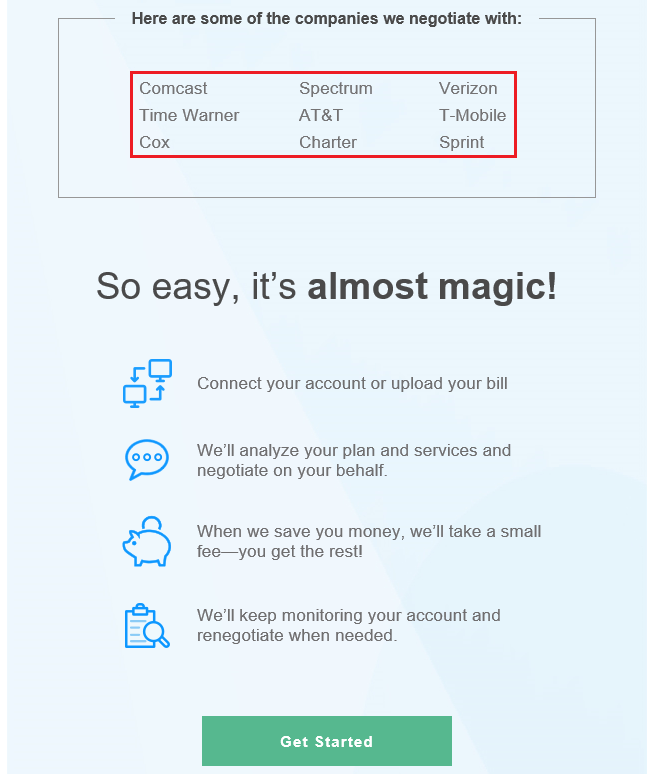

Good morning everyone. A few weeks ago, I friend told me about a service called Trim, where they will monitor your cable / phone / TV / Internet bills and negotiate a lower rate for you. In exchange for negotiating a lower rate, Trim takes a cut of the savings. The service sounded like a cool idea and I decided to try it out on my home Comcast cable / TV / Internet bill. Trim works with several cable / phone / TV / Internet providers, so most TWG readers should check it out.