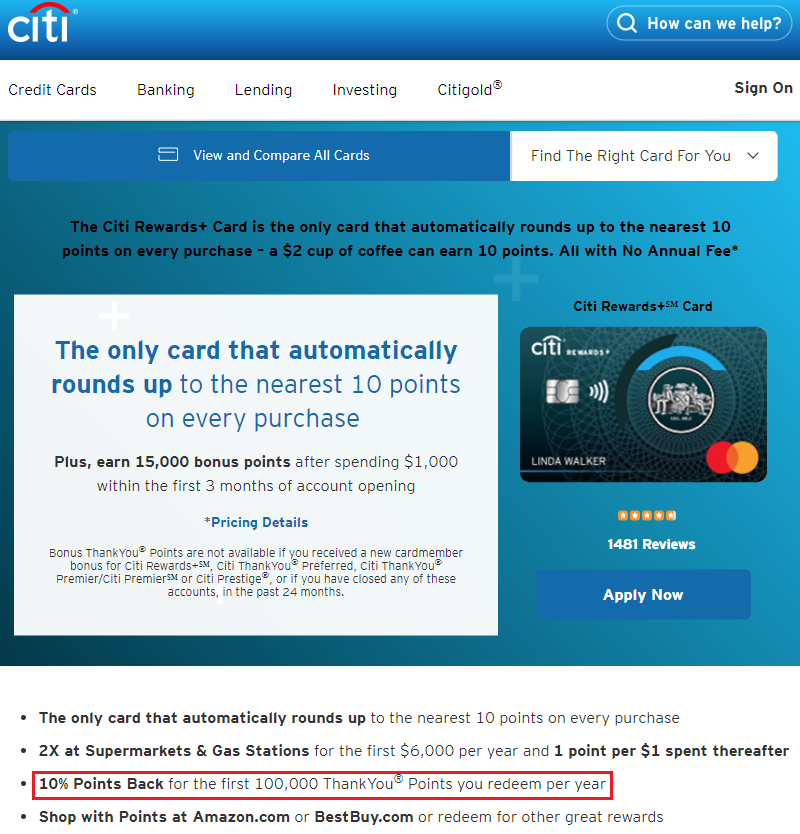

Good evening everyone, I need some help. First of all, this post could be classified as a “First World Problem” or a “Good Problem to Have”, but I would still like to get some help on making my decision. Long story short, I have a Citi Rewards+ Credit Card and one of the benefits of the credit card is the ability to get 10% of your redeemed Citi ThankYou Points (TYPs) back, on the first 100,000 TYPs redeemed per calendar year (10K TYPs rebate max). Since there are only a few weeks left in the year and I have only redeemed a few thousand TYPs this year, I need to spend 84K TYPs by December 31 in order to max out the 10K TYP rebate. In this post, I will discuss how I calculated how many TYPs I need to spend and go through all the various redemption options and my thoughts on each option.

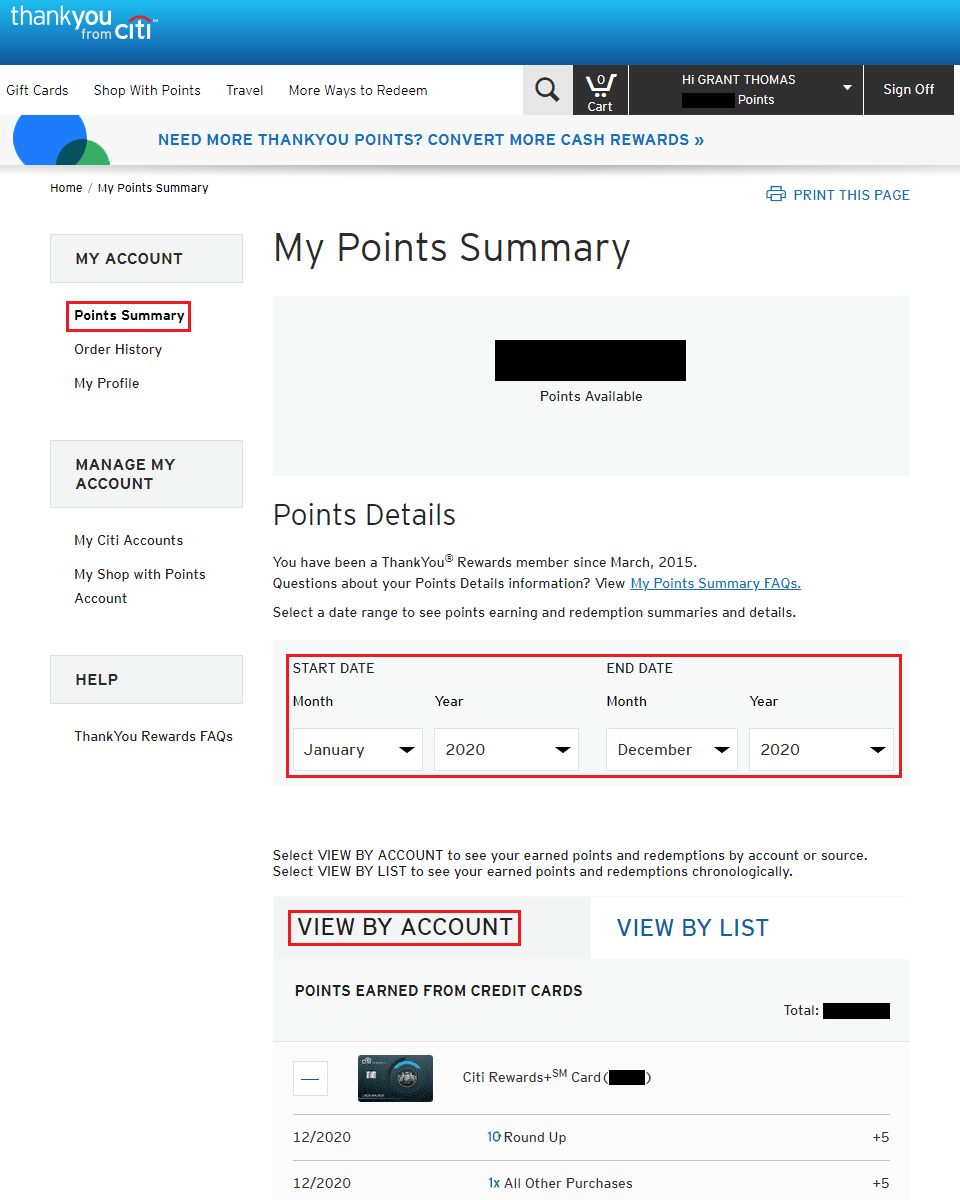

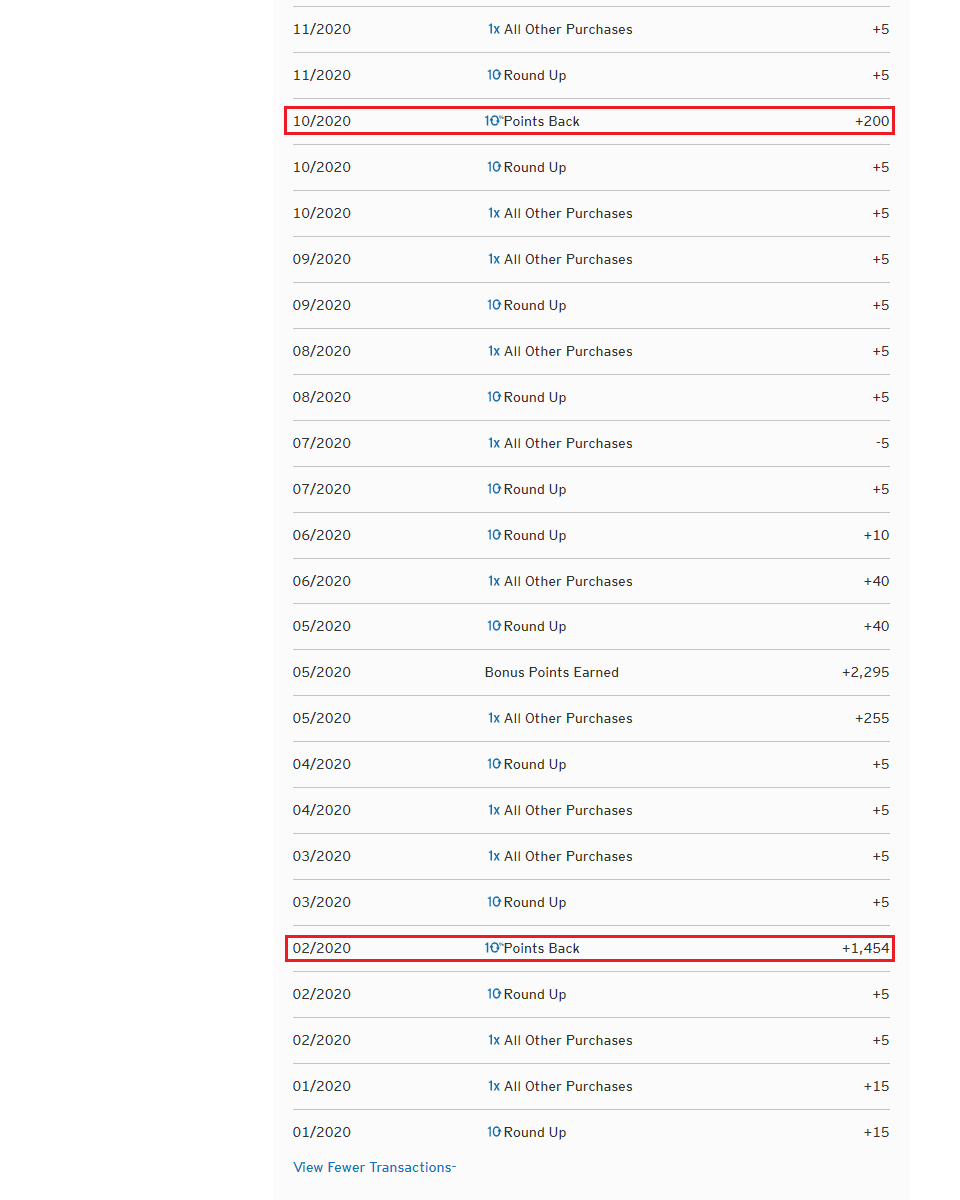

To see how many TYPs I have been rebated thus far in 2020, I signed into my TYPs account, went to the Points Summary page, changed the date range to January 2020 through December 2020, and then expanded all the point transactions for my Citi Rewards+. For the record, I have 300K TYPs and I earn tons of TYPs with my Citi AT&T Access More Credit Card, so I always seem to have more TYPs than I can redeem (a good problem to have). I then searched for the “10% Points Back” transactions and found 2 transactions in February 2020 and October 2020 that totaled 1,654 TYPs. Since I can get a max of 10K rebated TYPs, I can still receive 8,346 TYPs (10,000 – 1,654 = 8,346). Since I get 10% of TYPs rebated, I multiplied that number by 10 to get 83,460 TYPs (8,346 x 10 = 83,460).

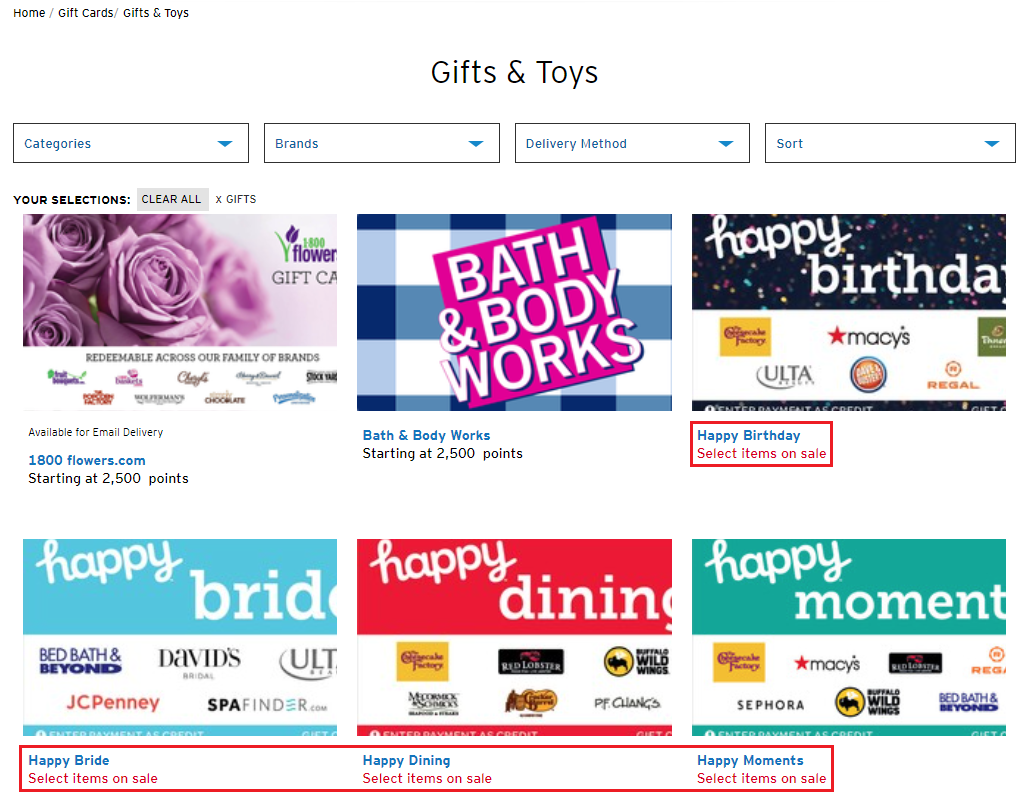

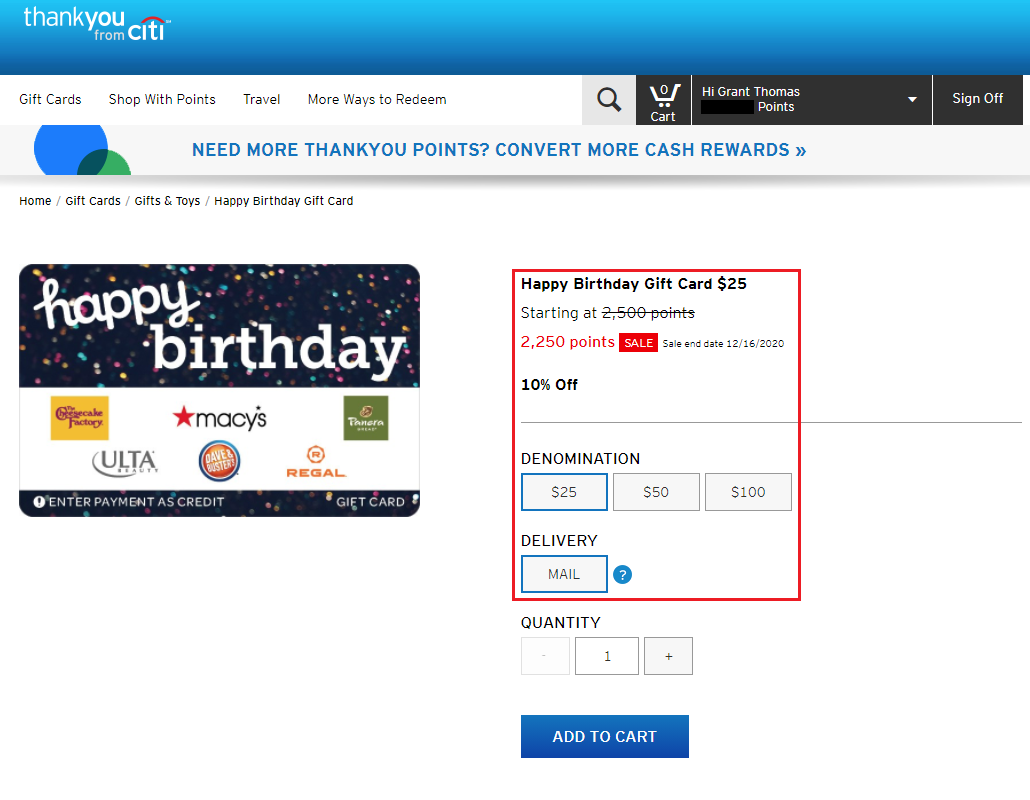

In most years, I easily redeem more than 100K TYPs by transferring TYPs to airline partners to book award tickets, but 2020 is anything but a normal year. Throughout the rest of this post, I will go through the various redemption options and share my thoughts on each option. The first option is redeeming TYPs for Gift Cards (GC). Citi has around 100 GC brands from major retailers. A few weeks ago, Citi was offering 15%-20% off select GC brands during Black Friday and Cyber Monday. Those deals are currently over, but Citi is currently running a 10% off promo on select GC brands through December 16. Most of the discounted GCs do not interest me, but some of the “Happy GCs” could interest me – not enough to spend 84K TYPs ($840 – $930) on GCs, but I could order a few hundred dollars worth of GCs. Most GC brands come in Mail and Email delivery options. The standard value of TYPs for GCs is 1 CPP, but if you buy a 10% discount GC, your TYPs are worth 1.11 CPP.

TYPs can also be linked to these 6 companies (Amazon, PayPal, 1-800-Flowers, Best Buy, BP, and Shell) and you can use Citi’s Shop with Points option. I haven’t tried all the options, but from past experience, I think you get 0.8 cents per point (CPP), which means an $8 Amazon order will cost you 1,000 TYPs ($8 / 1,000 = 0.8 CPP). I didn’t spend too much time researching these options since I want to get at least 1 CPP for my TYPs.

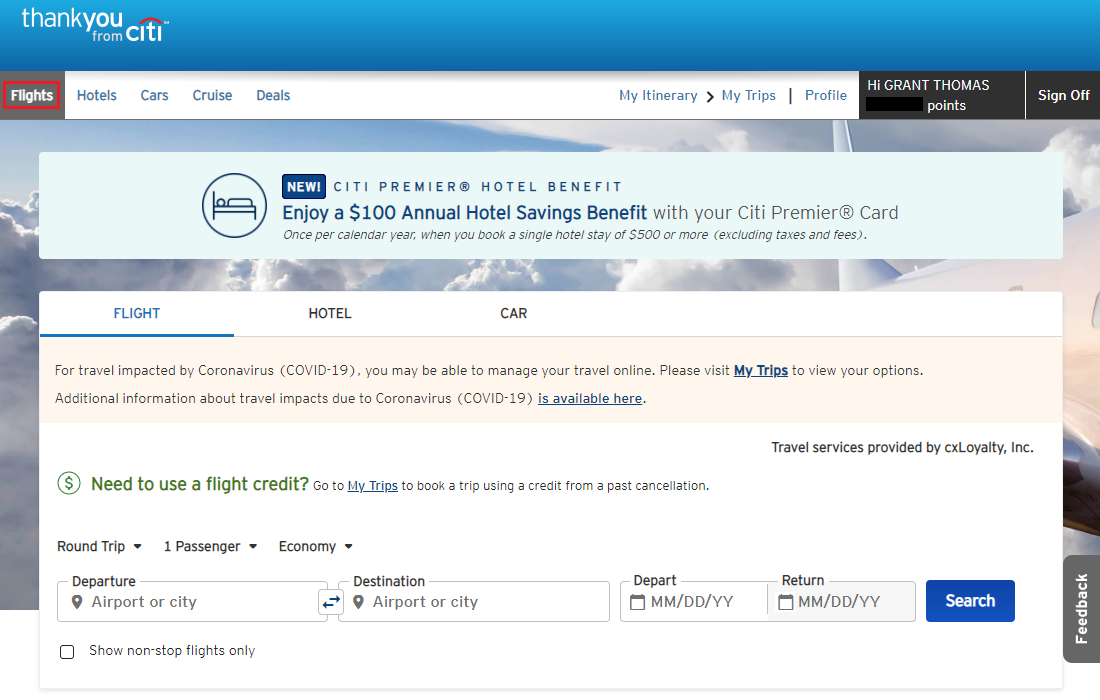

Of course, you can spend TYPs on flights through the ThankYou Travel Portal. Now through April 10, 2021, TYPs are worth 1.25 CPP for flights. After April 10, 2021, TYPs will only be worth 1 CPP. If I had plans to fly next year or even speculative trips in mind, I would consider booking some flights. Due to the Coronavirus Pandemic, most airlines are waiving cancellation fees and will give you a travel voucher for the value of your cancelled flight. I am currently sitting on several hundred dollars of airline travel vouchers and airline GCs to multiple airlines, so the thought of adding to those balances does not excite me much. I am really hoping that Citi changes their mind and does not make TYPs worth 1 CPP for flights after April 10.

You can also use TYPs to book hotels. If you have the Citi Premier Credit Card, you can get a $100 “Annual Hotel Savings Benefit” when you book a hotel reservation that is $500 or more (excluding taxes and fees). You can pay for the hotel in cash or with TYPs at a value of 1.25 CPP. If I was able to book a $500 hotel reservation using TYPs, I would need 40,000 TYPs. After making the hotel reservation, I think you will receive a $100 statement credit on your Citi Premier. This is a 1 time per calendar year benefit, so I could book a hotel reservation in December and another hotel reservation in January 2021. Does anyone know if you end up cancelling the hotel reservation, are there any hotel chains that will give you a travel voucher for use in the future? I don’t currently have any hotel vouchers, but I do have several hotel free night certificates. This option intrigues me and I might need to do more research.

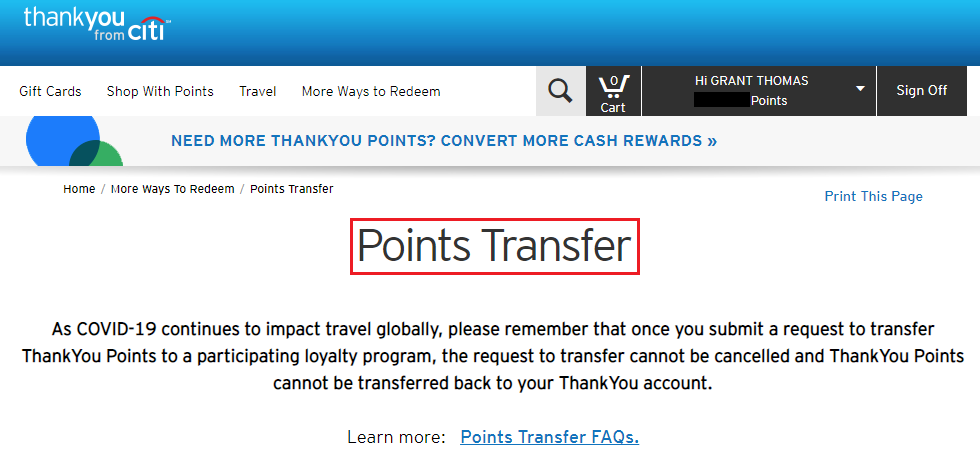

The next travel option (and usually the best value) is transferring TYPs to 1 of the 17 ThankYou travel partners listed below. Since some of these airlines are in different stages of bankruptcy, I am cautious about transferring TYPs to an airline that might go out of business or redo their route network before I could use the miles. Plus, I have decent balances with some of the airlines I am familiar with and do not need to increase those mileage balances. If this were any other year, I would probably consider splitting up my 84K TYPs between Avianca, KLM / Air France, Singapore, Turkish, and Virgin Atlantic.

| AeroMexico Club Premier Miles | InterMiles | Sears Shop Your Way Points |

| Avianca LifeMiles | JetBlue TrueBlue Points | Singapore Airlines KrisFlyer Miles |

| Cathay Pacific Asia Miles | KLM / Air France Flying Blue Points | Thai Airways Royal Orchid Plus Miles |

| Emirates Skywards Miles | Malaysia Airlines Enrich Miles | Turkish Airlines Miles&Smiles Miles |

| Etihad Guest Miles | Qantas Points | Virgin Atlantic Flying Club Miles |

| EVA Air Infinity MileageLands Miles | Qatar Airways Privilege Club Miles |

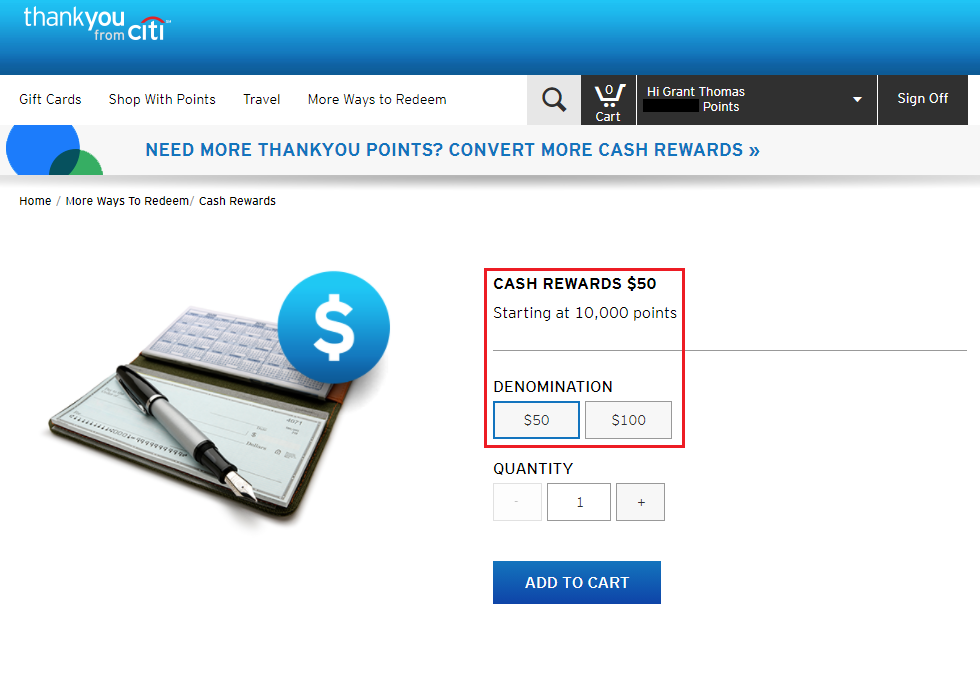

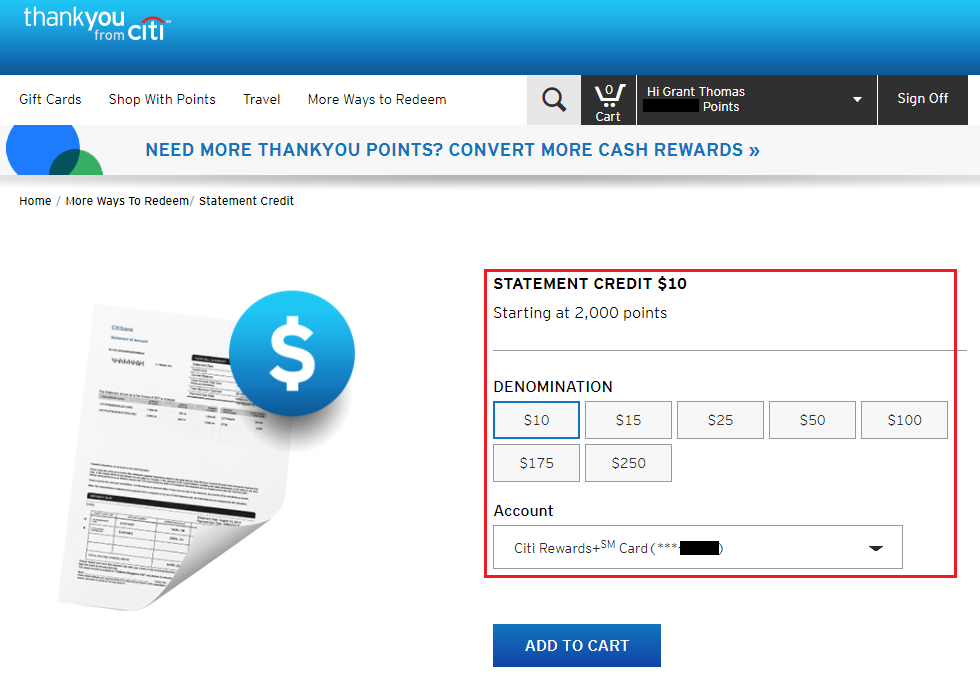

If cash is what you are after, you could redeem your TYPs for a cash reward or a statement credit. Unfortunately, these are probably the worst redemption options since you only get 0.5 CPP value.

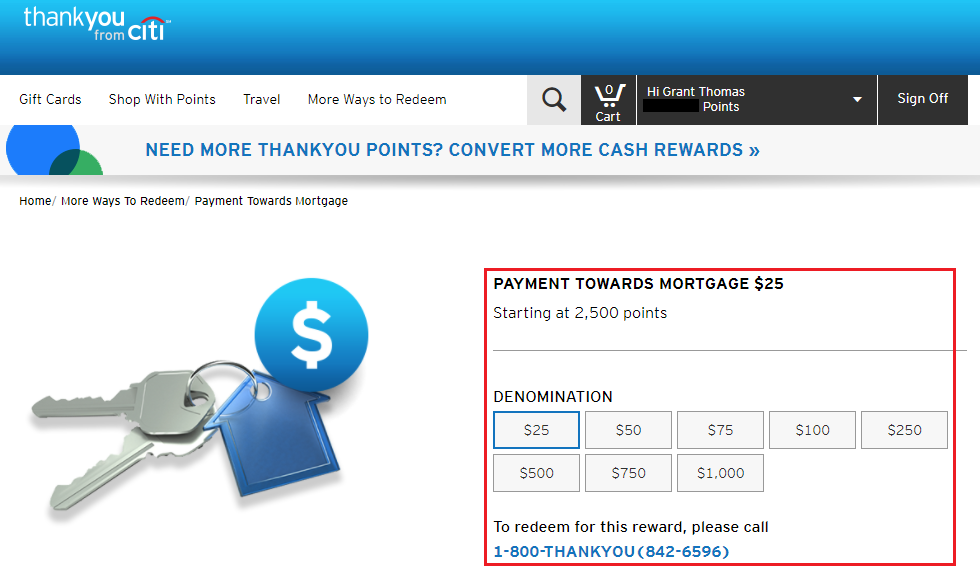

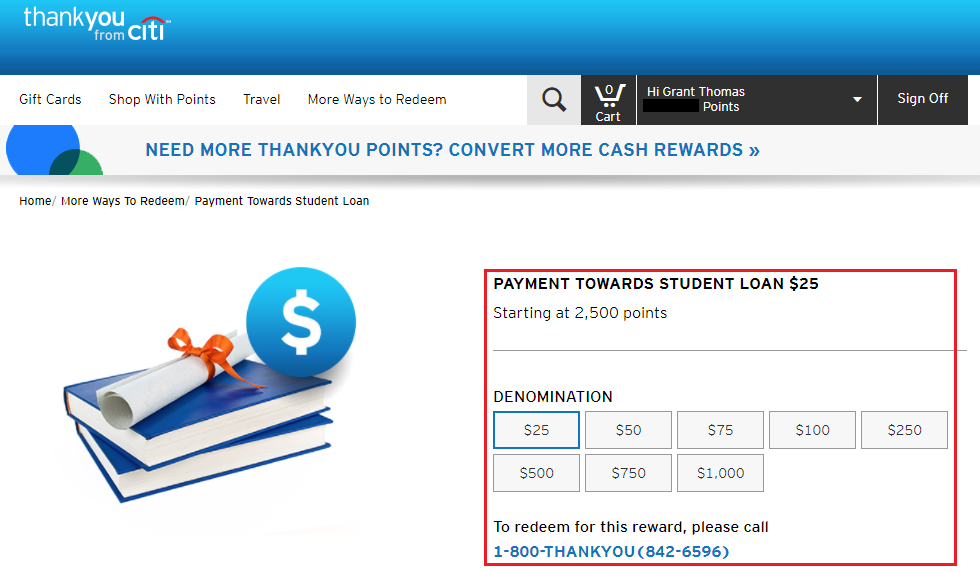

A tempting offer for those with mortgage payments or student loan payments is to redeem your TYPs for a payment toward your loan. Both options provide 1 CPP value. I have never looked into these options very closely, but it looks like you need to call 1-800-842-6596 to speak to a TYP agent. They will then mail a check to your address in the name of your finance institution. You then send the check to your financial institution along with any other payment or documentation. I currently pay our mortgage with Plastiq, but making an extra principal only payment to the mortgage could save us big bucks down the road from interest. Here are the terms for these redemption options:

Your confirmation letter and check are sent only to your address on record via USPS First-Class.

We’re not responsible for payment to your financial lending institution. It’s your sole responsibility to issue payment to your financial institution for mortgages or student loans. Contact your financial lending institution regarding your mortgage and student loan payment policies and/or restrictions specific to accepting multiple checks for monthly payments, third-party checks and/or partial monthly payments.

All student loans and mortgage payment redemptions are final. Points redeemed for payments toward student loans and mortgages can’t be returned unless we cancel the check and a stop payment is placed, resulting in a return order status and automatic reinstatement of Points into your ThankYou Account. Please note that a check may be canceled if, for example, there was a misspelling on the check or you never received it. If you haven’t received the check within 3 weeks of redemptions, please report it to us as lost or stolen.

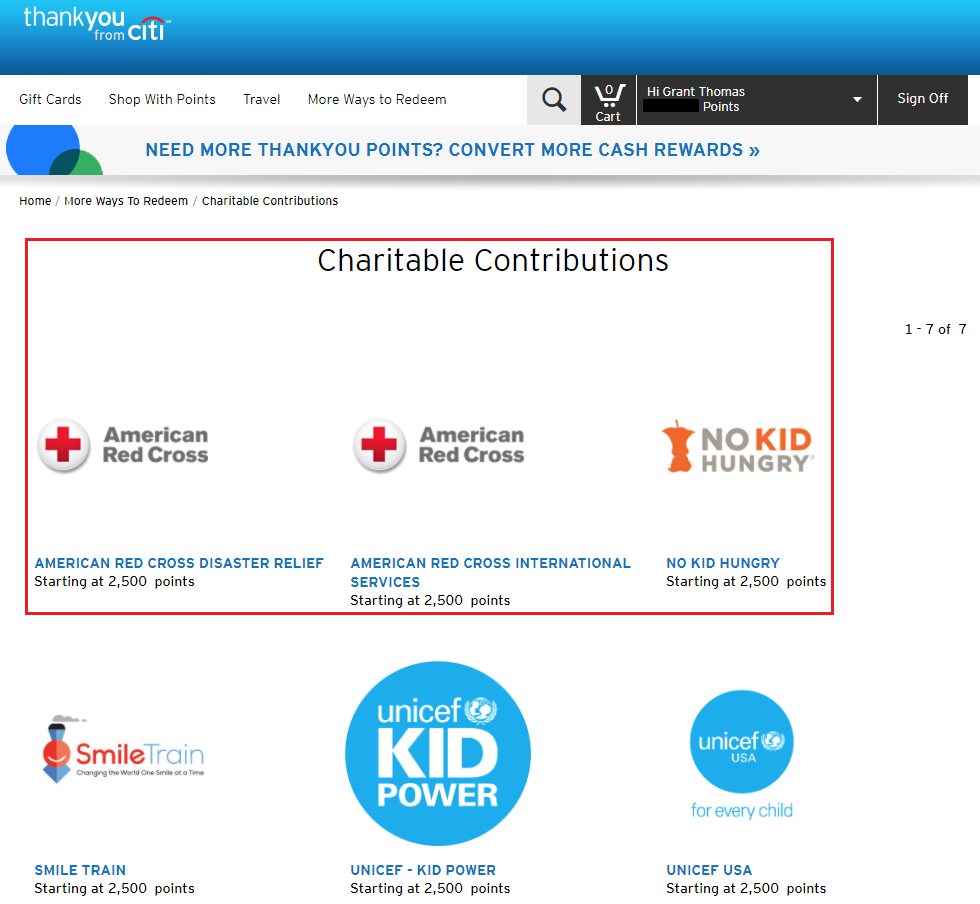

Last but not least, if you are in the giving mood, you can redeem your TYPs for charitable contributions. There are only 7 charities listed and you get 1 CPP value for the donations. Here are the terms for this redemption option:

Your charitable contribution check is sent via USPS First-Class® Mail directly to the charity, and you should receive a written confirmation letter within one (1) to three (3) weeks of redemption. If you don’t receive the letter within that time, please let us know.

There is no mention of your donation being tax deductible, does anyone know?

Those are all the possible TYP redemption options. I could also do nothing and have the TYPs keep sitting in my account until a real need comes around. This option is the simplest, but I would be missing out on the 8,346 rebated TYPs. With those options in mind, what do you suggest I do? You can either answer the poll question (pick your top 3 choices) or provide more detailed thoughts and ideas in the comments section. If you have any questions about any of these redemption options, please leave a comment below. Have a great evening everyone.

I predict that there will be a transfer-bonus of ~25% to one of the airlines sometime after January 1st, LoL

Haha, I like your thinking / guessing. Here’s hoping for many transfer bonuses in 2021.

FWIW, Turkish has some extremely attractive discounts on Business class flights right now. I have a tentative trip planned in May 2021 and I’m seeing one-way flights to/from the Middle East for under 40,000 miles.

@mfk …..how much are the taxes with Turkish in business to Middle East ?

@CJ I looked at a few different destinations and return points in the region for the cost in miles, but only clicked through to see the taxes/fees on one (Beirut, I believe) and it was approximately $212. In comparison, I had to cancel a roundtrip ticket to Afghanistan in Turkish business class and the cost was over $500 in total taxes/fees.

That is a great deal, I loved my SFO-IST business class flight a few years ago.

Hi Grant – Great article and very interesting question. I would quickly eliminate some of the options: GCs (cash/mortgage is better, given that GC selection costs you flexibility and you can usually get discounted GCs anyway if you want them); Shop With Points (rate too low); and 0.5-cent Cash Rewards/Stmt Credits.

The rest of the answer depends on personal situation & preferences:

Redeeming for flights at 1.25 cents is eliminated – unless you have an upcoming flight need where you’re virtually sure you’re going to take the flight. Your own painful experience this past Spring is the primary source for not doing this if you may need to cancel. However, if there’s a flight that you’re pretty sure you’re going to take, this could be a reasonable option.

If cash is important, the 1-cent mortgage/student loan option could be a very reasonable choice. With the 10% rebate, the effective cash-out rate becomes 1.11 cpp.

With respect to hotels, I have a question – if you make a prepaid-but-refundable hotel reservation using TYPs, get the Rewards+ rebate, then cancel the booking, is the rebate clawed back? I don’t know the answer to this but it seems like there’s a good chance of no clawback. If so, that would perhaps be the best use in your situation where all future travel plans are uncertain. You would get the best of both worlds – that is, collect the rebate, and then have the TYPs you used for the reservation back in your account after you cancel. On the flip side, if the rebated points are clawed back, you’re in the same position as if you did nothing (except for the time you spend making & canceling the reservation), given that the TYPs should be returned to your account. (And getting a TYP refund for canceling a refundable hotel reservation should be much smoother & easier than your experience on the airline side.)

Alternatively, I could see transferring to an airline partner as an option. Of course, you lose the flexibility of having the TYPs in your account. But if there’s a program you feel like you’re likely to use in the next couple of years, that’s not a bad option. It’s probably the highest potential value use for your TYPs, and it’s not like you have a pressing need to have the TYPs in your account for other uses at the moment anyway.

Well, I didn’t answer your question, but maybe these thoughts will help you and/or your readers :)

On my end, I used the Rewards+ rebate to transfer points to airline partners and booked flights to Europe for trips next year, with fingers crossed that we’ll be able to take them!

Hi Craig, thanks for your detailed answer and for going through all the options with me. There are still 3 weeks left in the year to make a decision. Part of me wants to try the mortgage payment option since I have never done that and it seems like the most “adult” thing to do. Based on the Coronavirus Pandemic and the vaccine rollout, I am assuming that I will not be getting on a plane in the first 6 months of 2021. Luckily, there are many great places to roadtrip around California and many great hotel options too. I really wish I had an airline transfer in mind, but maybe Citi will have a great transfer bonus later this month that will help me make my decision.

A refundable trip seems like an interesting option to maximize the $100 calendar year benefit, regardless of maximizing the Rewards+ 10% benefit. I could see a clawback less likely for the former than the later (i.e. would Rewards+ “charge” you 10% for a points refund).

Im really not sure, but Citi does have the ability to do negative adjustments. I had $50 cash back on my Citi Double Cash and cashed out for $50 statement credit. I had a return post to my account so now my Citi Double cash has a few dollar negative balance.

In regards to the $100 credit for the hotel, if you cancelled the reservation, I wonder if the $100 credit would be reversed and the 10% rebate on TYPs would be reversed too. Lots of Citi IT systems would have to work together perfectly for that to happen.

Thanks for the reminder, Grant.

Had ~ 9,000 points expiring from checking account, so opted for the Happy Moments gift card that included Macy’s and others. Have a wedding gift to get so the $100 gift card will go towards defraying the cost. With the 10% rebate from the Rewards + card = 900 TY points returned to account, each point was ~ 1.23 cents!

Hi Hadley, that is a great idea and a great use of your TYPs. Hopefully you can get the perfect wedding gift for around $100 and don’t forget to get cash back on the purchase through a shopping portal (like Rakuten).

Since you asked. Treat your Mother/Father to a great hotel stay. Otherwise, a gift to one of your “greedy unwashed relatives” could change a life.

Respectfully, Rob

Thanks Rob, good idea.