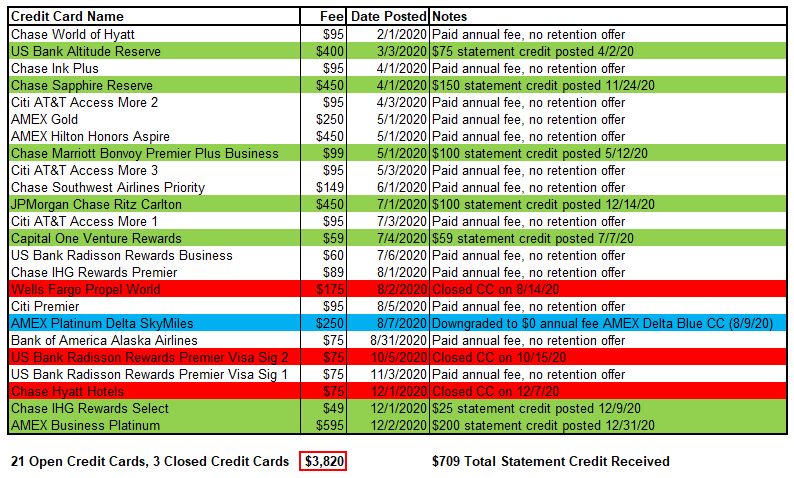

Updated at 9:20am PT on 1/4/21: I went through my credit card statements and found 2 more retention offers, so I updated the second table below.

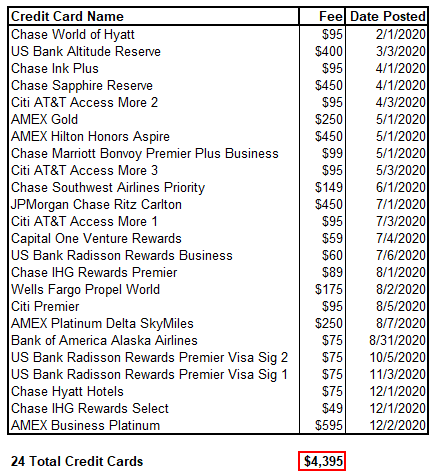

Good morning everyone, I hope your weekend is going well. In December 2019, I wrote I Paid $4,588 in Credit Card Annual Fees in 2019 – Was it Worth it? In that post, I listed all of our credit cards that had annual fees and I attempted to justify why paying over $4,500 in annual fees was worth it. Unfortunately, 2020 made it very difficult to get a ton of value out of our travel reward credit cards, so in March 2020, I wrote Reconsideration Strategy for Credit Card Annual Fees During Coronavirus Pandemic. I decided to list all of our credit cards that have annual fees, sort them by when the annual fee posted / will post, and called for retention offers every time a new annual fee posted. At the beginning of 2020, we had 25 credit cards with annual fees and would pay $4,845 in annual fees if we made no changes or retention offer calls. In this post, I will share what retention offers we received, which credit cards we closed, and which credit cards we product changed.

Long story short, we closed 3 credit cards (Wells Fargo Propel World, US Bank Radisson Rewards Premier, and old Chase Hyatt) because the benefits were not worth the annual fee. I plan on applying for the Wells Fargo Propel World (again) and the new Chase World of Hyatt Credit Card. I also product changed / downgraded my American Express Platinum Delta SkyMiles Credit Card into a no annual fee American Express Blue Delta SkyMiles Credit Card. These 4 moves saved us $575 in annual fees, but we still paid $3,820 in annual fees in 2020. Luckily, I was successful on a few retention offer calls and received a total of $709 in statement credits across 5 credit cards. Retention offers on my Chase Marriott Bonvoy Premier Plus Business (no longer available) and on Laura’s Capital One Venture Rewards Credit Card covered the entire annual fee.

If we subtract $709 from $3,820, we still paid $3,111 in net annual fees. This post would get really long if I listed why we kept and paid the annual fee for every credit card above, but in most cases, we received greater than or equal to the value of the annual fee. Here is a good example on my American Express Business Platinum Card. Thanks to AMEX’s pandemic benefits, we got a lot of value out of this card (8 months of $20 shipping credit and $20 wireless credit ($40 x 8 = $320), plus $400 in Dell credits, and $200 in airline fee reimbursements). I also received a $200 retention offer on the $595 annual fee. Here is the math for this card: -$595 annual fee + $200 retention offer + $320 in shipping & wireless credits + $400 in Dell credits + $200 in airline fee reimbursements = $525 profit (assuming all the credits are worth face value).

Most of the other high annual fee credit cards provided statement credits for grocery, gas, and restaurant purchases that covered most of the annual fee. I used the $300 travel credit on the Chase Sapphire Reserve Credit Card for $300 in grocery purchases, the $325 travel credit on the US Bank Altitude Reserve Credit Card for $325 in restaurant purchases, and the $250 Hilton resort credit on the American Express Hilton Honors Aspire Credit Card for $250 in restaurant purchases. I’m hoping to see similar temporary categories in 2021.

I created a similar spreadsheet for 2021 credit cards and annual fees. I cleaned up the list by removing the closed cards and adding the new credit cards we opened in 2020. I also identified Laura’s cards with (LT) – we both have the Chase IHG Rewards Premier Credit Card and our annual fees should both post around August 1.

I’m hopeful that we will be able to use most of the travel benefits of these cards in 2021. I also plan on calling for retention offers again this year to see what offers are available on my cards. If you want some tips on retention calls, scroll to the bottom of this post. If you have any questions about any of these credit cards, please leave a comment below. Have a great weekend everyone!

In addition to cost, list value obtained from each card in 2020 – then it may make sense

Hi FFI, that is a great idea. I’ll work on that and update the post. Is there any specific CCs that you are most interested in?

I agree with FFI, this would be interesting to see. Speaking for myself, I’d love to see your value obtained particularly for the Sapphire Reserve, Altitude Reserve, and your hotel cards. Besides the free night certs, I’d enjoy reading how you make up the annual fee on the hotel cards.

Hi Robert, I’ll work on this info and get a new post live in a few days.

Great article to read. Now it is my time to do the same with our portfolio. Apparently, we were not able to use an airline credit with an airline of choice from Amex Hilton Aspire:)

I’m sorry you were not able to use up the airline credit on your AMEX Hilton Aspire CC. Hopefully you can in 2021 :)

Pingback: Investing Rules, Chase Spending Promos, Icehotel, Virgin Atlantic Massacre - TravelBloggerBuzz

Pingback: I Paid $3,820 in Credit Card Annual Fees in 2020 – Was it Worth it?

Pingback: How Much Did I Pay in Credit Card Annual Fees in 2021?