Good morning everyone, I hope your week is going well. Doctor of Credit has a Best Bank Account Bonuses page that he keeps up to date with the best offers each month. In that master post, he links to individual bank account bonuses with helpful information regarding the bonus details, how to avoid monthly fees, when to close the account, how often you can open a new account, and much more. For the last 9 years, I have been opening new checking accounts, savings accounts, brokerage accounts, and cash management accounts for the new member bonuses. At the end of each year, I share my results on the blog.

Over the last 9 years, I have made over $24,000 in bank account bonuses. You will receive 1099-INT / 1099-MISC tax forms every year, so you have to pay taxes on the bank account bonuses, but sometimes you can fund the opening deposit with a credit card and earn miles, points, or cash back. If you are lucky, you can meet a minimum spending requirement by funding a new checking account or reach a high spending target to earn more rewards. Here are my results from the last 9 years with links to corresponding yearly summaries:

- 2015: $1,175 (no post)

- 2016: $2,850 (summary)

- 2017: $3,700 (summary)

- 2018: $2,725 (summary)

- 2019: $1,000 (summary)

- 2020: $800 (summary)

- 2021: $3,600 (summary)

- 2022: $4,485 (summary)

- 2023: $3,685 (this post)

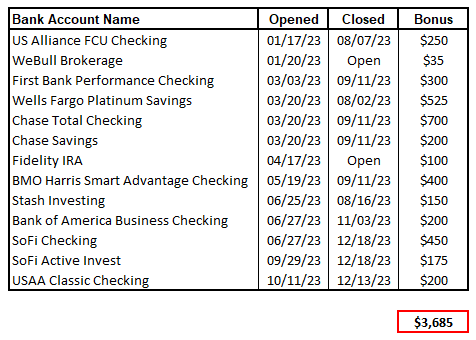

Drum roll please… Here are the 13 new accounts I opened in 2023 that paid out $3,685 in bonuses:

The list above includes traditional checking accounts, savings account, and brokerage accounts. I include everything above since the process is basically the same. Here are some additional pieces of info about some of the accounts:

- The WeBull Brokerage bonus was in the form of 6 shares of stock that were worth about $35. WeBull does have occasional promos for referring friends (WeBull referral link) and by adding new funds to your account that allow you to receive more free shares of stock over time.

- The Chase Checking and Savings bonuses were my biggest winners of the year. By opening both accounts and completing both bonuses, I received $900 total. This was the 4th round of Chase Checking bonuses, so my strategy is to open the account, receive the bonus, close the account a few weeks later, and then wait for the bonus to come around again. Some banks (like US Bank) have long waiting periods between when you can receive your next new account bonus, so the sooner you close the account, the sooner you can open a new account for the bonus.

- The $150 Stash Investing bonus came in the form of 15,000 AMEX Membership Rewards Points from signing up through Rakuten. I value 15,000 AMEX MR Points much higher than $150, but for simplicity, I listed the bonus as being worth $150.

- The SoFi Checking bonus came in 2 parts: $250 from SoFi and another $200 from Swagbucks since I opened the account through a Swagbucks link.

- The SoFi Active Invest (brokerage) bonus came in the form of 17,500 AMEX Membership Rewards Points from signing up through Rakuten. I value 17,500 AMEX MR Points much higher than $175, but for simplicity, I listed the bonus as being worth $175.

- I did redeem some Series I Bonds from the US Treasury in 2023, but I didn’t include the interest in the above table since it didn’t seem to fit in with the other accounts.

The requirements vary quite a bit between the accounts: several debit card purchases, recurring direct deposits, and large initial funding deposits. I don’t mind jumping through hoops to open new accounts, like funding accounts, moving money around, changing direct deposits, keeping track of bonuses, and then closing accounts. I try to focus on bonuses that pay more than $100 unless the bonus is very easy and quick.

Usually, I have a few other bank accounts that I am waiting for the bonuses to post, but this year, I don’t have any other bank accounts waiting for bonuses. This is mainly due to high interest rates on savings accounts. I can put money in my Marcus online savings account (currently paying 5.50% due to stacking referral bonuses and AARP bonuses) that would produce a similar return as getting a new bank account bonus with an account that pays a much lower interest rate and has a cash bonus after a few months.

If you are interested in bank account bonuses, I recommend checking out Doctor of Credit’s Best Bank Account Bonuses page. If you did any bank account bonuses in 2023, please let me know how much you made this year and whether your total is higher or lower than previous years. Thanks for reading and have a great week everyone!

How do you fund with a credit card?

Hi Patrick, sorry for the confusion. None of the accounts I opened this year were eligible for credit card funding, but some smaller credit unions and regional banks may allow credit card funding, up to $500 or $2,000. Unfortunately, none of the big banks allow credit card funding, just ACH transfers.

Highest year ever!

2023 Bank Bonuses (P1 & P2 and 1 business)

Denials:

Great River

Affinity

SF Fire CU (P1 & P2)

First Community

Andrews FCU (P2)

Fails:

Associated (P2): ACH transfer did not count for DD.

CommunityAmerica (P1 & P2): Applied before expiration date but approved after expiration date.

First Bank (P1 & P2): Failed to follow the terms.

Wins:

Live Oak Bus. $300

AllTru Savings $155 x 2

Keypoint CU $300 x 2

Credit Union 1 $500 x 2

CIBM $250 x 2

Sunflower $200 x 2

Bank of Blue Valley $300 x 2

UBT $250 x 2

Wells Fargo Savings $525 x 2

Midland States $250 x 2

Central Bank $400

PSECU $200 x 2

Educational Systems $250 x 2

Fidelity Bloom $135 x 2

Jovia $250 & $200

Upgrade Checking $200 & $150

Associated $600

Oxygen $200 & $100

Homebank $100 x 2

Arizona Financial CU $200 x 2

US Bank $500

Fifth Third $350 x 2

Hancock Whitney $300

UMB $400 x 2

Fidelity CMA $100 x 2

FCNB $200

CIBC $200 x 2

Bank of America $200

BMO Harris (P2) $600

Chase Bus. $750

Bank of America Bus. $200

Andrews FCU $200

Wells Fargo $325 x 2

Regions $200 x 2

Hawthorn Bank $300 x 2

Citibank Bus. $500

HSBC $500 x 2

Total $17,830

Hi Charles, those are fantastic numbers! Congrats on having a great 2023! I had a few denials as well, probably due to Chex or due to my frozen credit reports. I wish I could do the big bank bonuses year after years, but I’m in “time out” until the big banks will let me apply for new accounts in the future.

My wife and I made two trips out of state to open bank accounts in branch and I opened a Hancock Whitney checking account while on vacation in Panama City Beach, FL. I tried to hit every opportunity available this year. I will not expect these results in 2024.

Wow, that is dedication. Years ago, I opened a few checking accounts while visiting a friend in NYC. We will see what the market is like for bank bonuses in 2024.

How do you do direct deposit for all of them ? Or some of them ?

Hi Rahulk, you can switch your direct deposit with your employer (YMMV on how easy that is to do) or do transfers from certain accounts that code as a direct deposit. I use RelayFi for my direct deposits.

Good job!

Thank you Faji!

Some are more similar to savings account bonuses so the APR is not too high.

Bank Bonus Referral

1st United 197 50

Ally 700 0

America First 176 0

American Express 350 0

Andrews 200 0

Arizona Financial 185 0

Bank of America 300 0

Bits of Stock 8 7

BMO 600 0

Capital One 350 0

Chase 1650 0

Citi 500 0

Commonwealth 0 100

Discover 150 0

Educational Systems 250 0

Excite 0 48

Fidelity 30 0

Figure Pay 100 50

Gateway 250 0

Goldenwest 140 0

Groundfloor 500 200

H-E-B 49 0

Horizon 180 0

Idaho Central 50 0

IG Trading 250 0

Investors 25 0

Kinecta 250 0

Marcus 100 0

Navy Federal 30 0

OANDA 500 0

One 5 0

Pennsylvania State Employees 0 50

Plynk 210 0

PNC 400 0

Potlatch Number 1 200 0

Robinhood 1 0

San Francisco Fire 300 0

Securityplus 48 95

Southland 75 0

Stockperks 23 0

Technology 400 0

Tiicker 162 0

Travis 250 0

Upgrade 0 200

WeBull 0 180

Wells Fargo 850 0

Wescom 0 500

Total 10995 1480

Impressive numbers! Did you do Chase personal and business checking and savings?

yes

Do you find that any of these accounts that are paying bonuses are also paying a decent interest rate? So far I have not found that. That makes me less inclined to chase after these. But, i applaud your effort and dedication to this hobby!

Hi Paul, that is a great question. From what I have observed, usually the banks that offer cash bonuses have really low interest rates. For that reason, I haven’t chased a lot of bank accounts this year, most of my extra cash has been in my Marcus savings account.